Good day traders,

We are heading into the 3rd week of November and as the market is resting, let’s head right into our charts and mark all our targets for the week.

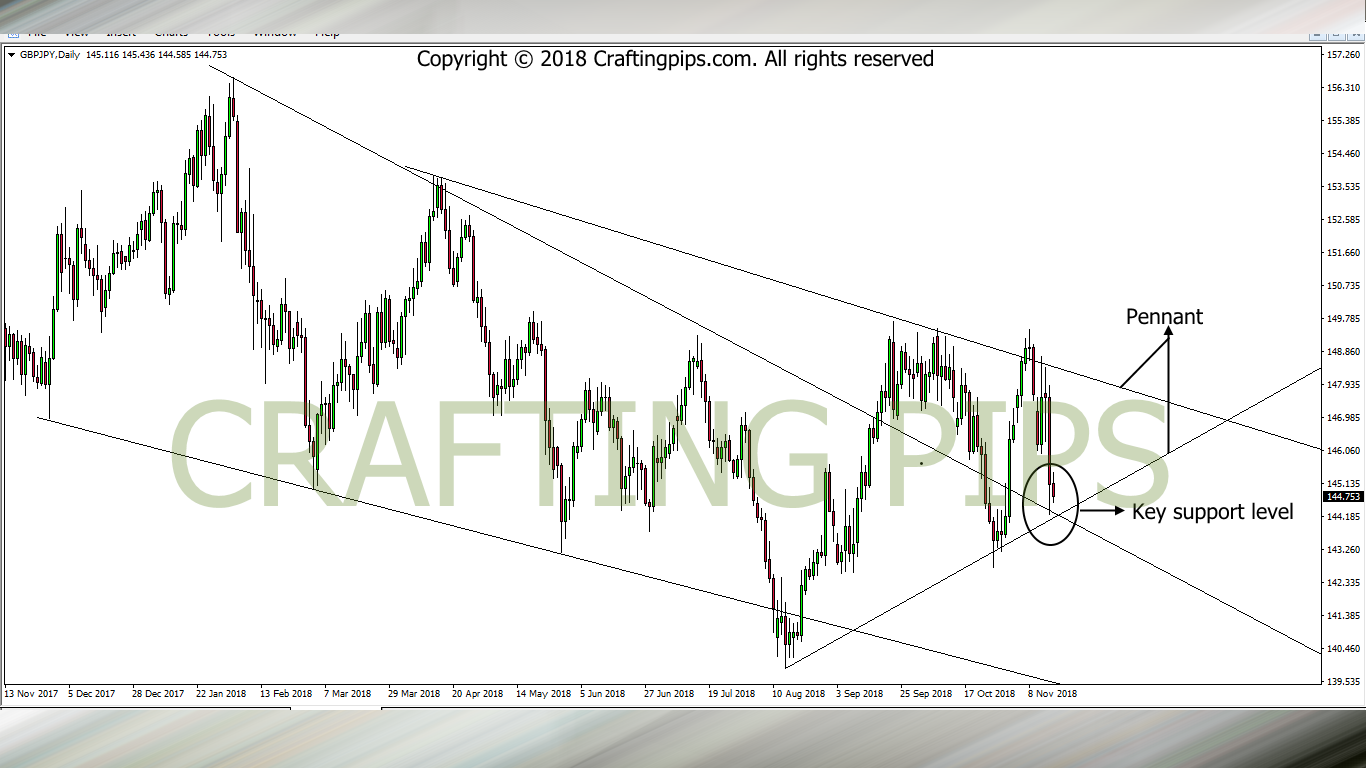

1. GBP/JPY

GBP/JPY on the daily time frame is pretty straight forward. Price is currently testing an ascending support for the third time.

The present support level (144.209) coincidentally intersects a former resistance level, though currently acting as a support. For this reason, the current support is a lot more stronger than the previous support levels.

A breakout through this support level would send price on a bearish run to the next support level (142.641). On the other hand, if price bounces off the current support, we should see price hit a familiar resistance level (148.127).

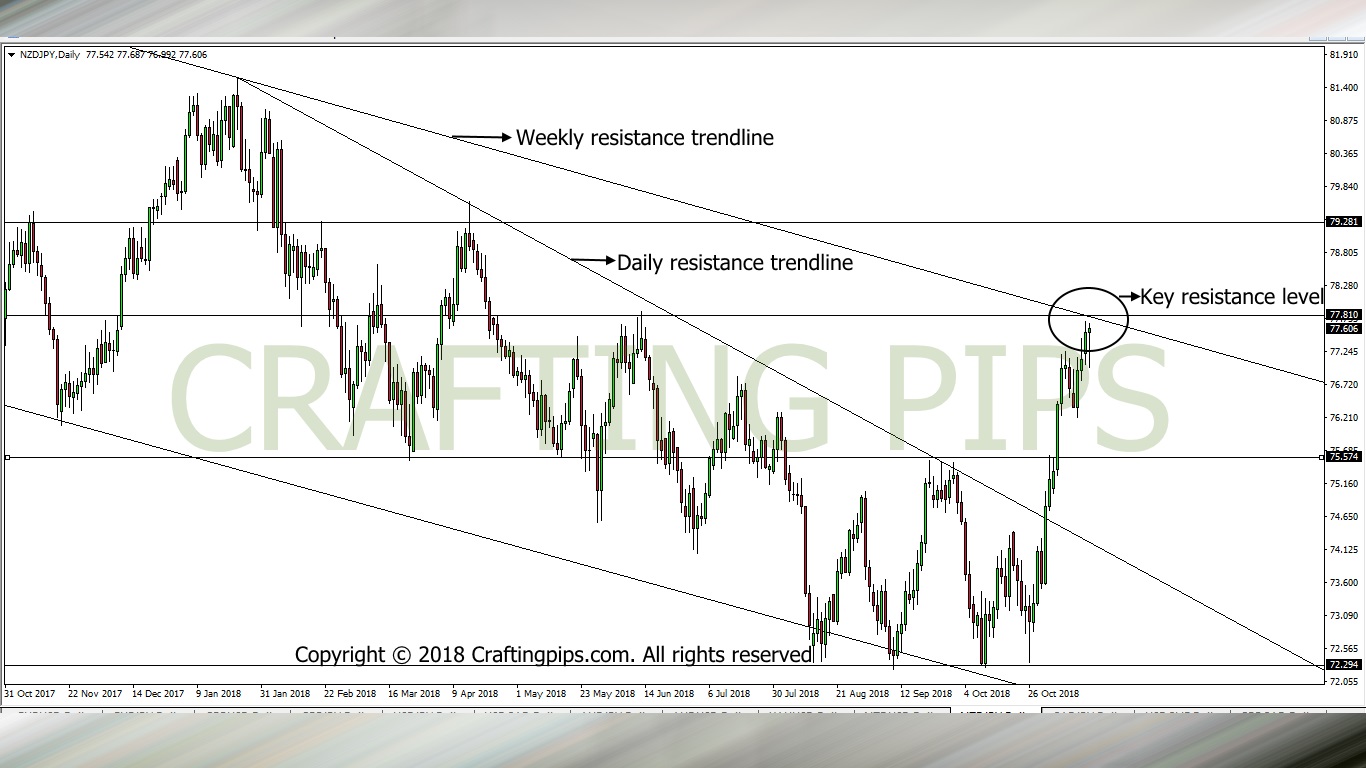

2. NZD/JPY

NZD/JPY is another pair to look out for. On the weekly chart, you will observe a beautiful descending channel, most importantly, the maret closed with a strong bullish trend.

That said, price is currently faced with the challenge of breaking through an INTERSECTION (Where two trend lines meet ). The current resistance level (77.810) should either reverse price to hit a minor support level (76.194) or we may see a breakout, which could take price to it’s next resistance level 79.281.

3. EUR/USD

The EUR/USD on the daily chart is a little messy. The resistance trendlines could be drawn in two different ways, picking the tops of each candlestick formed.

If we were to trade this pair, we would need to get either a breakout or reversal confirmation. The breakout should take price to the next resistance level (1.15215) and if a reversal is confirmed, we should see the bears take price back to level (1.12916).

4. NZD/USD

NZD/USD has an early bullish start this week. On Friday, the market closed with a breakout of resistance level 0.68447. The next resistance level we should be looking at is 0.69492.

NOTE: It’s a Monday, and like I always advice, be cautious, the market may open with a GAP, or even do some crazy moves which may not align with our analysis. Be patient enough to wait, observe, before taking any of the trades we analysed.

Kindly comment, share, and subscribe. Do have a fruitful week ahead.