Happy Sundaaaaaaaaaaay Awesome Traders,

We got two weeks plus before the month of February ends. How has February treated you so far?…

How did your weekend go?, hope you had enough time to relax and tend to other pressing needs.

I just walked out on Manchester City Vs Chelsea game after the first half. In my opinion, It seized to be a competition after ending first half with 4 goals.

That said…, let’s go into the forest of forex and mark some pairs we should be paying close attention to this coming week.

Are you ready?….

Let’s go

1. EUR/USD

Price on EUR/USD is locked within a pennant on a daily chart.

One thing we should be waiting for is to see how price reacts, when it finally touches support level (1.13083).

A breakout below the support level should encourage the bears to take price further south to the next possible support level (1.12183). A bounce on support level 1.13083 should encourage the bulls to take price to resistance level 1.14790.

Hopefully, this trade should be ripe enough by Wednesday.

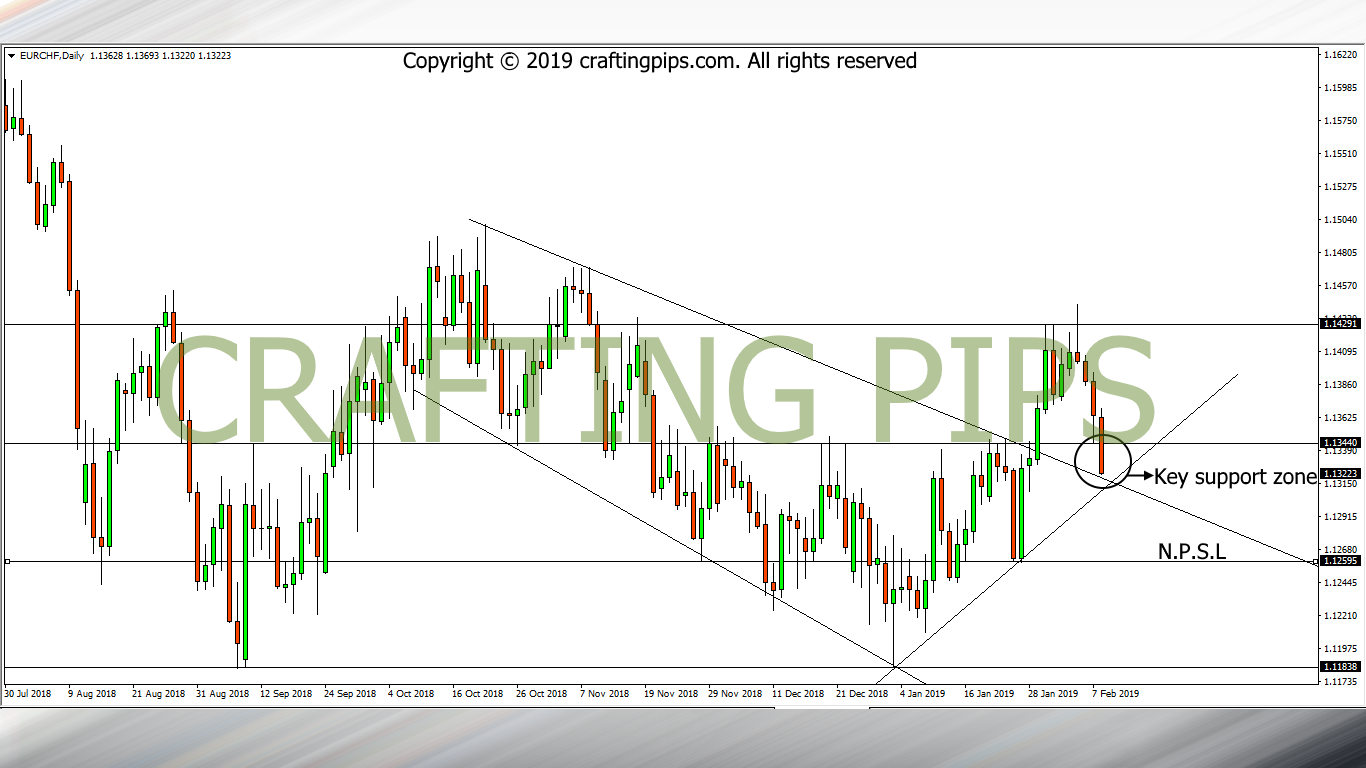

2. EUR/CHF

EUR/CHF is looking bearish on the daily time frame and good for a sell, but is it?

I was not planning to analyse this trade, but…

On a second thought, I decided to, because when I initially looked at it, I was almost hypnotized by the setup, then I looked closely and saw some traps, so I decided to share.

After price obeyed resistance level 1.14291, the sellers jumped into this trade and further forced price below support level 1.13440 without hassles.

Presently, price is approaching another important support level which is actually an intersection between:

- A descending support level and

- An ascending support level

If at all we are selling this pair, let’s ensure that a bearish breakout of support level 1.13165 is confirmed.

VERY IMPORTANT

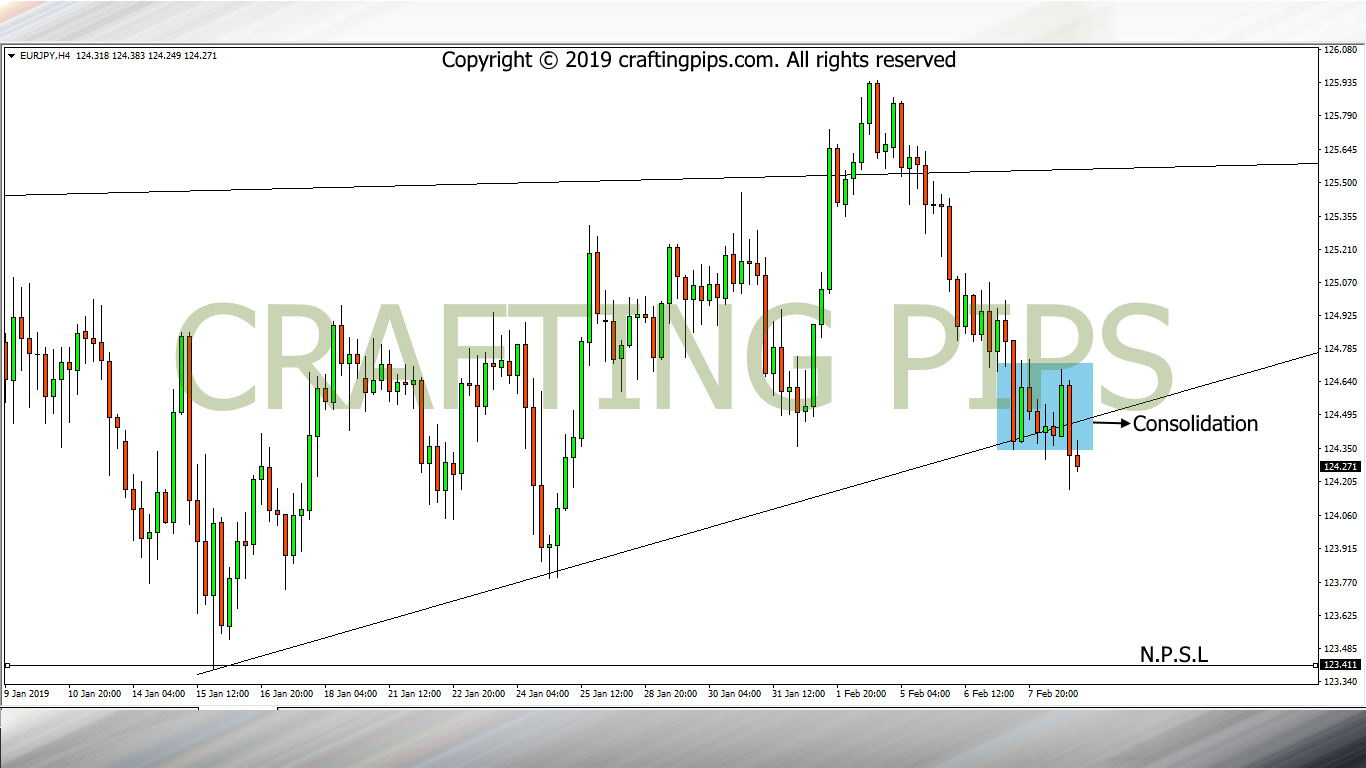

3. EUR/JPY

EUR/JPY on the 4 hours chart is currently contemplating a bearish breakout.

If you zoom out to the weekly chart, you will observe that:

Last week, price hit a weekly resistance level (125.640) on Monday, and it spent the rest part of the week observing a bearish run.

On the 4 hours chart, EUR/JPY is about to breakout from an ascending support level. The pair is still contemplating though as we can see a consolidation.

Personally I will be waiting a few hours into Monday, before I decide on taking this trade. It’s one trade I am looking forward to.

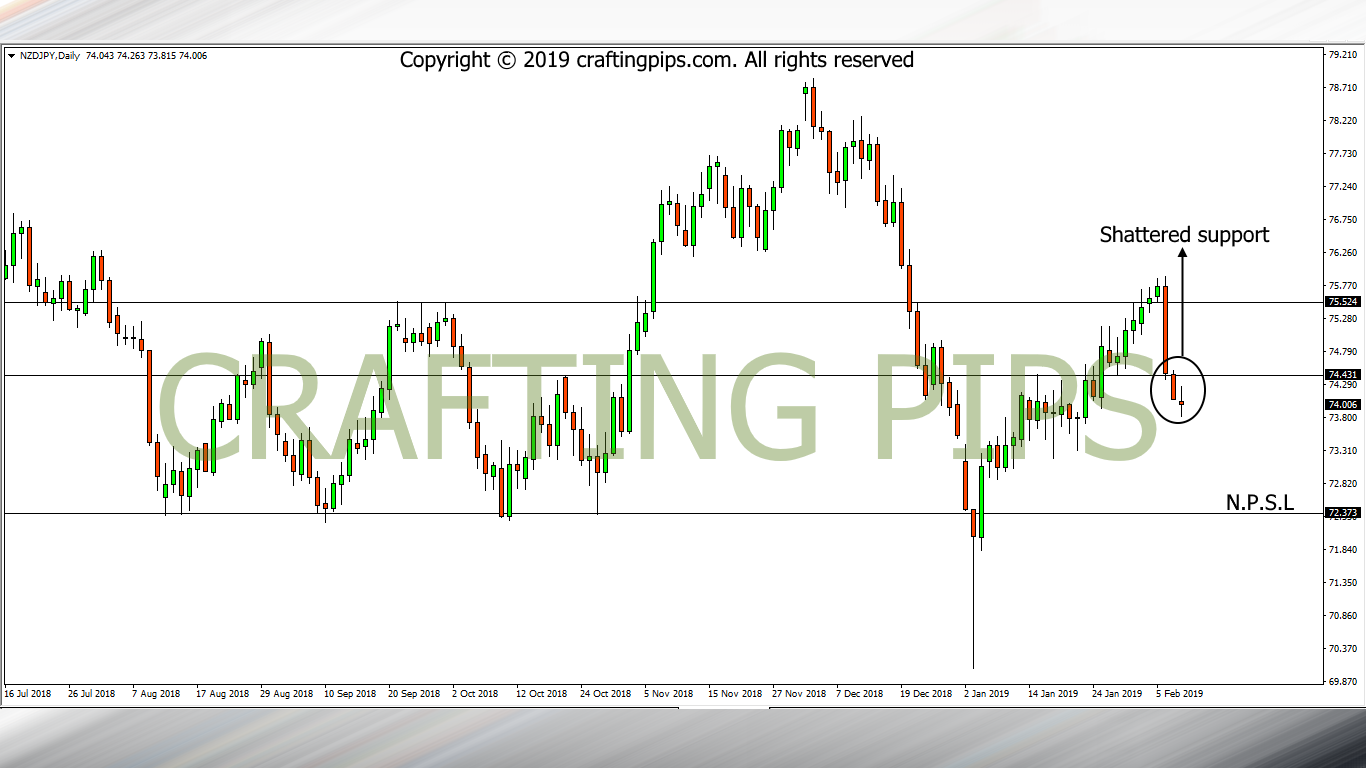

4. NZD/JPY

NZD/JPY is sneaking through some key support level on the daily chart.

What say you?… Do you think it’s a viable trade?

Well, I believe it would have been a super viable trade if this setup happened at the middle of the week. Since we are seeing this setup at the beginning of the week, it’s important to observe the pair for a few hours before committing to it.

If the bears continue their run this week, we may most likely see price hit the next possible support level 72.373.

I doubt a reversal at this point, however, if you taking this trade, ensure you pick a decent stop loss and apply a good money management technique.

That’s all we have for the week, we will continue to update you as the week progresses.

What is your favorite pair for the week?

Share our content If you got pip loving friends, and subscribe if you don’t mind getting daily trade updates.