Happy Sunday Legendary Traders,

How is the holiday celebrations coming up?

Well, it’s crazy over here, I am having a full house and presently writing this weekly analysis at the foot of my bed, nursing a slice of cake and some funny looking beverage that is currently lighting up my taste buds.

Today on our charts, I spotted many viable setups. I am already wondering if the market is trying to call me out of retirement (lol)?

Let’s get into the market:

1. EUR/JPY

EUR/JPY on the daily chart is highly bearish.

Friday’s market closed with the Japanese Yen gaining strength across most currencies.This action broke a key support level (126.609) on the EUR/JPY.

Although this breakout is not fully confirmed, but from the current outlook on the pair, I believe the EUR/JPY may most likely continue its bearish run. If it does, we could see price hit support level 124.887.

2. CAD/JPY

The Canadian Dollar was not spared from the wrath of the Japanese Yen.

In the process, a strong support level 82.188 that price visited a little over 6 months ago was broken just before market’s close on Friday. In my opinion, price may most likely hit the next possible support level (80.629).

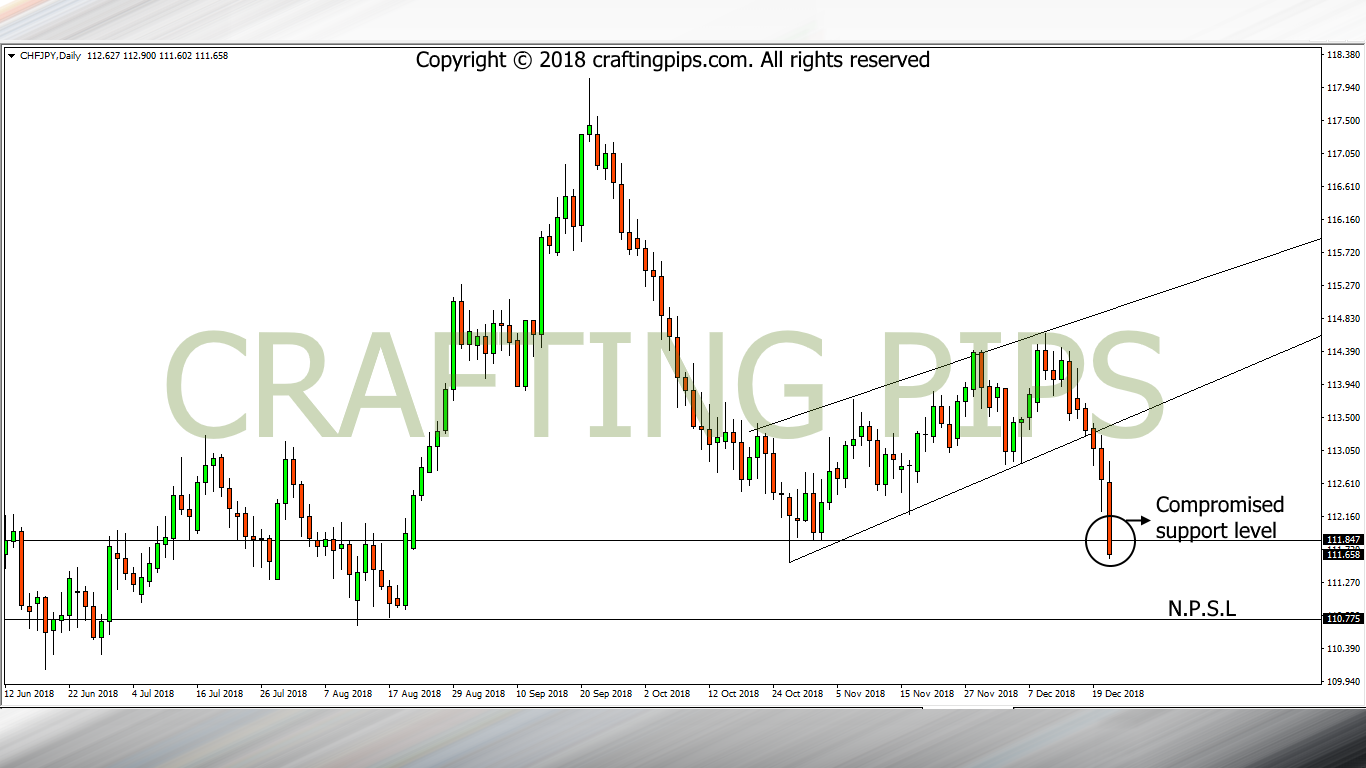

3. CHF/JPY

The Swiss Franc was not spared by the Japanese Yen’s brute force.

After an ascending channel on the daily chart of the CHF/JPY was broken, the bears took price to the next key support level (111.847). Presently, this support level is compromised as the bears slightly broke out of the current support level.

If we were going to sell this pair, we would need an additional confirmation to do so. If this week confirms that the bears are in for the long run, we may most likely see the next possible support level (110.775) hit by price.

If the bears strength fails at the current support level, price may revisit level 113.124.

4. AUD/USD

AUD/USD suffered a major hit from U.S dollar last week.

The strength of the dollar brought price down to a key support level (0.70388), which is also an intersection with a former resistance level of a descending channel.

Price could either breakout from the current support level to hit the next support level 0.69088 or price could bounce off the present support level to revisit a key resistance level (0.71533).

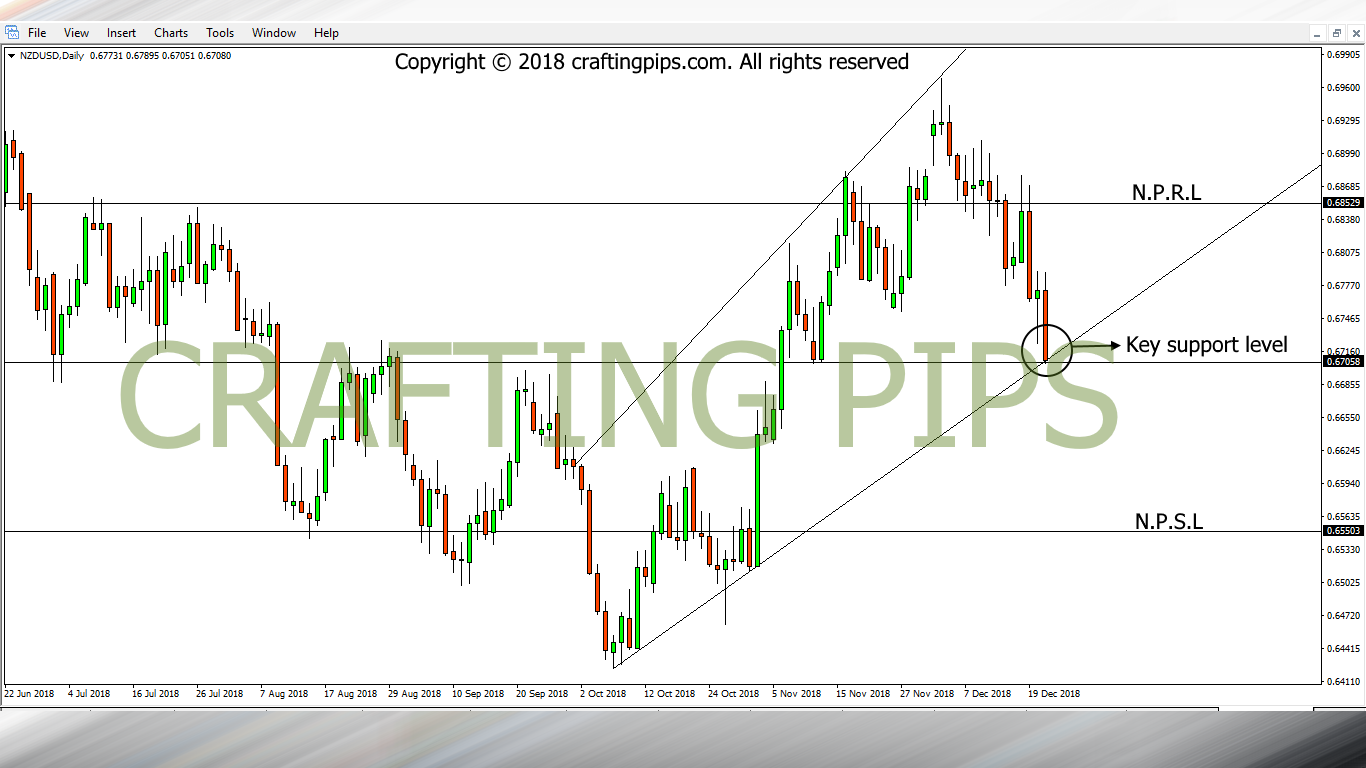

5. NZD/USD

NZD/USD is pretty straight forward. Price is presently on a key support level (0.67058), which is also an intersection, since it shares a key support area with a horizontal channel.

If the present support level is strong enough, price could bounce back to hit a former resistance level (0.68529), on the other hand if the current support level fails, there is every likelihood that price will be taken to the next support level (0.65503)

In all of these setups, please ensure to wait for confirmation before committing.

That said, permit me to go back to the spoils that accompanies these special holiday season. Just in case I don’t show up this week for our daily analysis, pardon me.

Wishing you a Merry Christmas fam