Happy Sunday Great Traders,

How did your weekend go?.

Personally I pampered myself with quality sleep, I had some accumulated fatigue during the week, which I had to sleep off.

So, we are back to the charts, and this is our third week in the month of January. Let’s make it count.

1. EUR/JPY

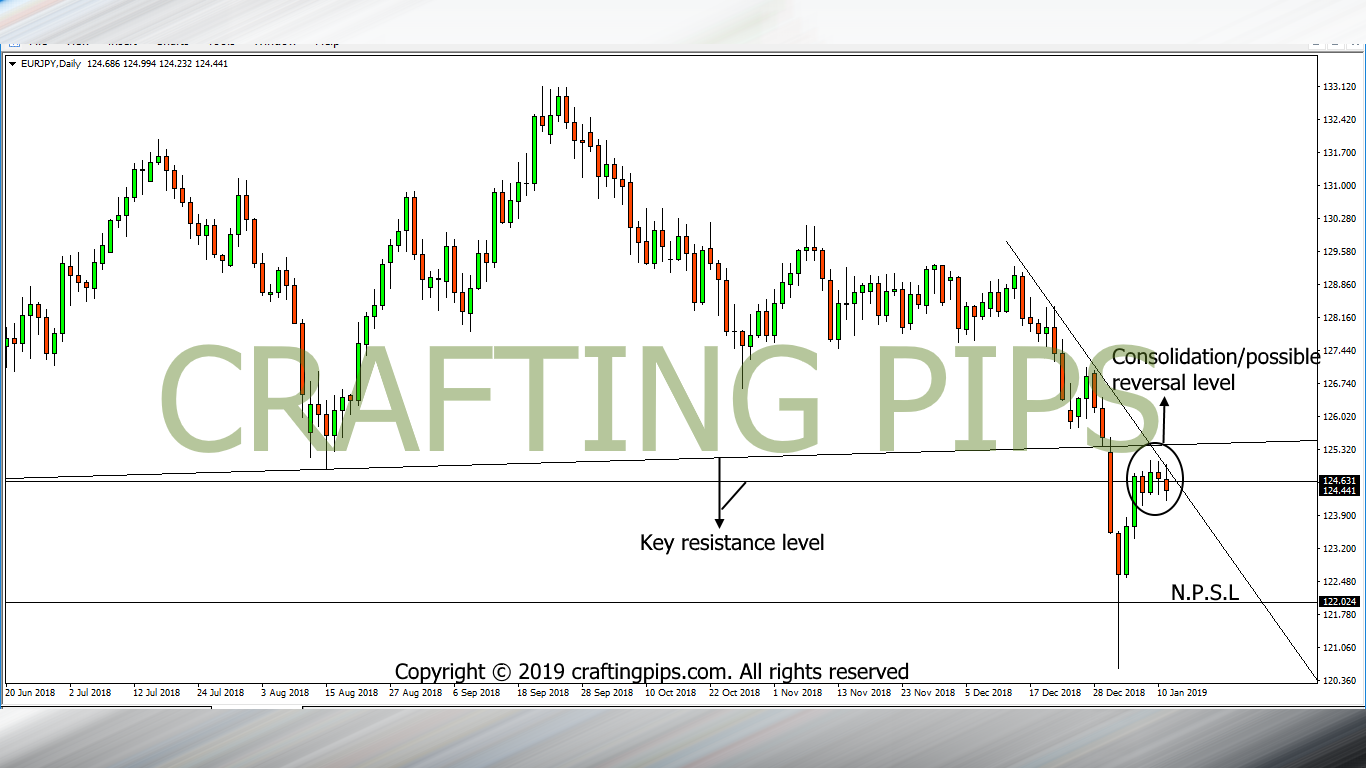

EUR/JPY on the daily chart seem to be struggling with an important resistance level.

Price spent the better part of last week consolidating around level 124.90, which coincidentally happened to be a resistance level formed by a previous ascending support level and a descending resistance level.

This week may most likely bring forth a reversal on EUR/JPY. If it occurs, the bears should lead price to it’s next support level (122.024).

In my opinion, I doubt EUR/JPY breaking the present resistance level….

But hey…

If it does, we may see the next resistance level (126.957). Before taking this trade, ensure your trading system confirms it.

2. AUD/JPY

AUD/JPY price pattern is very much similar to EUR/JPY.

A reversal at the current price level will definitely see price hit it’s next support level (75.354).

A breakout from the present resistance level (78.269) should take price to the next resistance level (80.509)

3. USD/CHF

This is a BONUS TRADE. We have been trailing this pair all through last week, if you missed out, check last week’s analysis here.

USD/CHF on the daily chart closed on Thursday with a bullish engulfing candlestick, which pretty much signified a bullish move on the daily chart.

Friday’s market closed with price obeying a descending channel’s resistance level (0.98565) on the 4 hours chart.

In my opinion, waiting for a bullish breakout of the present resistance level is KEY.

That said, I am wishing each and everyone an awesome week ahead, and remember…

In forex trading, the adage:

“A patient dog eats the fattest bone” ALWAYS APPLIES

Take it away…