Happy Sunday Legendary Traders,

We are already in the month of festivity, I just hope we don’t get carried away with all the razzmatazz December brings along with it.

Meanwhile, I have not yet made up my mind on when I will call it a wrap for the year. Well, let’s keep on keeping on while I still ruminate on those thoughts.

So, let’s head right into the market and see how we could make this month count.

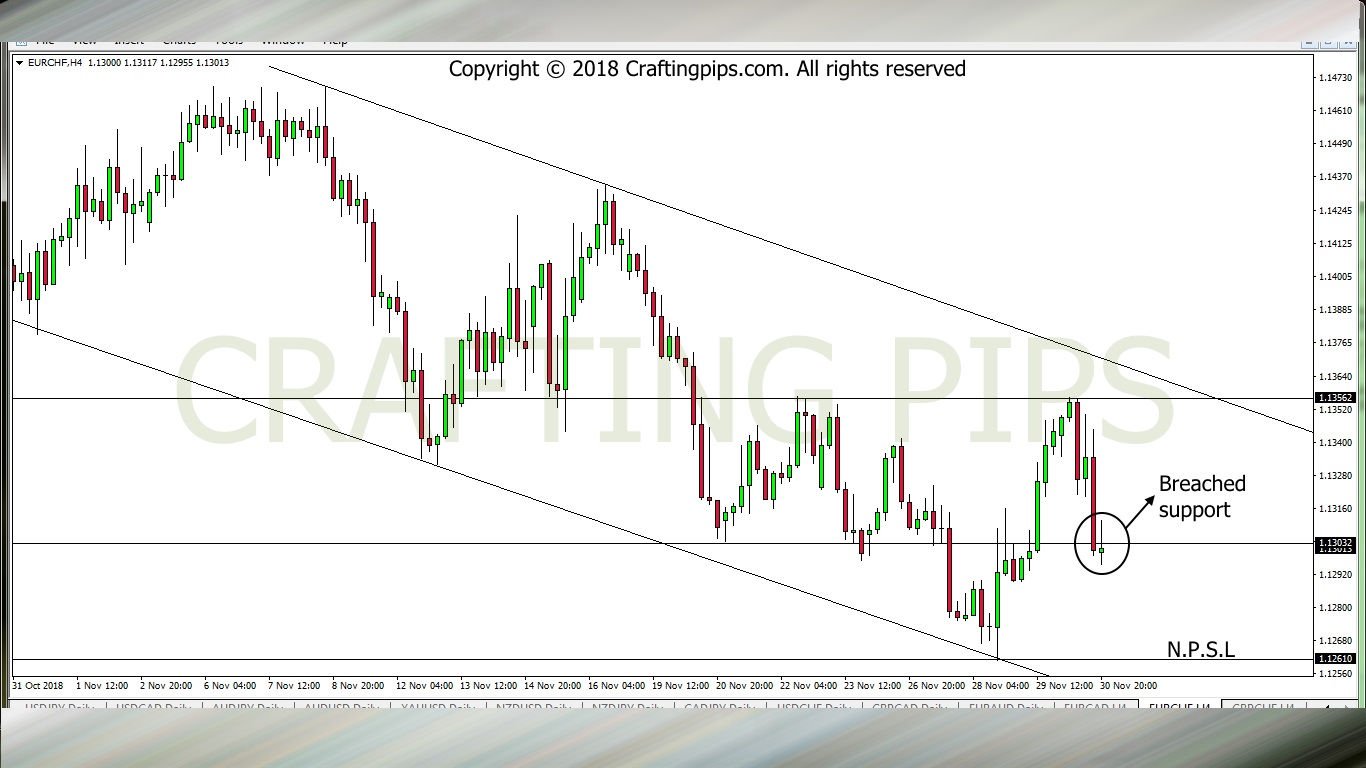

1. EUR/CHF

EUR/CHF was analysed on Friday. That said, I never expected the bearish move that happened prematurely (in my opinion).

In any case, since the market has decided on it’s direction, we are left with no choice than to harness the present situation. A key support level was breached on the 4 hours chart 1.13032.

We will definitely need an additional confirmation before we make any decision to continue selling this pair. If the sell is still valid after the erratic nature of Monday’s market, we should be expecting the pair to hit the next support zone (1.12610).

We should also watch out for a slight pullback at the present level before the bears come in. Patience would be needed on this particular setup, in order to full utilize it.

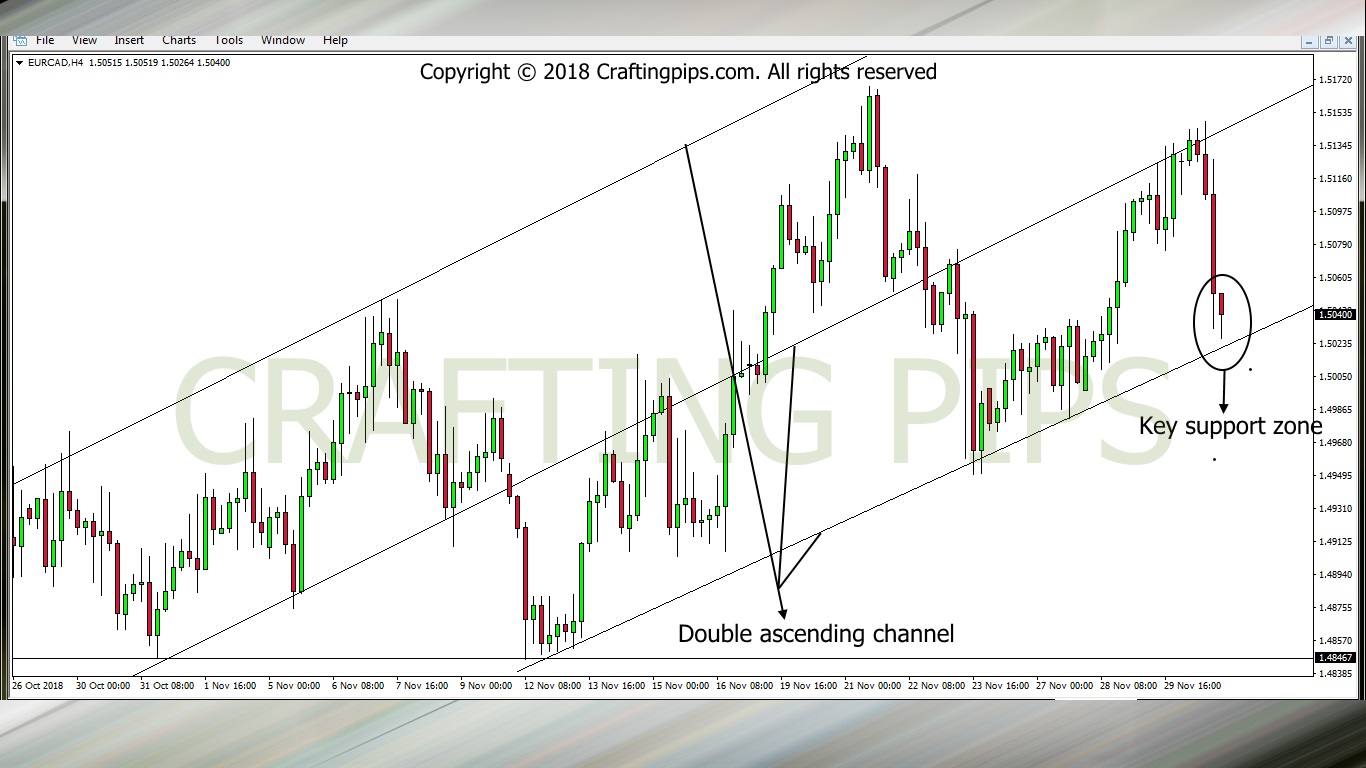

2. EUR/CAD

Another promising setup is the EUR/CAD

A double ascending channel on the 4 hours chart is in view. Price is presently resting on level 1.50251. The highly bearish outlook on EUR/CAD occurred when price hit a descending resistance level (1.51425).

For price to break through the present support level, there will be a need for a little more effort by the bears, simply because, on the daily chart, the entire setup is resting within a pennant.

A breakout or reversal has a 50/50% chance of happening.

A breakout from the current support level should take price to it’s next support level (1.49530) and a reversal should see price hit resistance level 1.51320.

3. EUR/AUD

EUR/AUD could easily be called a BONUS TRADE.

Meaning: The trade has all the potentials to give us an easy meal. The trade closed with a clean breakout, through a minor support level (1.55170).

There could be a minor pullback, forcing price to go back to the former support level (1.55170) as soon as the market opens, after which there is a likelihood that the bears would take price to the next support level (1.53197).

4. GBP/USD

On GBP/USD, price is locked within a consolidation. The bulls have been struggling for a bullish or bearish breakout since Wednesday last week.

This week, we should be looking out for either a bearish breakout below level 1.27226 or a reversal. Until that happens, GBP/USD is a “no go area”.

A bearish breakout should take price to the next support level 1.25916. If a reversal occurs, we should see the bulls take price to a former resistance level (1.28531).

This is another trade that would need our patience.

5. GBP/JPY

For the past one week plus, GBP/JPY has been struggling to attract buyers. Price has formed a consolidation on the daily chart.

A breakout through the current support level should send price on a bearish rampage to its next support level (142.777). A bullish confirmation from the present consolidation should send price to around level 147.921.

Remember, it’s another Monday and extreme caution should be applied in trading the market.

Wishing you all a great week ahead, subscribe, to get our daily market analysis. Comment, we would love to know your views on the market and kindly share our analysis with fellow trader if our views on the subject have been helpful to you.