Happy Sunday Legendary traders,

Another brand new week to get to know ourselves better, by studying how we react to opportunities in the market and basically how we get to execute viable trades.

That said, I hope your mind is well rested and fully prepared for another trading week?… Alrightyy, let’s hit the charts and bookmark the setups we should be looking out for all through the week.

1. CAD/JPY

If you remember, this bad boy (CAD/JPY) was analysed exactly a week ago here.

Our analysis was SPOT ON. However, I never expected the entire bearish move to happen within a week, immediately after breaking out from it’s key support area (80.854), but it did, and that was amazing.

Presently, price has succeeded in forming a beautiful bullish pin bar above the the former strong support level (80.854) which is now a KEY RESISTANCE level.

My bias concerning this pair is that, it has every potential to remain bullish for the rest part of the month of January, and if there was a minor target profit that we should be looking forward to, is level 83.686. If price can break this level, then, price level 85.821 should be the next resistance level.

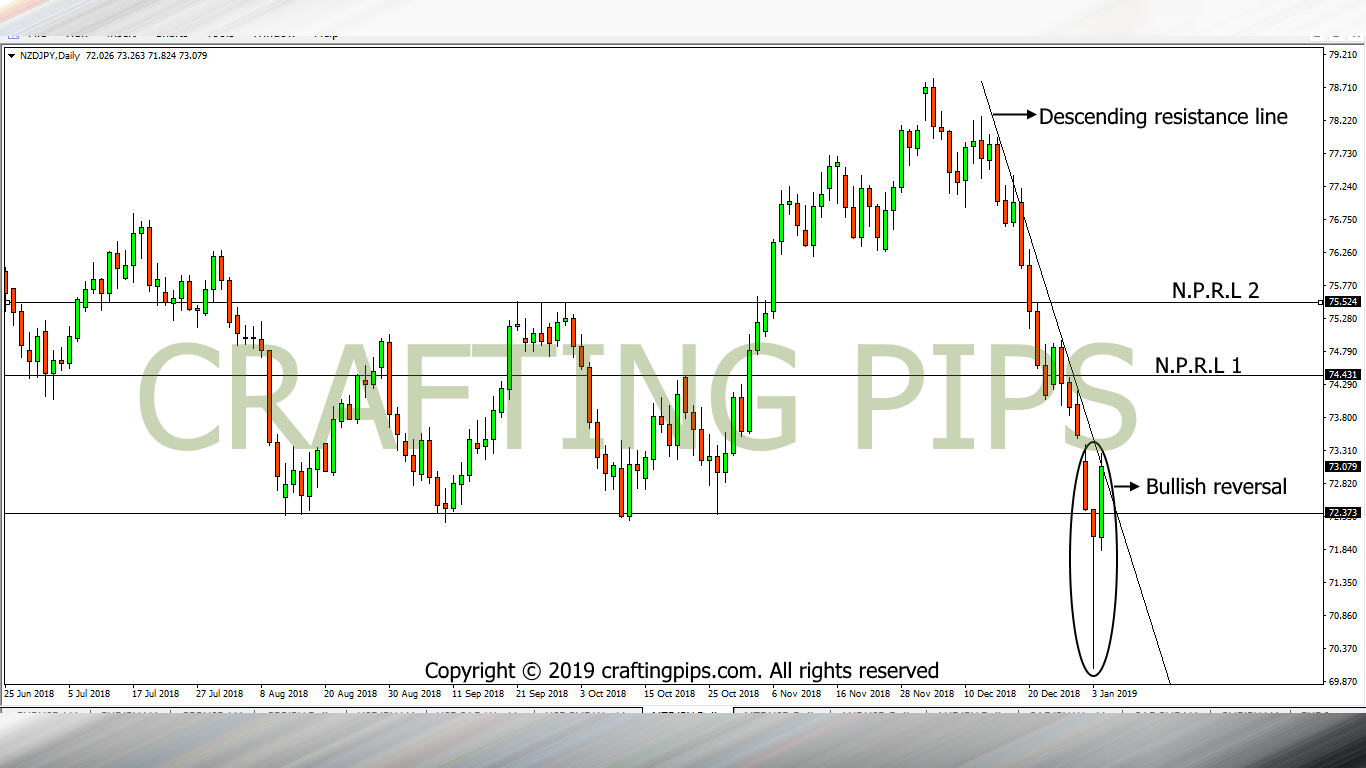

2. NZD/JPY

NZD/JPY may be our bread and butter this week.

After support level 72.373 held for over 2 years, a breakout, after the new year break, sent this pair on a mad bearish frenzy which spewed over +200 pips to a few fortunate traders.

This shouldn’t be much of a surprise if you follow this pair closely, because same ordeal repeated itself on June, 2016. When it happened then, over +320 pips were gifted to another set of fortunate traders.

Presently, NZD/JPY closed on Friday with a bullish reversal setup.

Now…, you ask, Am I buying it?

Oh, well. I will be gauging the seriousness of the bulls by determining if they would cross a key descending resistance line before committing my shekels to this trade.

If the bulls prove themselves this week, we should be looking at two possible resistance levels (74.431 & 75.524) to get hit within the month of January.

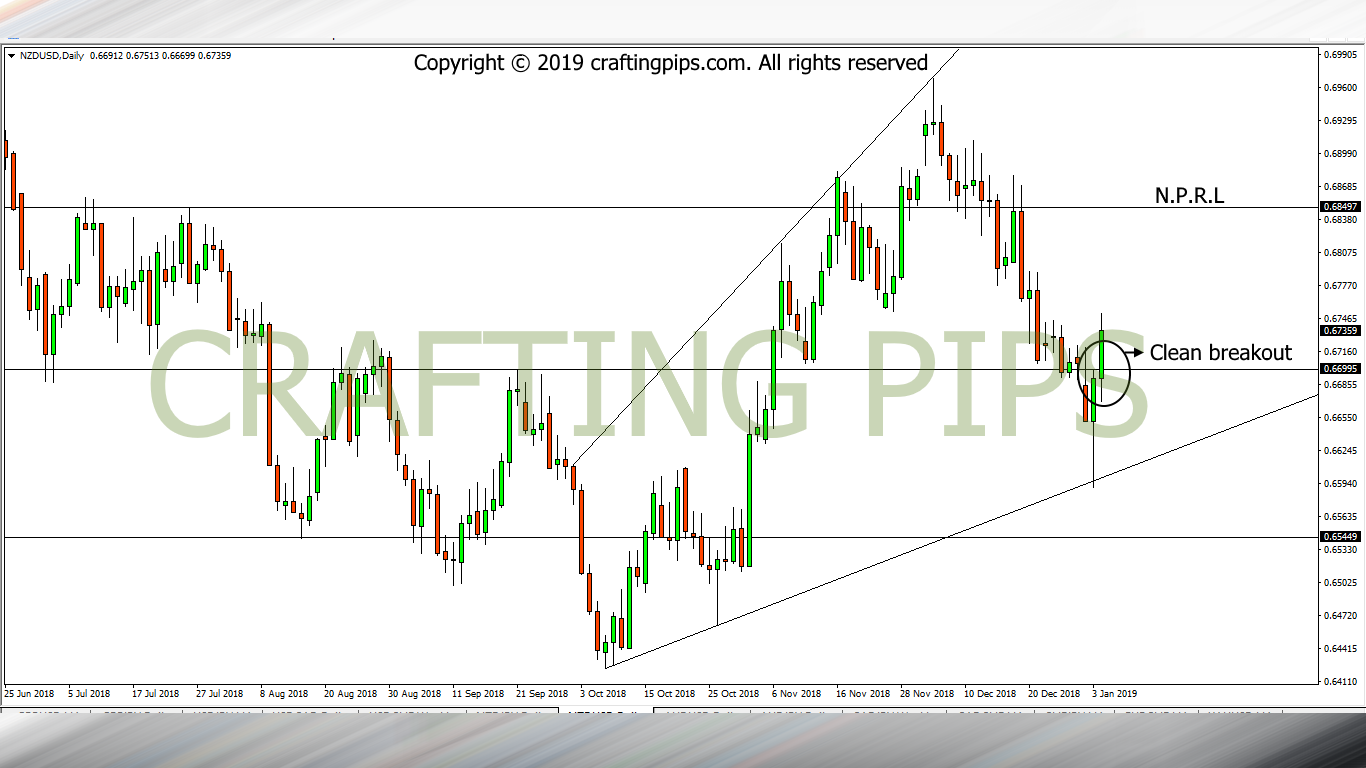

3. NZD/USD

I will call this setup a BONUS – TRACK, for those who have been following our analysis closely, I am sure this shouldn’t sound strange to you, for those who missed out, kindly check here

The only phobia I had last week Friday about NZD/USD, was about the pair not having enough bullish strength to breakout from a minor resistance level (0.66995). However, those doubts were cleared towards the tail end of Friday market.

My bias about this pair is that the bulls are back, and there is a huge possibility that the next resistance level (0.68497) should get hit.

That said, I am wishing each and everyone a grand week ahead and remember to always use a sound money management technique.