Happy Sunday fam,

What’s happening?

How did your weekend go? and

How are you preparing for the week ahead?

For me, I spent almost the entire weekend trying to punish an old foe on Pro Evolution Soccer 19 on my Play Station IV gaming console.

You want to know the outcome of our duel?

I lost woefully (sob sob).

It’s not like I am trying to give excuses for my loss, but I personally lost interest in soccer years ago, especially after the advent of adventure games with dope multiplayer game plays.

Well, that means I need to sharpen my skills again, hopefully, I will work on that.

Okay, that aside, I was going through my charts to see how we could make some good trades this coming week and I came up with…

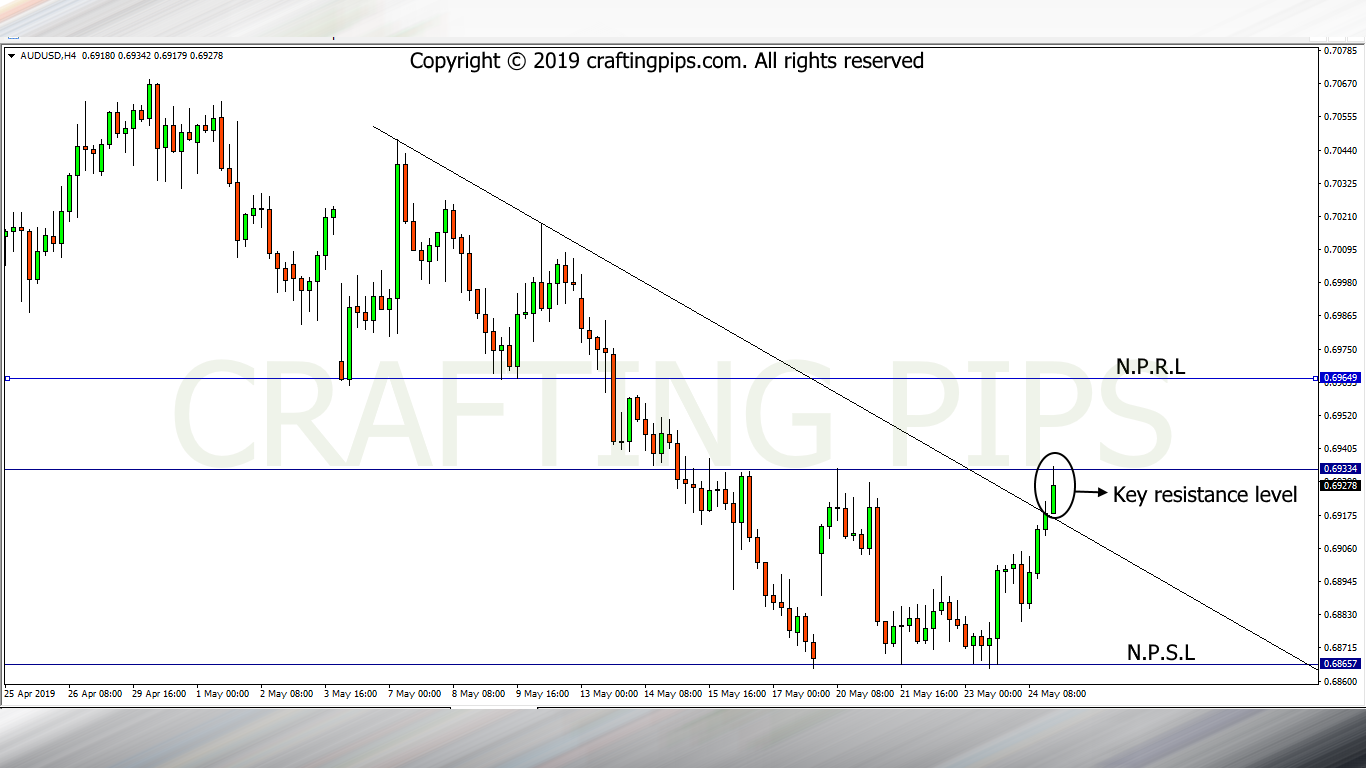

1. AUD/USD

AUD/USD is currently facing a strong resistance level (0.69334)

Though the current resistance level looks formidable, let’s not forget that on the daily chart, price bounced off a key support level (0.68657) and before the market closed on Friday, the Bulls were pretty much on steroids.

Personally, I am bullish biased and believe the current resistance level will be broken, and price will continue it’s upward move to the next resistance level (0.69649).

Please note that that’s my bias, not what I will necessary trade this coming week.

Confirmation is important even when you have a strong bias regarding a setup.

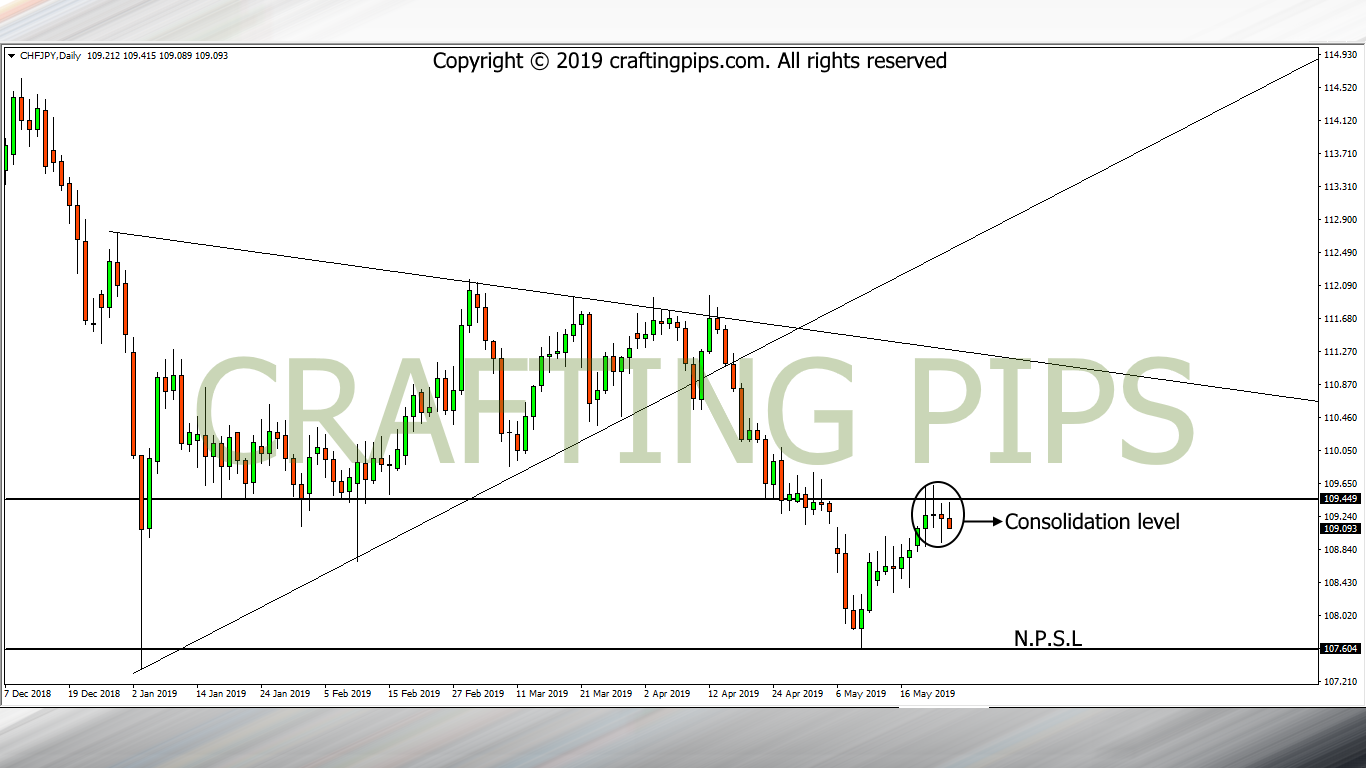

2. CHF/JPY

CHF/JPY on the daily chart formed a consolidation level around a key resistance level (109.449)

If this trade occurred during the week, I won’t hesitate to shorten it, because it has all the characteristics of a reversal.

Since it’s the beginning of the week, a good dose of patience would be needed to ensure the reversal is not a fakey.

If the reversal pulls through, we should be looking at support level 107.604 as price’s next safe haven.

If the current resistance level is broken, then we should be looking at resistance level 110.260 as price’s next bus stop.

These are the trades I will be watching this last week of May. If there are other viable setups along the week, I will definitely update you guys.

Wishing everyone a pip-full week ahead