Good day traders,

Hope everyone is well rested?

It’s the last week of January, and I always see the last week of each month as a week of reckoning, a time to check our performance and see where we need to fine tune our trading habits or systems.

That said, let’s see which currency pairs we should be monitoring this week.

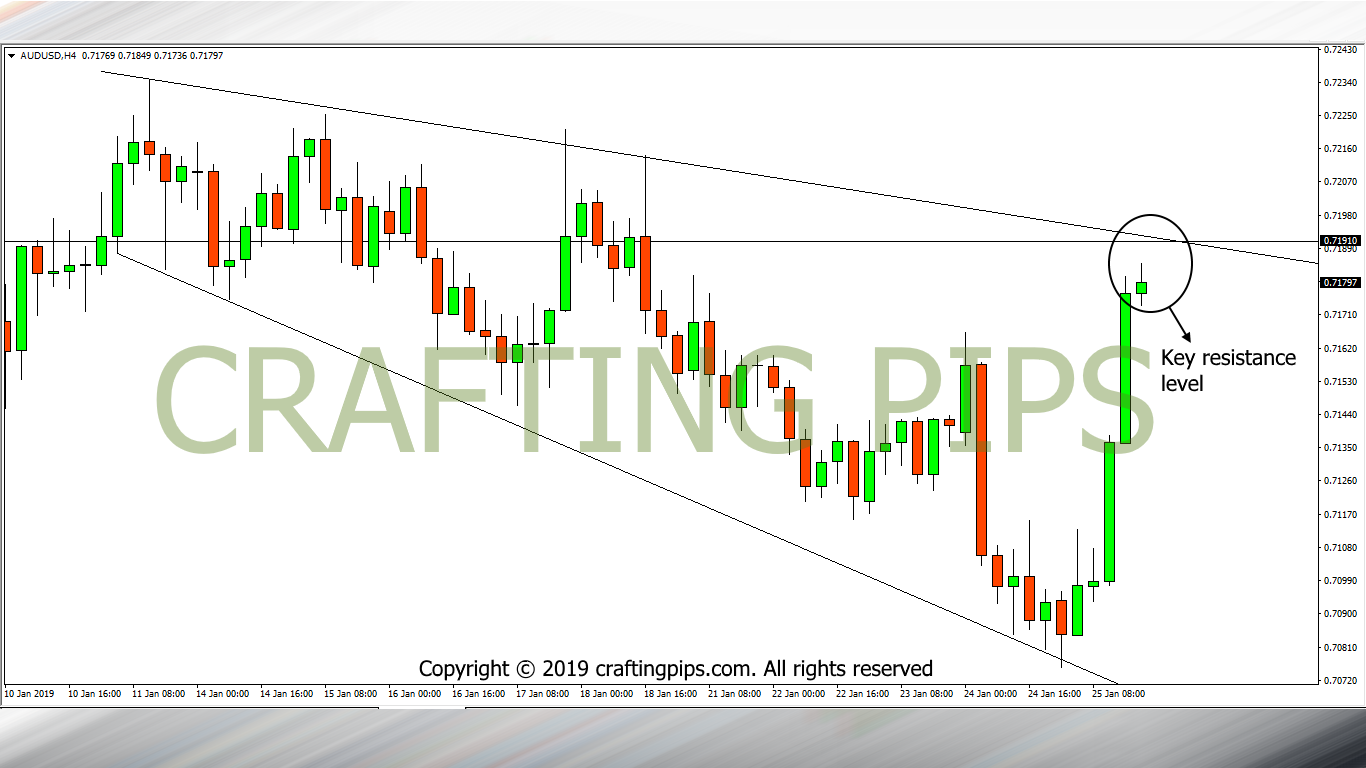

1. AUD/USD

For AUD/USD, price on the 4 hours chart, formed a descending expanding funnel.

On the daily chart, price only reacted to an important support level (0.70834) which bounced price to the current resistance level (0.71910), which is also a key resistance level on the daily chart.

If price breaks the present resistance level, the bulls may most likely take price to the next resistance level (0.73006) before the week runs out and If a reversal occurs, we may see price return to a former support level (0.70834).

Personally my bias is bullish regarding this pair. However we must not lose sight in ensuring adequate confirmation is ascertained before taking this trade.

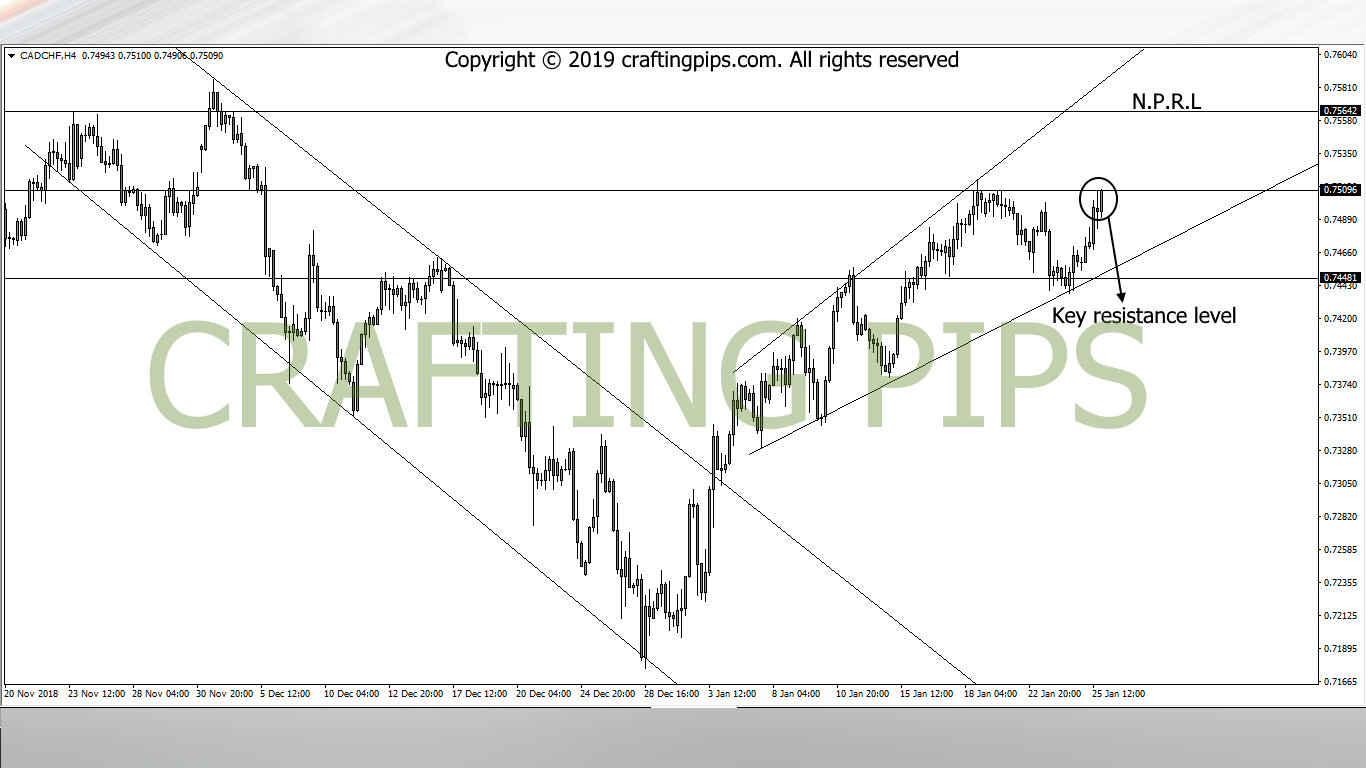

2. CAD/CHF

We saw CAD/CHF go on a bullish rage on Friday, however the strength of the bulls in the market was not strong enough to break resistance level 0.75096.

Judging from the 4 hours chart, there is a huge possibility that the bulls will continue their journey to the next possible resistance level 0.75642.

However, there is also a tendency for price to form a little consolidation as soon as the market opens on Sunday, before the market resumes it’s upward movement.

Personally I would advice traders interested in this pair to apply a generous stop loss, in order to accommodate any fluctuation before the bulls commence their upward run.

3. XAU/USD (GOLD)

Regarding Gold, looking at the daily chart:

Before the close of market on Friday, traders anticipated price, to either break through the conservative resistance level (1304.21) or

Bounce back to form a range between the liberal price level (1297.38) and the conservative price level.

This week, if price breaks through the present conservative resistance level, we should see the bulls take price to the next resistance level (1325.63).

The only time I may consider selling gold, is:

If the NOW liberal support level (1297.38) is broken by price and a good confirmation that the bears are in control of the market is given. Other than that, we suggest waiting for the bulls to confirm another upward movement.

We have come to the end of our analysis for the week, do drop a comment if you have a different view, share if you have pip loving friends and subscribe if you don’t mind getting our daily analysis forwarded to your inbox.