Happy Sunday Family,

How did your weekend go?

Mine was restful, I spent the most part of it sleeping, gaming and watching one of my favorite seasons, “Into the badlands”.

If you love martial arts and loads of action, I suggest you go watch it.

That said, let’s see how we could tap into some of the trading opportunities the market is presenting for the week.

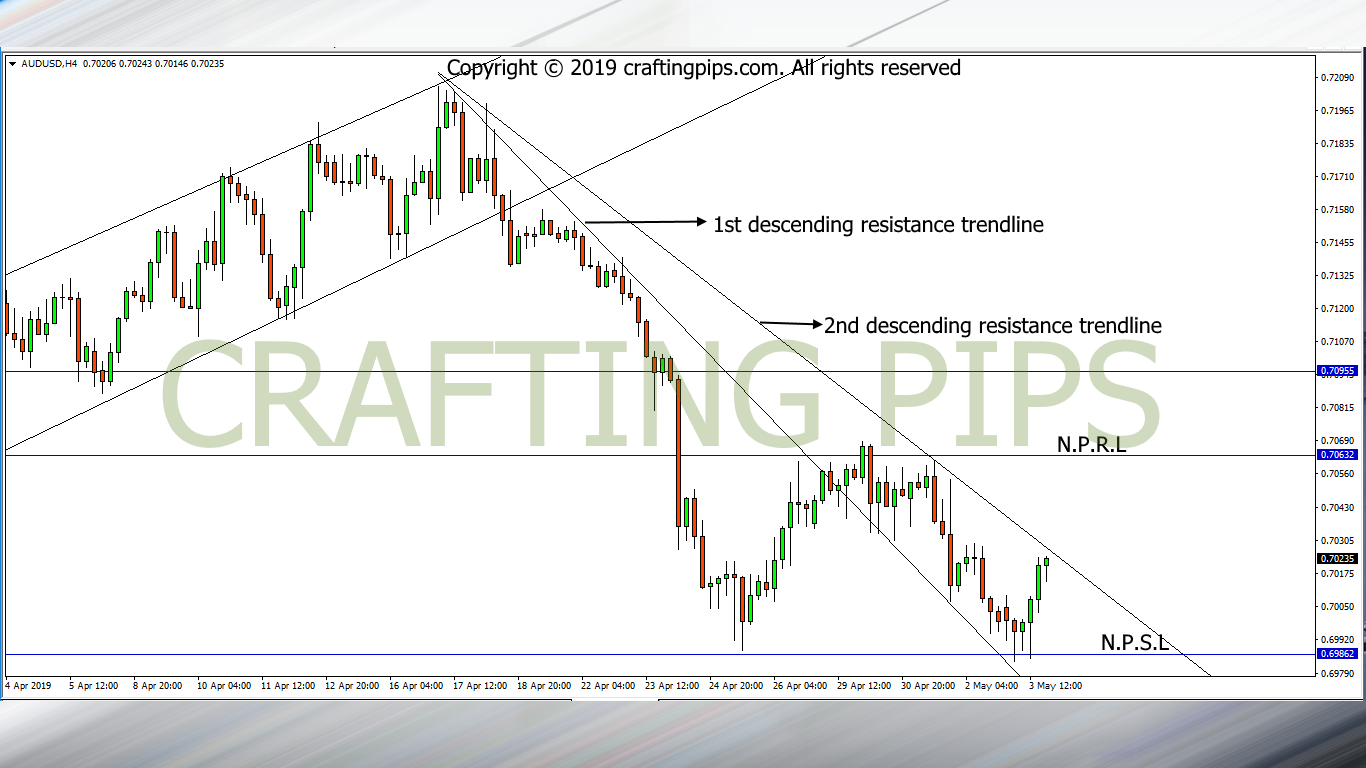

1. AUD/USD

Bullish price on AUD/USD is presently making its way to resistance level 0.70272.

On Friday, price bounced off support level 0.69862.

If the Bulls are strong enough to break the resistance, the next possible resistance level would be 0.70632.

If price reverses at the present resistance level, we should see the Bears pull price back to support level 0.69862.

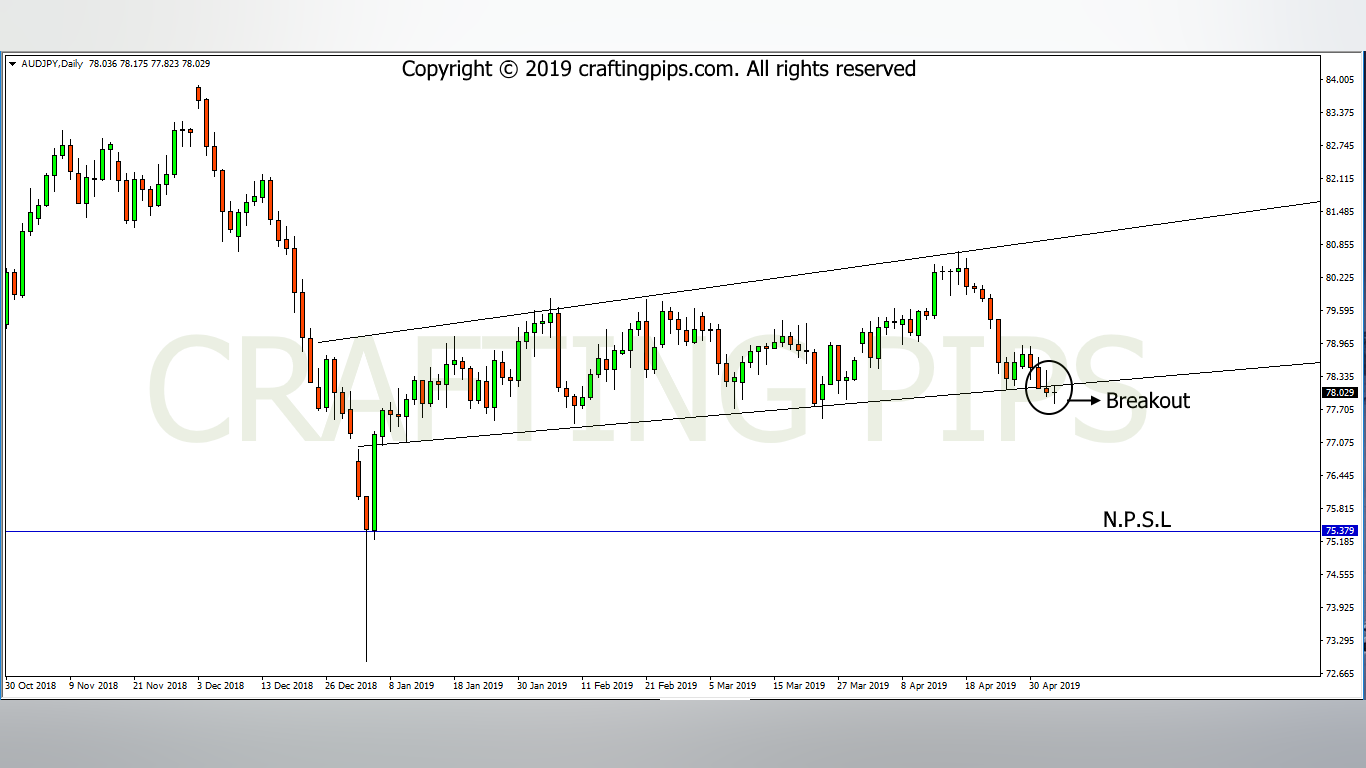

2. AUD/JPY

On the daily chart, price on AUD/JPY broke out from support level 78.127.

This week should further authenticate the breakout.

If the breakout is confirmed, we may see AUD/JPY tumble down to its next possible support level (75.379).

3. XAUD/USD (GOLD)

On the 4 hours chart, price on gold is locked within a descending channel.

In recent times, we have observed that gold has lost its bullish swag, hence taking price to the 1st resistance 1289.87 (within the descending channel) has become arduous.

If the present resistance level (1282.56) prove its strength, we may most likely see gold fall back to support level (1266.39),

IF NOT

Price may crawl to the first resistance level (1289.87).

Yes, we are done for today.

Thanks for spending your time with us. Tomorrow will be another day for some great analysis of the market.

Well done bro… You define consistency on the next level.

Would be observing AU and gold as we have similar views. Thanks

Thanks Tope,

I really appreciate the kind words.

Wishing you a pip-full week ahead man