Good day traders,

It’s our weekly analysis once again, and it’s time to speculate all the possible ways price could move. The reason for this is to make our week less stressful on us and it also helps us plan our trades for the week.

Let’s hit the charts and see what the market has for us

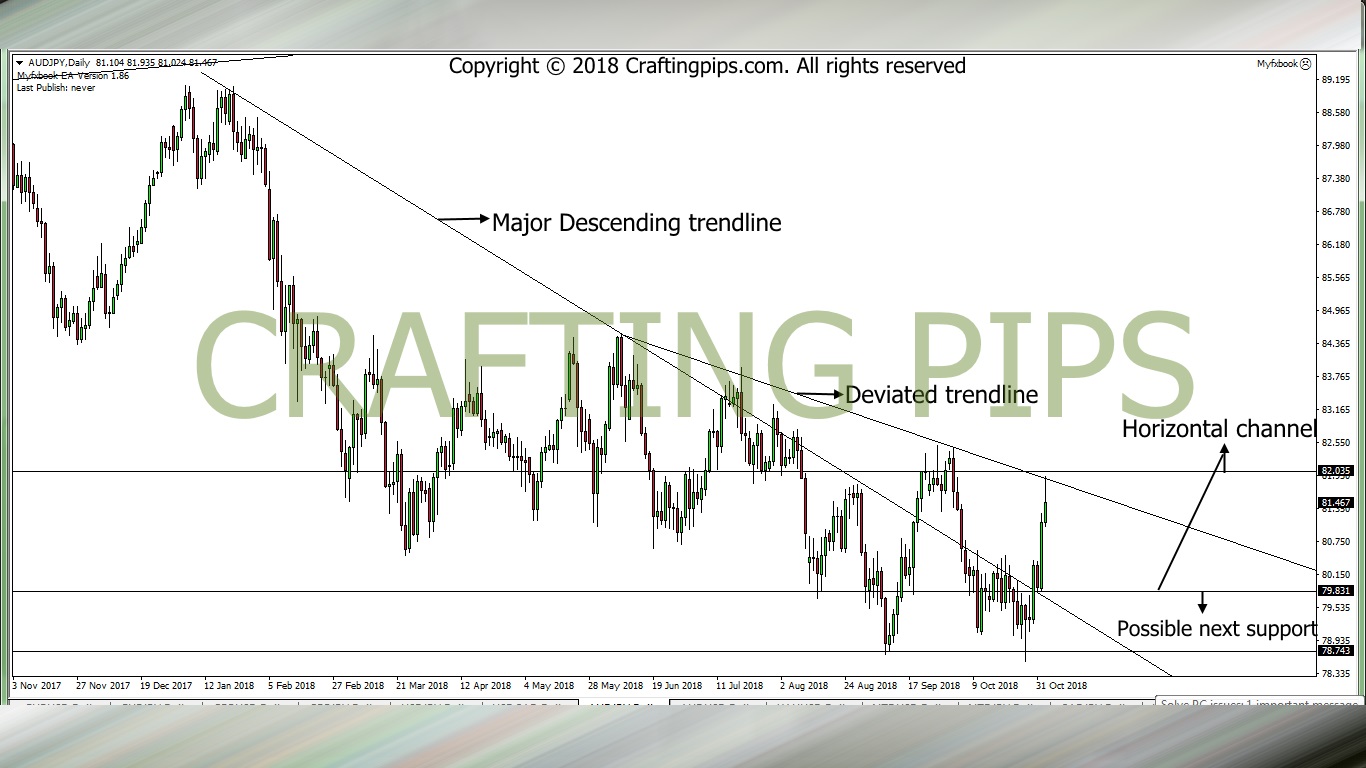

1. AUD/JPY

On the daily chart, AUD/JPY has a major descending trend line, picking the tops of two major peaks and a second descending trend line, deviating from the second major peak, however covering the rest of the swings in the trend.

The horizontal channel also intersects with the deviated trend line at 82.035 (current resistance level) and the major descending trend line at 79.831 (possible next support). Patience would be needed to determine a reversal at the present resistance level or a breakout of the resistance before trading this pair.

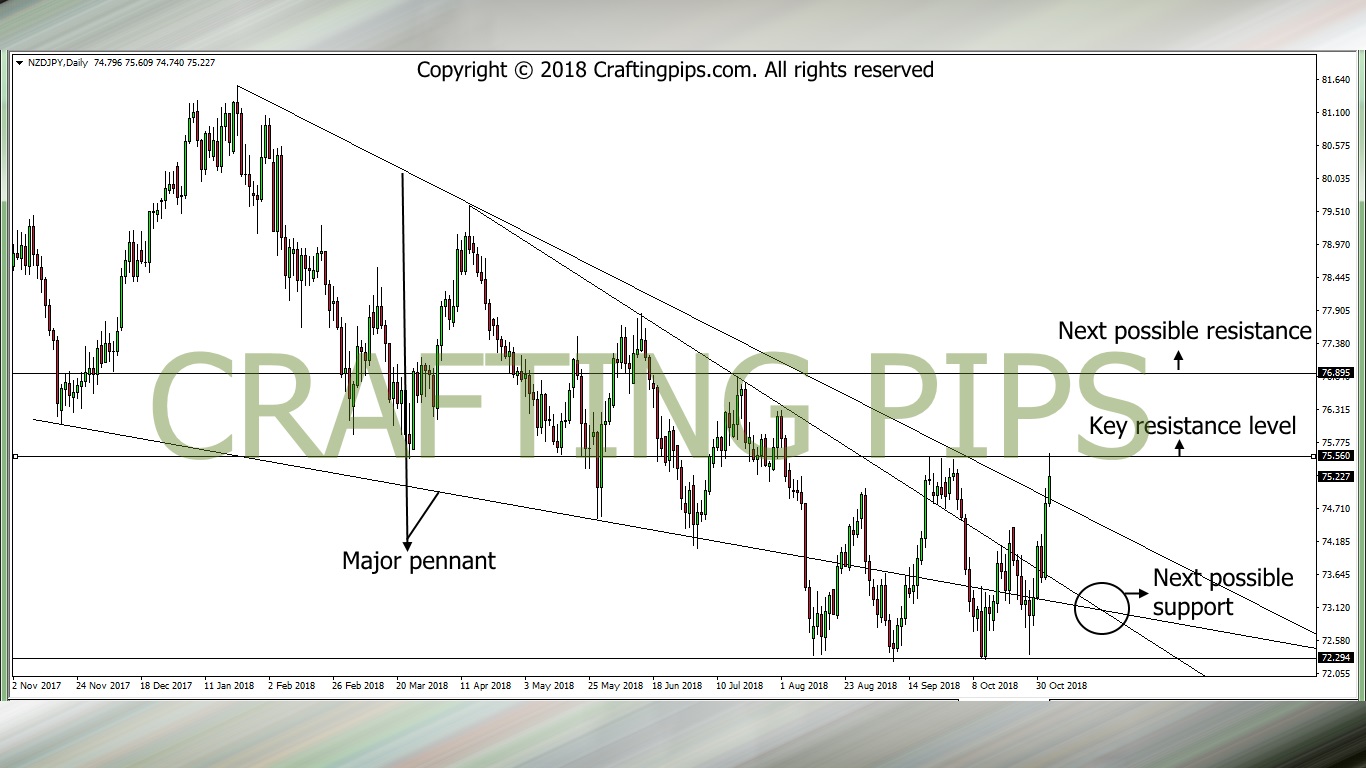

2. NZD/JPY

NZD/JPY on the daily chart has double pennants locking key price level.

the MINOR pennant converges at 73.081. This is a price level that could serve as the next possible support level. A horizontal channel also cuts across key support and resistance level.

Price is currently on a key resistance level (75.560). A reversal at this point should send price bouncing back to level 74.794 which could serve as a minor support level, before the bears take price to the next support level 73.081.

A breakout at the current resistance level could mean the bulls taking price to the next key resistance level (76.895).

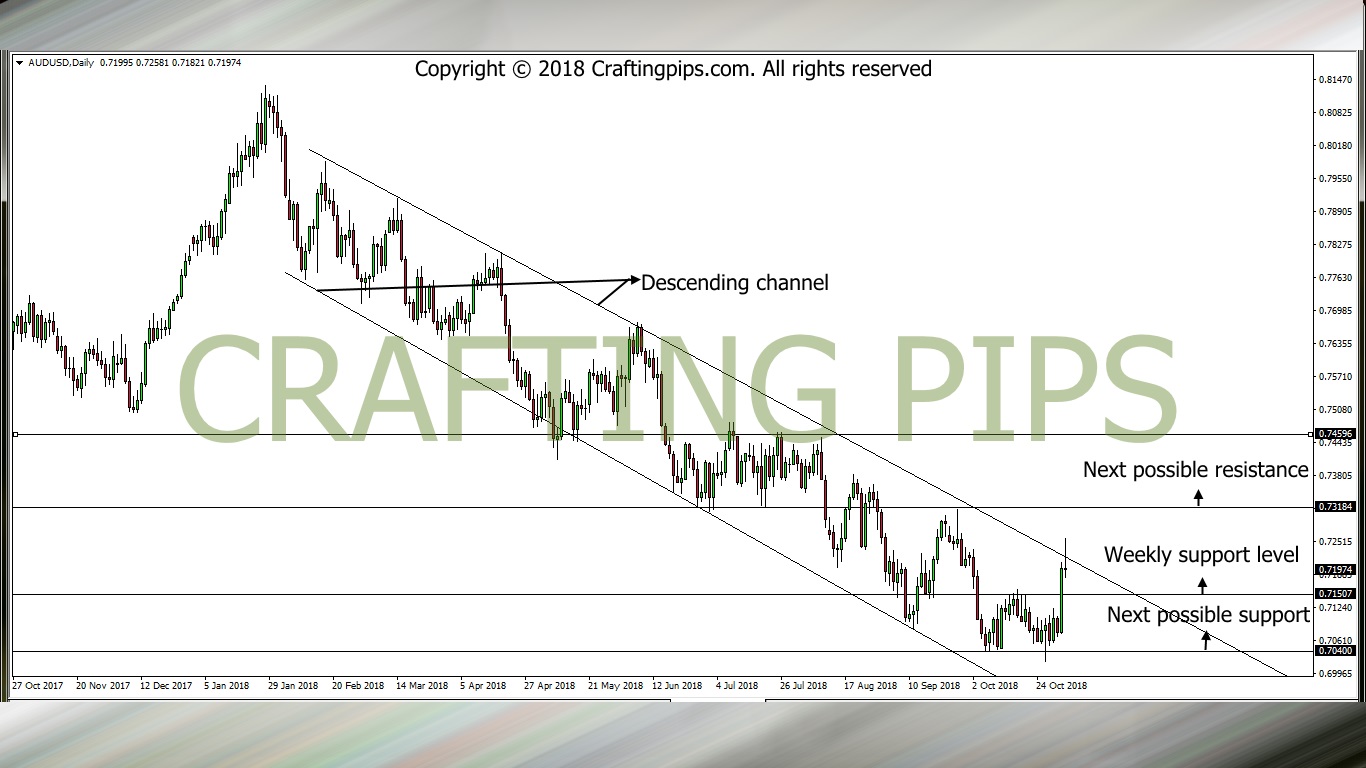

3. AUD/USD

The AUD/USD setup on the daily time frame is pretty straight forward.

A massive descending channel which commenced since the beginning of the year found a common support level where price took as its reversal point (0.70400). After price broke a key weekly resistance level (0.71507), Friday’s market closed with a bearish pin-bar after price hit the roof of a descending channel.

A bearish reversal on this pair may need an extra push from the sellers in order to break the weekly support level (0.71507), so sellers beware.

NOTE: Judging from how the US dollar and the Japanese Yen fared on Thursday and Friday. I would say they closed rather weak. This means our Australian and New Zealand Dollar have the advantage to go on a bullish run this week.

However, I will advice that exercising patience will pay off this week. We need to confirm if last week’s weakness on the USD and YEN will still continue this week before we decide on engaging any of our setups above.

Do have a great week ahead folks

Kindly leave a comment and share