Happy Sunday Legends,

Another beautiful week has commenced and it is with great pleasure I bring to you our analysis of the possibilities in the market this week.

Like always… Let’s jump right in..

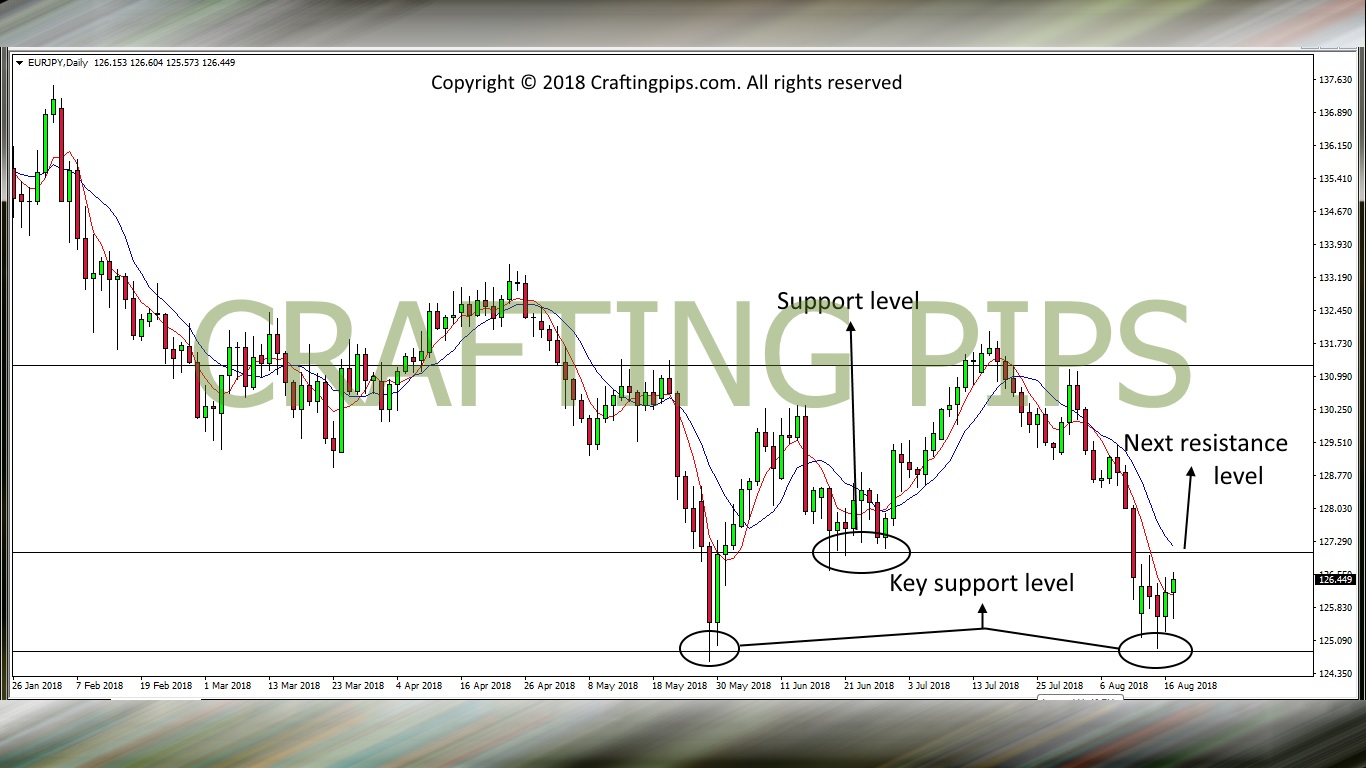

1. EUR/JPY

After EUR/JPY touched a key support level on Wednesday, it began a bullish run to level 127.036. This week, we may see level 127.036 broken as it is a minor support or the bears may come in and take this pair back to level 124.848.

Hopefully the 10pm GMT end of the day’s candlestick of Tuesday or Wednesday should make this setup clearer.

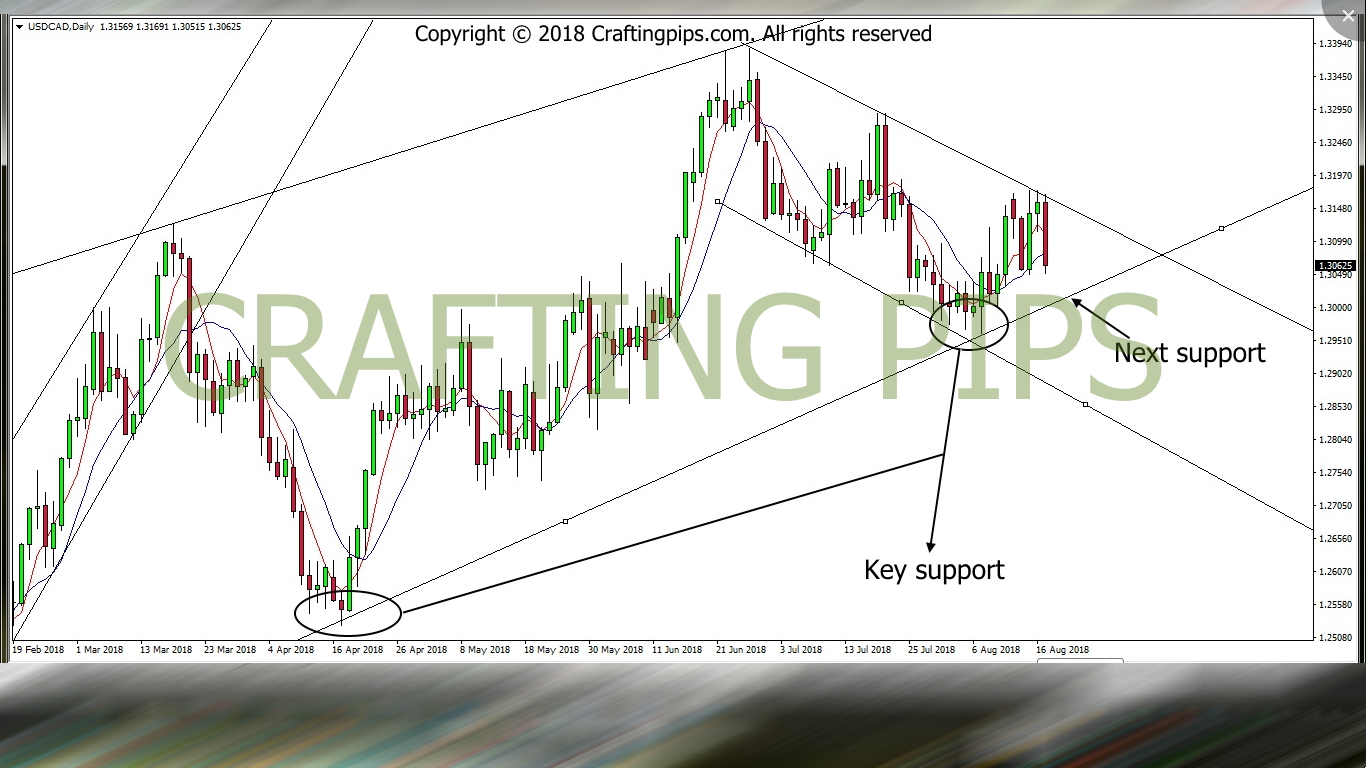

2. USD/CAD

This bad boy has become another local legend. We analysed USD/CAD on Thursday

and just when I was about getting ready to see a bullish run after a breakout on key resistance level 1.31678. I observed a bearish move just before the market closed. This weakening of the dollar, sent most USD pairs on a downward spiral.

Currently I am waiting to see if the bearish trend on USD/CAD would obey a key support level 1.30126. If it does, then we should be riding this pair back to level 1.31333, and if support level 1.30126 breaks, we should be surfing this pair below level 1.29239.

3. EUR/USD

The fall of USD as earlier stated, gave the EURO a huge bullish boost. Currently EUR/USD is making it’s move to level 1.15263 which is a massive resistance level. Patience would be required to see the outcome of this pair after touching level 1.15263.

4. GOLD (XAU/USD)

Gold started a bullish run on Friday too after the demise of the dollar.

Looking closely at the weekly chart of this metal, we would observe that this upward movement may just be a minor pull-back before the bearish movement continues. A key factor we should be looking out for is:

If the key resistance level (1201.29) would send this metal back on a bearish run.

With these few analysis of mine, I hope I have been able to assist and not confuse you this coming week.

Do have a blessed day and week ahead