Good day traders,

How was your day at the market today?, mine was fair, I was able to capture a few pips and that was it. Hopefully Thursday will bring better opportunities for us.

So, let’s see what the market has for us.

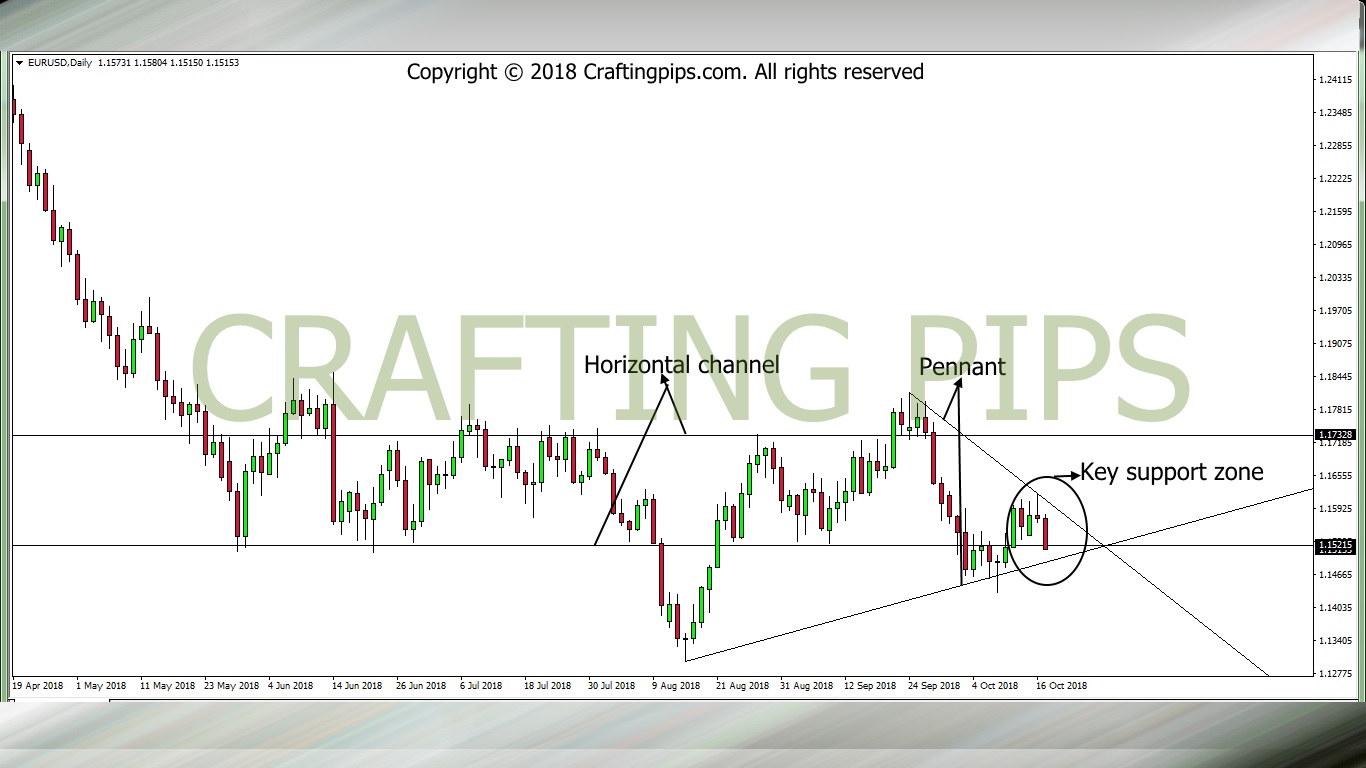

1. EUR/USD

On the daily chart, price is currently at the base end of a key support level (1.14976) which coincides with the support level of a horizontal channel.

A breakout from the support will most likely send price tumbling down to its next support level which is below level 1.14027. A bounce on the current support will make price range between 1.15735 and 1.15166 before deciding on the next move.

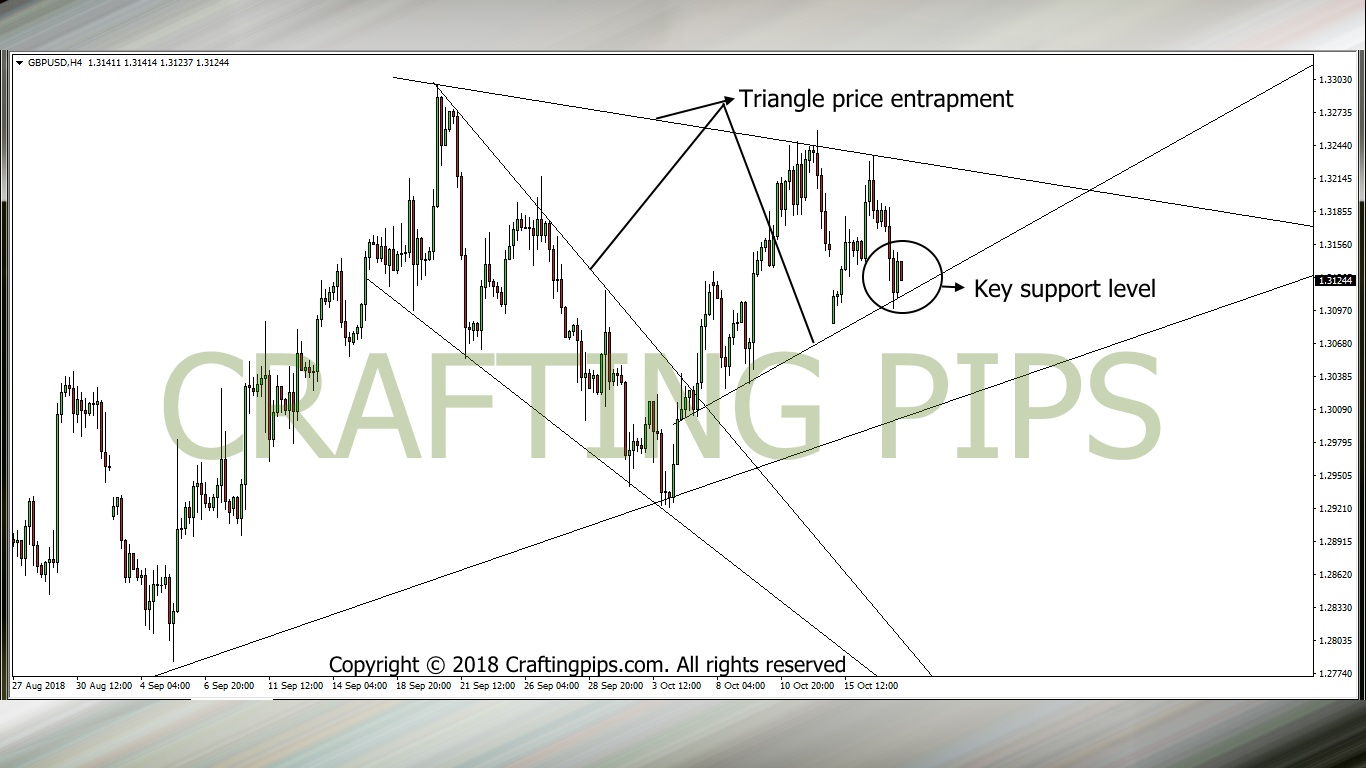

2. GBP/USD

Remember GBP/USD from our weekly setups?…You can check here in case you missed out.

There was not just a breakout, but also a large gap as the market opened on Sunday. Market was later taken over by the bulls, this made price meet its next resistance level 1.32369 which shared the same descending resistance level from the previous resistance level.

Price started another bearish move yesterday, only to come to a halt on an ascending support level (1.31129), which coincides with previous support levels price has formed in the past. A bearish breakout from this level would most likely send price to its next support level which is below level (1.30805)

If the present support bounce price on another bullish run, we may most likely see price hit level 1.32192.

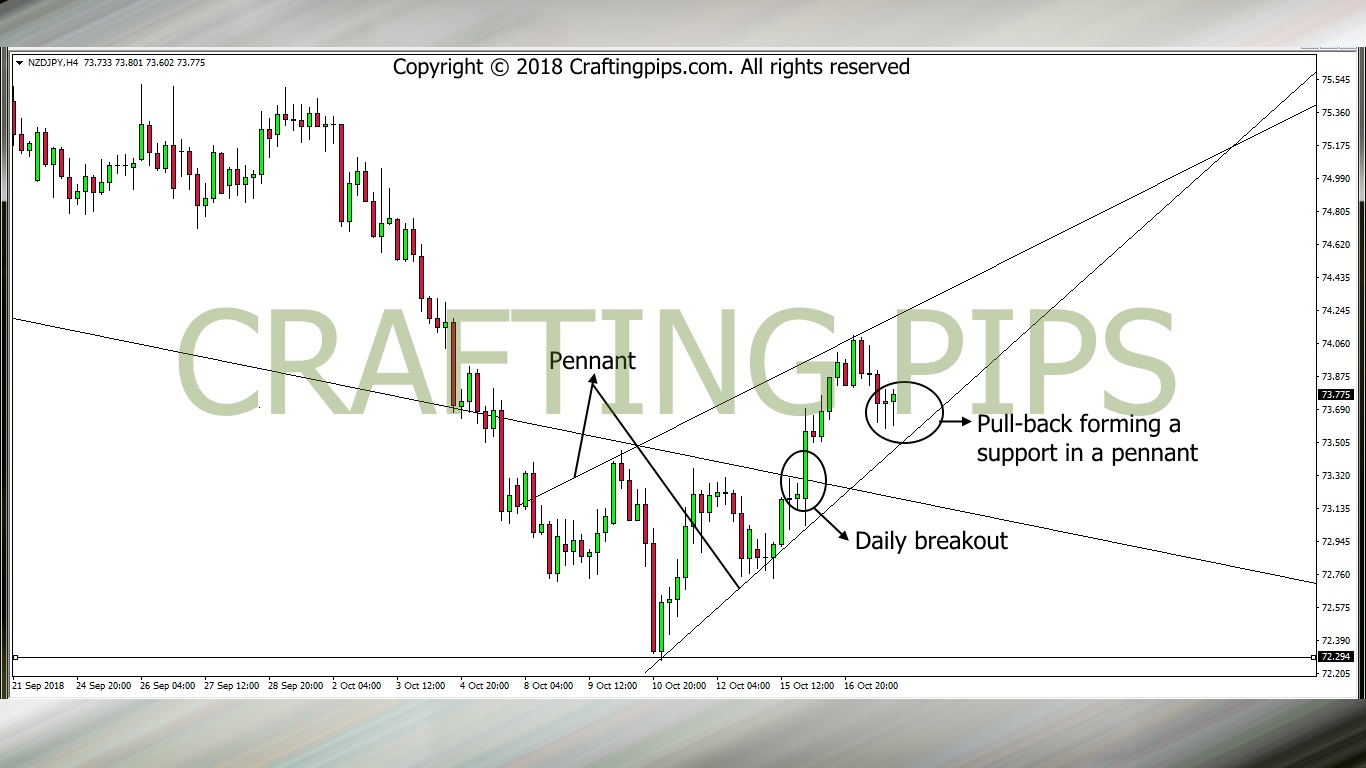

3. NZD/JPY

Do you remember our Tuesday setup?… If you don’t, kindly check here

After the daily setup breakout, there was a pull-back today. This pullback is presently resting on a key support level of a pennant. There is a high probability that the bulls will resume their bullish duty this Thursday. Next resistance level will most likely be 74.084

Let’s see how all these setups play out this Thursday.

Kindly comment and share. Do have a great day ahead