My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

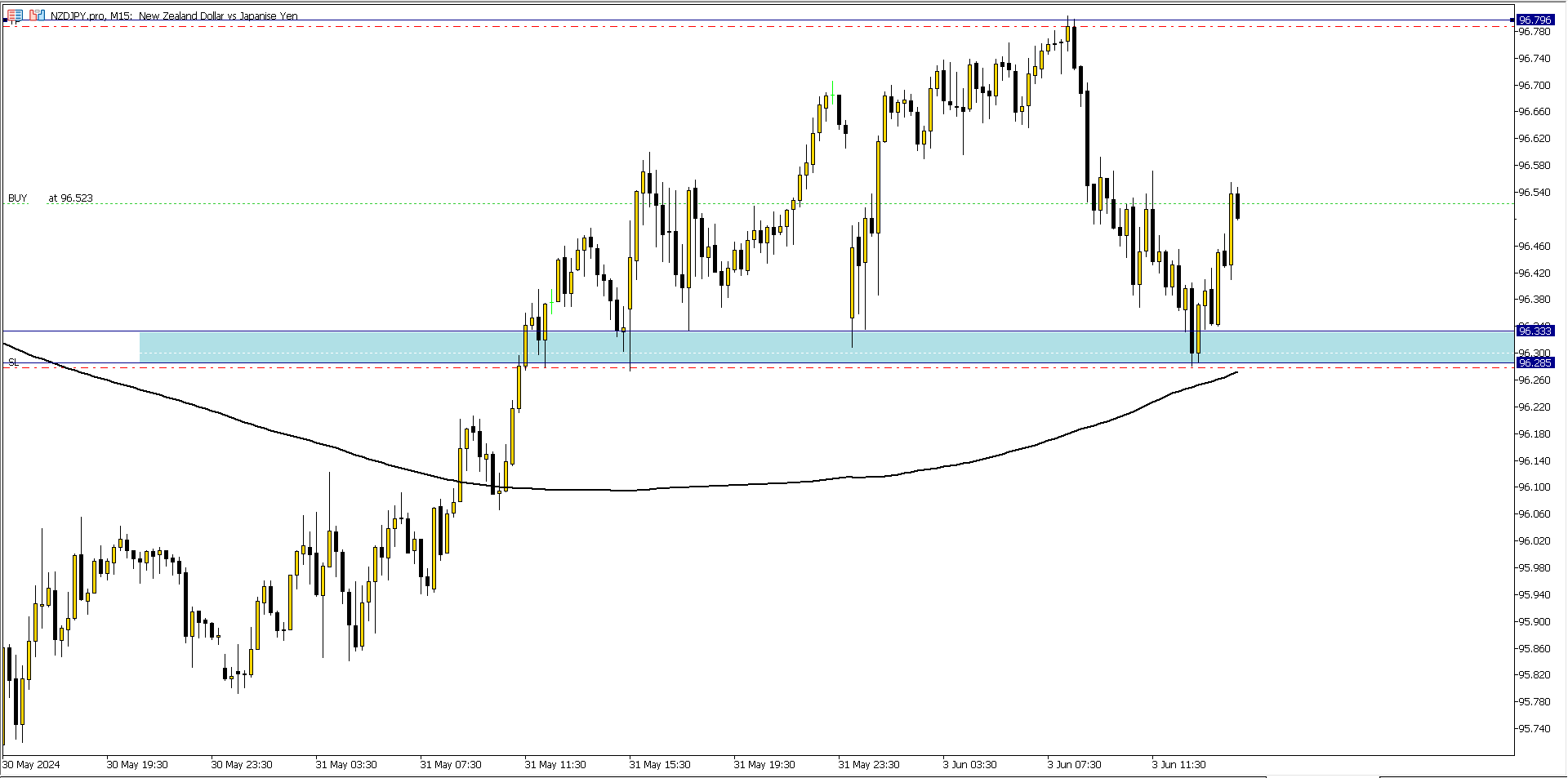

MONDAY 03/06/2024

NZD/JPY (12.45 pm)

Analysis: My reason for buying was based on my bias from our Weekly Market Analysis

NZD/JPY Update (1.50 pm)

Closed manually with +3 pips

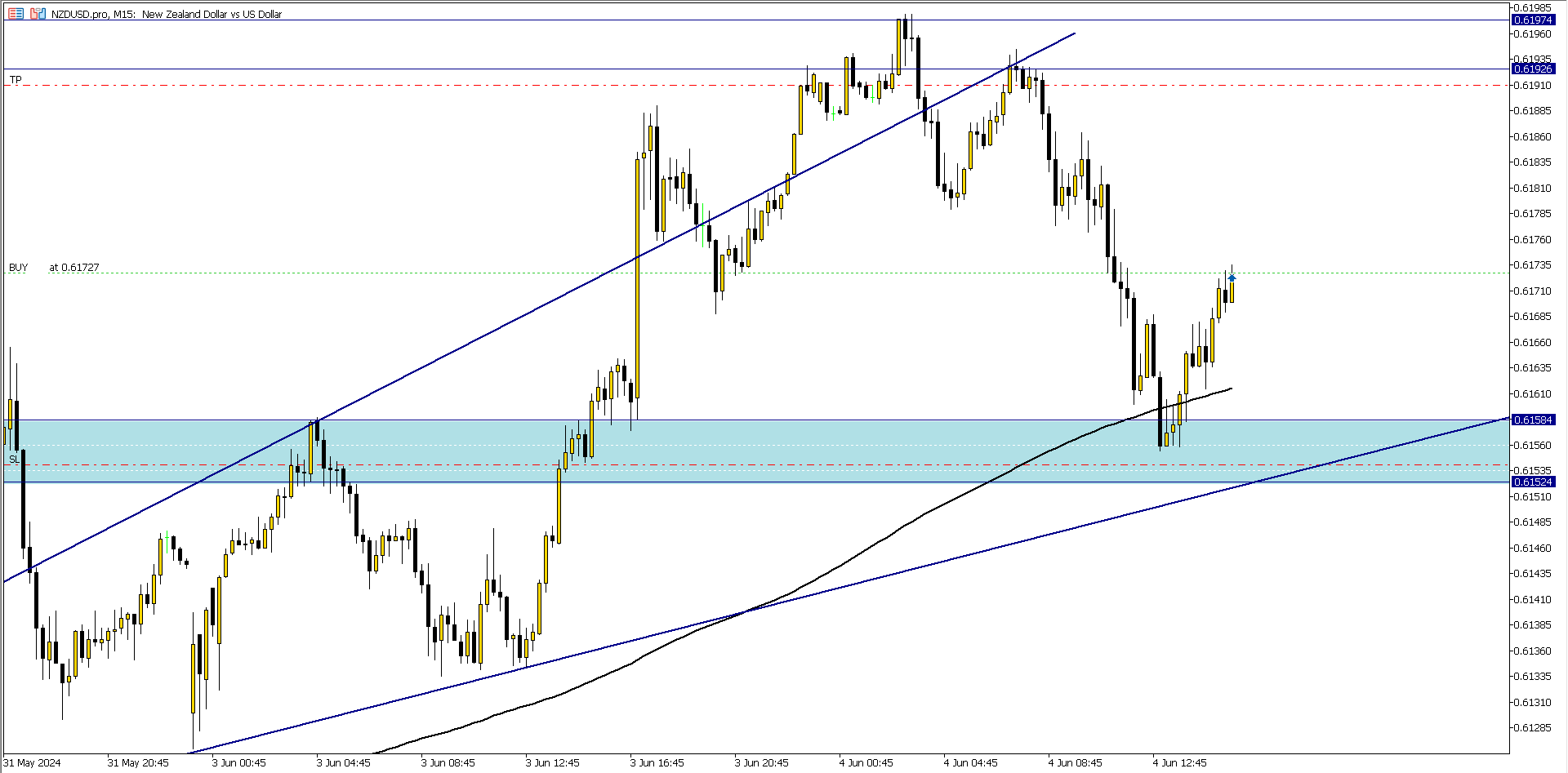

TUESDAY 04/06/2024

NZD/USD (1.45 pm)

Analysis: My reason for buying was based on my bias from our Weekly Market Analysis

NZD/USD Update (4.19 pm)

Closed manually with +4 pips

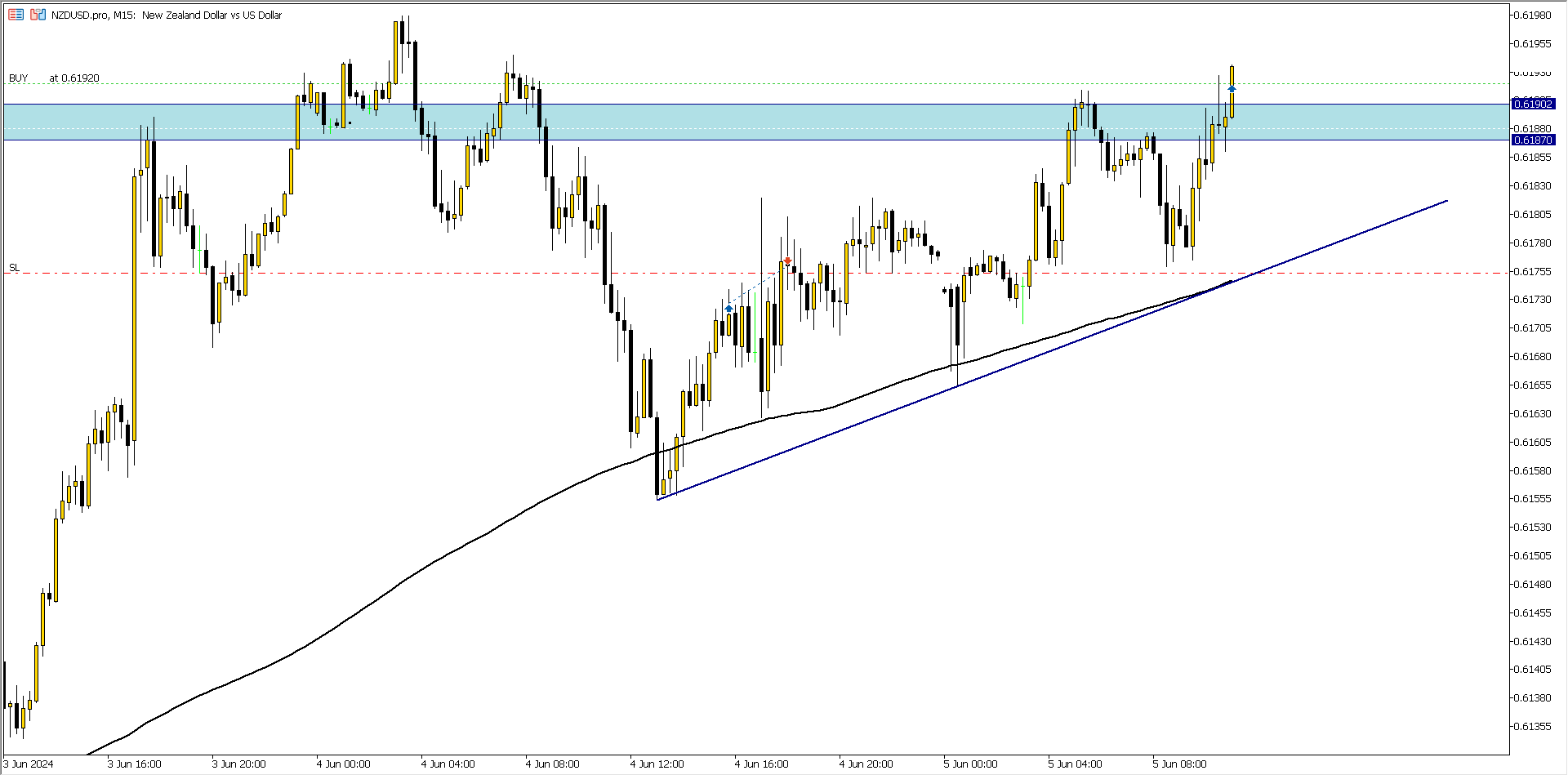

WEDNESDAY 05/06/2024

NZD/USD (9.07 am)

Analysis: My reason for buying was based on my bias from our Weekly Market Analysis

NZD/USD Update (2.50 pm)

I suffered slippage on this trade because I left it through the news (I broke my rule), and I got punished

Trade closed with -24 pips instead of -16 pips

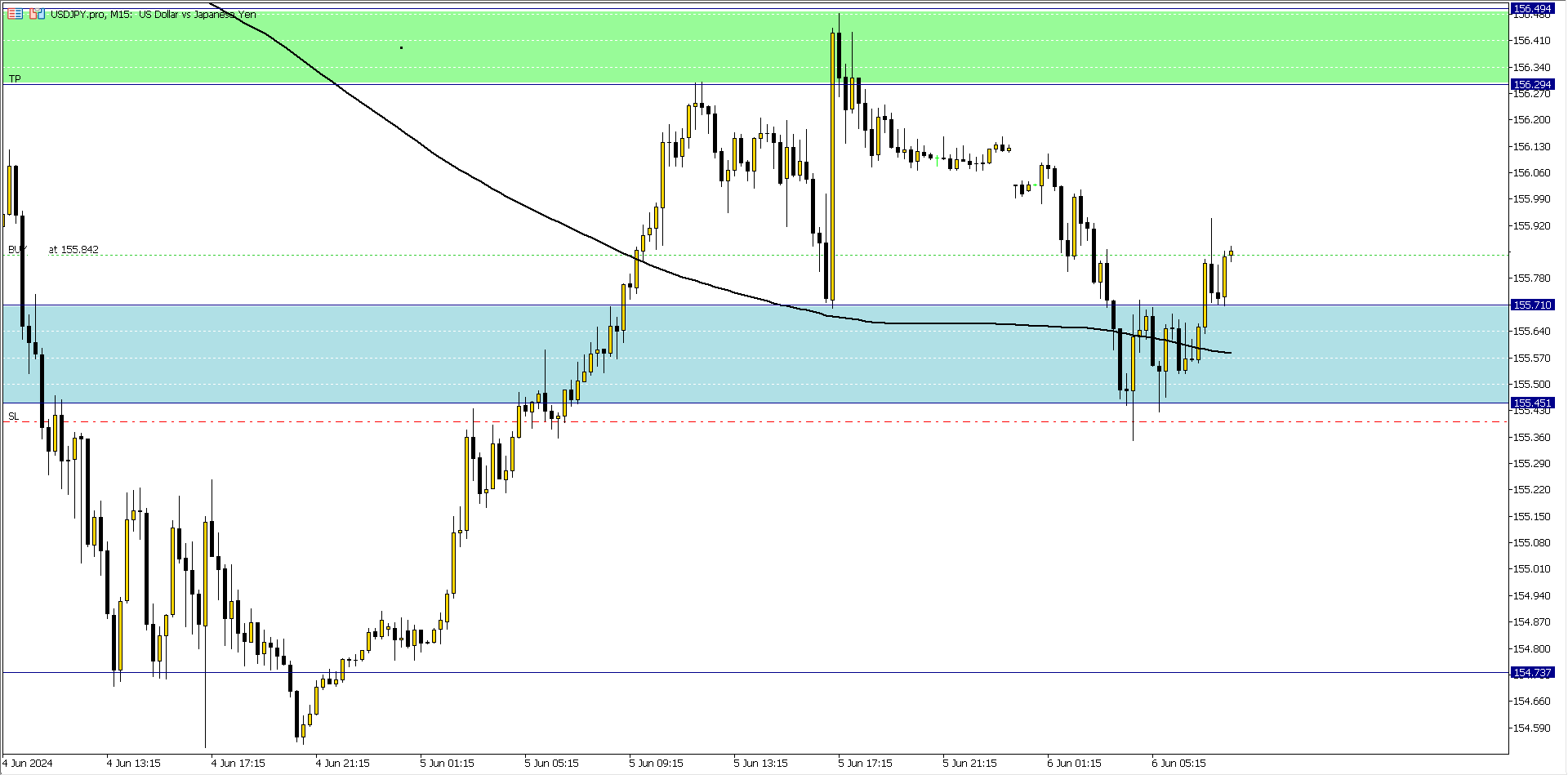

THURSDAY 06/06/2024

USD/JPY (6.20 am)

Analysis: A massive bounce of on a key support zone, on the daily time frame and a break above a key resistance zone prompted the buy

USD/JPY Update (6.20 am)

Closed manually at +34 pips due to unemployment claims scheduled late in the day, and gave it a rest for the rest of the week

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (03/06/2024) | NZD/JPY | BUY | +3 pips |

| TUE (04/06/2024) | NZD/USD | BUY | +4 pips |

| WED (05/06/2024) | NZD/USD | BUY | -24 pips |

| THUS (05/06/2024) | USD/JPY | BUY | +34 pips |

| TOTAL | +17 pips |

In Conclusion:

Last week I closed with pips been in positive, but I lost -0.4% of my account because I broke a golden rule.

The golden rule was holding a trade during Wednesday’s PMI news on the USD. I suffered slippage on the NZD/USD trade. If I had exited the trade an hour before the news, I could have closed the trade at breakeven.

Other than that, I executed my trades like a champ last week.

I am looking forward to the week ahead. How did your trading week go?

Note:

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS