My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 22/04/2024

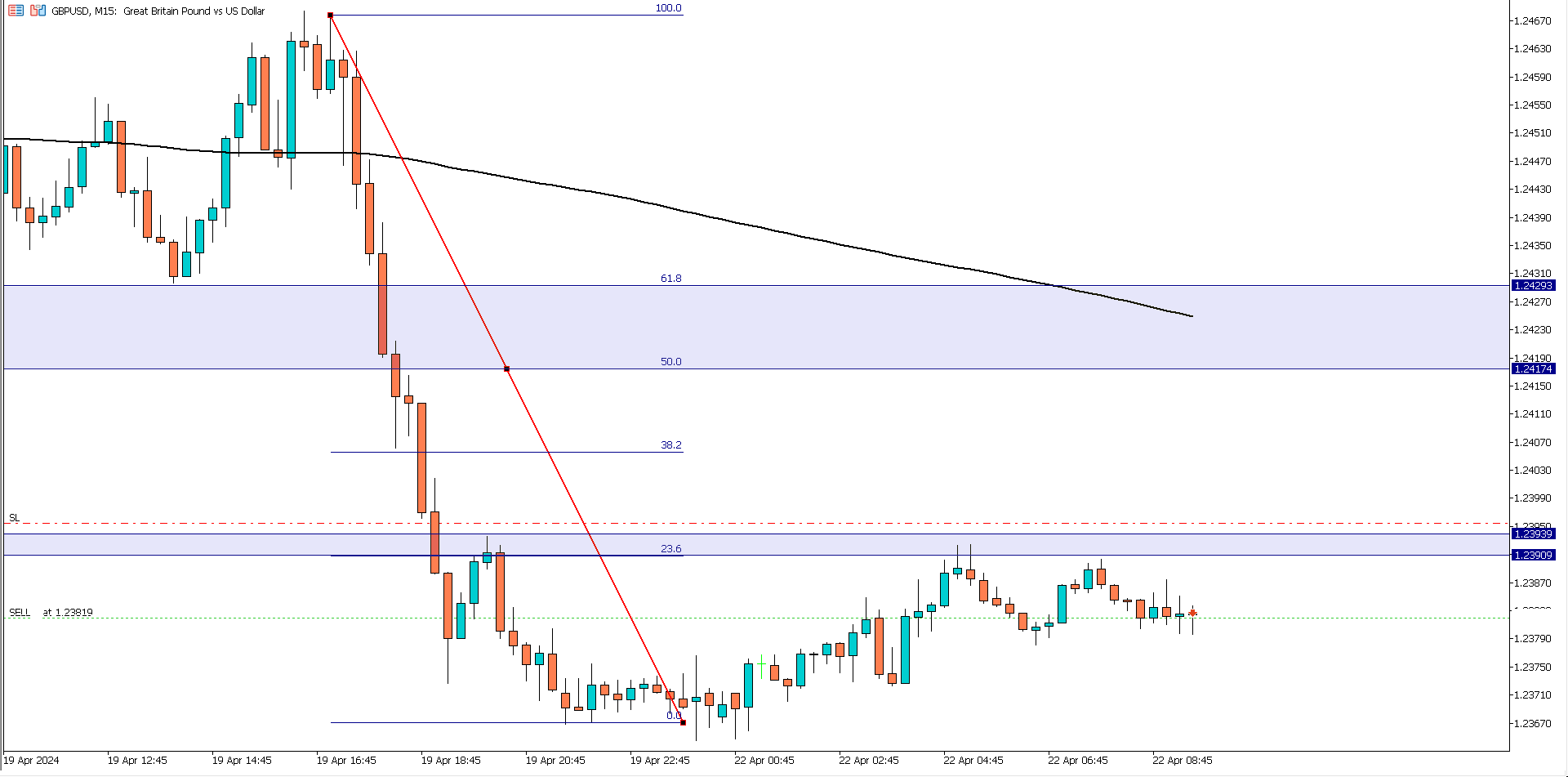

GBP/USD (7.38 am)

Analysis: My reason for selling can be seen in our Weekly Market Analysis (bearish bias), and the fact that our 15 mins time frame gave us a double to

GBP/USD Update (8:47 am)

Analysis: Closed GU using a trailing SL (+24 pips)

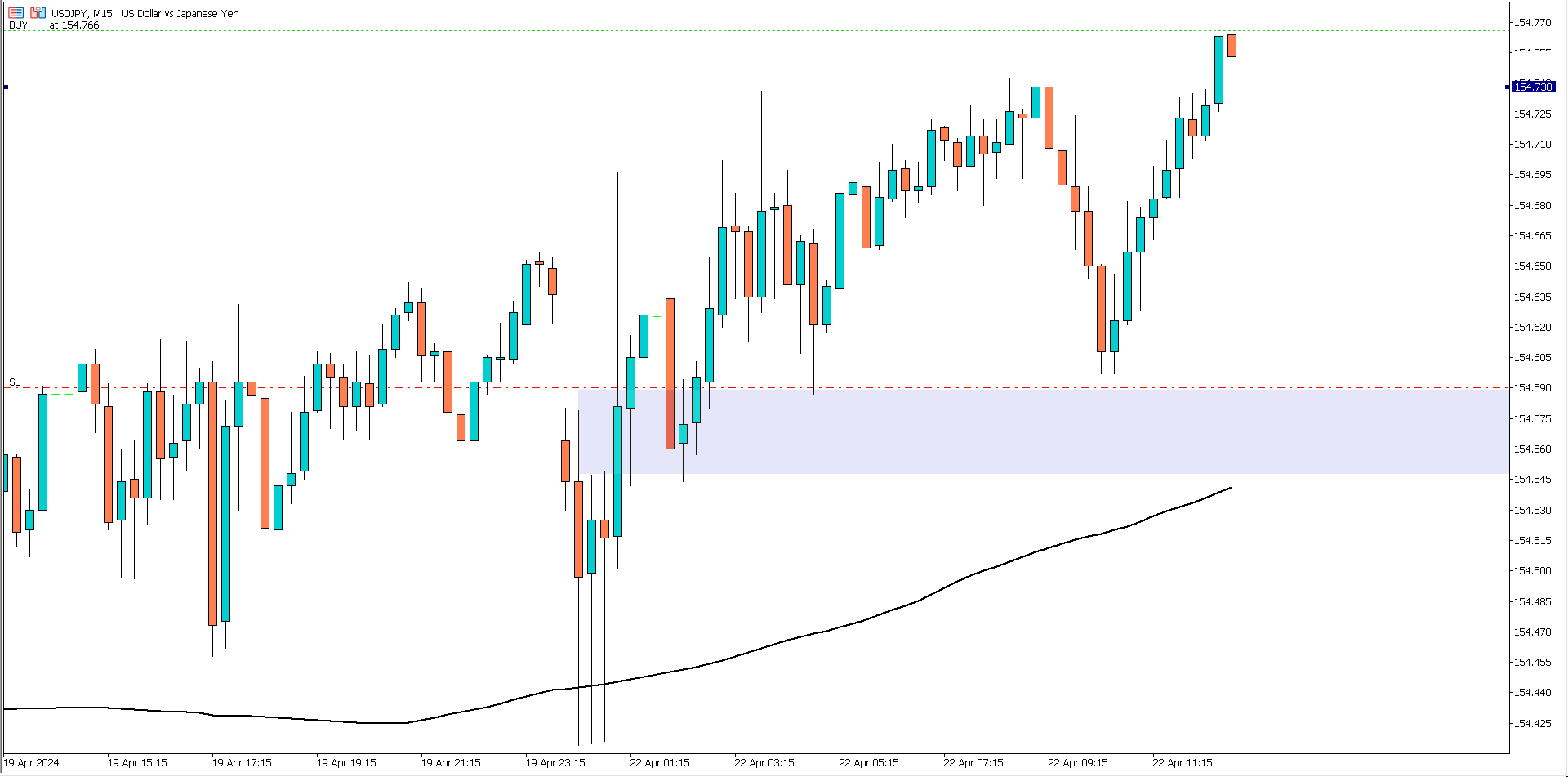

USD/JPY (10:45 am)

Analysis: My reason for buying can be seen in our Weekly Market Analysis (bullish bias), and a bounce off the golden zone on the 15 minutes time frame

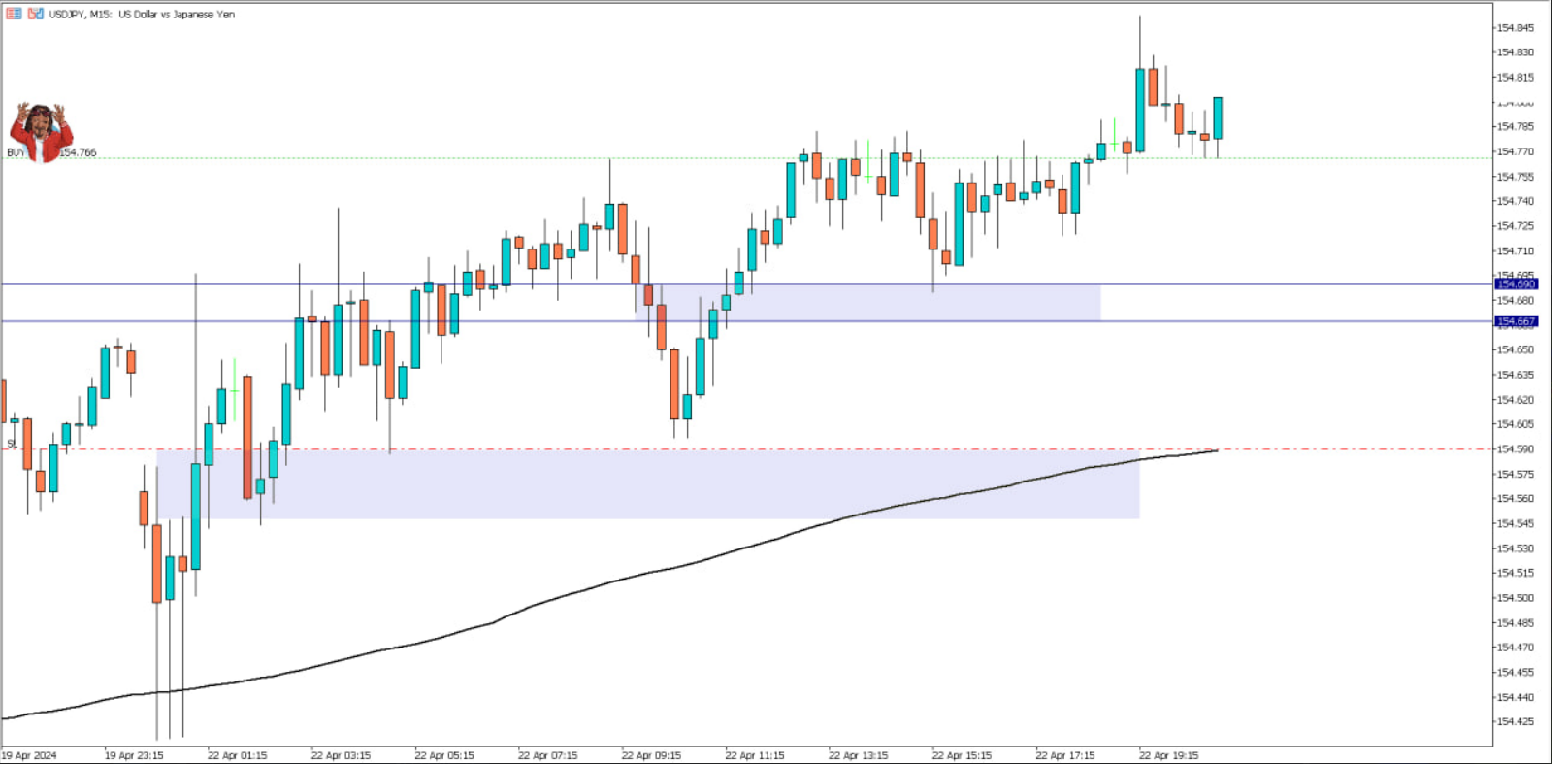

USD/JPY Update (7.40 pm)

Analysis: I manually closed this trade with +4 pips, and my reason is because it has gone beyond its shelf life

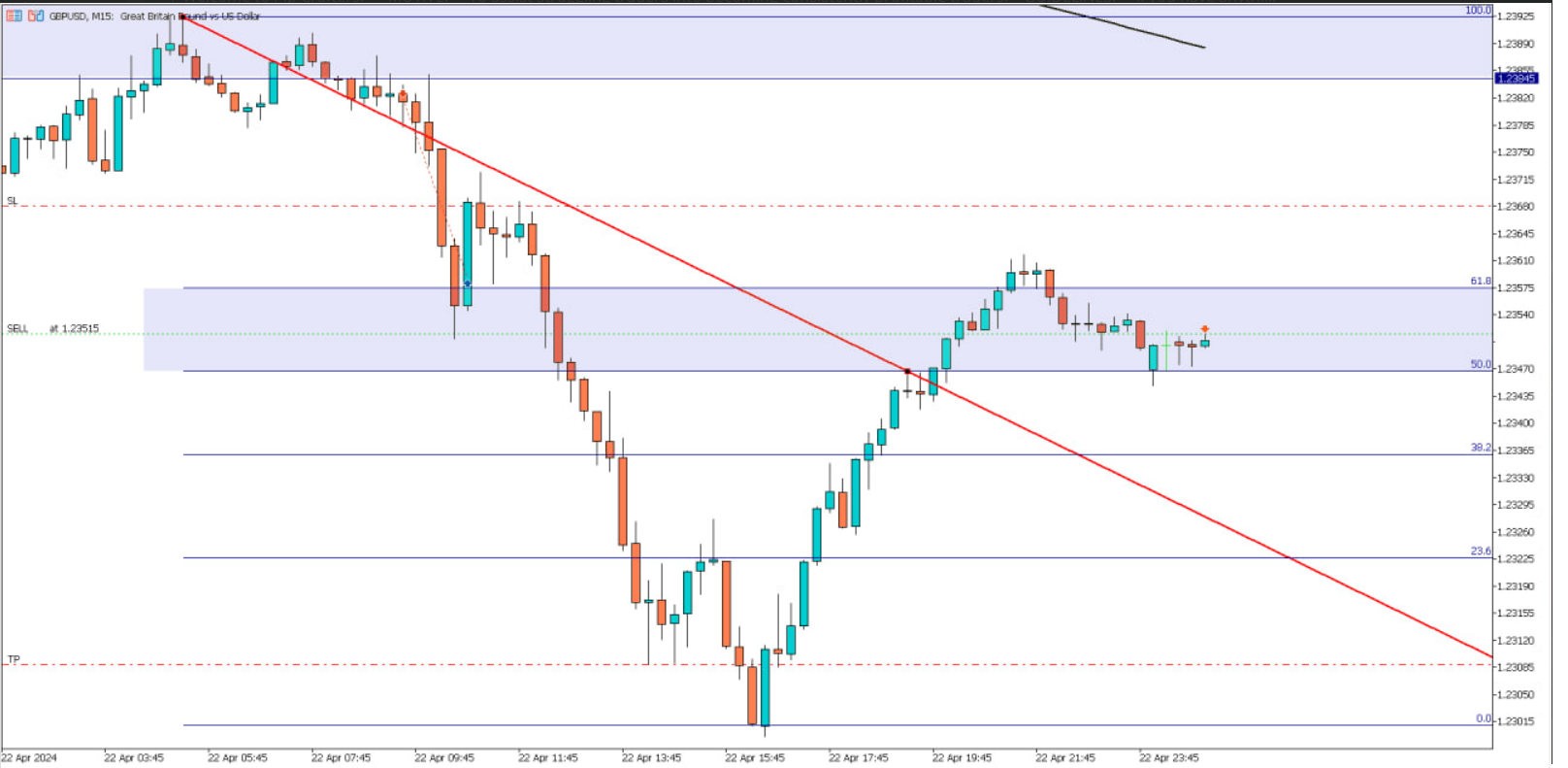

GBP/USD (11.02 pm)

Analysis: My reason for selling can be seen in our Weekly Market Analysis (bearish bias), and the fact that our 15 mins time frame shows that GU is struggling to break past the golden zone.

TUESDAY 23/04/2024

GBP/USD Update (10:43 am)

Analysis: With news a few minutes away, I am locking my GU trade (closed with +4 pips), but looking back now, I should have exited with more pips, rather than waiting for price to hit my trailing SL

AUD/JPY (12.30 pm)

Analysis: The daily time frame gave us a strong bullish bias, and on the 15 minutes time frame we can see an expanding ascending channel supporting our bullish bias

AUD/JPY Update (2.50 pm)

I manually closed the trade with +20 pips

WEDNESDAY 24/04/2024

GBP/USD (12.15 pm)

Analysis: My reason for buying can be seen in our Wednesday Market Analysis. The 15 minutes time frame also shows us that price respects the key support zone

GBP/USD Update (2:33 pm)

I manually closed the trade with +12 pips

THURSDAY 25/04/2024

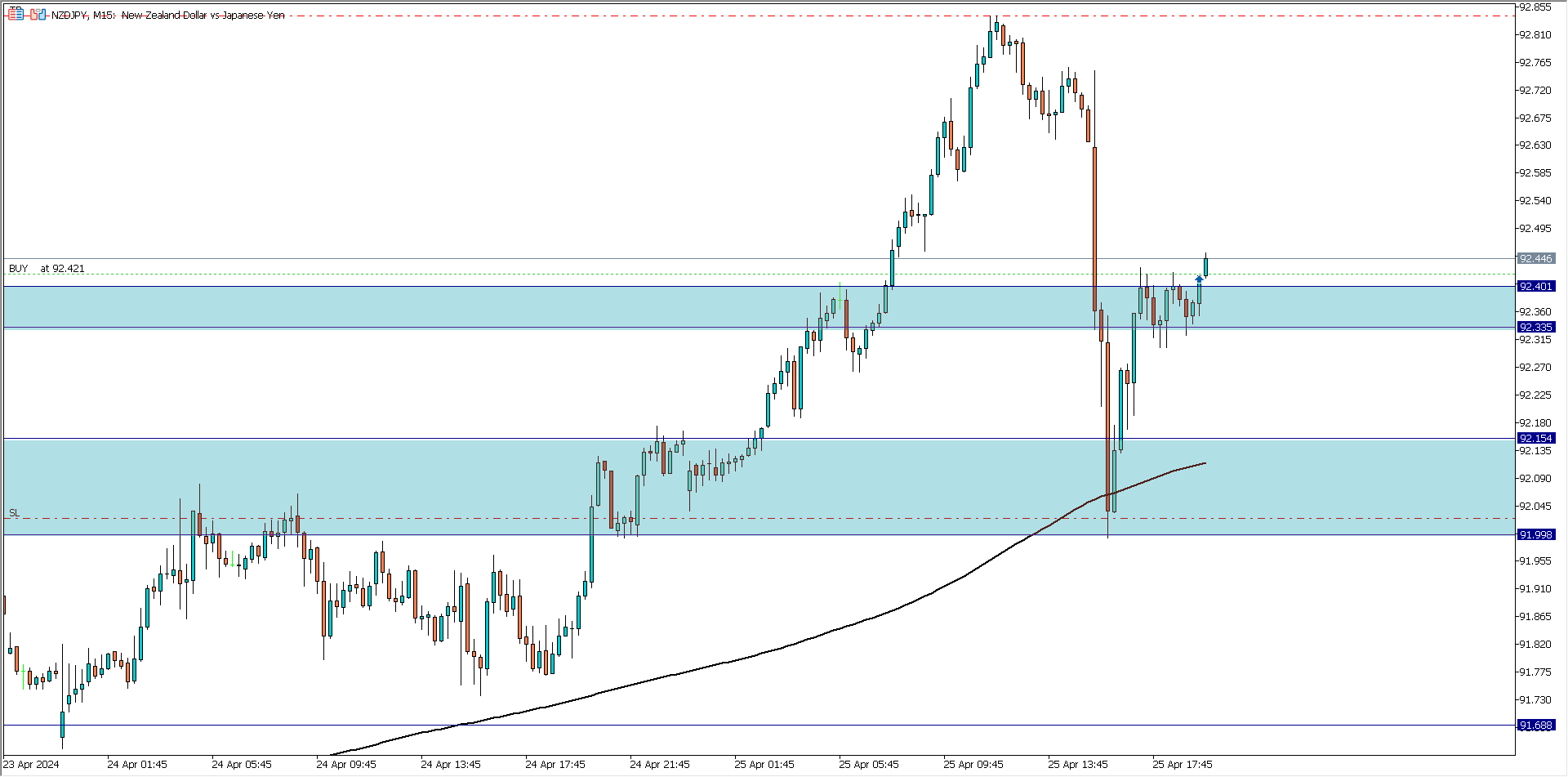

NZD/JPY (5:45 pm)

Analysis: My reason for buying can be seen in our Thursday Market Analysis. On the 15 minutes time frame we can see a decent pullback and a breakout from a consolidation

NZD/JPY Update (7.10 pm)

I manually closed this trade with +9 pips. If I had kept it, my TP would have been hit, but I was mentally and psychologically too drained to monitor this trade, so I exited the market for the week

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (22/04/2024) | GBP/USD | SELL | +24 pips |

| USD/JPY | BUY | +4 pips | |

| GBP/USD | SELL | +4 pips | |

| TUE (23/04/2024) | AUD/JPY | BUY | +20 pips |

| WED (24/04/2024) | GBP/USD | BUY | +12 pips |

| WED (25/04/2024) | NZD/JPY | BUY | +9 pips |

| TOTAL | +73 PIPS |

In conclusion:

It was an extremely busy week for me and half way through the week I suffered a burn out.

The week was also a challenging one to navigate through due to its erratic moves. That was one of the reason why non of my trades hit TP.

I give kudos to myself and how I managed my emotions and trades all through the week. If there was one thing I wish I could have done better…

It would be me having enough mental capital to take me through the week. Then my last trade (NZD/JPY) would have hit target profit.

That said, I closed with +5% ROI and all trades in profits.

How did your trading week go?

NOTE:

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS