Hello traders,

let’s hit them charts:

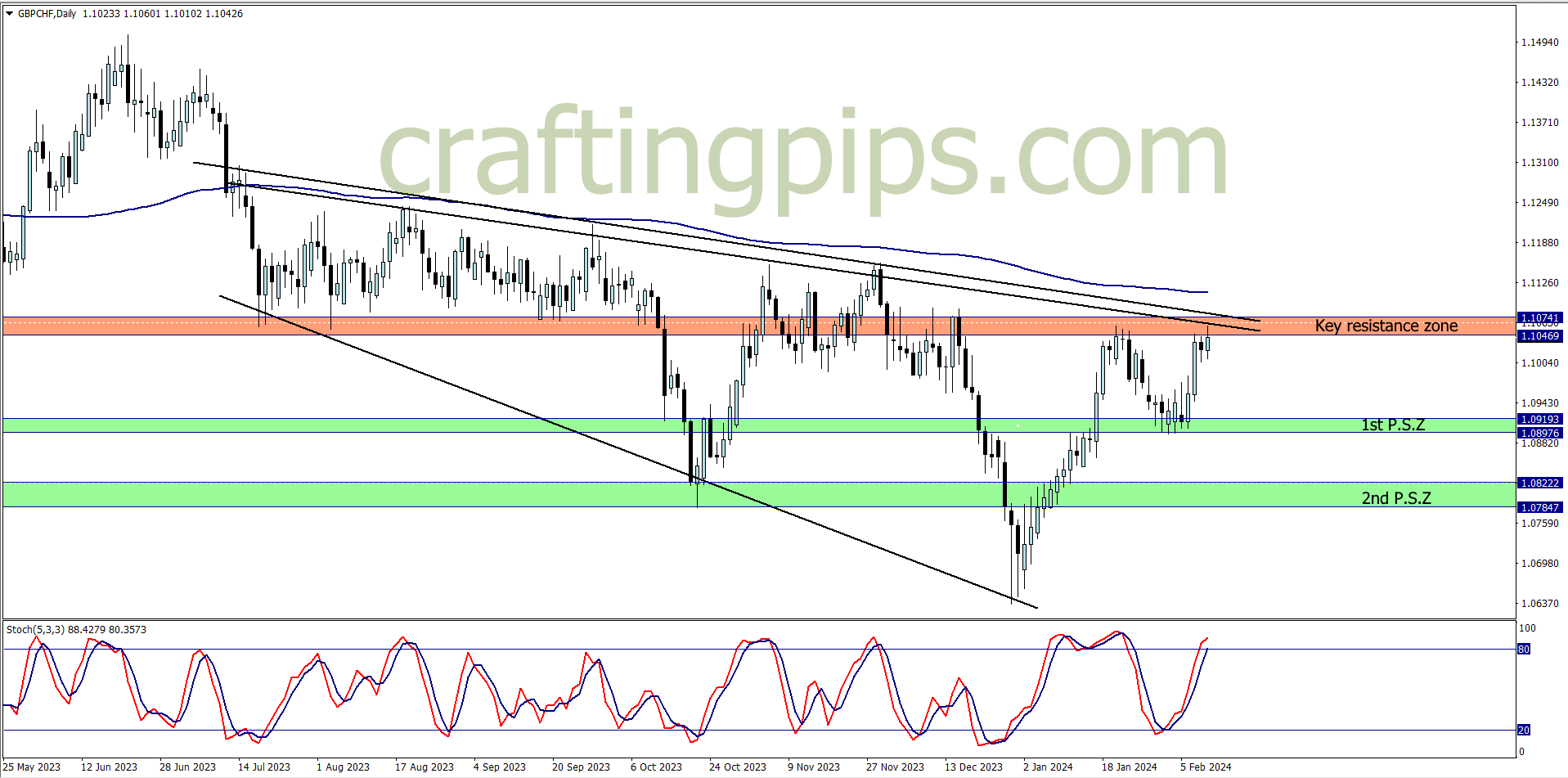

1. GBP/CHF

We can clearly spot a double top formation on the GBP/CHF

The 200 ma and stochastic also points to the fact that we are most likely going to see the bears rule this coming week. The first few hours the market opens may give us opportunities to sell. Having in mind that 1.09608 may be our first target profit

2. NZD/JPY

The last time resistance level 91.189 was cleanly broken was around November 2014.

Last week, the market closed and gave us a 61 pips breakout on the NZD/JPY. This week I will be waiting for a pullback, before the buyers possibly kick in again.

Wherever the pullback ends, we will be ready to continue the buy

3. CAD/JPY

To some, the CAD/JPY may be looking like a reversed head and shoulder waiting to break, while to others, a triple top is in the mix

Whichever side of the divide you are in, there is no harm waiting to see how Monday’s daily candlestick closes.

If we do get price break above the key resistance zone, then our next target will most likely be 200 pips above the current resistance zone. However, if a reversal is spotted, then we may see price revisit NPSZ before the week runs out

What say you?

NOTE:

-

THE FUNDED TRADER: (Use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS