My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

TUESDAY 02/01/2024

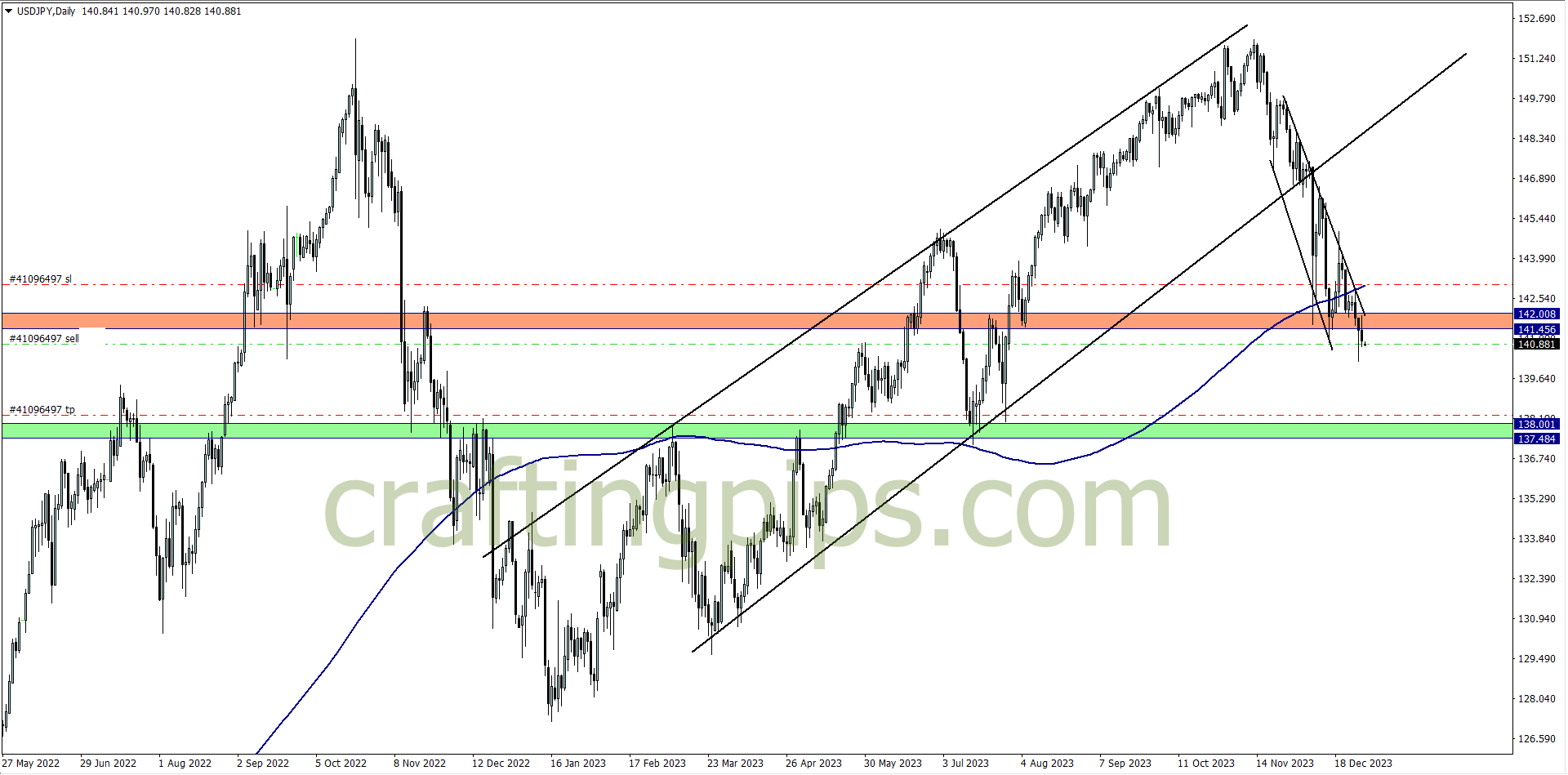

USD/JPY (12.15 am)

Analysis: The sell of USD/JPY was inspired by our weekly market analysis

WEDNESDAY 03/01/2024

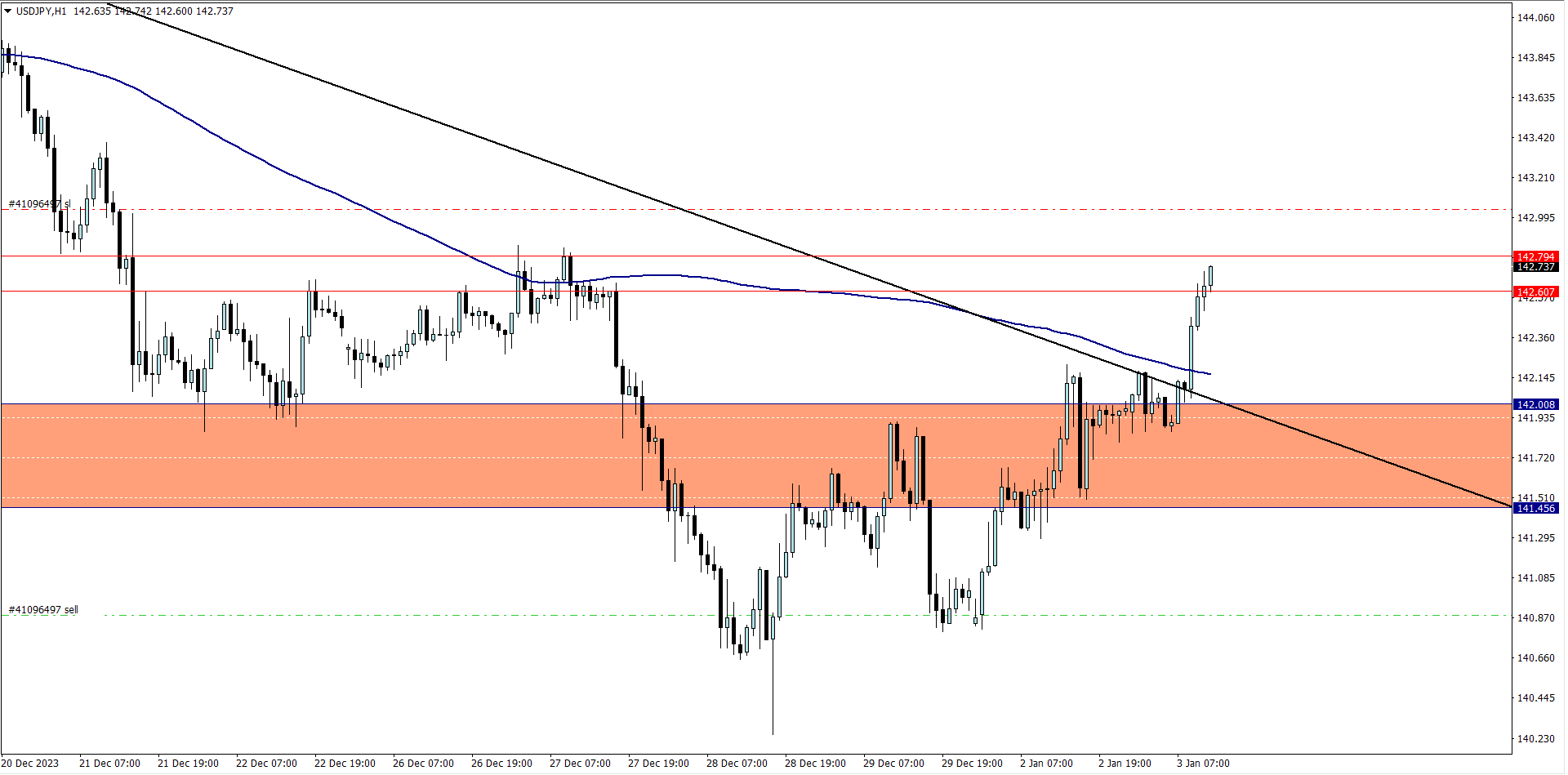

USD/JPY update (10.05 am)

Analysis: I manually closed the trade with -196 pips

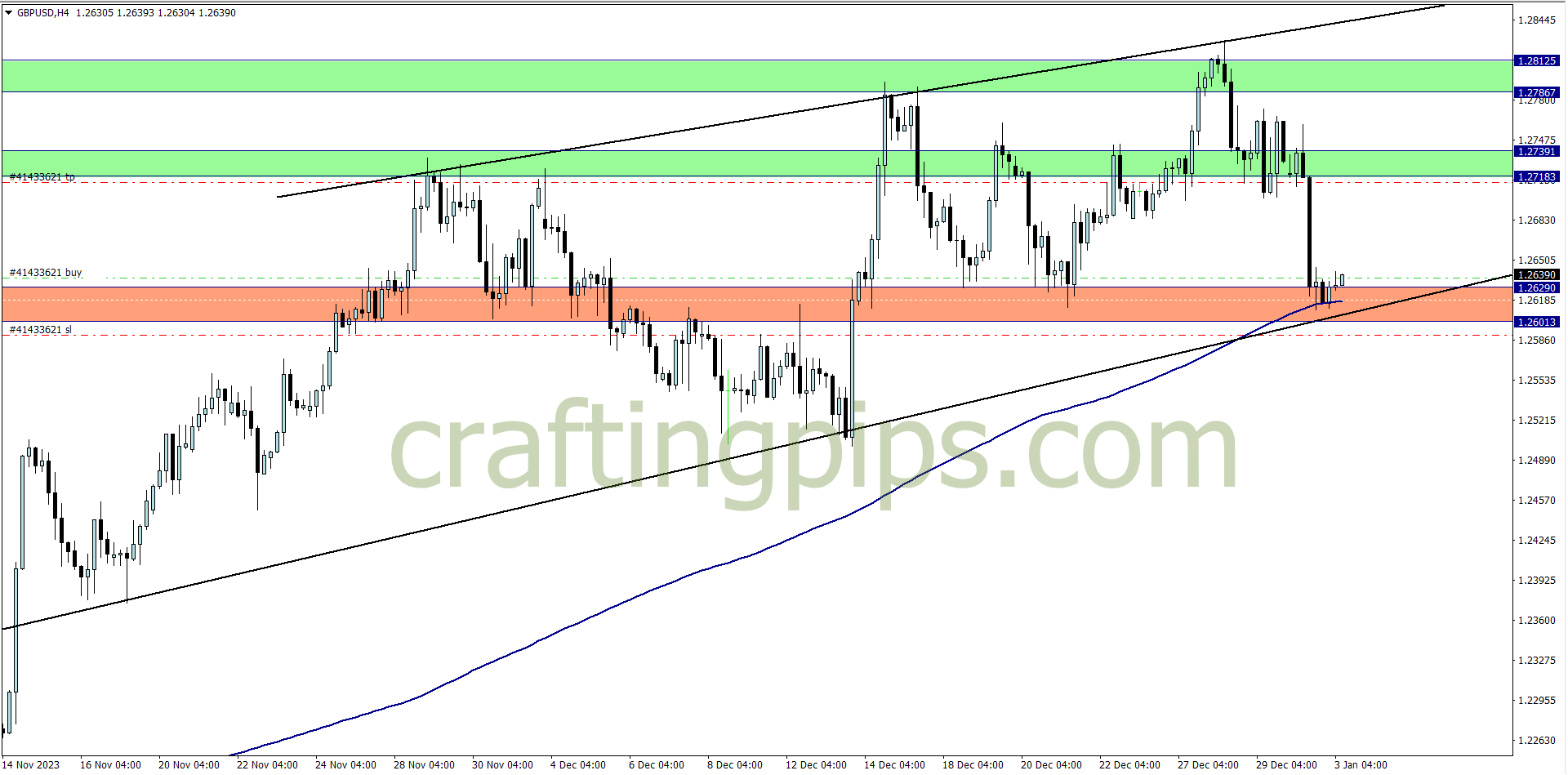

GBP/USD (10.05 am)

Analysis: The key support zone and 200 ma was a good reason to join the buyers

THURSDAY 04/01/2024

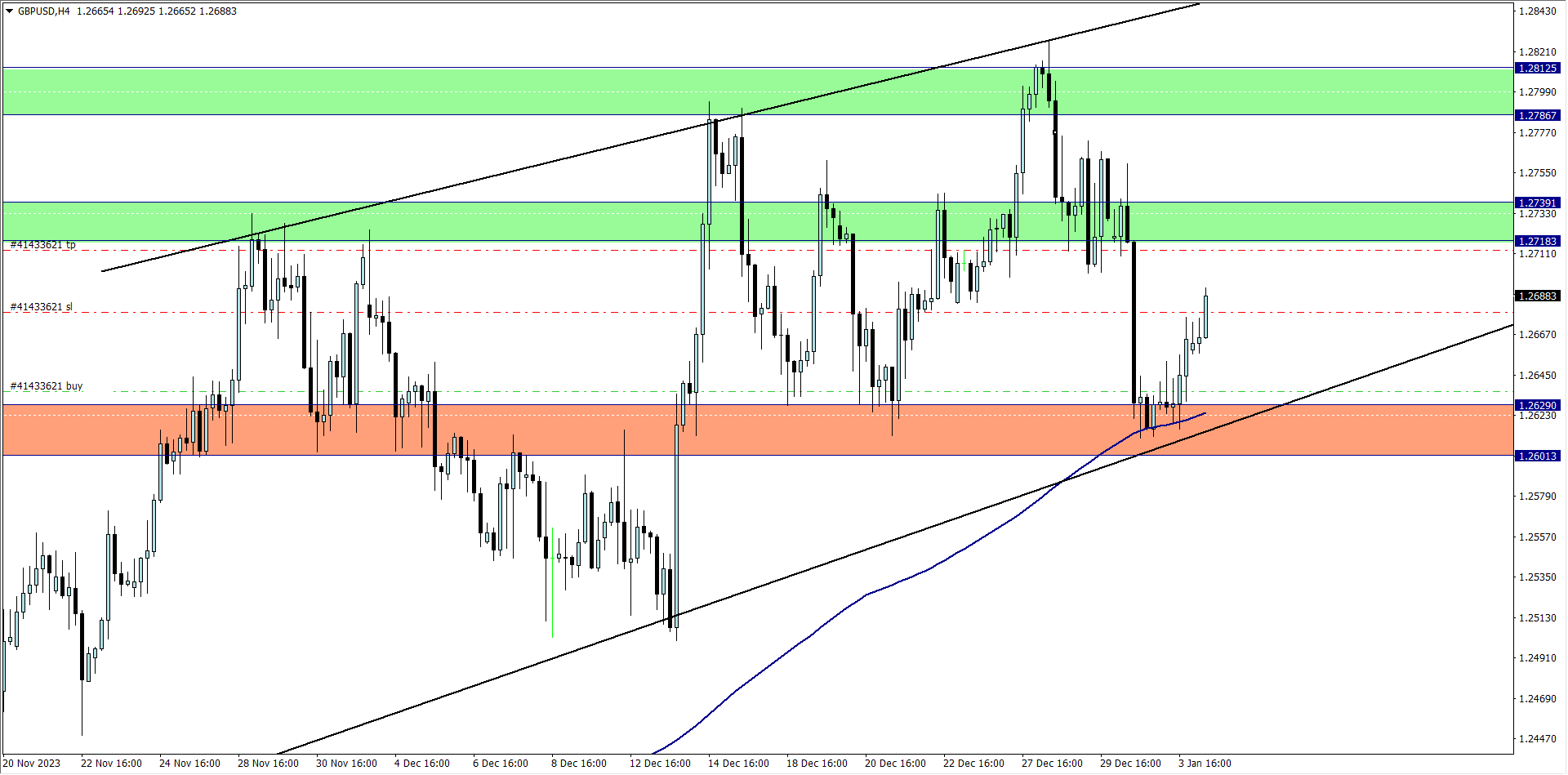

GBP/USD Update (10.05 am)

Analysis: My trailing SL threw me out at +57 pips

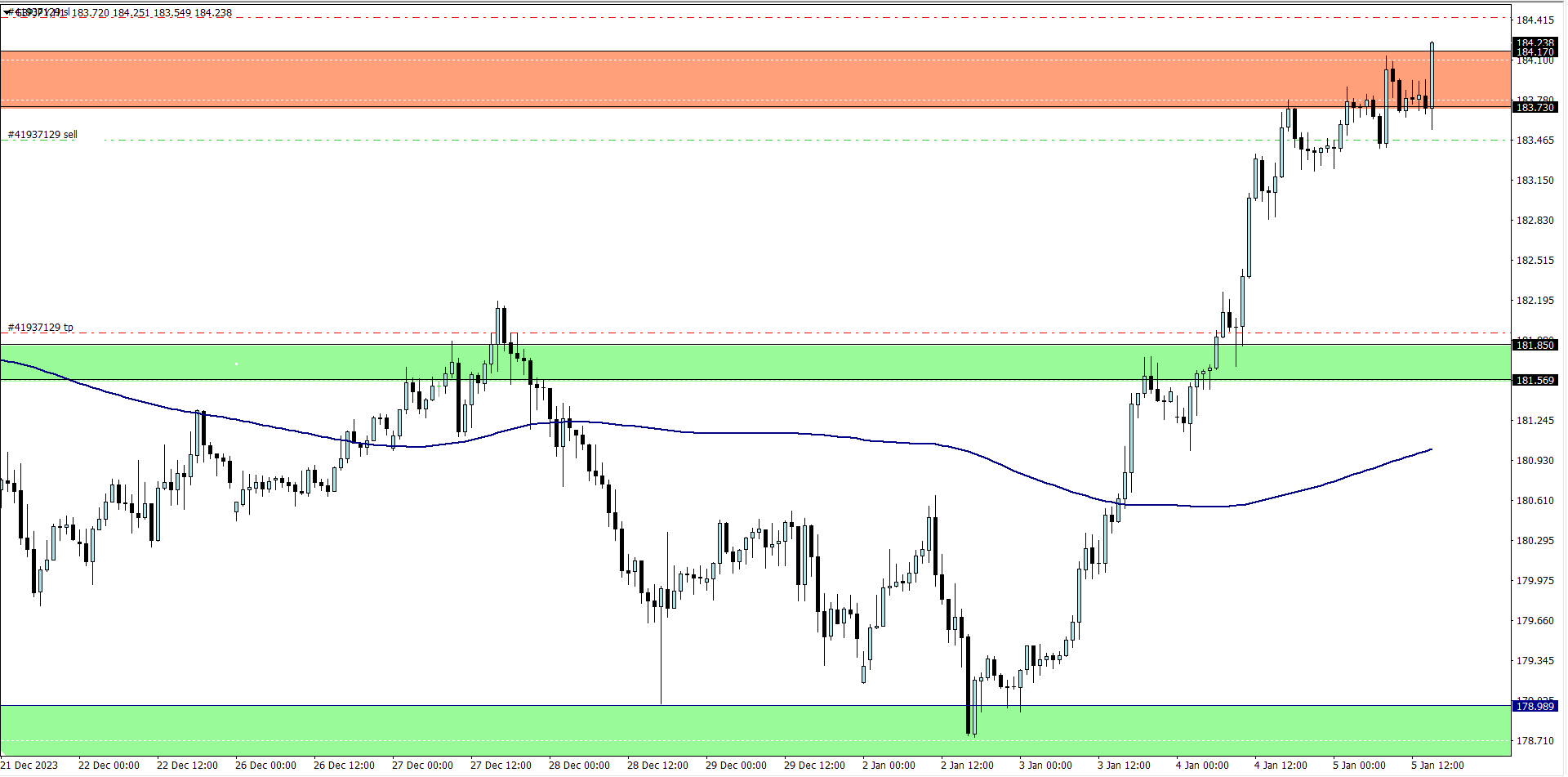

GBP/JPY (10.35 pm)

Analysis: The sell of GBP/JPY was inspired by our Friday market analysis

FRIDAY 05/01/2024

GBP/JPY update (3.15 pm)

Analysis: I manually closed the GBP/JPY trade with a -92 pips loss

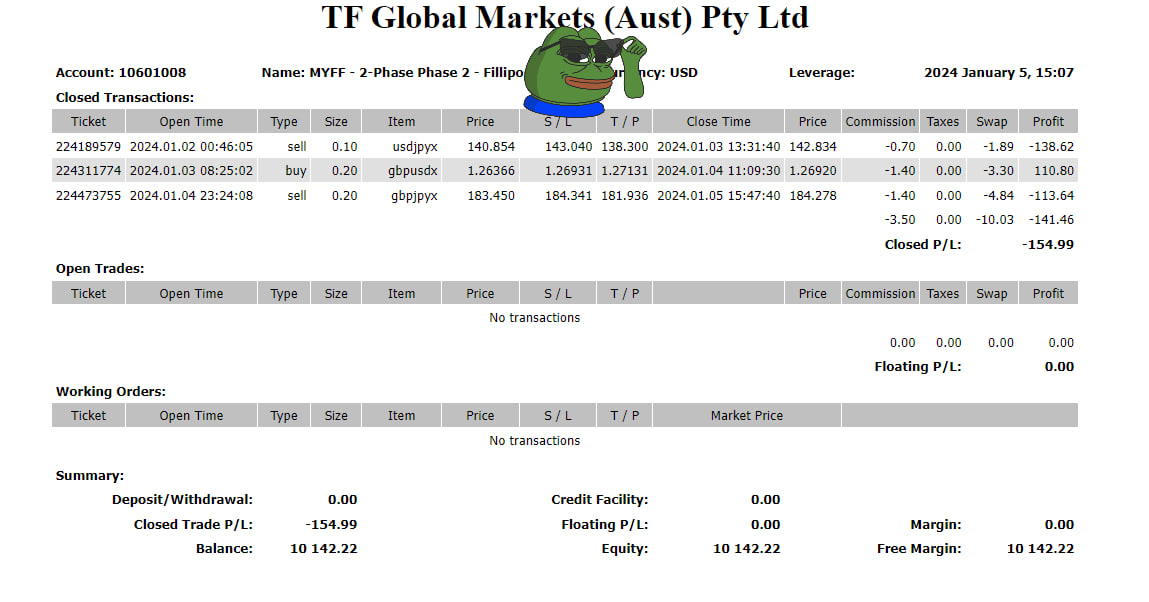

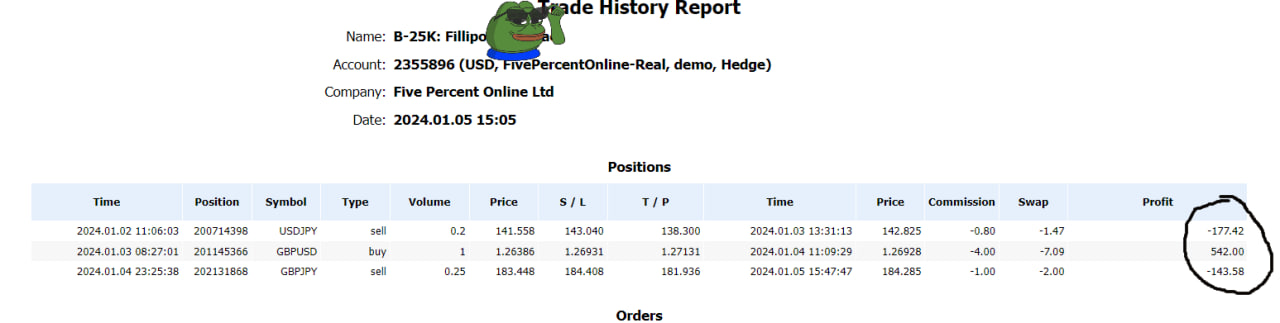

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| TUE (02/01/2024) | USD/JPY | SELL | – 196 pips |

| GBP/USD | BUY | + 57 pips | |

| THUS (04/01/2024) | GBP/JPY | SELL | – 92 pips |

| TOTAL | -231 pips |

In conclusion:

The first week of trading was treacherous. The GBP/USD trade saved the day for my major accounts. So I closed with +0.8% profits on my major accounts, but for my smaller accounts, I took a -1.4 to -2% loss

So far, I am happy with my discipline and following through with my rules, but I am not happy with the results. I look forward to next week.

How did your trading week go?

Minor Account:

Major account:

In summary:

My reason for sharing screenshots of some of my personal accounts I manage is for educational purposes and not for bragging rights

In recent times, I have come across traders who will almost swear that to be a consistently profitable trader, you must have a risk-to-reward ratio of at least 1:2, and if you are a swing trader, you must not trail your profits or suffer any loss above -200 pips (Lmao)

This is what I call “Trading Dogma”

When you choose to have a fixed mindset or set of ideologies you strongly believe in, simply because your mentor or your circle of trading buddies also believe in, without trying to authenticate it, you may be limiting your horizon as a trader

There is no “ONE WAY” of trading the market.

You could close the month with +1,000 pips, yet be at a loss. You could also close the month with -250 pips, yet be well into profits.

I close with one of my favorite Bruce Lee quotes:

“Be like water making its way through cracks. Do not be assertive, but adjust to the object, and you shall find a way around or through it. If nothing within you stays rigid, outward things will disclose themselves.

Empty your mind, be formless. Shapeless, like water. If you put water into a cup, it becomes the cup. You put water into a bottle and it becomes the bottle. You put it in a teapot, it becomes the teapot. Now, water can flow or it can crash. Be water, my friend.”

―

NOTE:

-

THE FUNDED TRADER: (Use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS