My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 04/12/2023

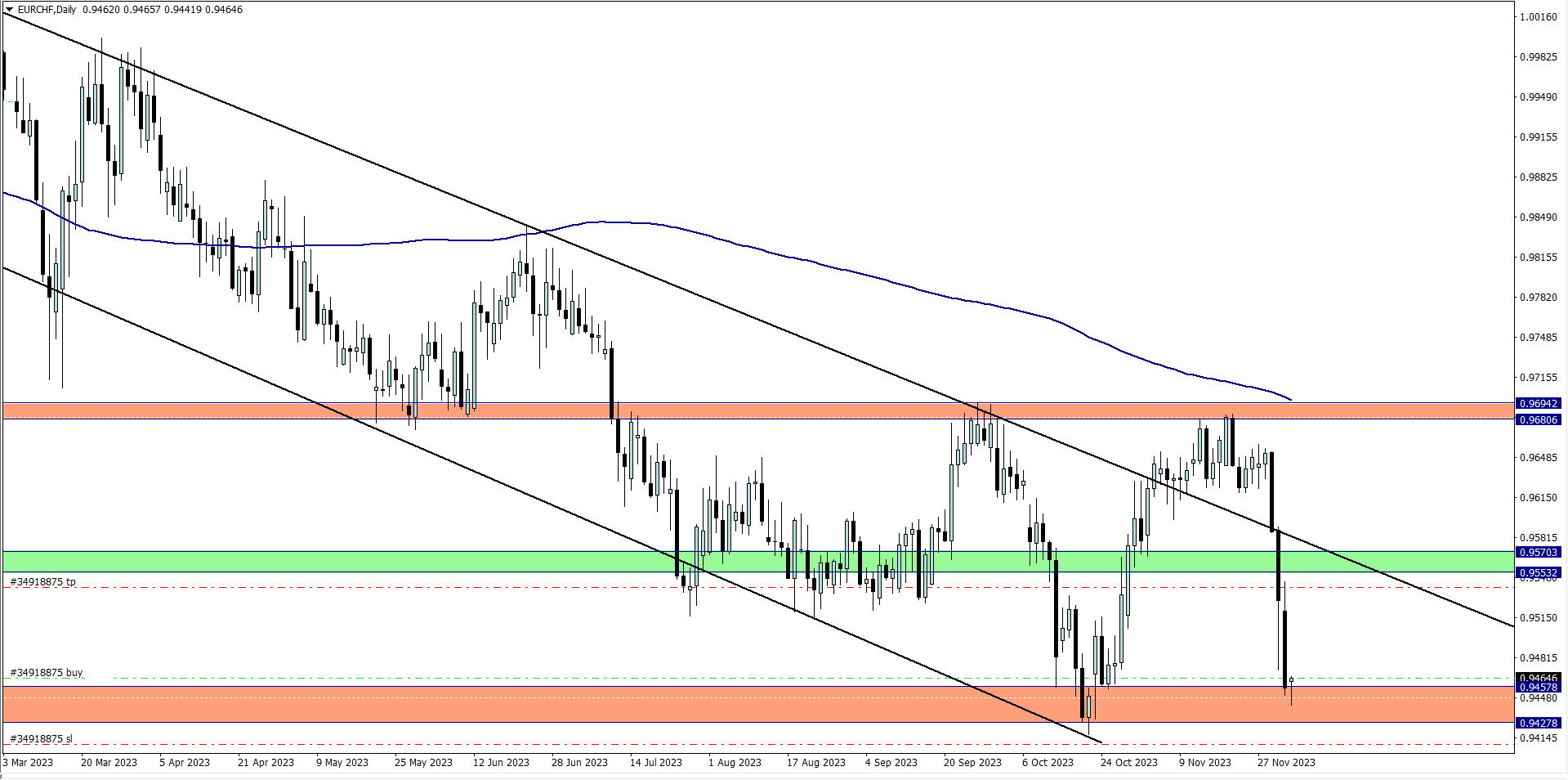

EUR/CHF (3.30 am)

Analysis: Our Weekly market analysis inspired the buy

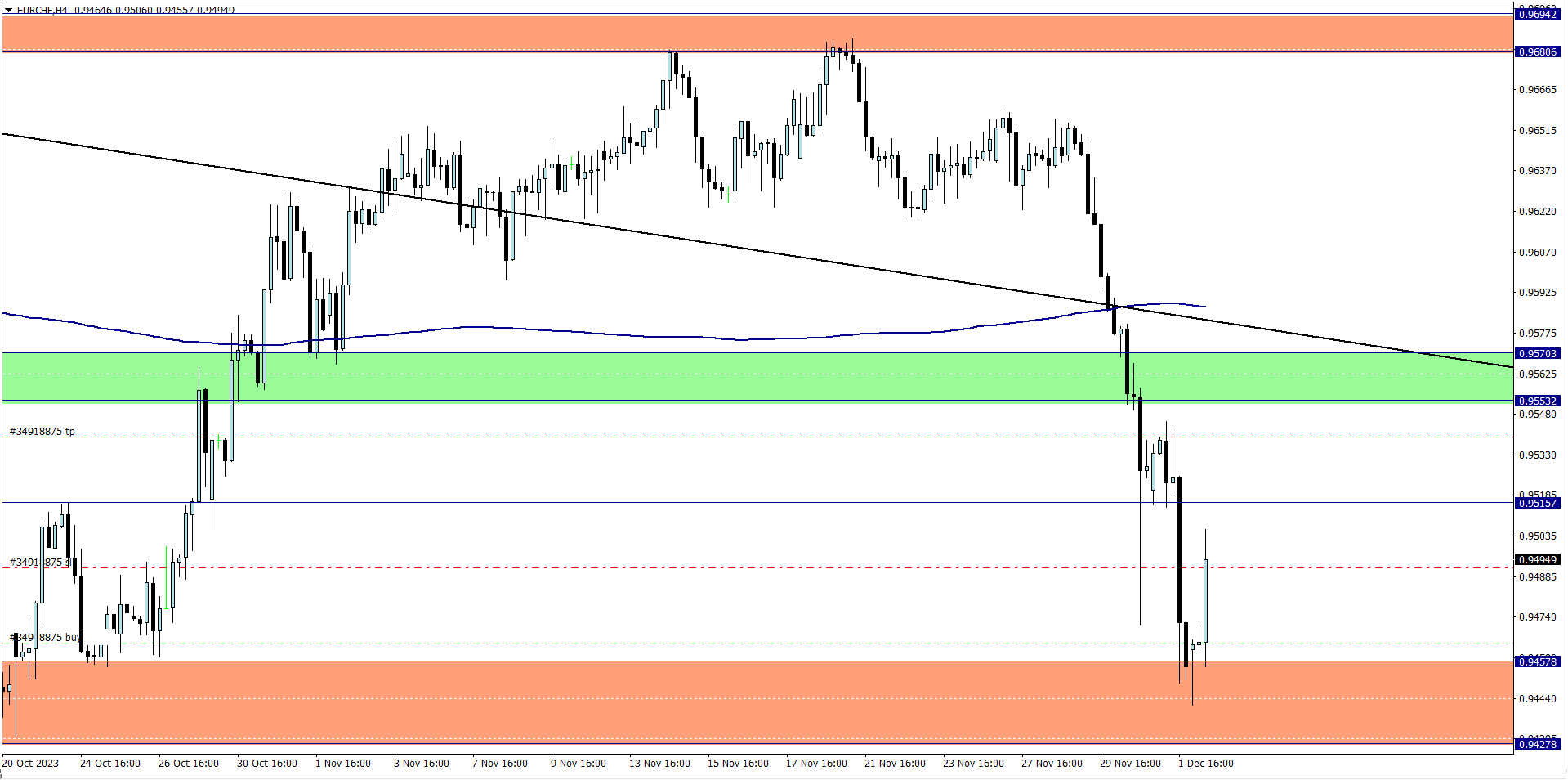

EUR/CHF Update (9.25 am)

Analysis: I was kicked out of this trade by my trailing SL. I closed with +27 pips

TUESDAY 05/12/2023

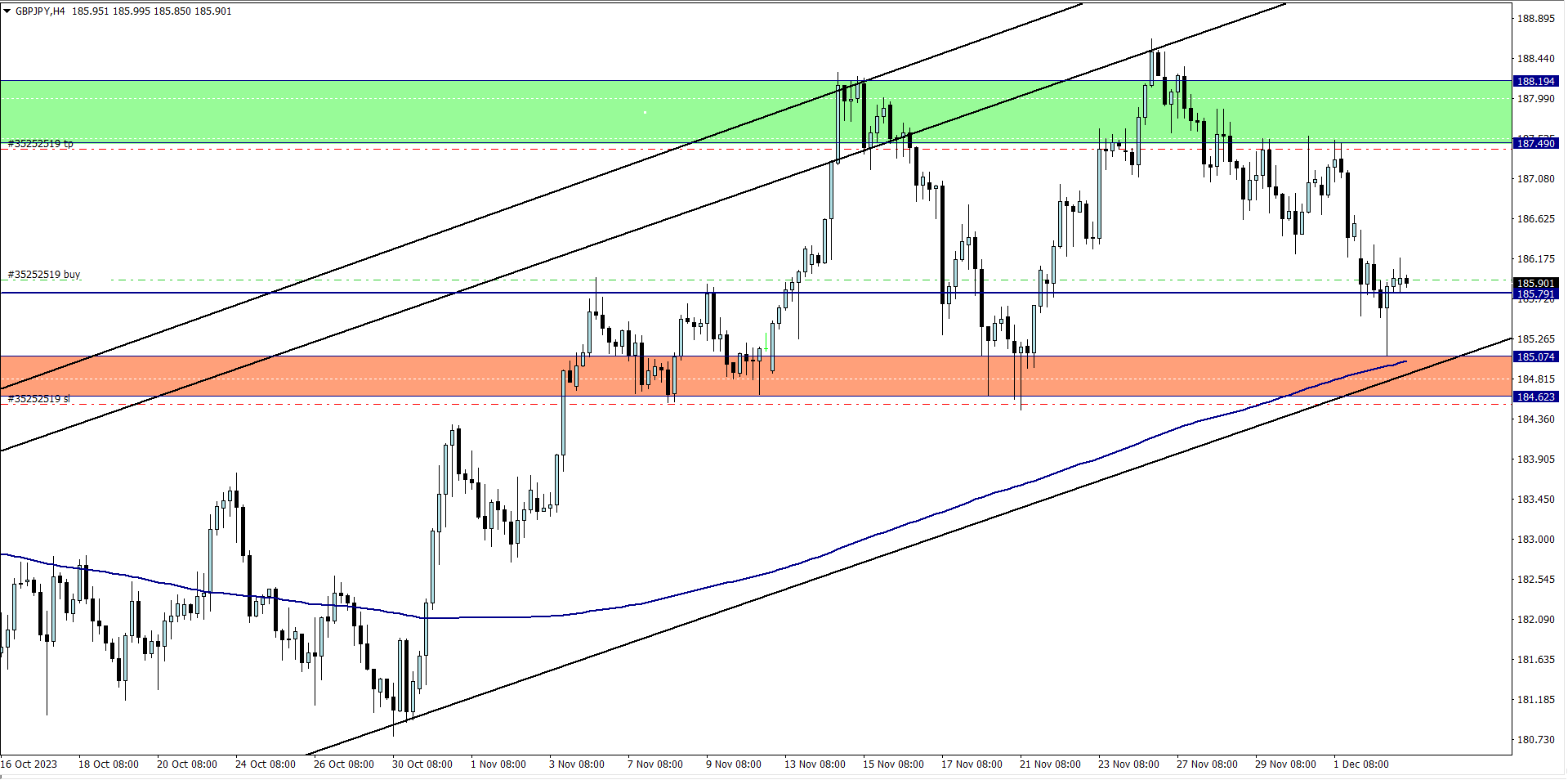

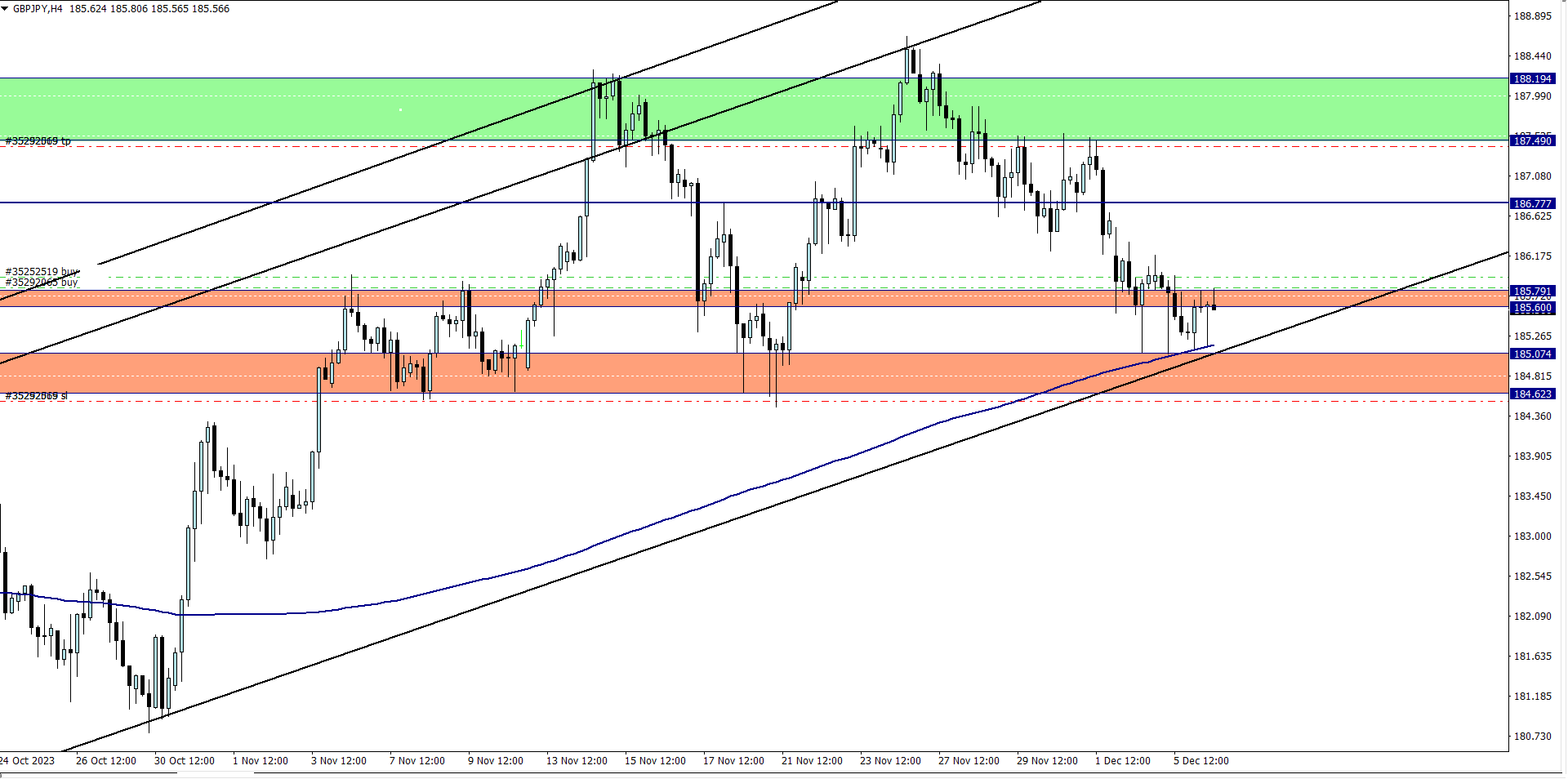

GBP/JPY (5:15am)

Analysis: Our Tuesday market analysis inspired the buy

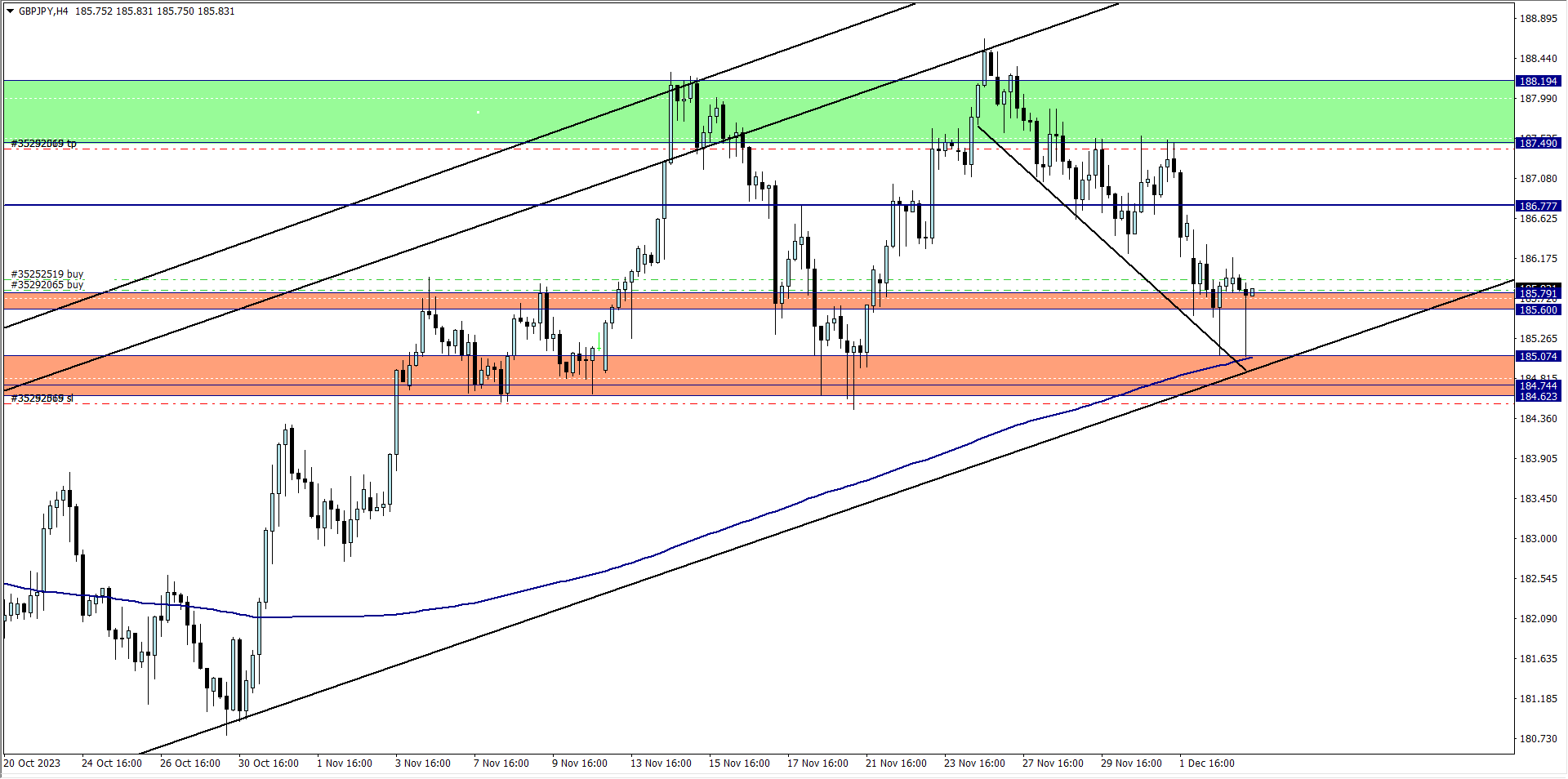

GBP/JPY Update (11am)

Analysis: The 11am rejection candlestick encouraged another buy entry

WEDNESDAY 06/12/2023

GBP/JPY Update (11:30 pm)

Analysis: I closed the trade manually and took a -215 pips loss on both trades

THURSDAY 07/12/2023

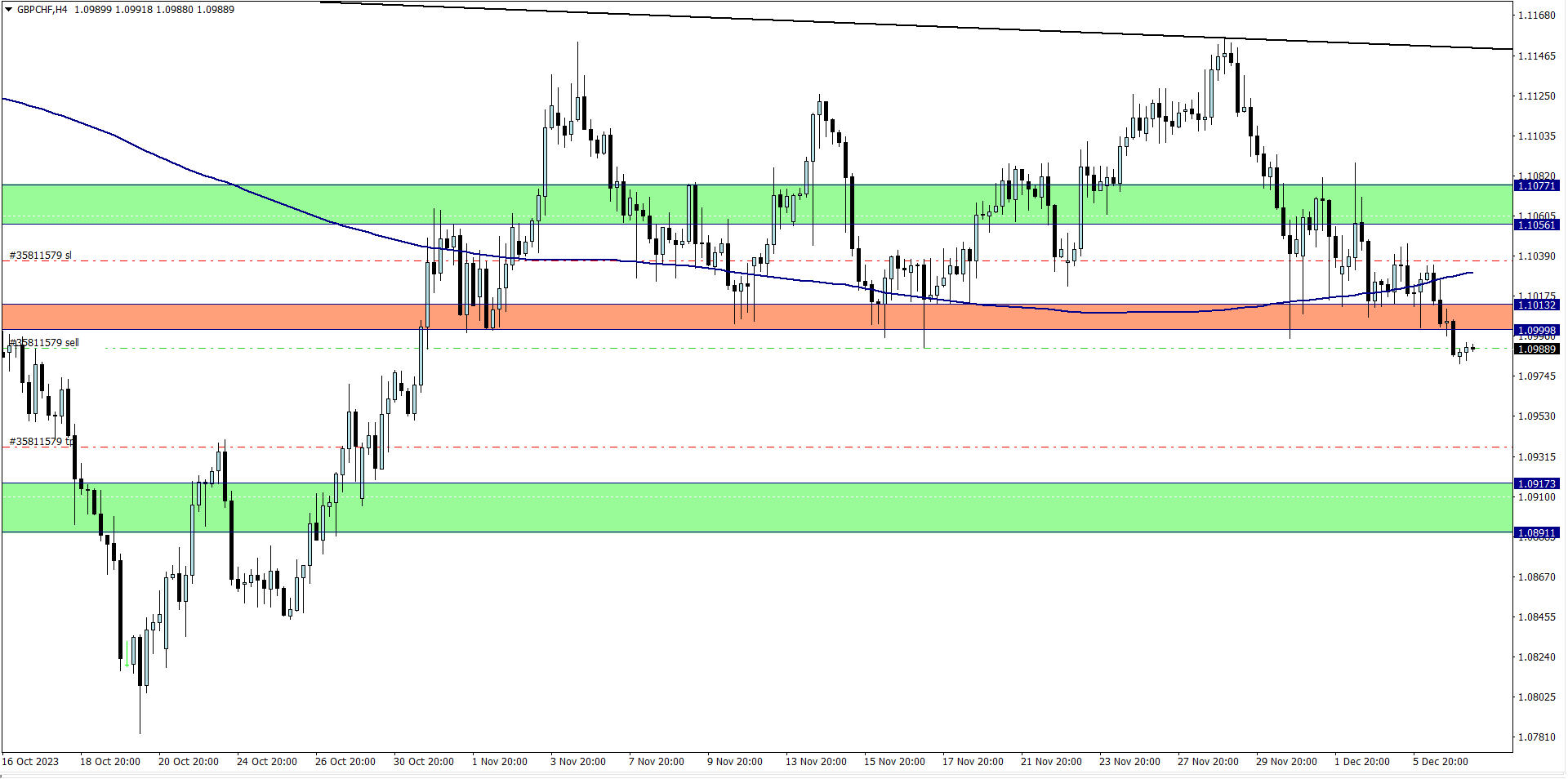

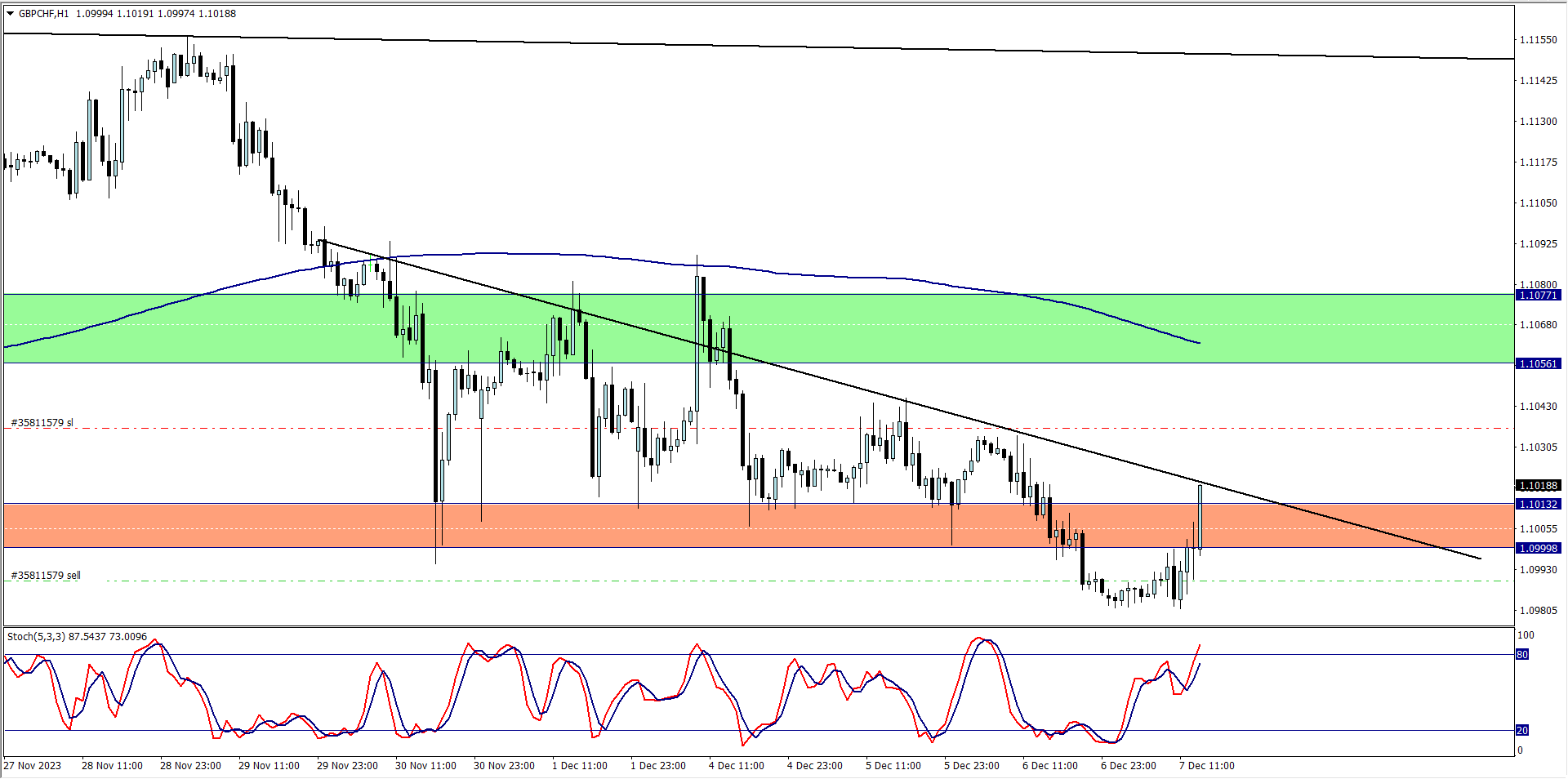

GBP/CHF (7:45am)

Analysis: My reason for selling is due to the clean daily breakout of price through the key support zone

GBP/CHF Update (1.45 pm)

Analysis: I manually closed the trade with -48 pips

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (04/12/2023) | EUR/CHF | BUY | +27 pips |

| TUE (05/12/2023) | GBP/JPY | BUY | – 215 pips |

| TUE (07/12/2023) | GBP/CHF | SELL | – 48 pips |

| TOTAL | – 236 pips |

In conclusion:

Three weeks of winning streaks ended this week. It was an awesome run, but there was a lot to learn from this week

Lesson 1: I fell in love with the GBP/JPY trade. Despite the fact that the trade gave me ample opportunities to exit, I did not. Entitlement crept in, and the trade expired on me.

Lesson 2: The GBP/CHF trade was a solid setup, but I did not settle down to do a proper, extensive analysis of where CHF/JPY was at the time. It happened that CHF was already weak, and a drop was imminent. So the loss I also took on GBP/CHF was avoidable

I lost at least -1.5% to -2% in trading capital this week due to my entitlement. Looking back now, its all clear. Looking forward to next week

How did your trading week go?

NOTE:

-

THE FUNDED TRADER: (Use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS