My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 06/11/2023

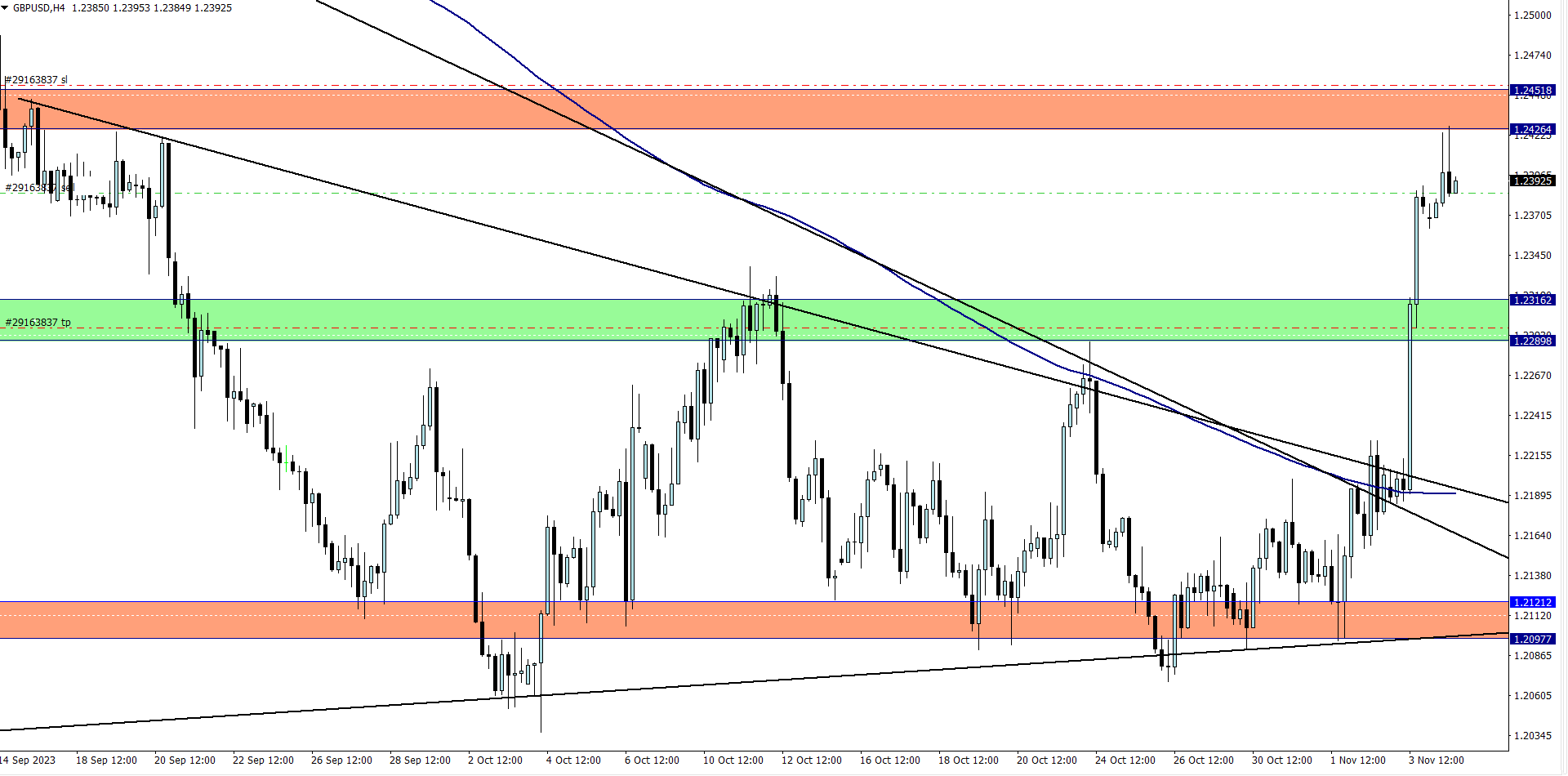

GBP/USD (9.45 pm)

Analysis: My reason for selling was the fact that price hit a key resistance zone on the daily time frame, and on the 4 hour time frame a strong bearish pinbar gave us a sell opportunity.

TUESDAY 07/11/2023

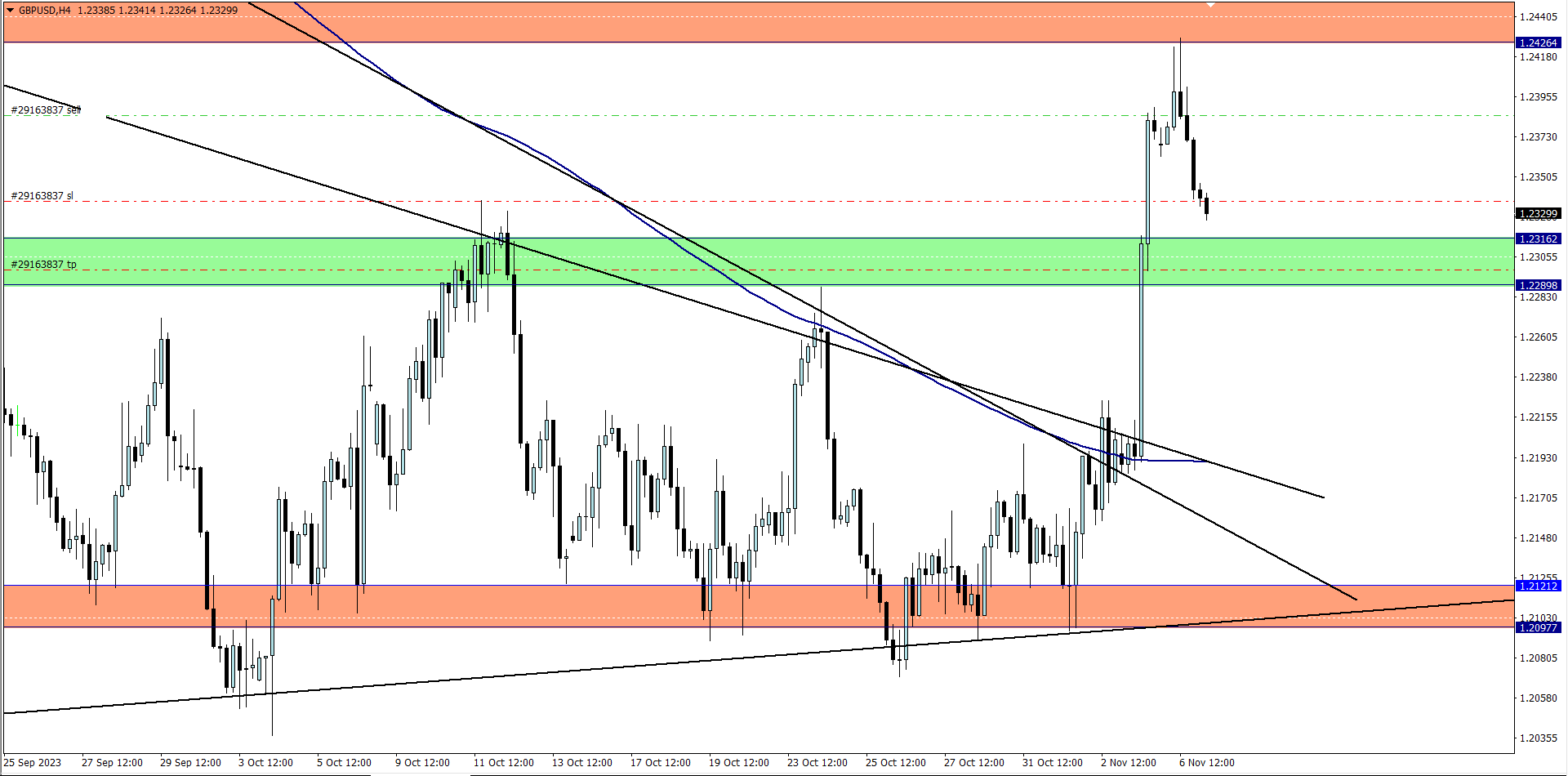

GBP/USD update (9.45 pm)

Analysis: Closed at +47 pips after price hit my trailing SL

WEDNESDAY 08/11/2023

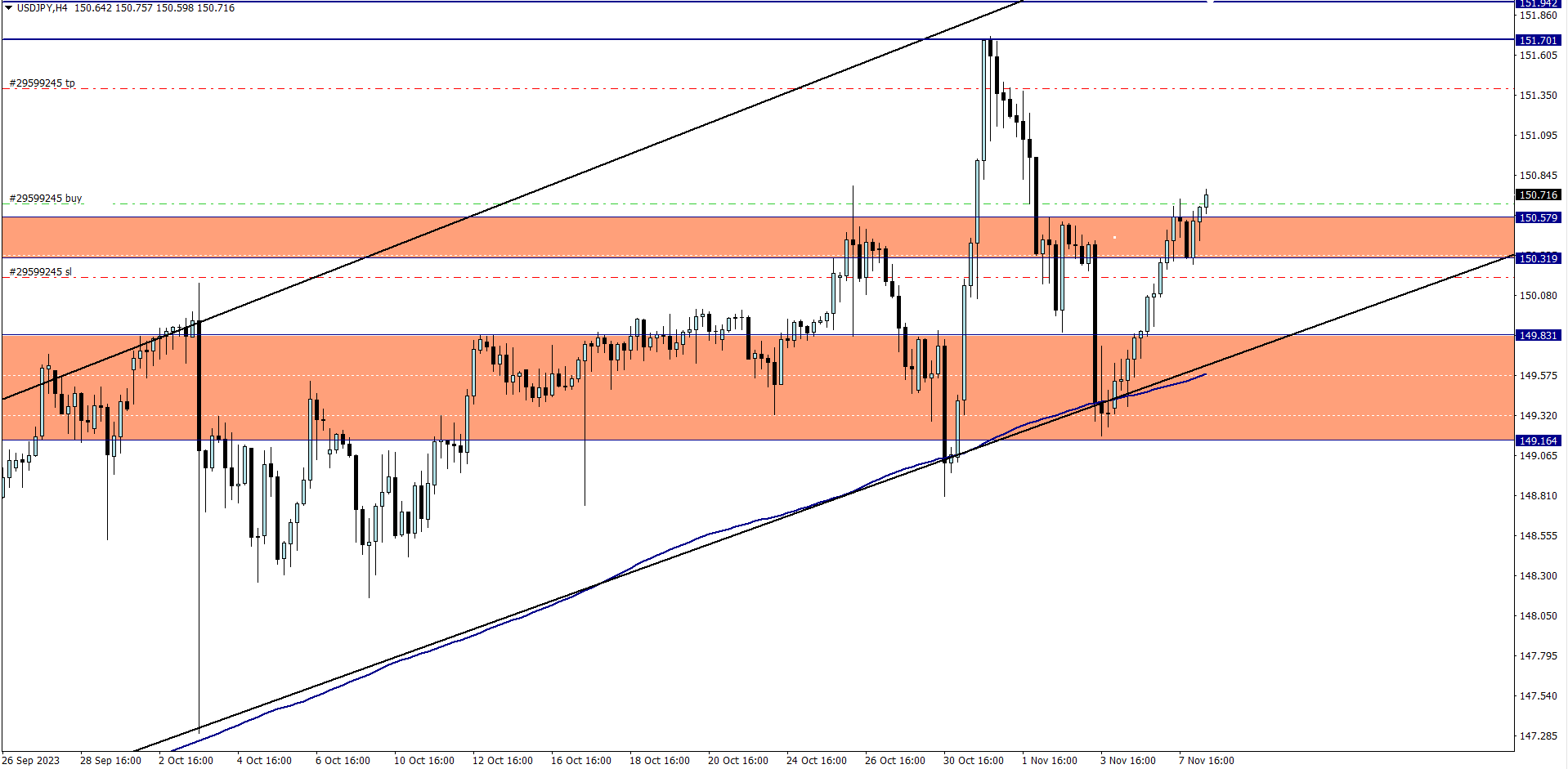

USD/JPY (10 am)

Analysis: Taking the trade because of the clean resistance zone breakout on the 4-hour time frame

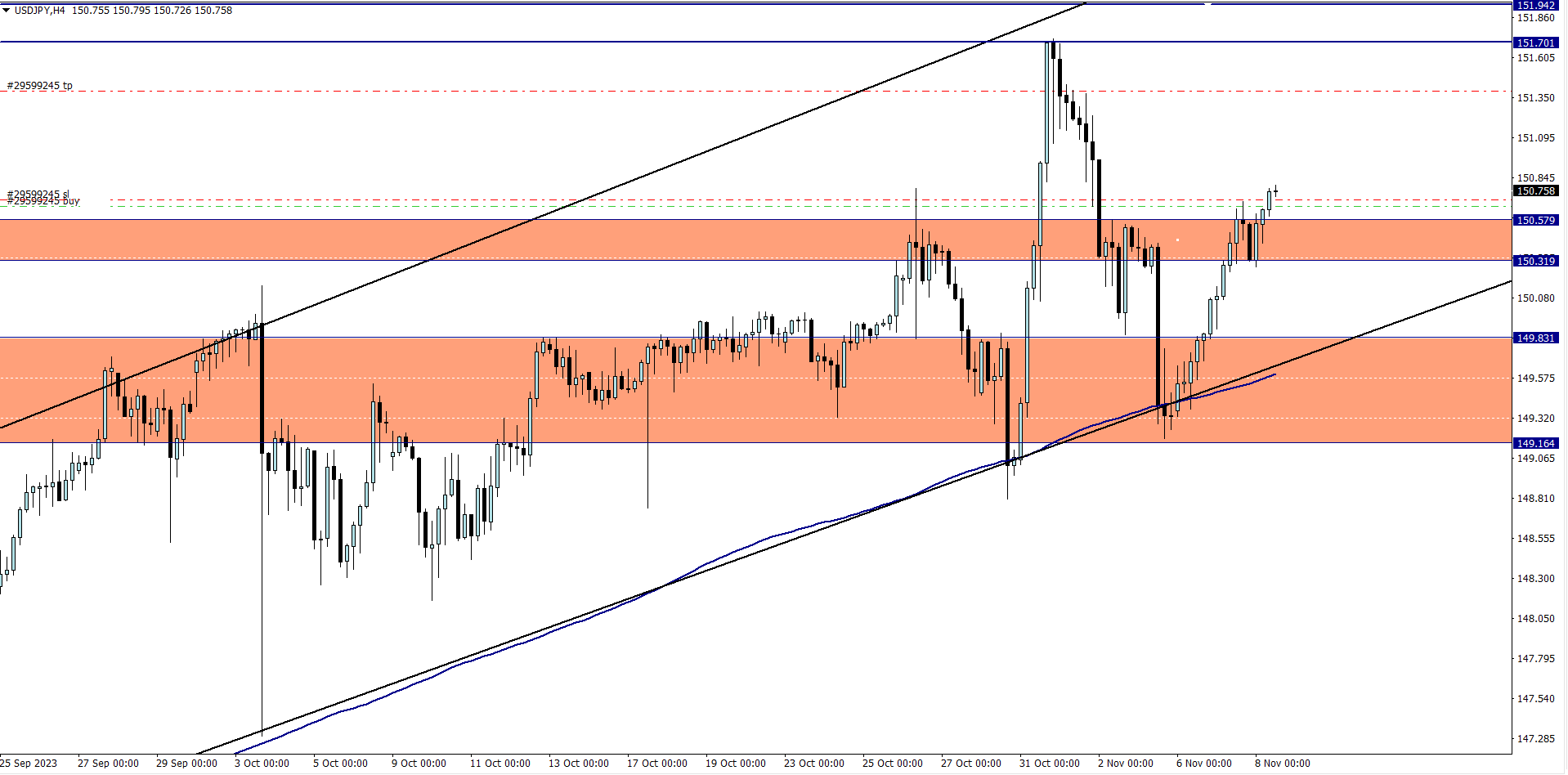

USD/JPY update (12.50 pm)

Analysis: Trailing SL shut me out with +5 pips

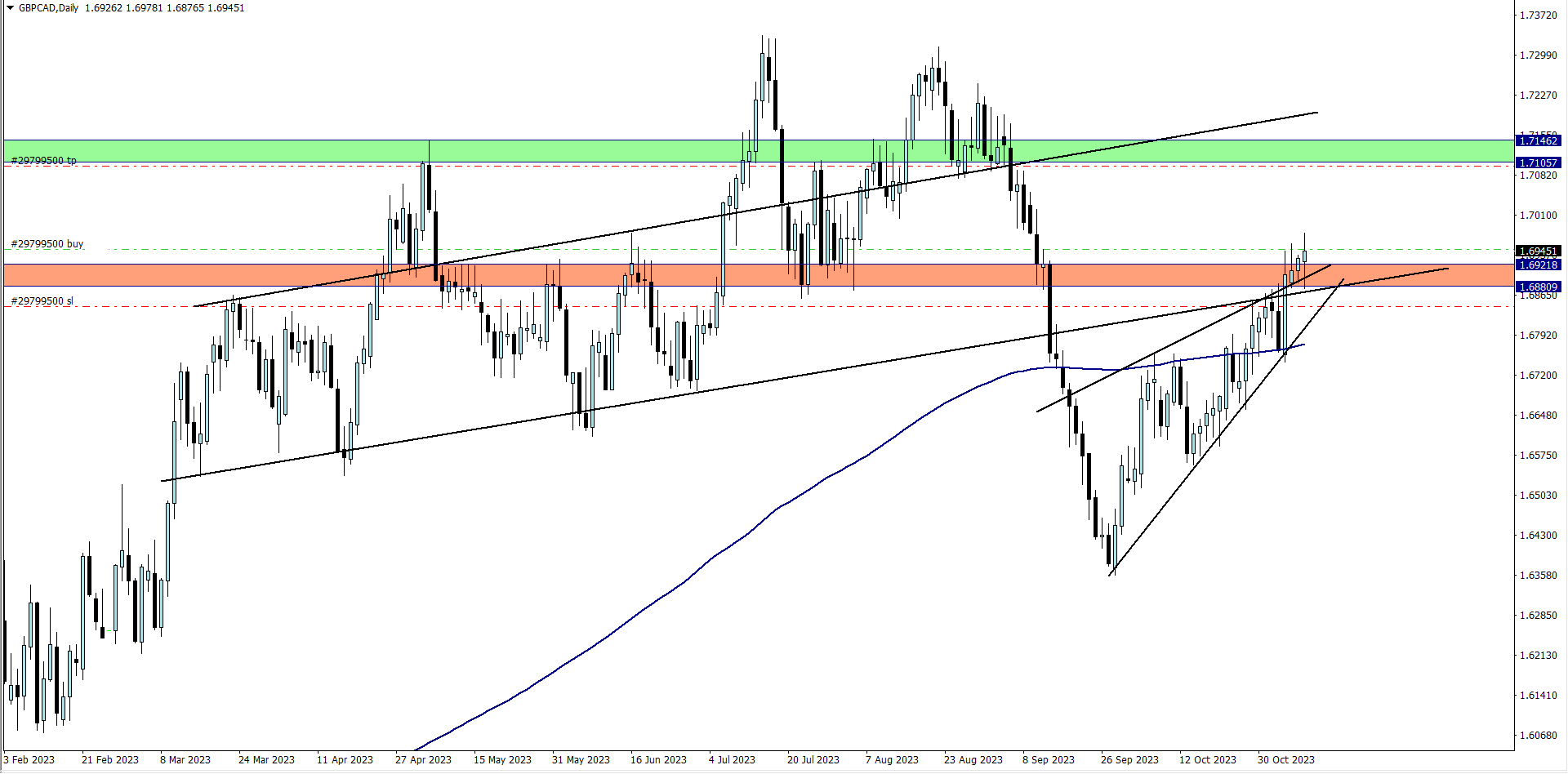

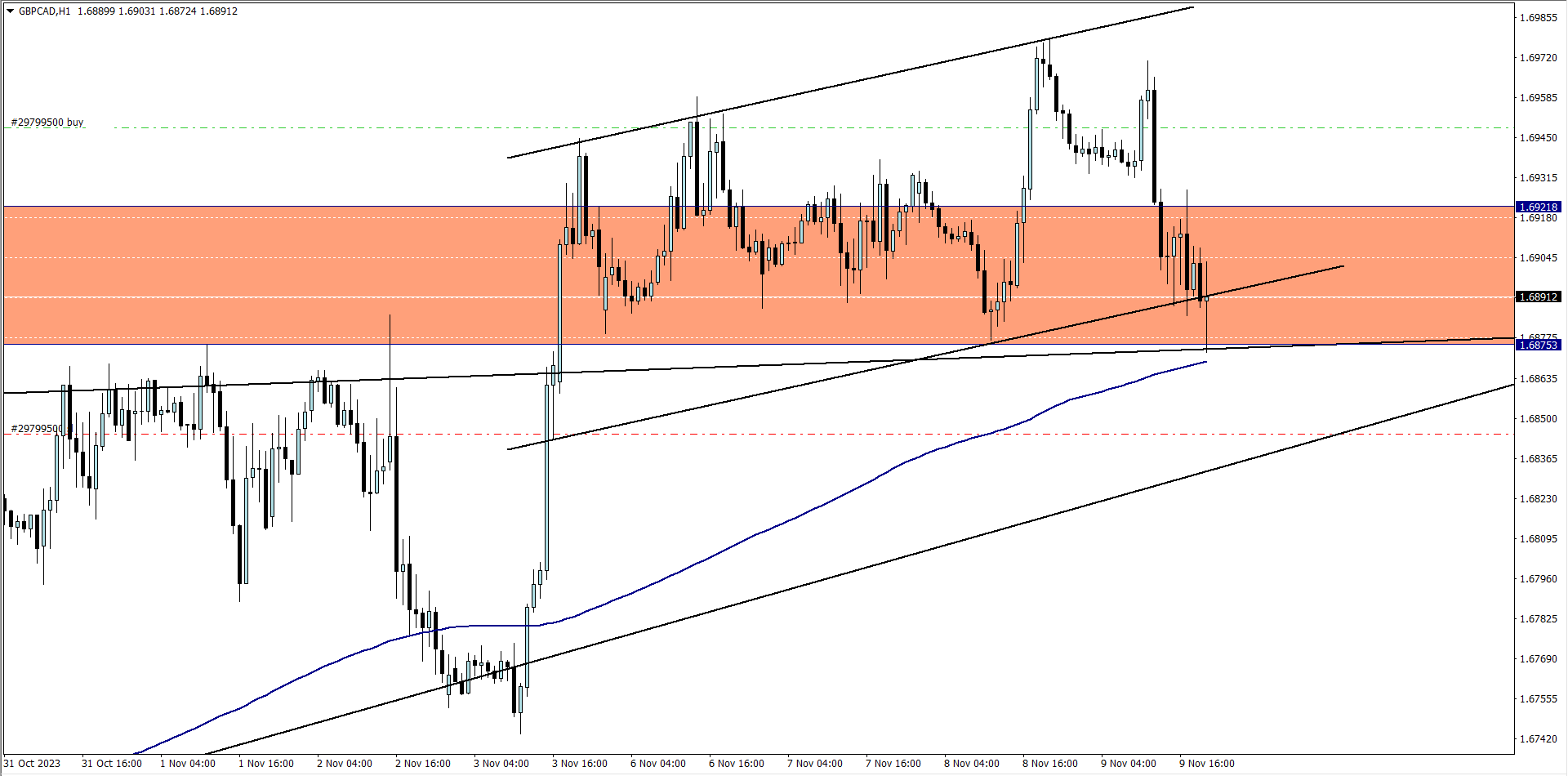

GBP/CAD (10.39 pm)

Analysis: This is one setup I have been waiting for to materialize all week. My reason for buying can be seen on our Thursday Market Analysis

THURSDAY 09/11/2023

GBP/CAD Update (8.30 pm)

Analysis: I closed this trade manually with -76 pips loss.

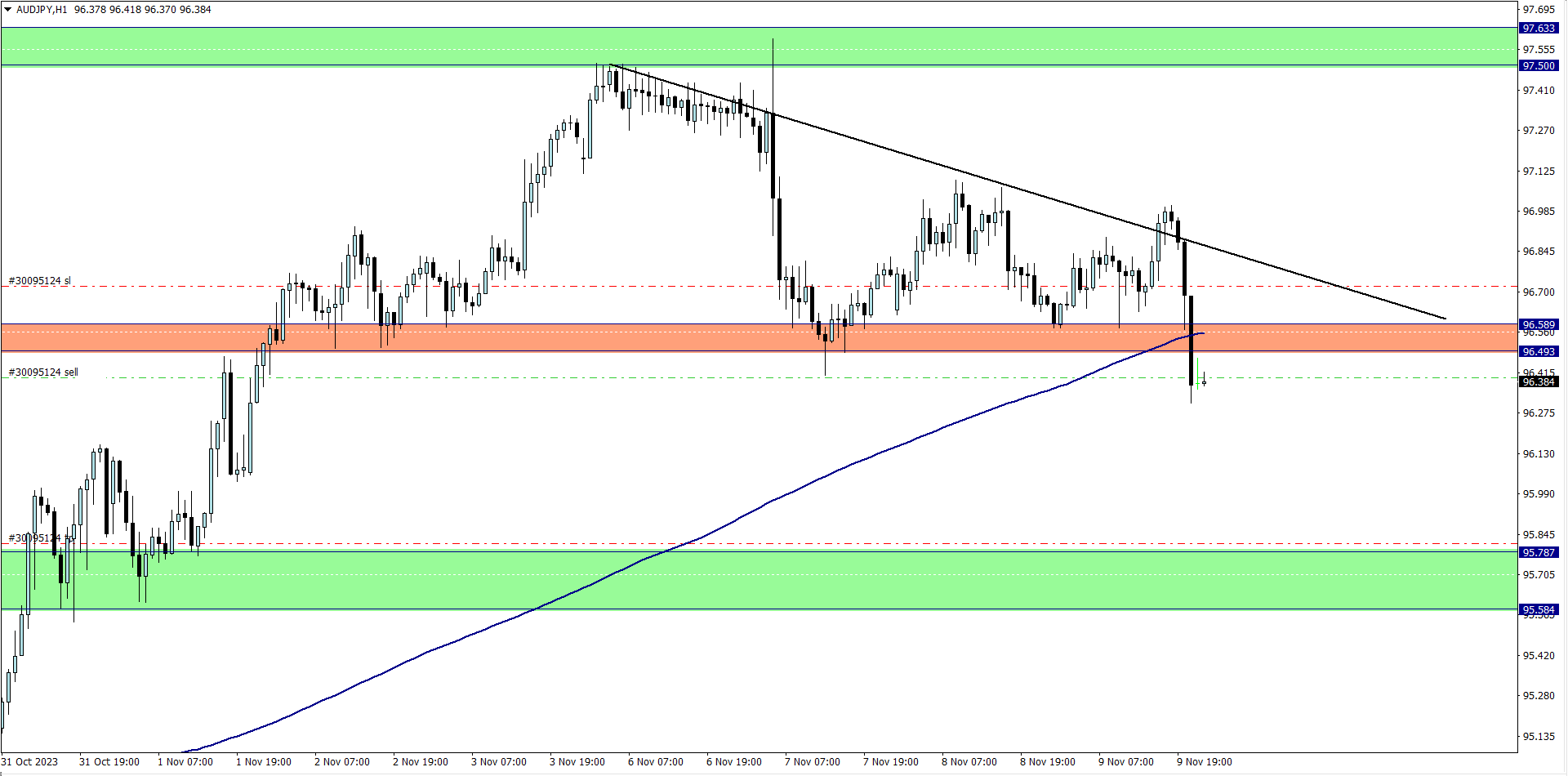

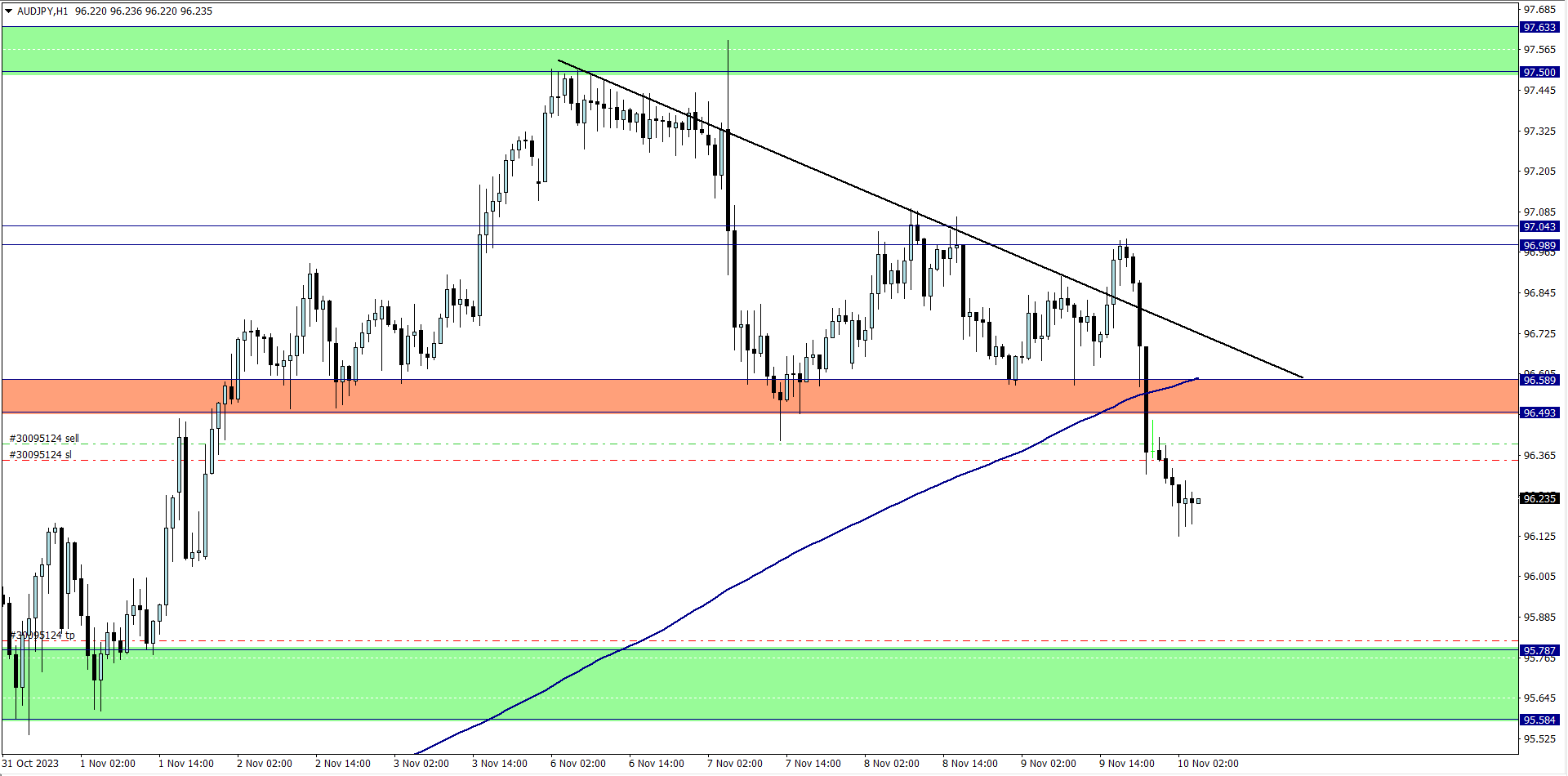

AUD/JPY (10.30pm)

Analysis: My reason for selling is on our Thursday Market Analysis

FRIDAY 10/11/2023

AUD/JPY Update (4pm)

Analysis: Locked +5 pips with my trailing SL, and closed with +5 pips

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (06/11/2023) | GBP/USD | SELL | + 47 pips |

| WED (08/11/2023) | USD/JPY | BUY | + 5 pips |

| GBP/CAD | BUY | – 76 pips | |

| THUS (09/11/2023) | AUD/JPY | SELL | + 5 pips |

| TOTAL | – 19 pips |

In conclusion:

It was a busy week in the market, but sadly, it did not translate to profits.

While I played a good game managing GBP/USD, USD/JPY and AUD/JPY, my reliance on GBP/CAD completely ruined my week’s profits, and took me back by – 0.8%.

GBP/CAD was an “A” setup that went bad, so I risked a little more than I should have done, but again the risk was well managed.

USD/JPY moved all the way to my intended profit target, but my trailing SL closed the trade prematurely.

AUD/JPY was well timed using my trailing SL, so no regrets

GBP/USD was a sniper entry and another A setup that did splendidly well

All in all, I will say that it was not a good week for me, but I am thankful for being disciplined enough not to lose more than I did.

Hopefully next week brings us better setups, and also the right mentality to manage them

How did your trading week go?

NOTE:

-

THE FUNDED TRADER: (Use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS