My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 04/09/2023

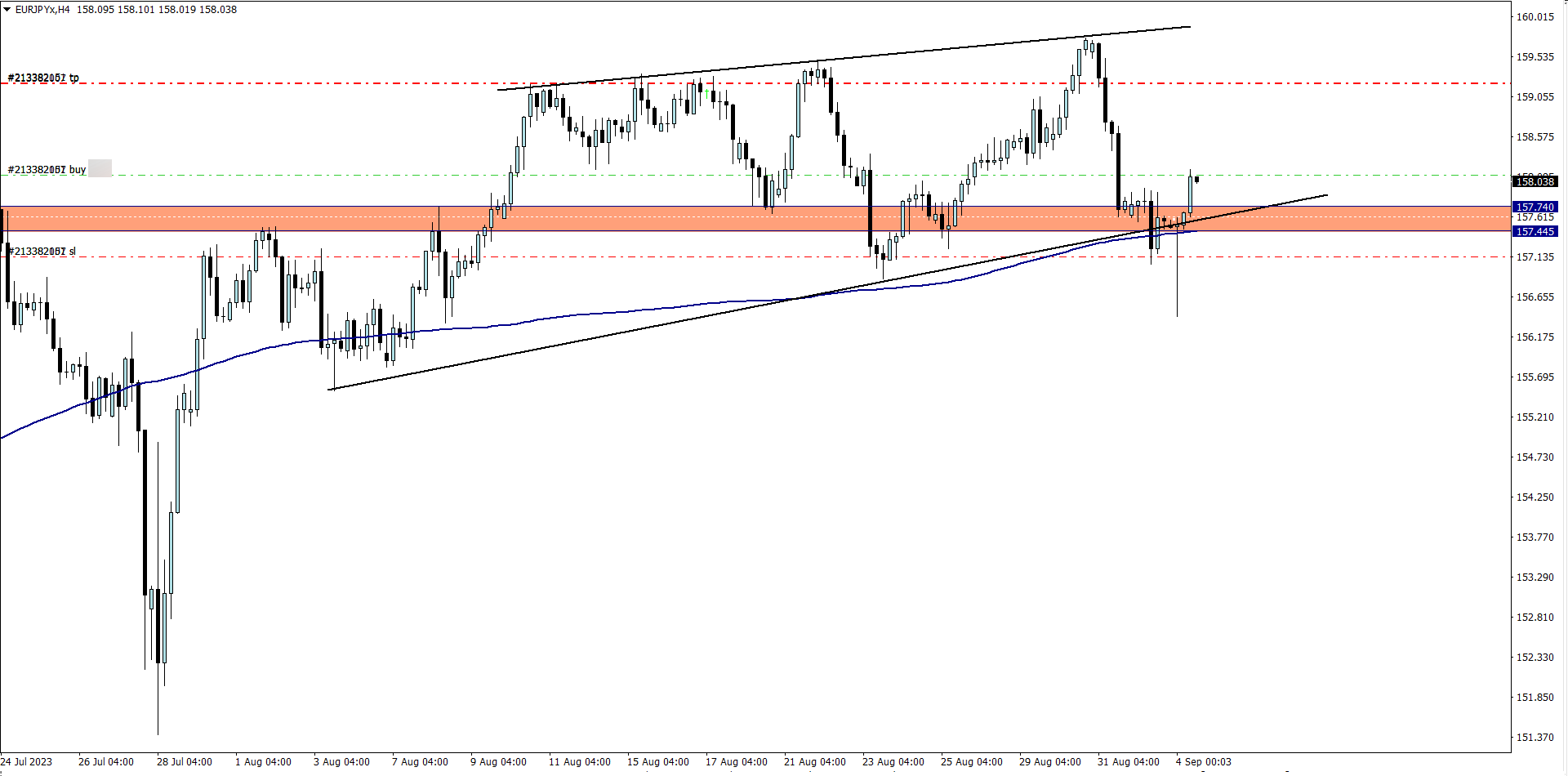

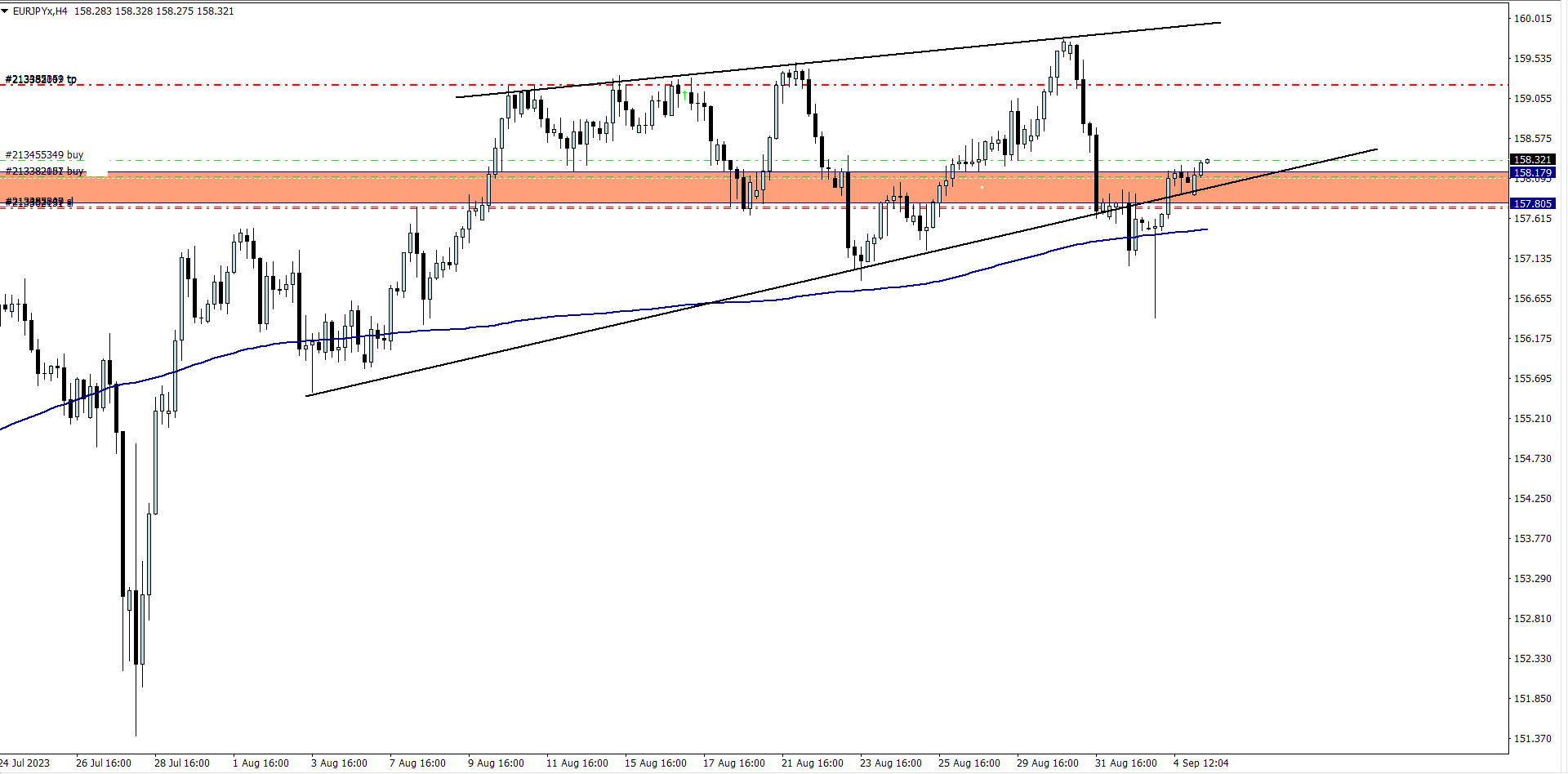

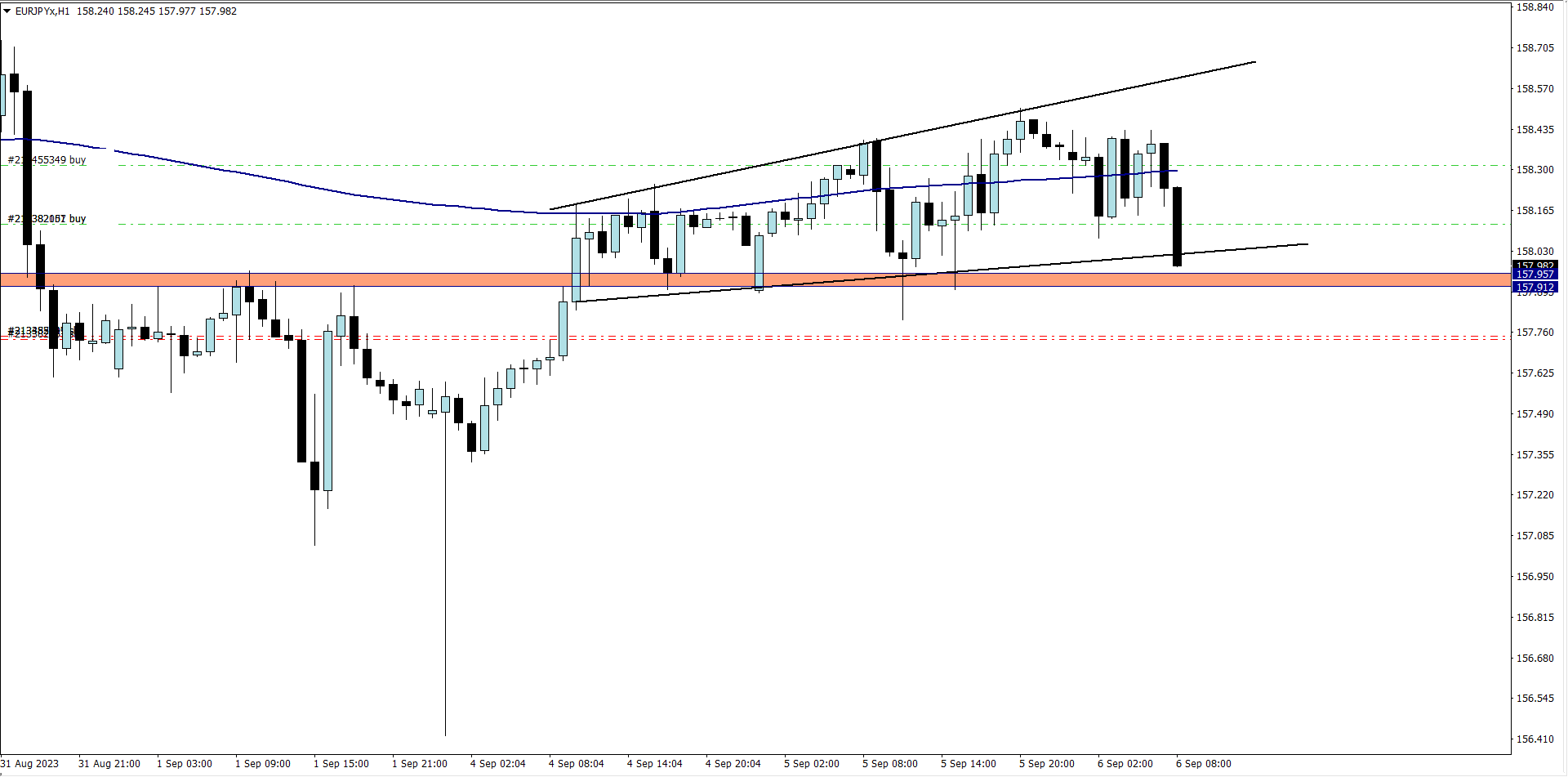

EUR/JPY (6.50am)

Analysis: This trade was inspired by our weekly market analysis

TUESDAY 05/09/2023

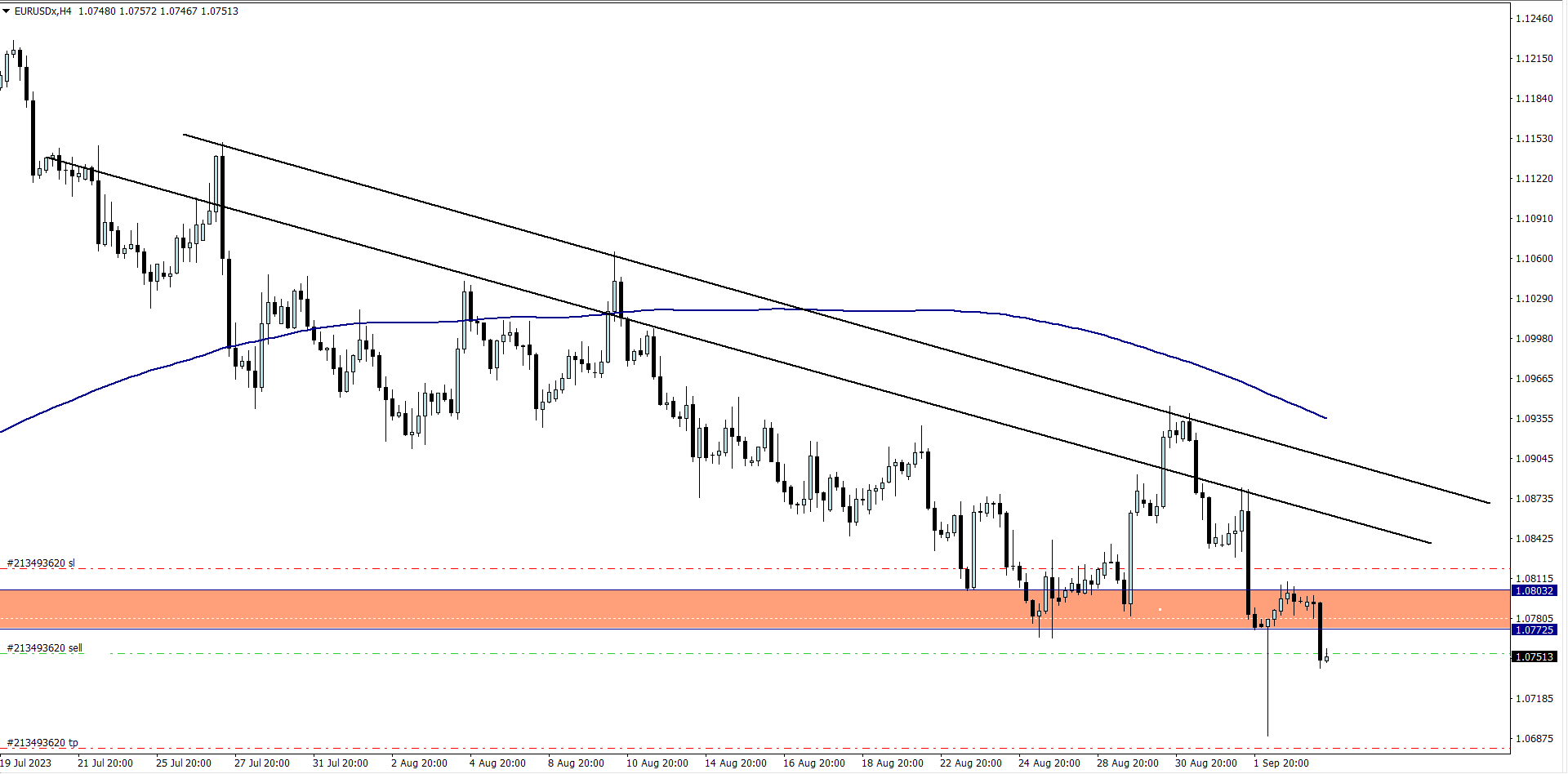

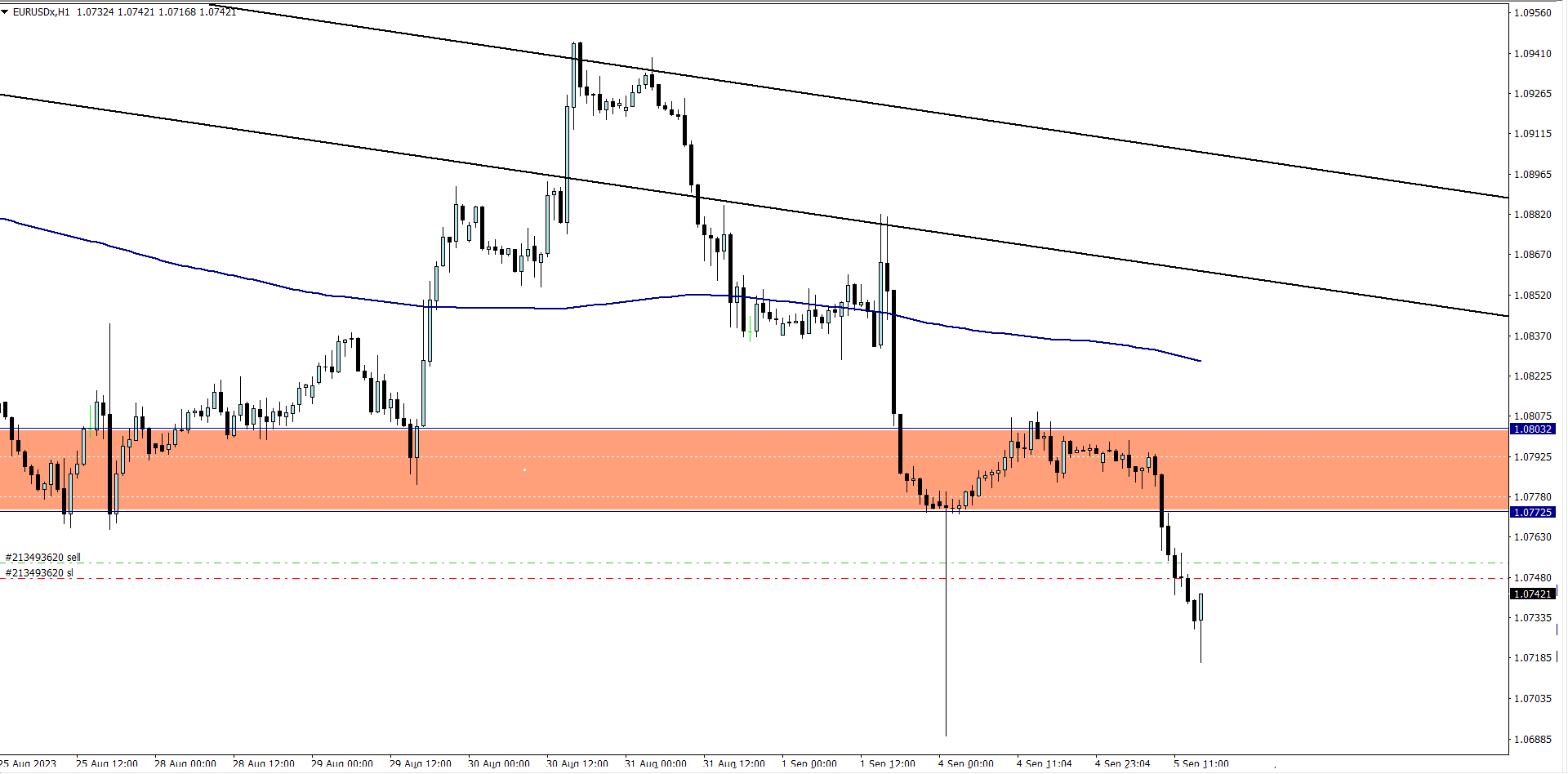

EUR/USD (10.15am)

Analysis: Head and shoulder formation spotted on the EUR/USD, and taken

EUR/USD Update (10.15am)

Analysis: I locked +6 pips , and was taken out by a pullback

EUR/JPY update(10.30am)

Analysis: Added to my EUR/JPY buy position

WEDNESDAY 06/09/2023

EUR/JPY Update (7.15am)

Analysis: I manually closed my scaling in position on EJ with -68 pips loss (-45 & -23)

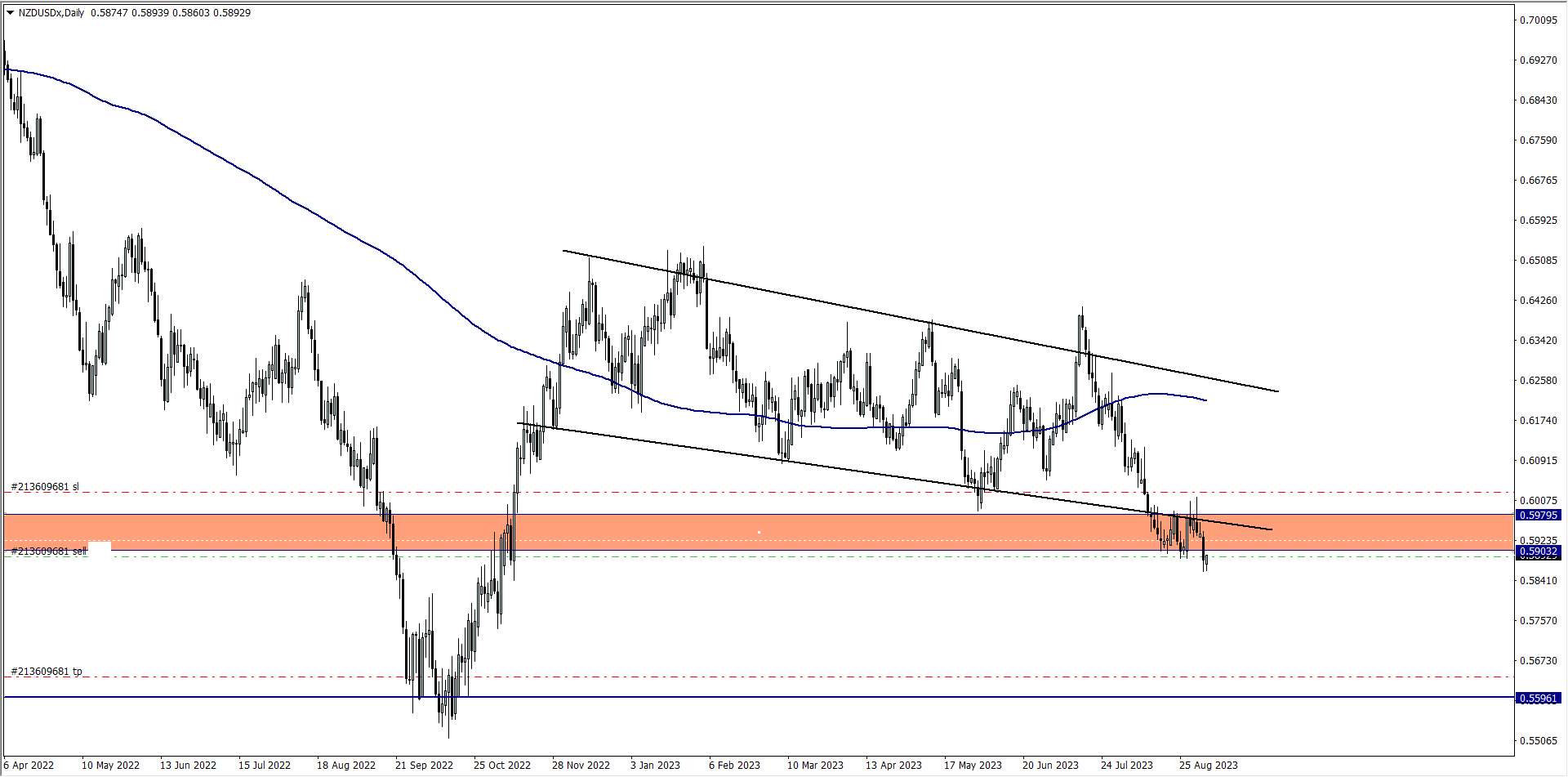

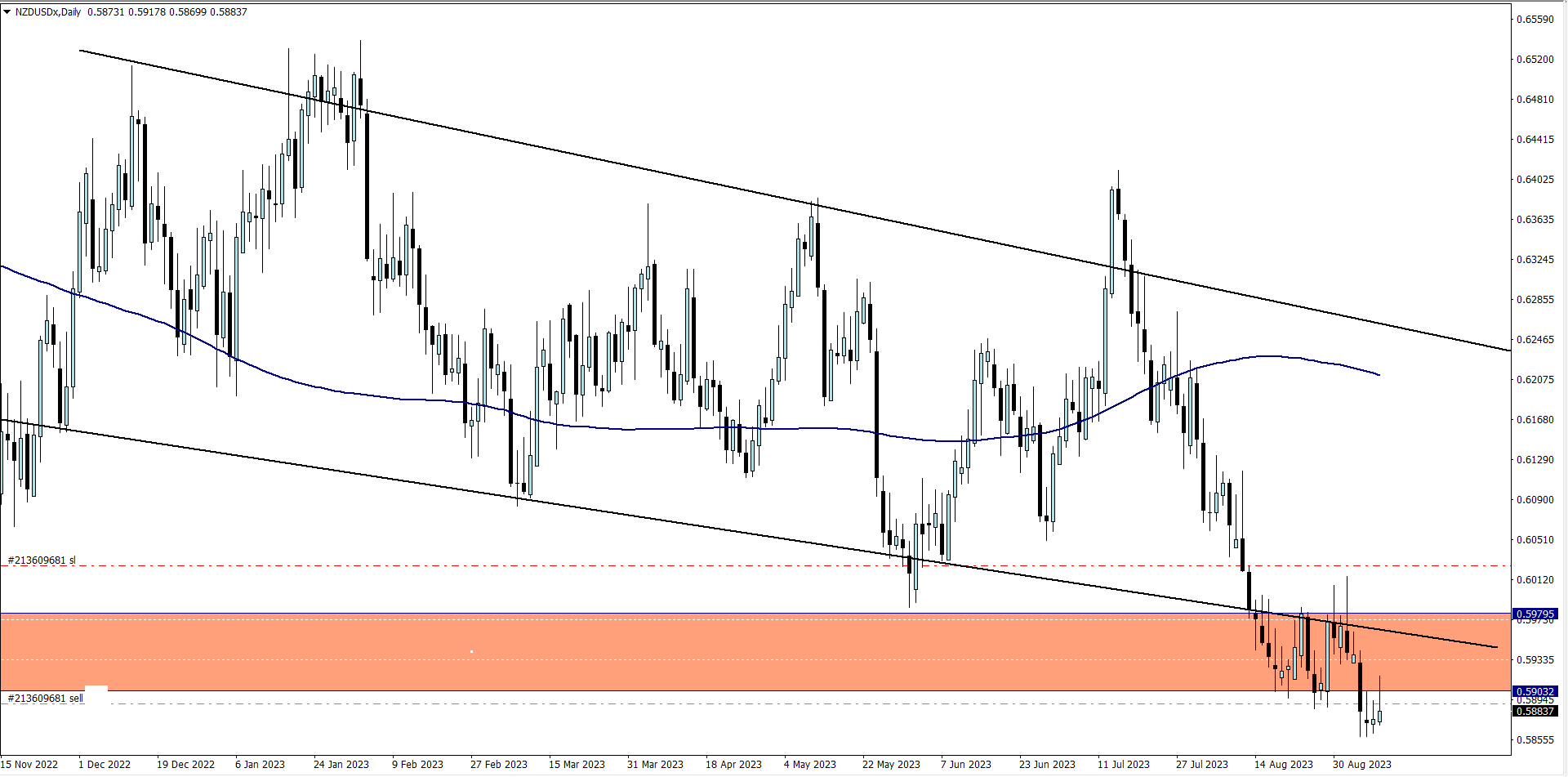

NZD/USD (6.25 am)

Analysis: This trade was inspired by our Wednesday market analysis

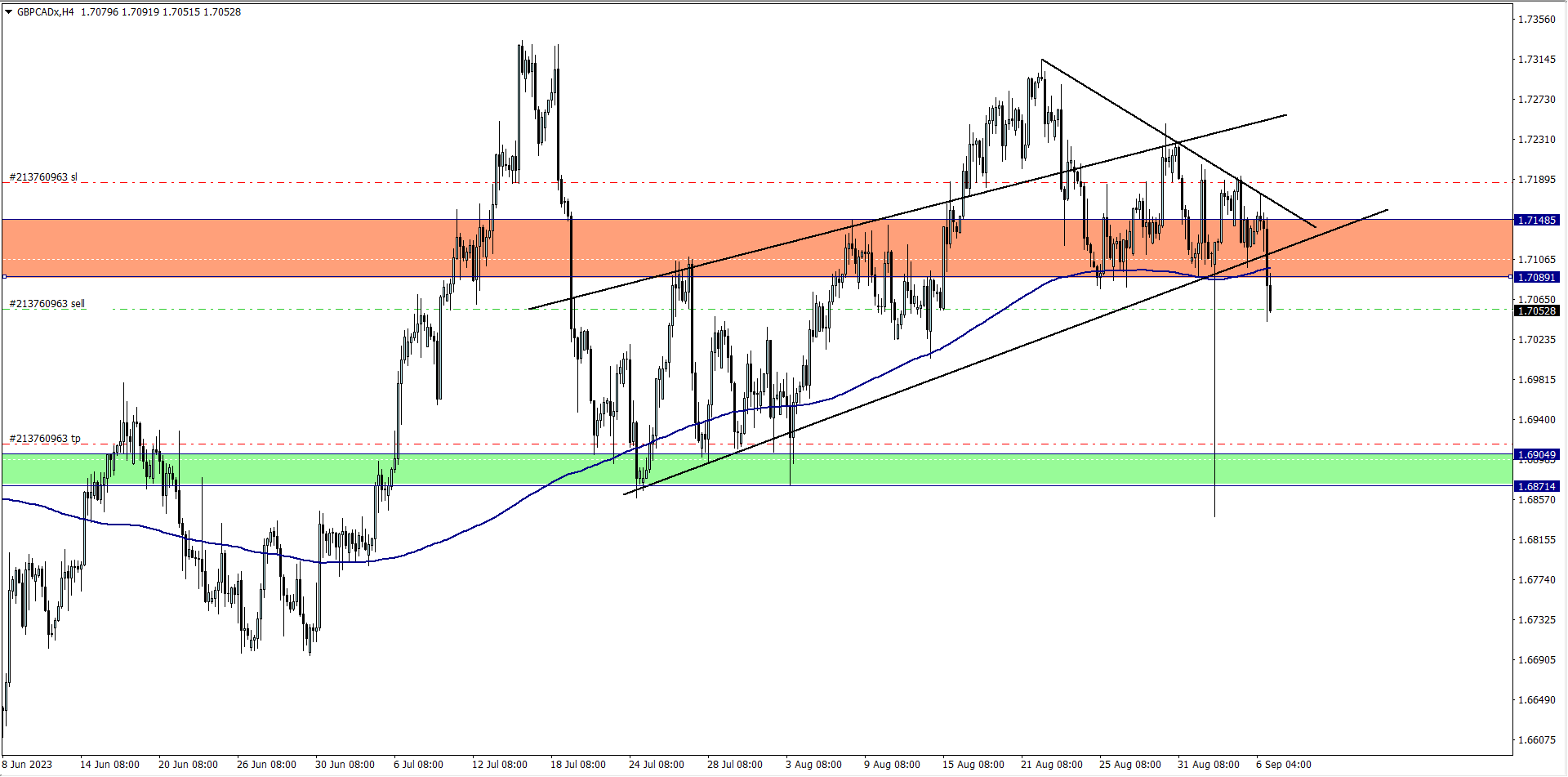

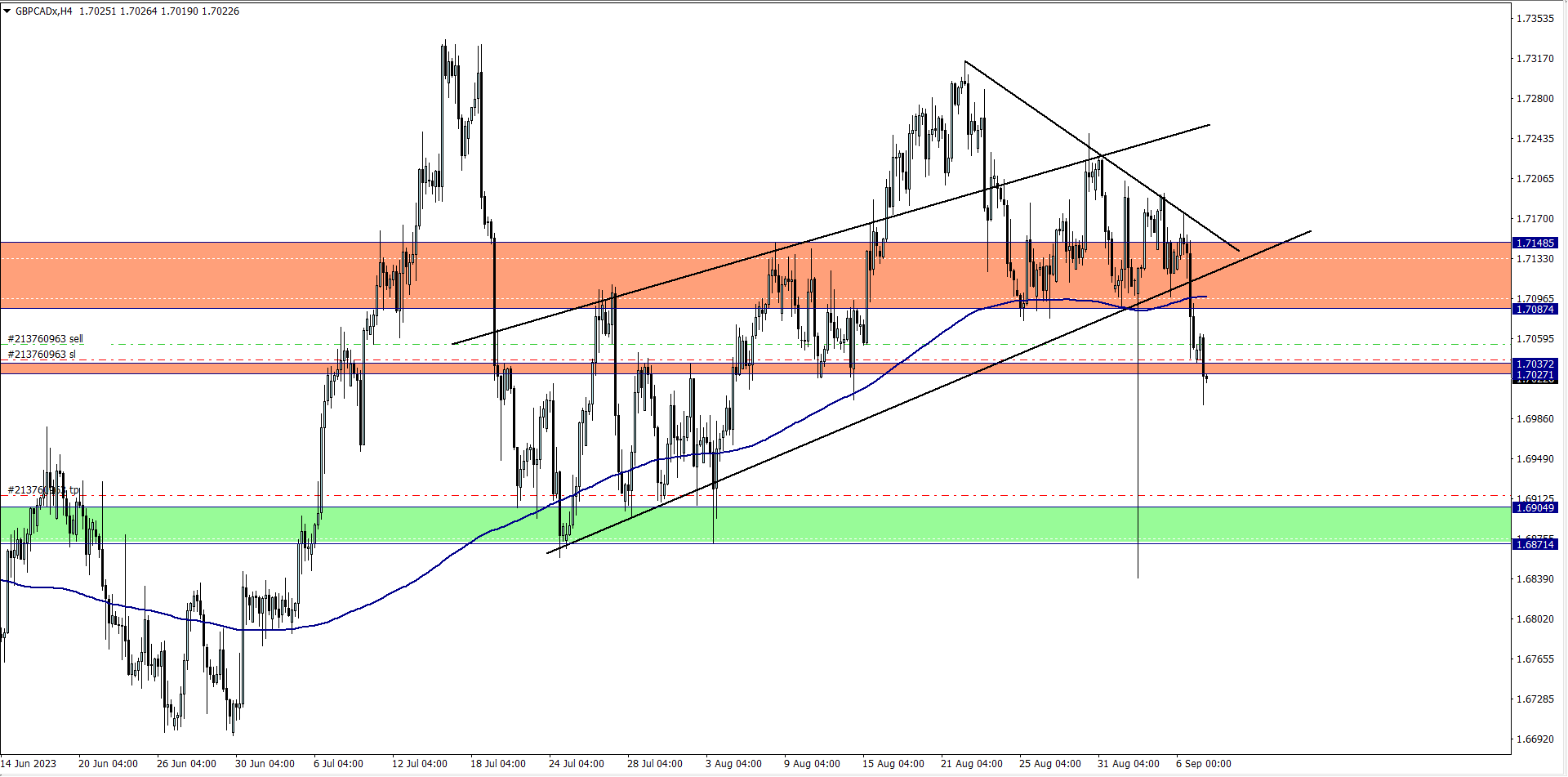

GBP/CAD (9.35 pm)

Analysis: My reason for selling was inspired by our Thursday Market Analysis

THURSDAY 07/09/2023

GBP/CAD Update (9.35 pm)

Analysis: Trailing SL was activated after price met movement met some criteria. I closed with +38 pips

FRIDAY 08/09/2023

NZD/USD Update(11.30 pm)

Analysis: I am still holding on to this Wednesday trade. Currently on positive, but we will conclude on it next week.

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (04/09/2023) | EUR/JPY | BUY | – 68 pips |

| TUE (05/09/2023) | EUR/USD | SELL | + 6 pips |

| WED (06/09/2023) | NZD/USD | SELL | Pending |

| GBP/CAD | SELL | + 38 pips | |

| TOTAL | – 24 PIPS |

In conclusion:

I executed my trading plan 100% this week, and I am happy for that.

The EUR/USD trade could have earned me more pips if I didn’t activate my trailing SL, but my trailing SL also saved me from the EUR/JPY (scaling in). For that I am thankful. Like I always say:

You trading system may leave a lot of money on the table, but it also guards you from losing a lot of money during critical conditions. I took a little loss this week (less than 0.4%). I am also looking forward to the NU trade materializing this week

We still have 3 solid trading weeks, in the month of September, so I am confident.

How did your trading week go?

NOTE:

-

THE FUNDED TRADER: (use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING

- THE5ERS