Hello traders,

This week looks promising. Some of the setups we are sharing have already reached key levels, and will most likely be triggered Monday/Tuesday.

1. USD/JPY

Last week was bullish on the USD/JPY.

The ascending channel resistance got wiped out, and the only major resistance the buyers are currently facing is the same that stood against the vicious buyers in June 2023.

The last time this zone was visited, buyers fought a good battle for 5 days, but lost to the strong walls of the sellers. This week I will be watching if what happened in October 2022 will repeat itself.

In October 2022, price hit the same resistance zone, broke it, and moves North, over 600 pips, before losing the battle to the sellers

Do you think the October 2022 move will repeat itself ?

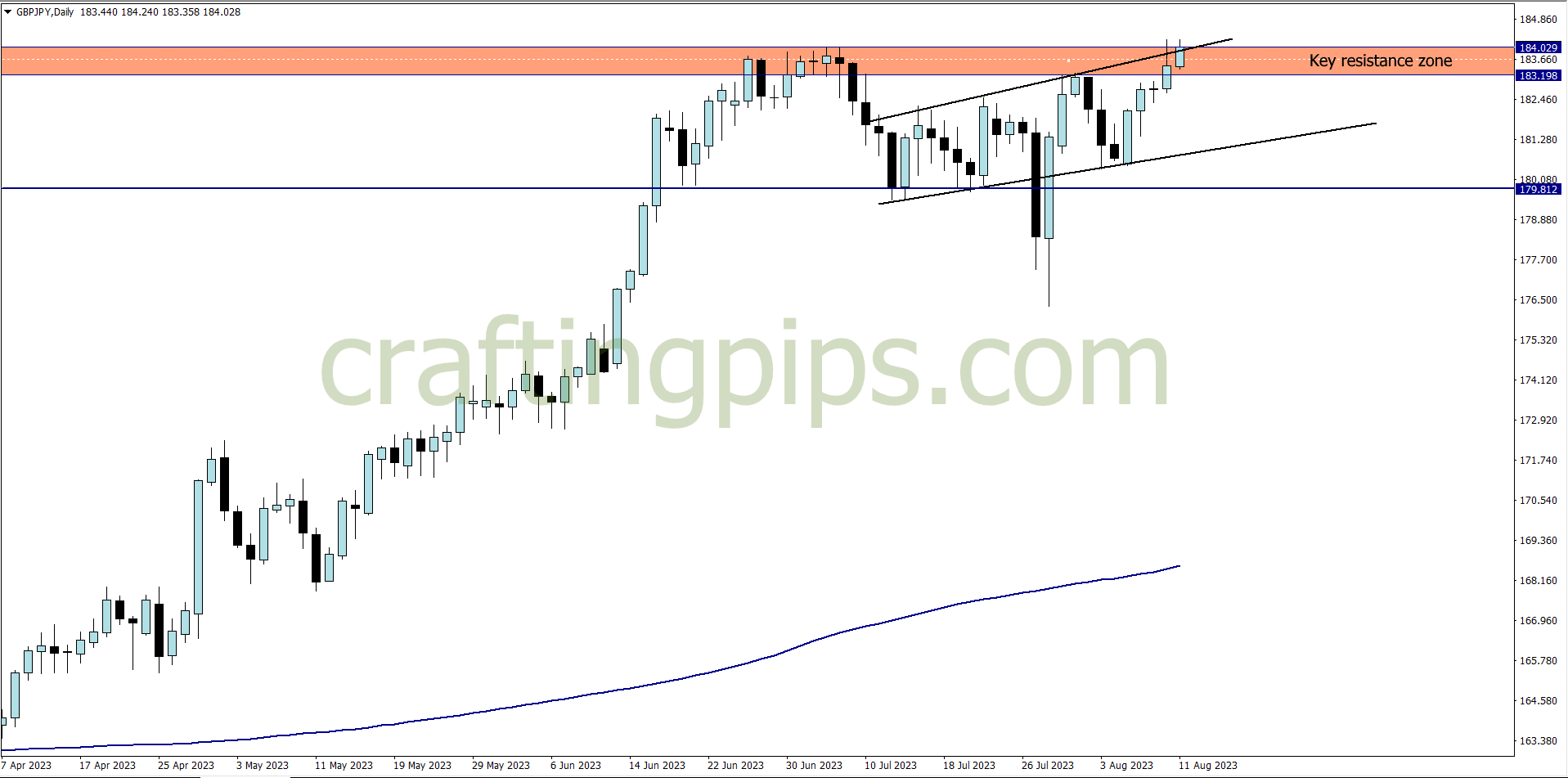

2. GBP/JPY

The key resistance zone on the GBP/JPY is threatened by the buyers

Do you think the the October 2015 event will repeat itself this week?

Well, I will allow the close of Monday’s daily candlestick before deciding. If the October 2015 breakout repeats itself this week, then we could be harvesting 100 to 250 pips bullish move before the close of Friday market

3. EUR/CHF

My personal favourite setup (hidden bullish divergence)

This setup could keep us busy if it pans out between 2am-6am Monday morning. All we should be looking out for is additional bullish confirmation before joining the buyers.

For me that will be any of the bullish candlestick reversal formations and a cross of the stochastic, then we ride with the buyers to NPRZ, which could fetch us a descent 30 to 40 pips.

4. NZD/USD

A descending channel is spotted on NZD/USD.

My interest in this setup is to see how the Monday daily candlestick closes. If we do have a break below the key support zone, then we may see a 100 to 150 pips drop before the close of the trading week. However, if the bears are aggressive, a 300 pips fall won’t be out of place, though rare.

That’s my only interest in this setup

What say you?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter