My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- have enough data, in order to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 24/07/2023

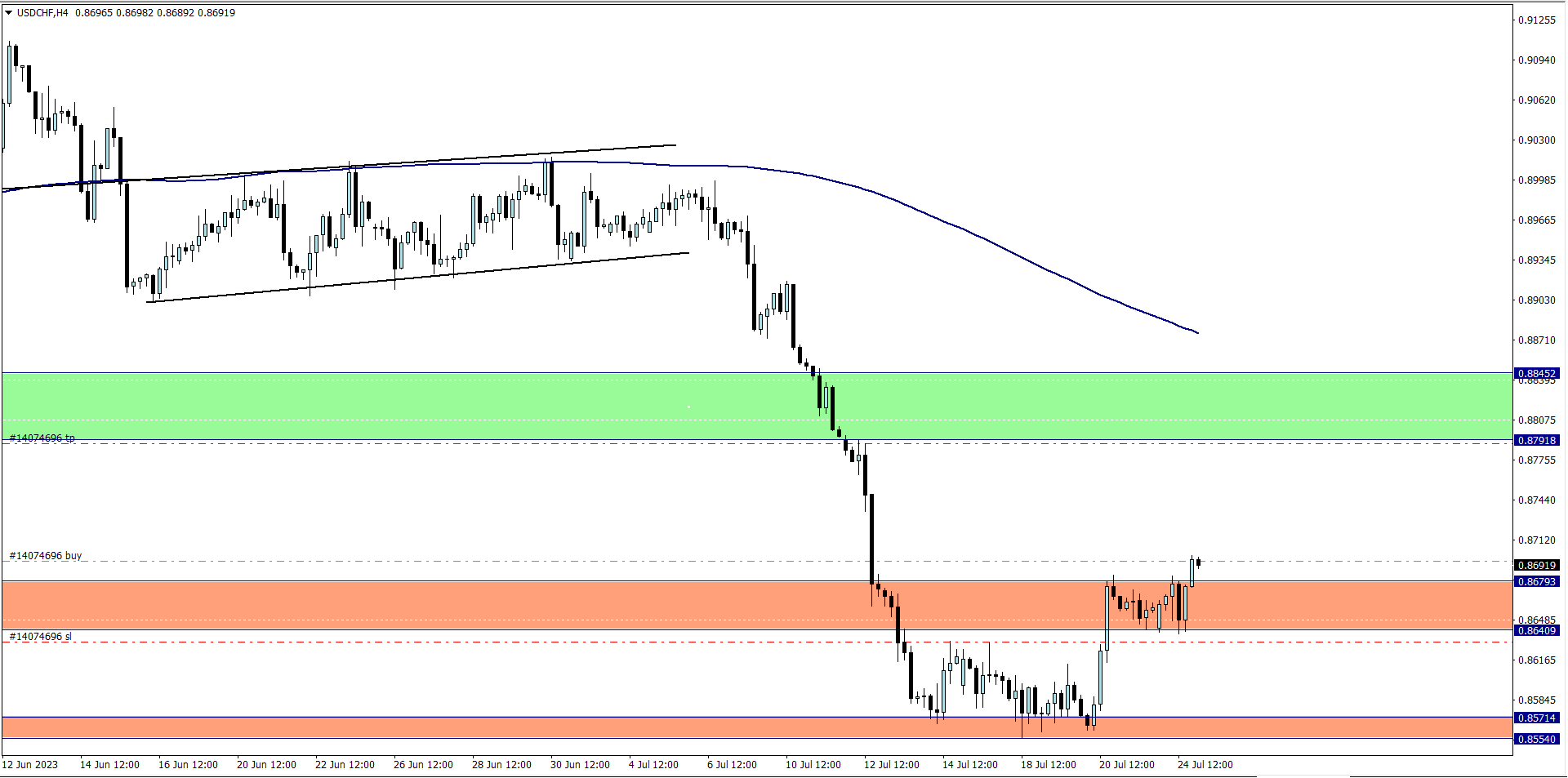

USD/CHF (10.50 pm)

Analysis: USDCHF setup was inspired from our Tuesday Market Analysis

TUESDAY 25/07/2023

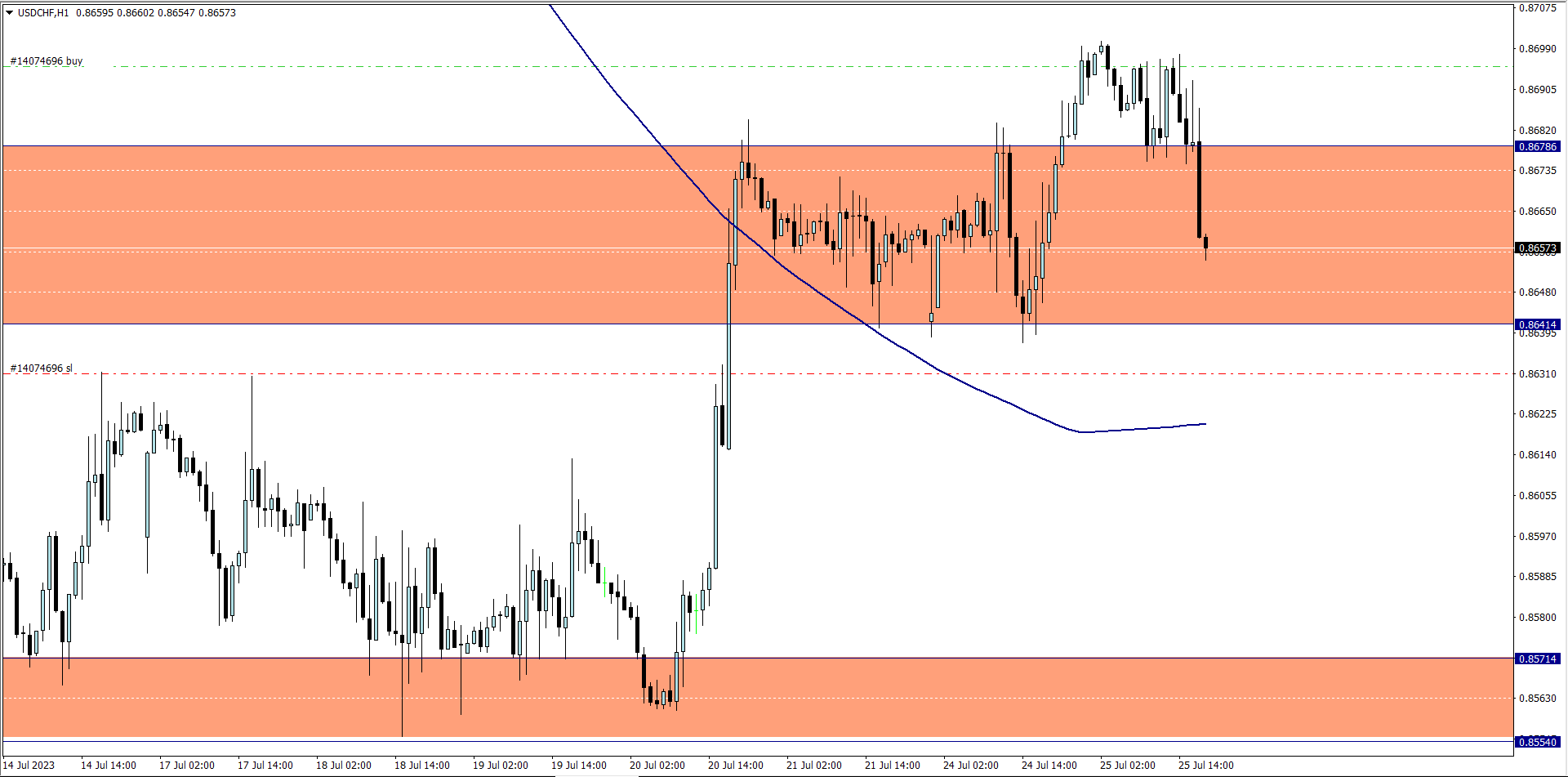

USD/CHF Update (5.15 pm)

Analysis: Market did not go our way, and I manually closed it with -50 pips

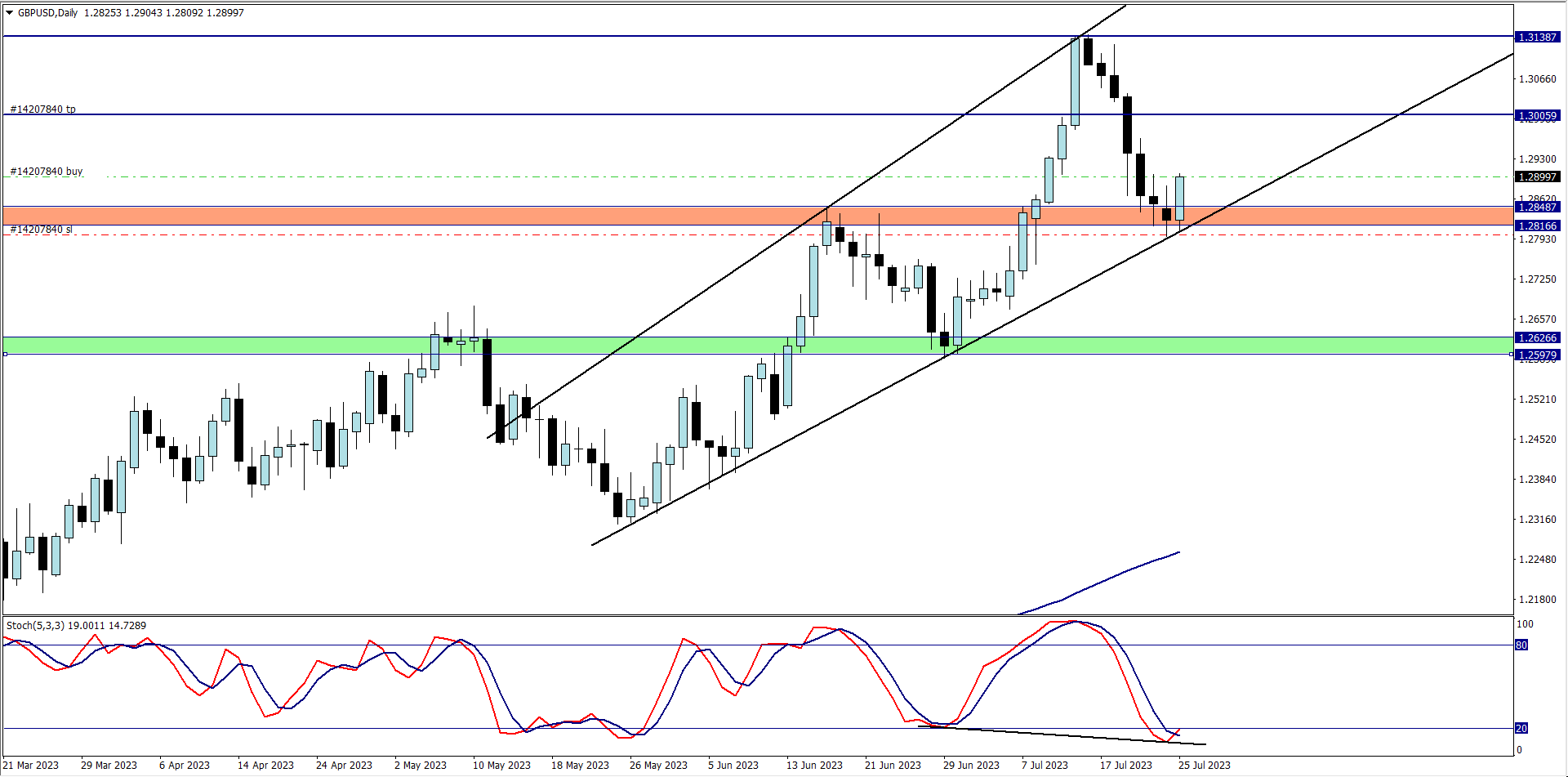

GBP/USD (9.30 pm)

Analysis: The GU trade was inspired by our Wednesday Market Analysis

WEDNESDAY 26/07/2023

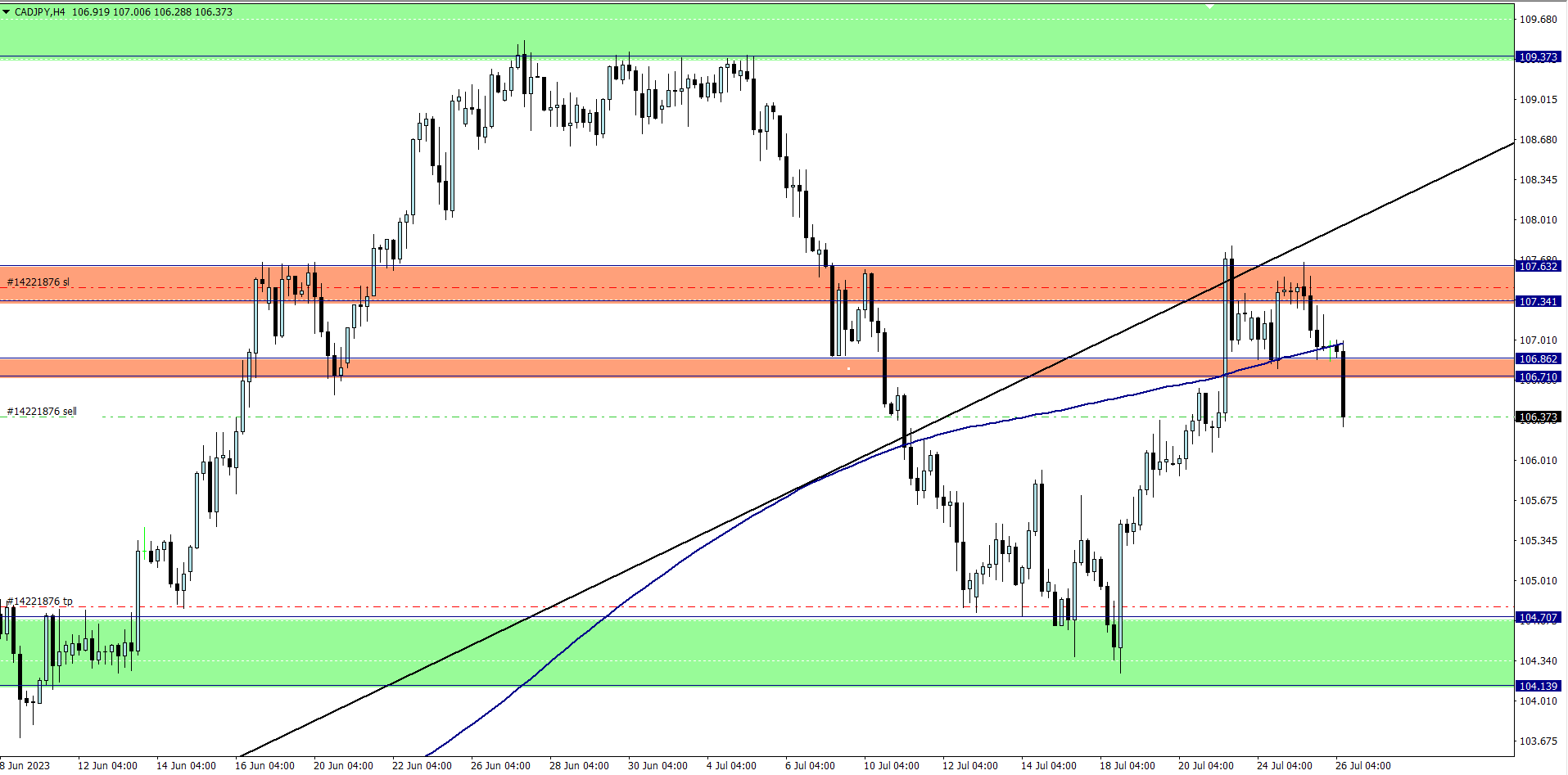

CAD/JPY (10 pm)

Analysis: This was one trade I took based on Our Weekly Market Analysis. Sometimes I have to wait for days/weeks, for setups to materialise

GBP/USD Update (6.30 pm)

Analysis: Closed the trade with +10 pips, and the reason for closing it was the FOMC news scheduled for 7.00 pm and 7.30 pm

THURSDAY 27/07/2023

CAD/JPY Update (4.15am)

Analysis: Locked +6 pips

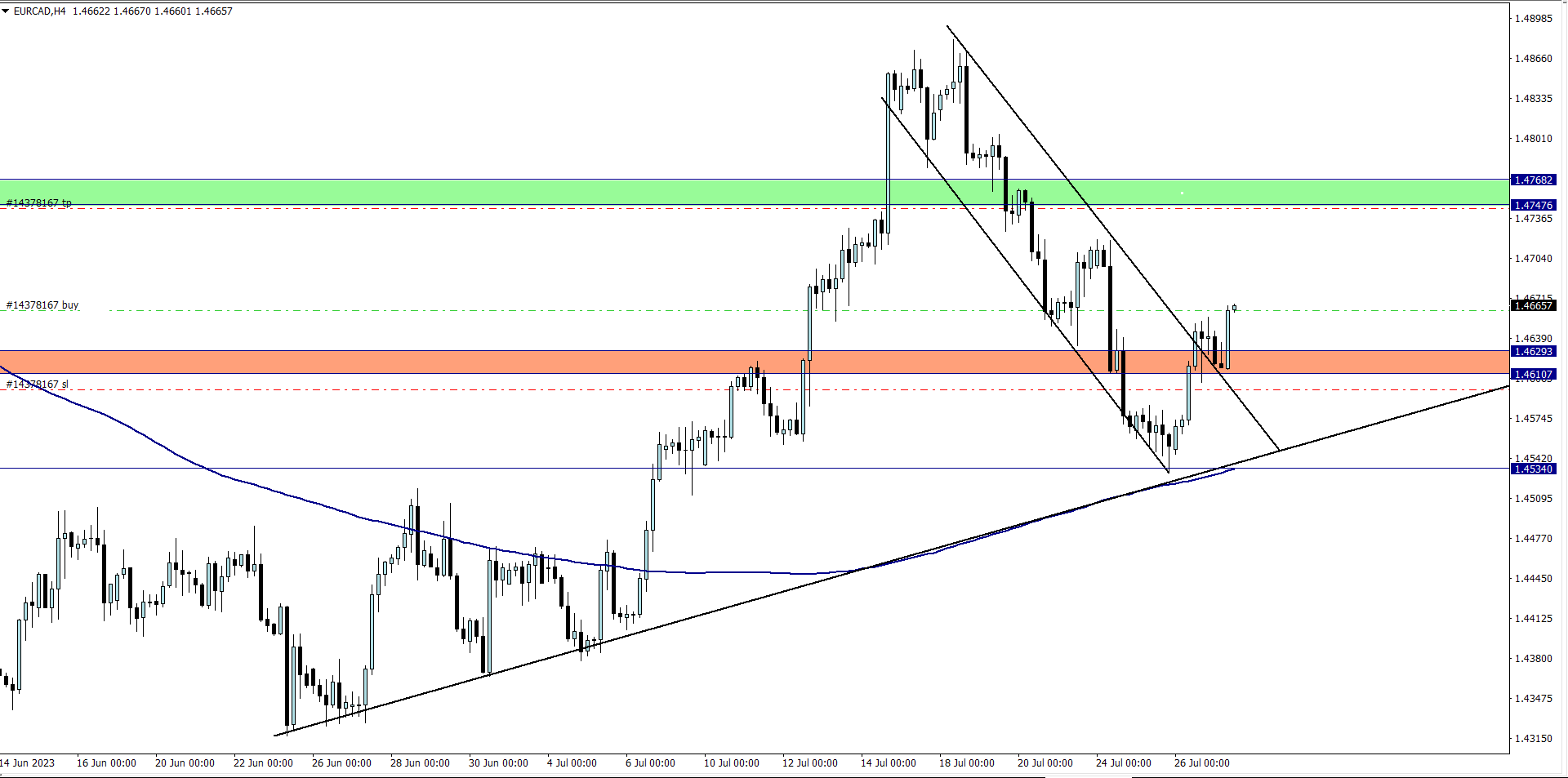

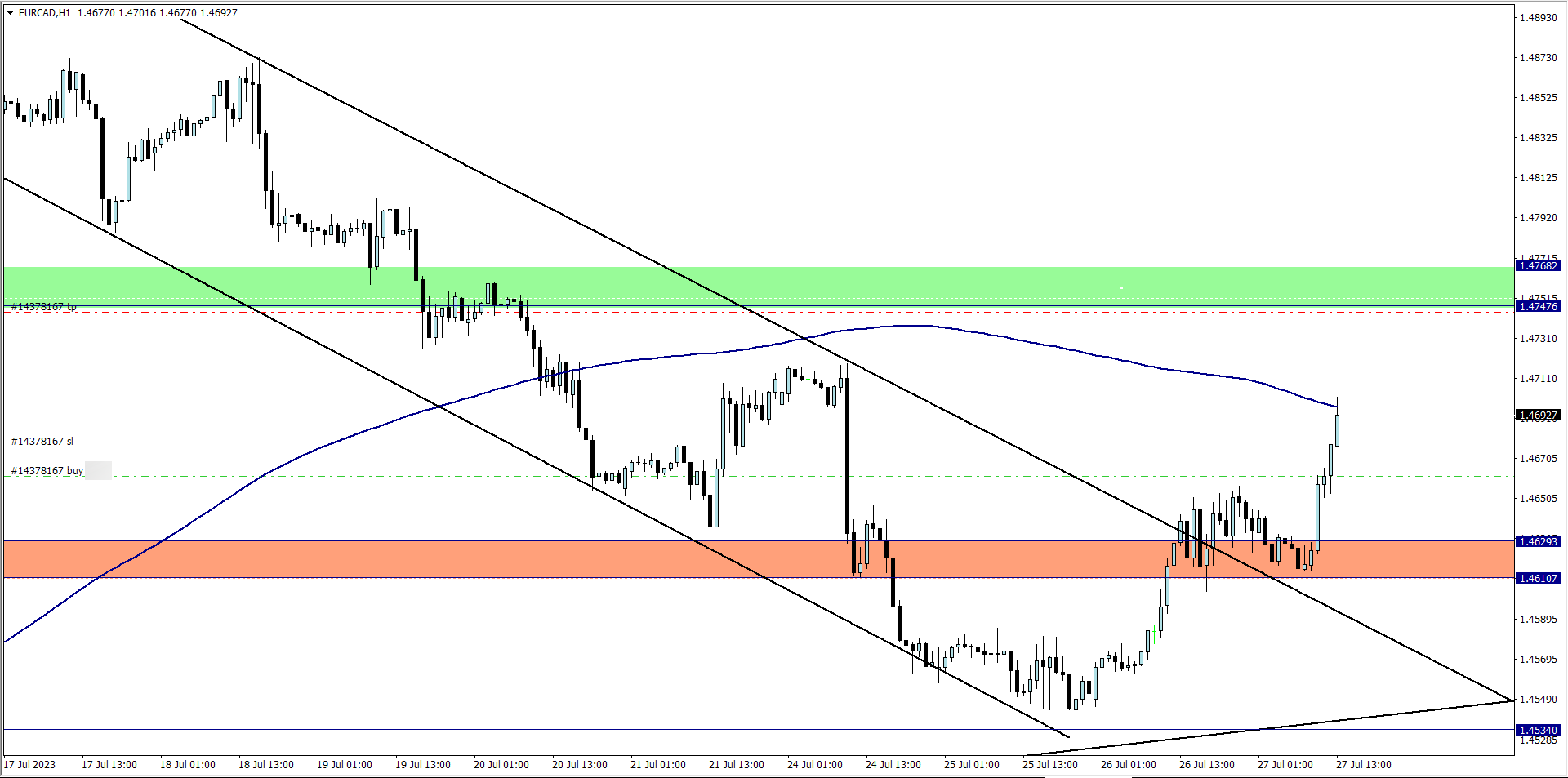

EUR/CAD (10.10am)

Analysis: My reason for buying was inspired from our Thursday Market Analysis

EUR/CAD Update (11.30 am)

Analysis: Locked +13 pips, and closed with +13 pips

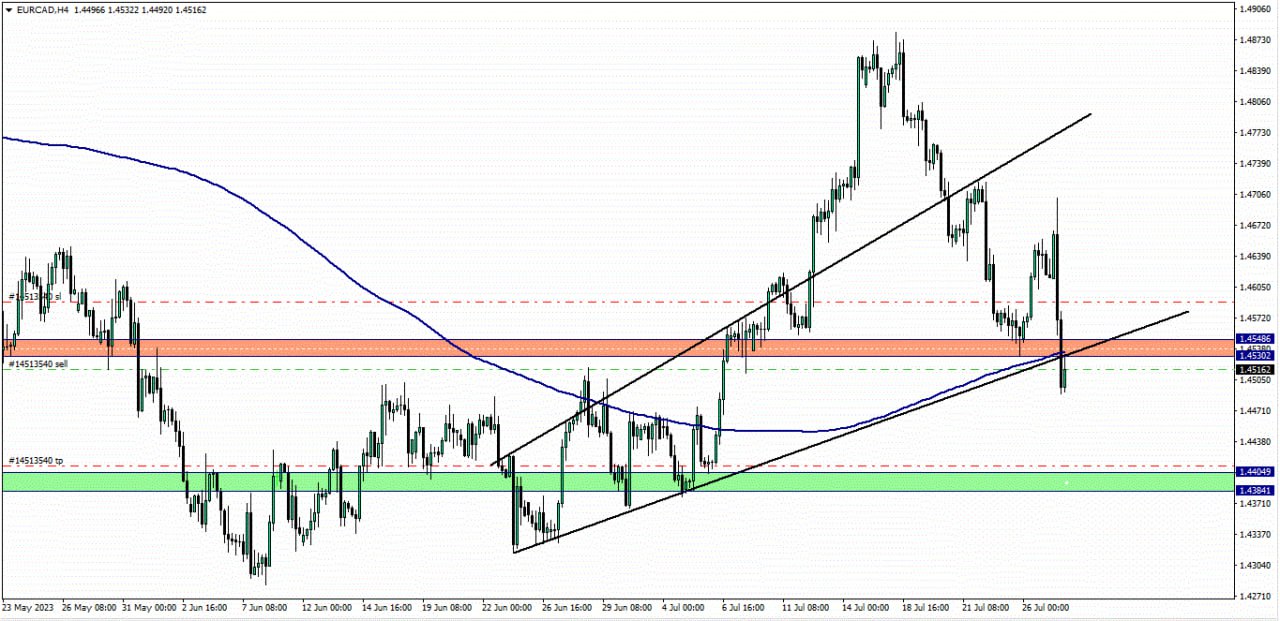

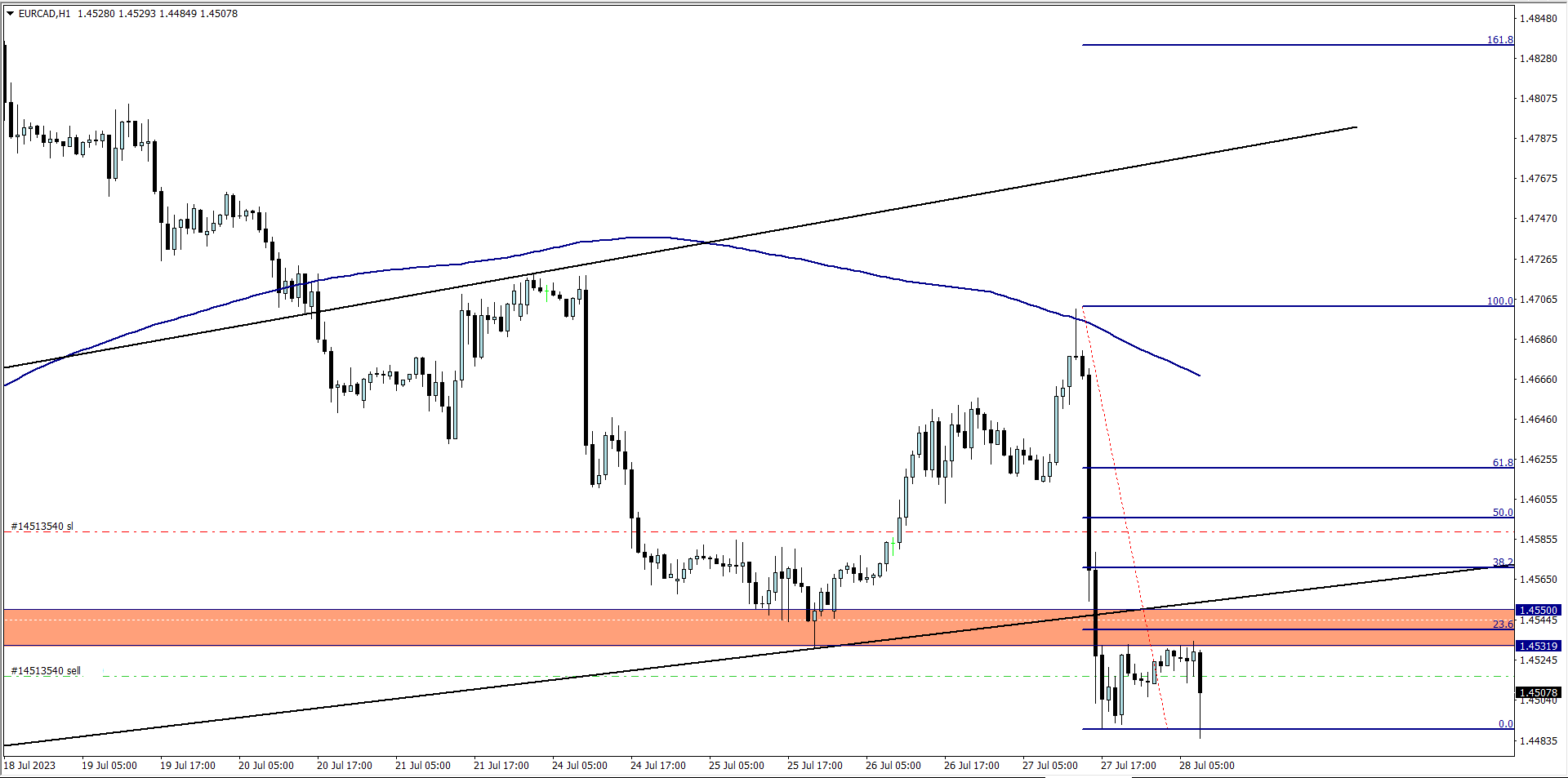

EUR/CAD Re-entry (9.30 pm)

Analysis: I got inspired to sell from our Friday Market Analysis

FRIDAY 28/07/2023

EUR/CAD Update (7.50am)

Analysis: Manually closed trade with +5 pips

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (24/07/2023) | USD/CHF | BUY | – 50 pips |

| TUE (25/07/2023) | GBP/USD | BUY | + 10 pips |

| WED (26/07/2023) | CAD/JPY | SELL | + 6 pips |

| THUS (27/07/2023) | EUR/CAD | BUY | + 13 pips |

| EUR/CAD (Re-entry | SELL | + 5 pips | |

| TOTAL | -16 pips |

In conclusion:

It was a busy week for me in the market, trying to play catch up after my initial loss on USD/CHF.

The only trade that could have put me back on the path of profits was the GBP/USD trade which was an “A setup”, but sadly I could not maximize it due to FOMC news, so I had to get out of the trade with meagre profits.

The other trades I took for the rest of the week had similar news related problems, so sticking to them and maximizing my trades was an impossible task.

Again it was technically the last week of the month, so I played a safe game, rather than being aggressive, and lose the gains I made through the month.

This week I lost -0.6%. I will be waiting to see how next week Monday plays out before I close the month of July.

How did your trading week go?

Trade activity summary for the month of July

| 1st TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| TUE (04/07/2023) | NZD/USD | BUY | Breakeven | |

| THUS (06/07/2023) | EUR/JPY | SELL | – 42 pips | |

| TOTAL | – 42 pips | |||

| 2nd TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (10/07/2023) | CAD/JPY | SELL | + 64 pips | |

| USD/JPY | SELL | + 231 pips | ||

| WED (13/07/2023) | AUD/JPY | BUY | +46 pips | |

| TOTAL | + 341 pips | |||

| 3rd TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (17/07/2023) | AUD/USD | SELL | +18 pips | |

| AUD/USD | SELL | Breakeven | ||

| TUE (18/07/2023) | CHF/JPY | BUY | +47 pips | |

| THUS (20/07/2023) | GBP/CHF | BUY | Breakeven | |

| FRI (21/07/2023) | GBP/CHF | SELL | +49 pips | |

| TOTAL | +114 pips | |||

| 4th TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (24/07/2023) | USD/CHF | BUY | – 50 pips | |

| TUE (25/07/2023) | GBP/USD | BUY | + 10 pips | |

| WED (26/07/2023) | CAD/JPY | SELL | + 6 pips | |

| THUS (27/07/2023) | EUR/CAD | BUY | + 13 pips | |

| EUR/CAD (Re-entry | SELL | + 5 pips | ||

| TOTAL | -16 pips | |||

| GRAND | TOTAL | +397 pips | ||

In conclusion:

Finally the month of July is over. My second trading week was my absolute best, followed by my third trading week. I closed the month with a +2.5% ROI, and I am pumped for the month of August

One thing I did so well this month was managing risky situations and my funds. Being able to trade in between high impact news, and knowing how to play with risk while doing so is something I have constantly worked on, and I am still working on.

Again, in the first trading week I practiced a lot of mindfulness, by trading less. The first trading week had lesser trade opportunities, and I exercised patience by being inactive for the most part, which further reduced my drawdown.

Talking about managing emotions, I am particularly happy with my second trading week, not because it was my best, and that I had no losing trades, but the fact that, I knew when to STOP trading the market. In my early days, winning streaks was accompanied almost immediately with strings of losses. Which will further send me into that path of over trading and trying to get the money I lost to the market (lol)

I look forward to a profitable August, though I know that market conditions will be a lot more unpredictable due to the summer break which is accompanied by low volatility.

How did the month of July go for you?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter