My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- have enough data, in order to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 17/07/2023

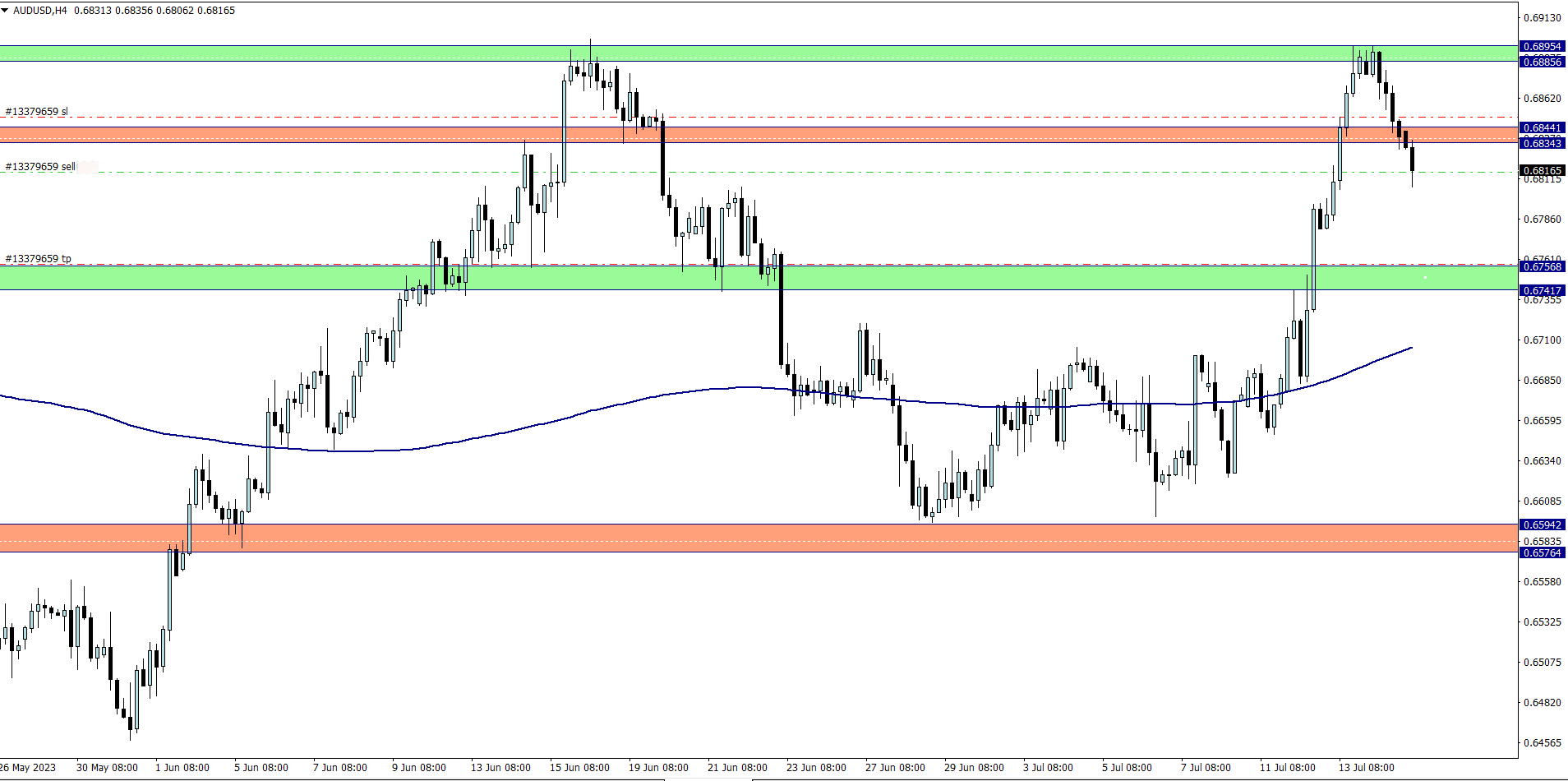

AUD/USD (6am)

Analysis: My reason for selling AUD/USD is because of our Weekly Market Analysis

AUD/USD Update (2 pm)

Analysis: A pennant breakout (trend continuation pattern) inspired a second position

TUESDAY 18/07/2023

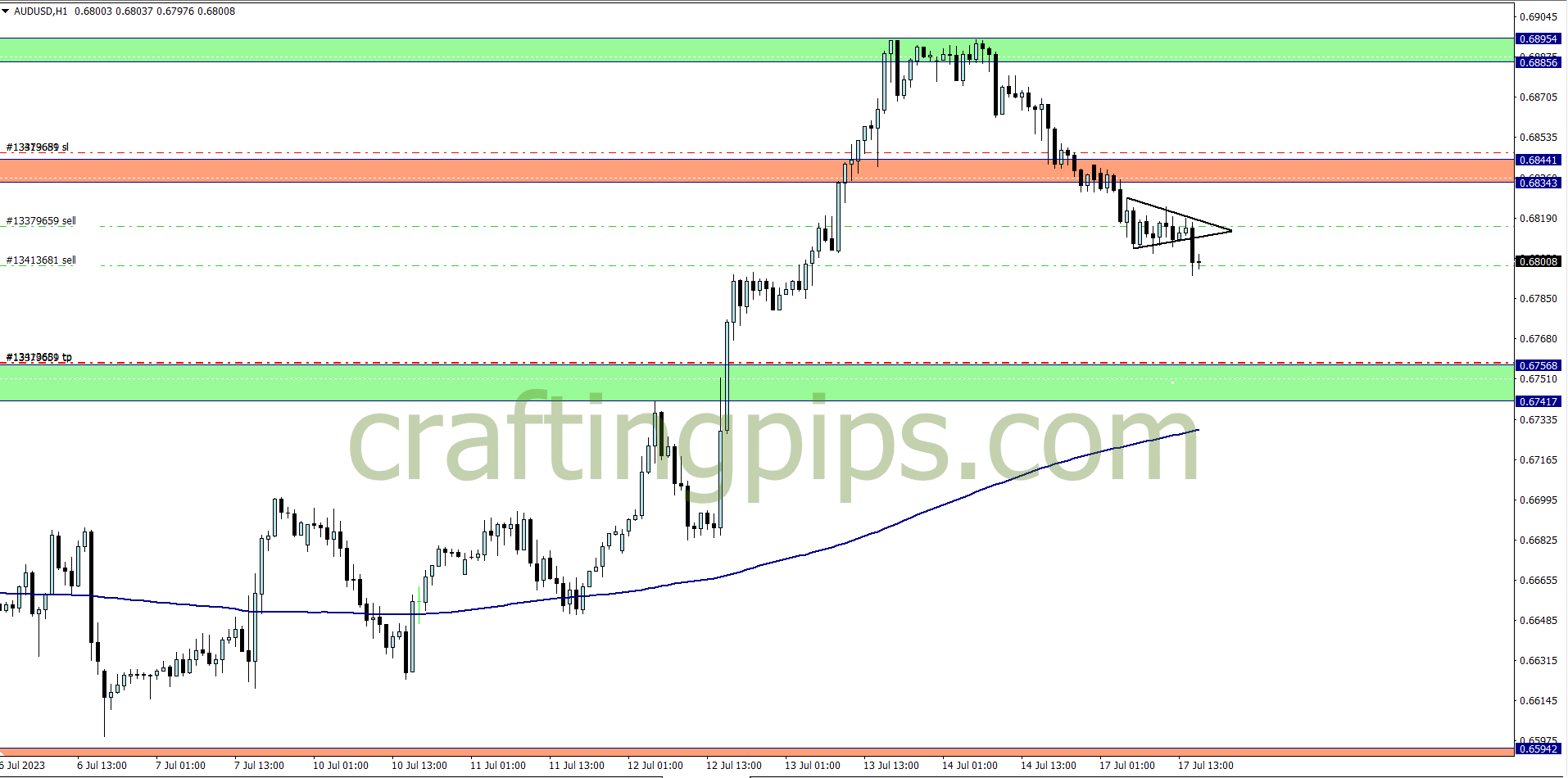

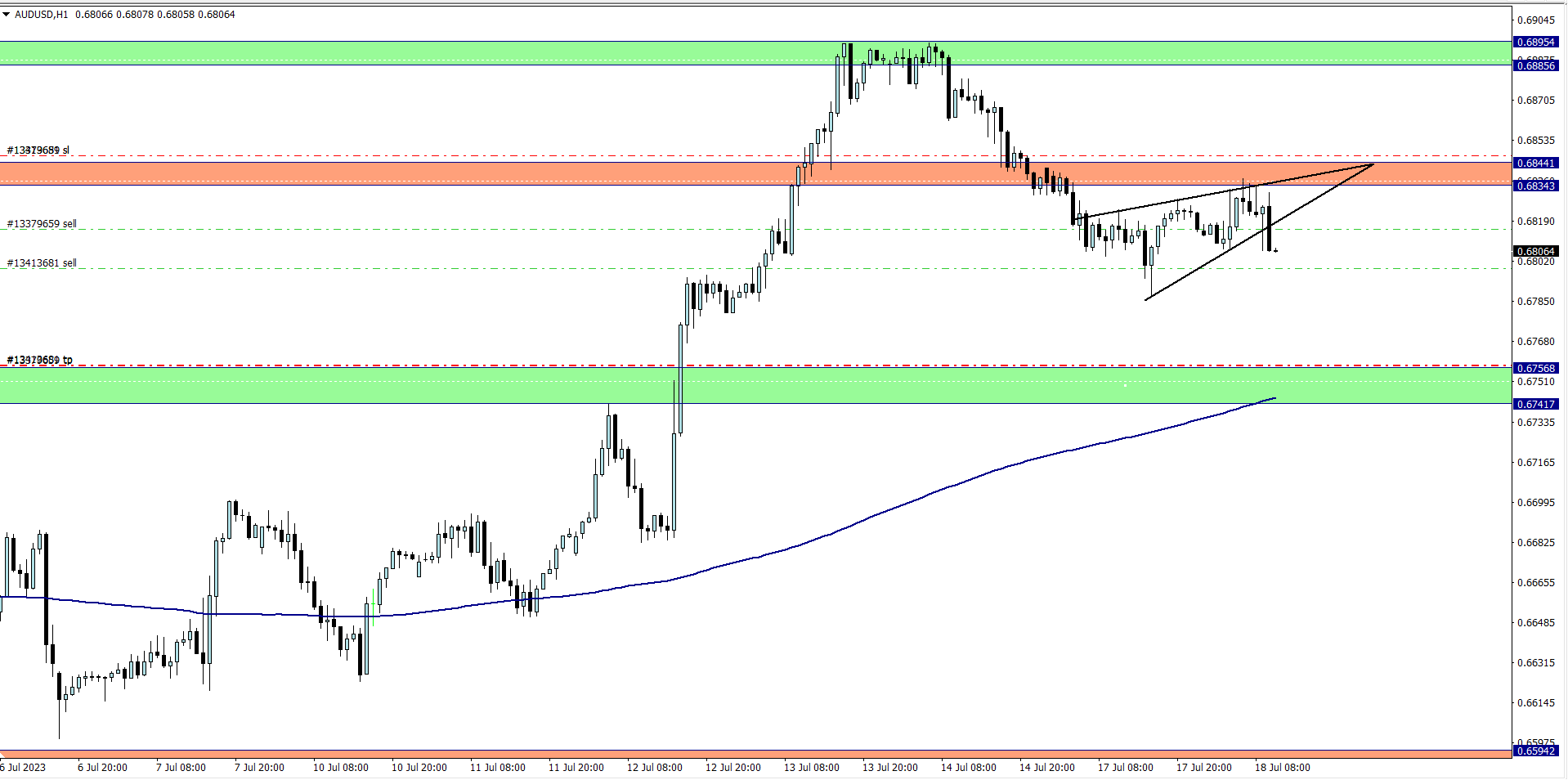

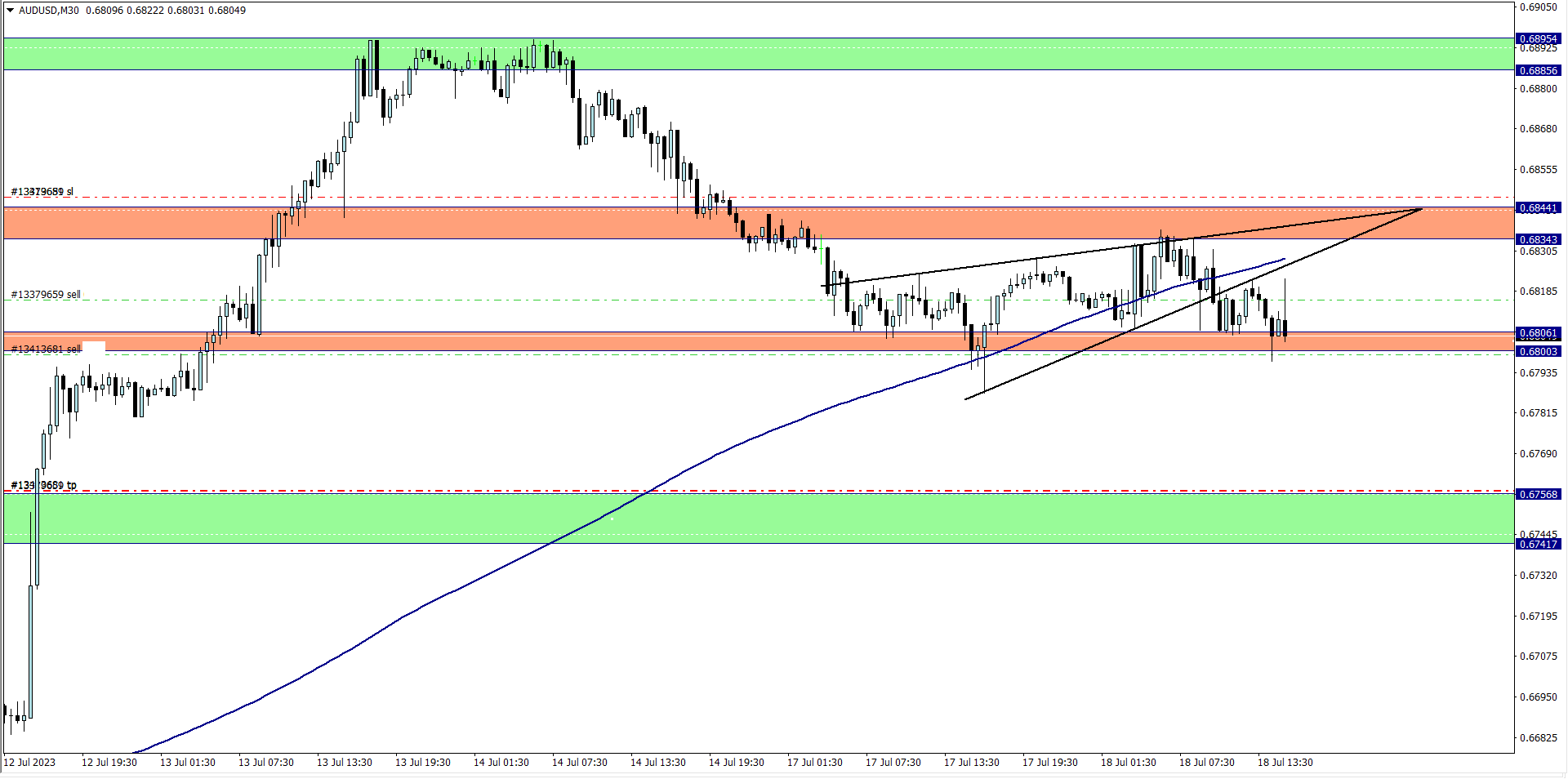

AUD/USD Update (9 am)

Analysis: Pennant failed but a rising wedge is still keeping the bearish bias alive

AUD/USD Update (1.40 pm)

Analysis: I closed this trader not only because it exceeded it’s shelf life, but also because of USD high impact news event. Both positions yielded +18 pips

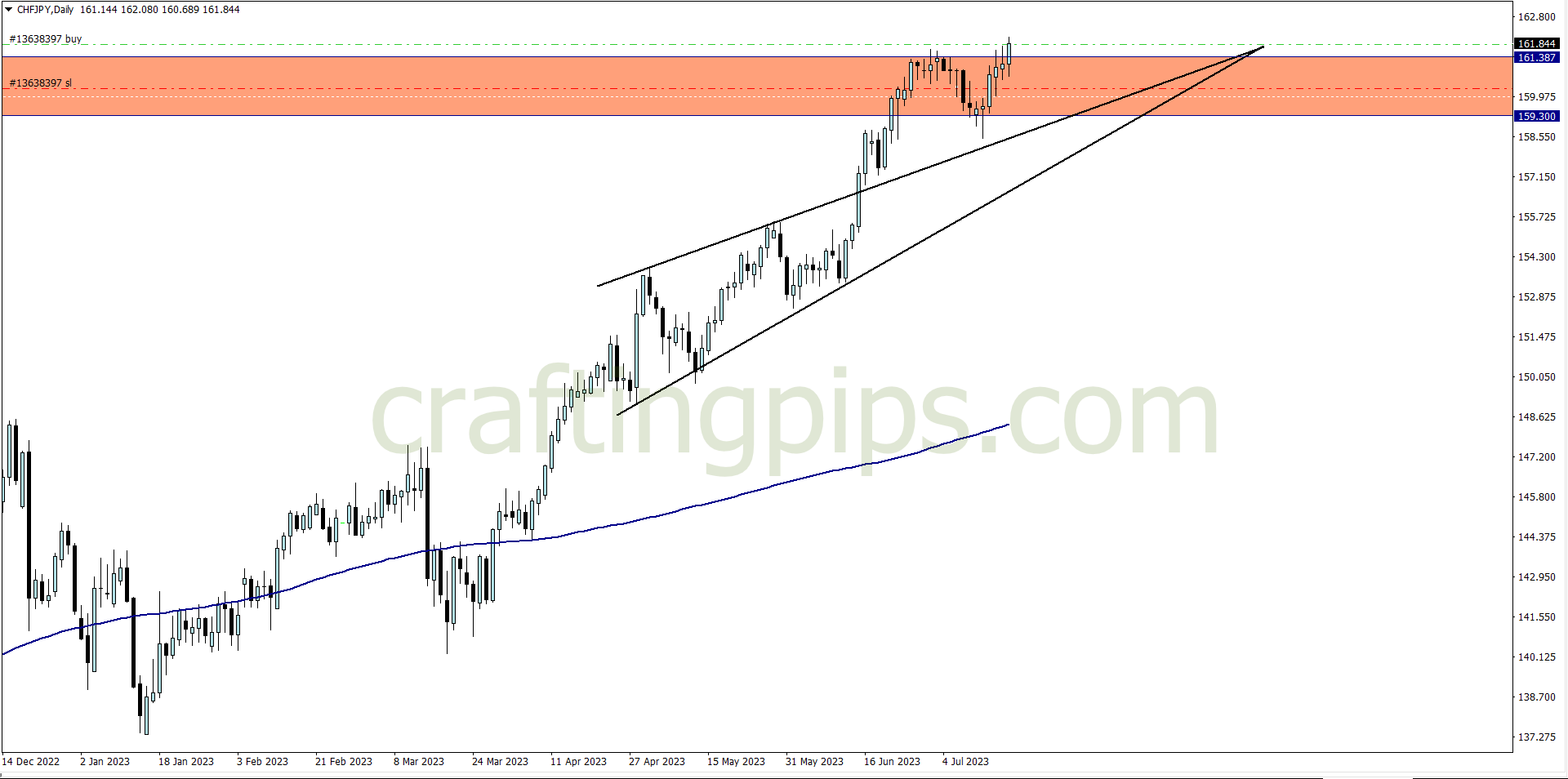

CHF/JPY (9.30 pm)

Analysis: My reason for buying CHF/JPY is because of our Wednesday Market Analysis

WEDNESDAY 19/07/2023

CHF/JPY Update (4 pm)

Analysis: Closed with +47 pips

THURSDAY 20/07/2023

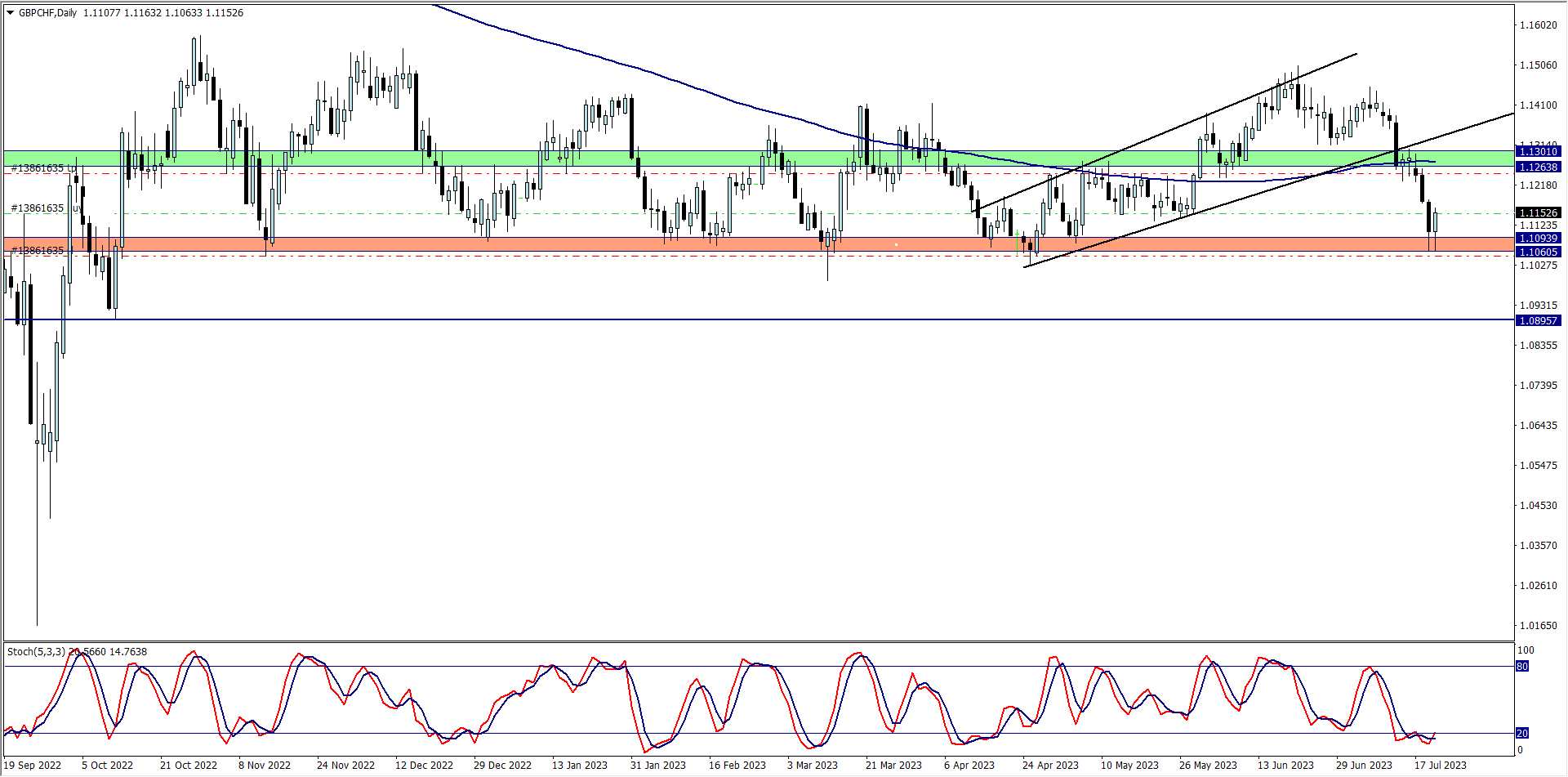

GBP/CHF (9.30 pm)

Analysis: I got inspired to buy GBP/CHF due to our Friday Market Analysis

FRIDAY 21/07/2023

GBP/CHF Update (9.30 am)

I closed the trade at breakeven.

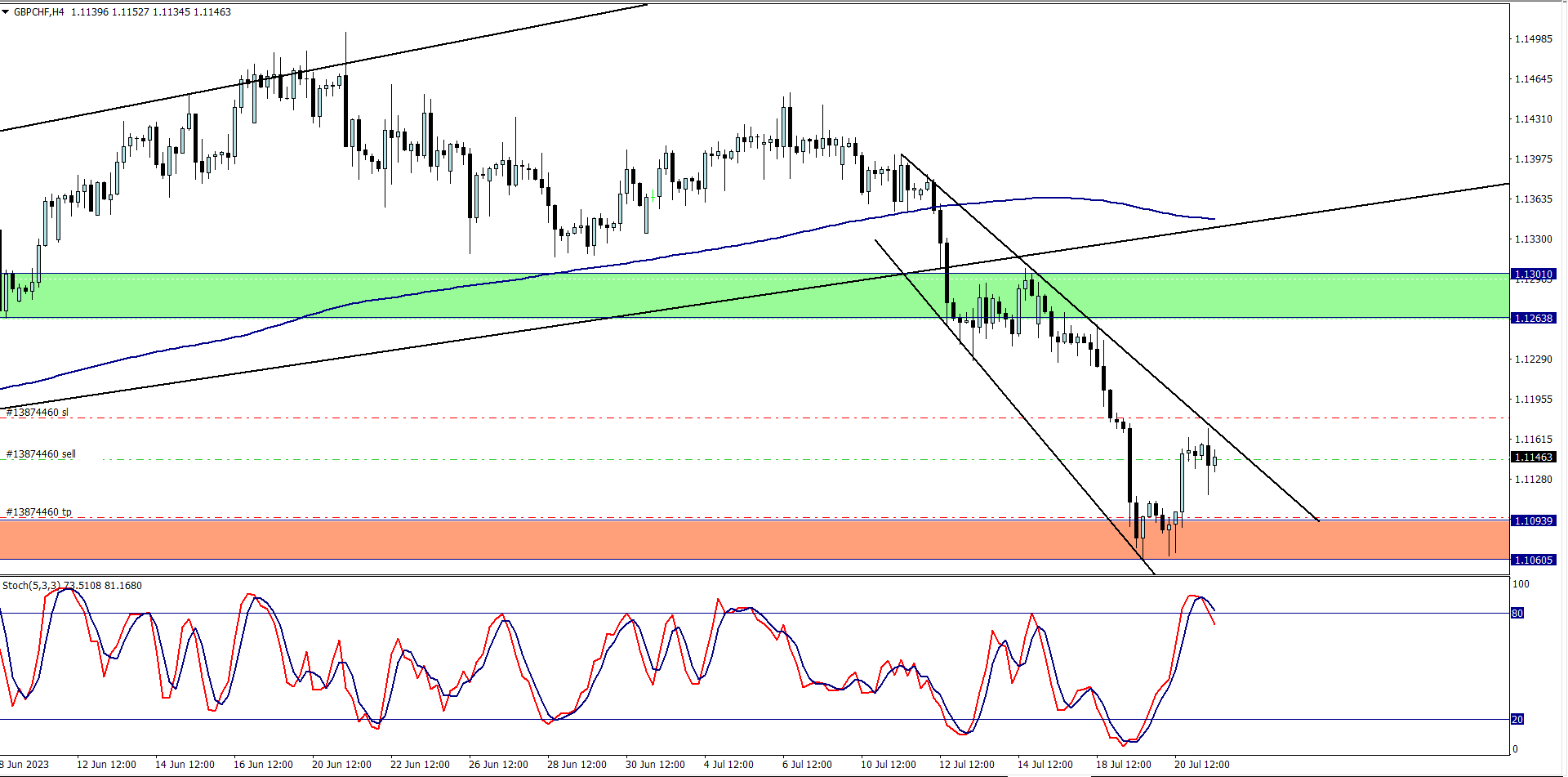

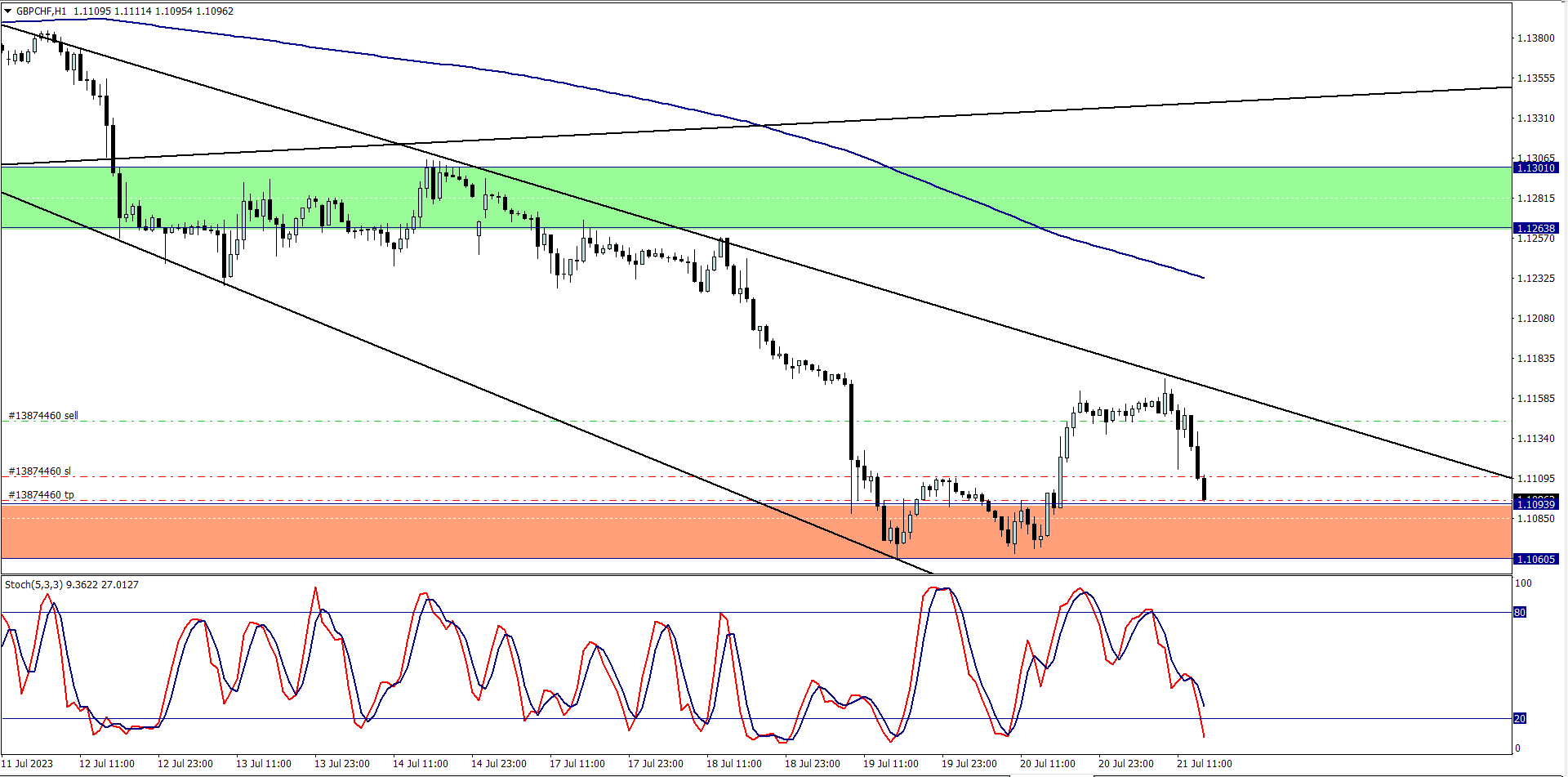

GBP/CHF Re-entry (10.50am)

Analysis: I exited my long position at breakeven on GBP/CHF (daily time frame), and opted for a short position on the 4 hour time frame because of the active divergence shown

GBP/CHF Update (1 pm)

Analysis: Target profit hit, and +49 pips made on the GBP/CHF

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (17/07/2023) | AUD/USD | SELL | +18 pips |

| AUD/USD | SELL | Breakeven | |

| TUE (18/07/2023) | CHF/JPY | BUY | +47 pips |

| THUS (20/07/2023) | GBP/CHF | BUY | Breakeven |

| FRI (21/07/2023) | GBP/CHF | SELL | +49 pips |

| TOTAL | +114 pips |

In conclusion:

This week was quite an eventful one, especially the last two days of the trading week.

I was particularly impressed with the way I managed the GBP/CHF trade. I started off by taking a long position on the GBP/CHF, on Thursday evening, using the trend on the daily/weekly time frame, and also knowing the shelf life of my position.

By Friday’s London session, I noticed price stalling, and the fact that there was an active divergence of the 4 hour time frame, already pointed to the fact that the initial buy trade had expired, so I closed at breakeven

I opened a sell position on the 4 hour time frame, knowing we were still in the London session, and there was still time for a divergence setup to play out.

Note that, after price hit our target profit on the GBP/CHF, the bullish structure on the daily/weekly time frame was not broken, which could be a nice setup for next week

Flexibility with my trading system saved the week for me, how did yours go?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter