Hello trader,

there are some solid setups lined up for the month of July, let’s check ’em out

1. USD/JPY

Alas, USD/JPY has hit that resistance zone we have been waiting for.

The last time this resistance zone was broken was October of 2022, and before price broke through, it formed a consolidation for about three weeks, so there is a possibility that we see price give us a pullback this week to NPSZ, then price possibly ranging for a couple of weeks.

So, what I will be looking out for this week is a bearish confirmation in order for me to join the sellers to NPSZ.

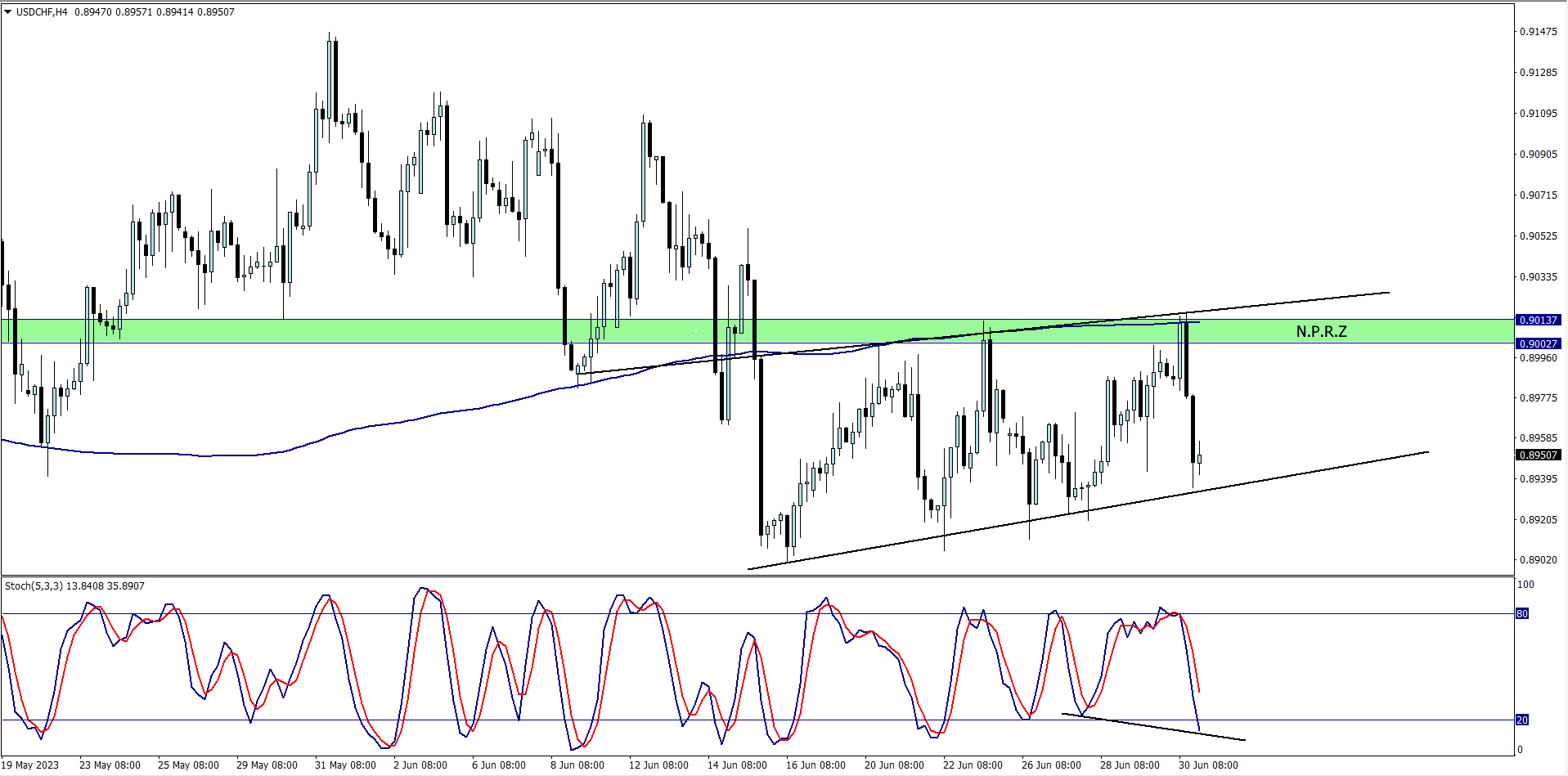

2. USD/CHF

A solid bullish divergence can be spotted on the USD/CHF.

Though my bias is bullish on this pair, I would advice traders who are keen on trading it to exercise caution

Why?..

Because CHF is currently bullish, while USD is either consolidating or weak against the major pairs. But if the setup plays out, price may most likely hit NPRZ

3. GBP/CAD

GBP/CAD closed last week giving us a bullish pennant (which is a bullish continuation pattern ). If you are wondering how traders trade pennants, you can check our article on them here

Don’t forget that last week I gave a bullish divergence setup on the GBP/CAD, and I also traded it. GBP/CAD also closed bullish last week.

This week, I will be waiting for price to close above the pennant formed last week before I join buyers to NPRZ

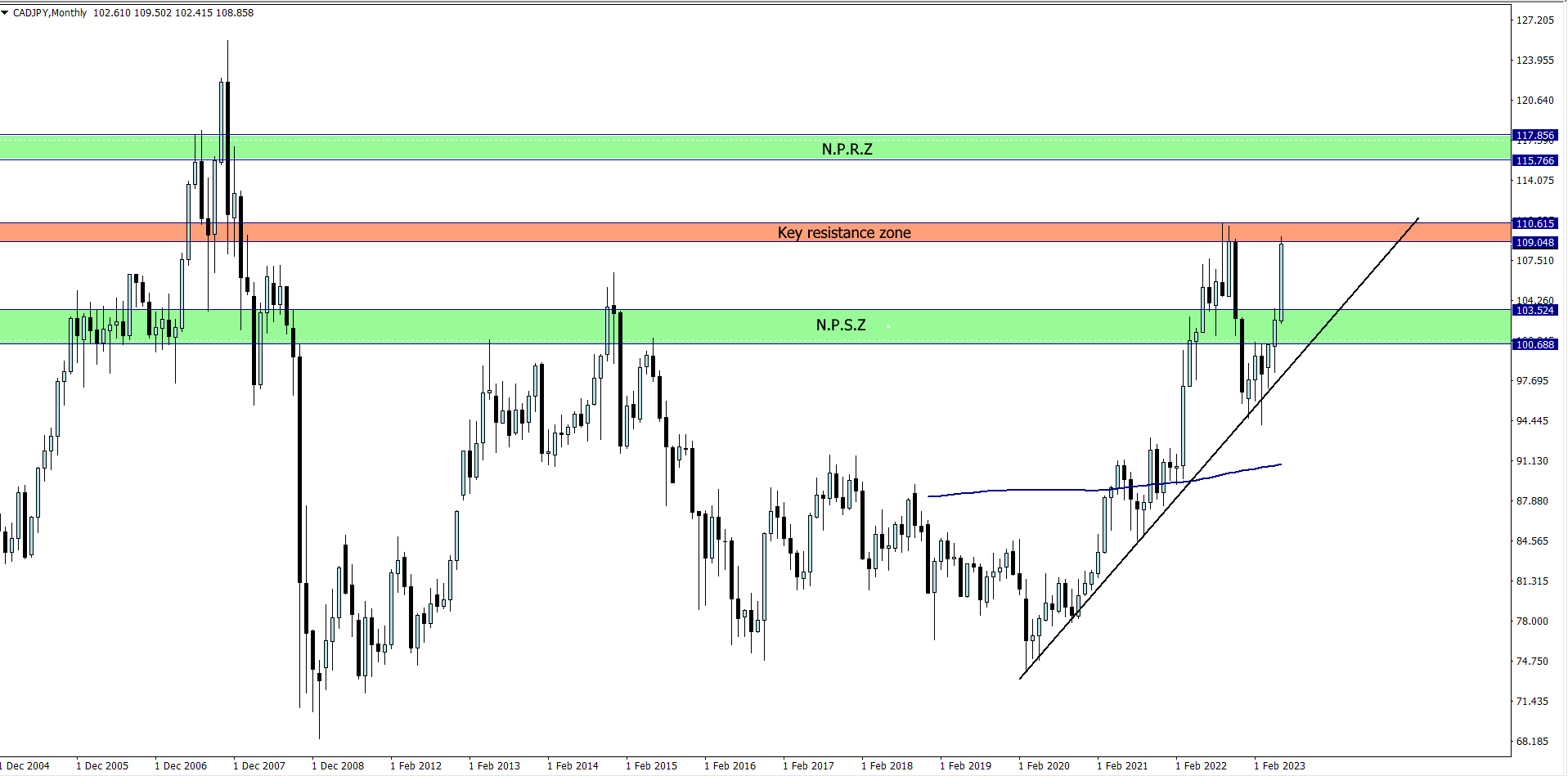

4. CAD/JPY

After a crazy bullish run last week, CAD/JPY reached a key resistance zone, which it last reached September 2022.

There is a huge possibility that we are going to see price get rejected in the month of July, and a possible 500 pips are up for grabs.

What say you?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter