Hello traders,

let’s hit them charts:

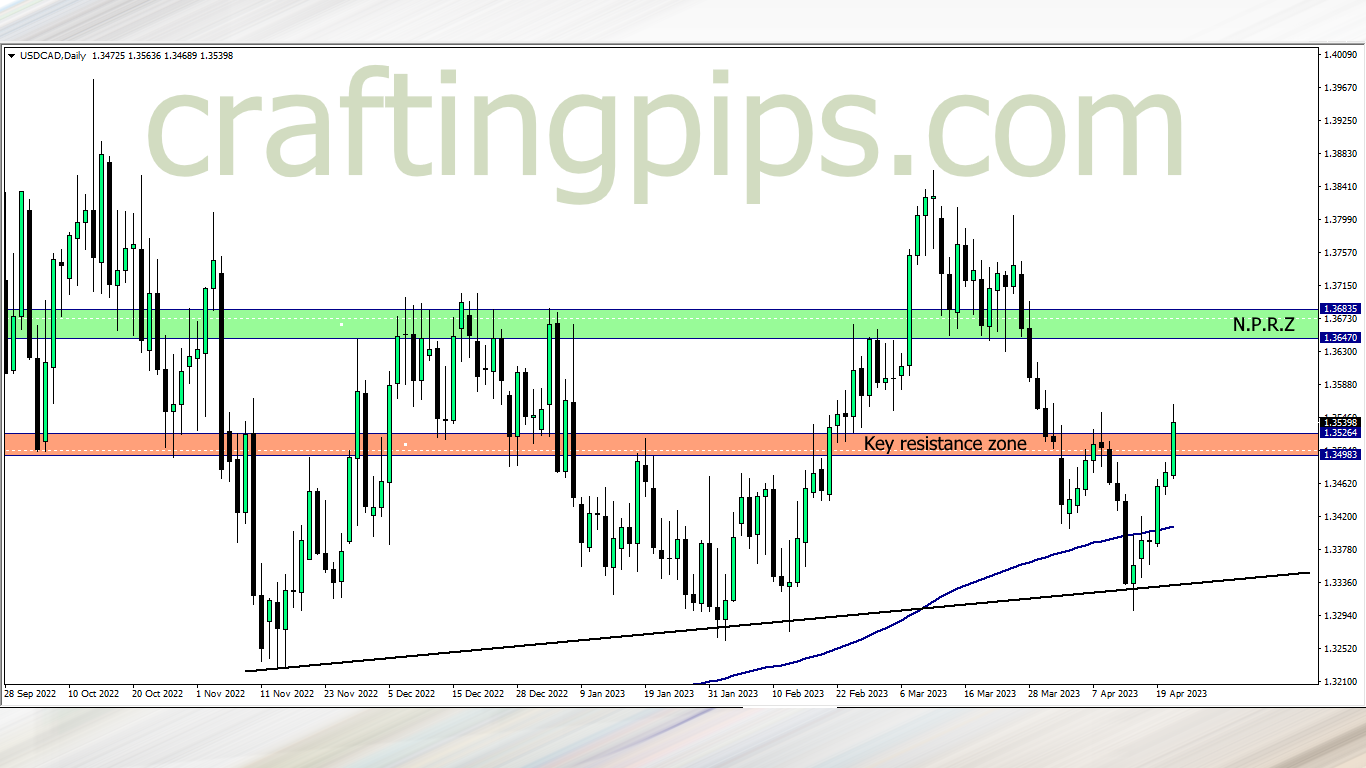

1. USD/CAD

The ascending trendline on the USD/CAD beautifully served its purpose last week. Before the close of last week, we saw two things actualized:

- The 200 ma was broken effortlessly, which means that the bulls are aggressive

- The key resistance zone was also broken effortlessly, further authenticating the strength of the bulls

This week I will be looking for bullish entry to NPRZ.

2. GBP/CHF

There was a good bounce off the key support zone last week, but Thursday closed with a huge retracement, while Friday gave buyers fresh hope after closing with a dragonfly-doji

If you ask me about this setup, I will tell you that the key support zone should be extremely week now, after price has bounced off it over 5 times in a little over 4 months.

There are two ways we could trade this setup:

- If opportunity presents, we could take a short buy to NPRL

- If price breaks the over 4 months old key support zone , we could also join sellers to NPSL

3. CHF/JPY

Looking at the CHF/JPY, My bias is still bearish, and I still maintain my bearish position. If the key resistance zone gets broken this week, then 159.587 will be my next focus.

That said, if a reversal kicks in, then NPSZ will be price next possible bus stop

What say you?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter