Hello traders,

welcome to the second quarter of the year, and the first week of the month of April, let’s hit them charts:

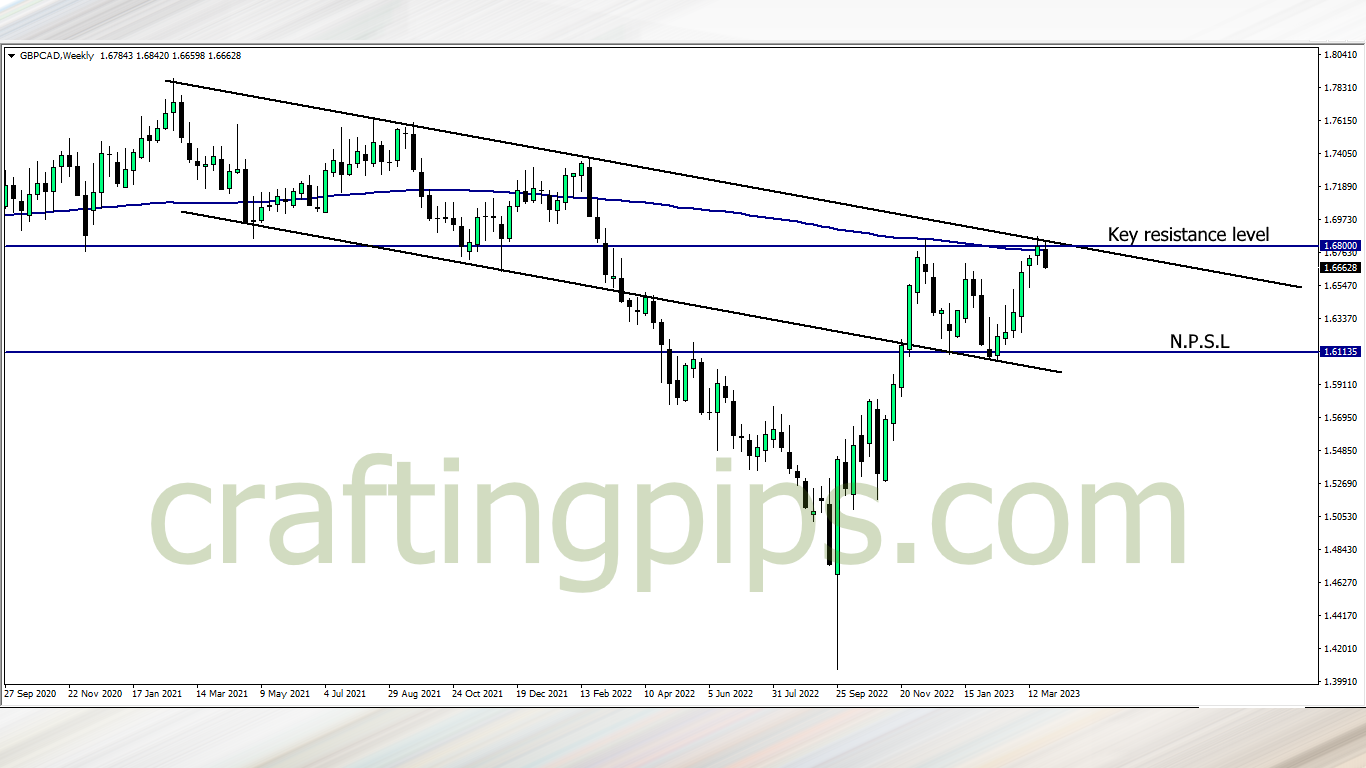

1. GBP/CAD

A double top can be spotted on GBP/CAD weekly time frame.

The last time price tested this resistance level was 3 months ago. This week we may see price retrace 50% on the Fib level, or hit NPSL before the month of April elapses.

I also see this setup as a viable trade because price is just below the 200 ma, and price closed last week giving us a bearish engulfing candlestick.

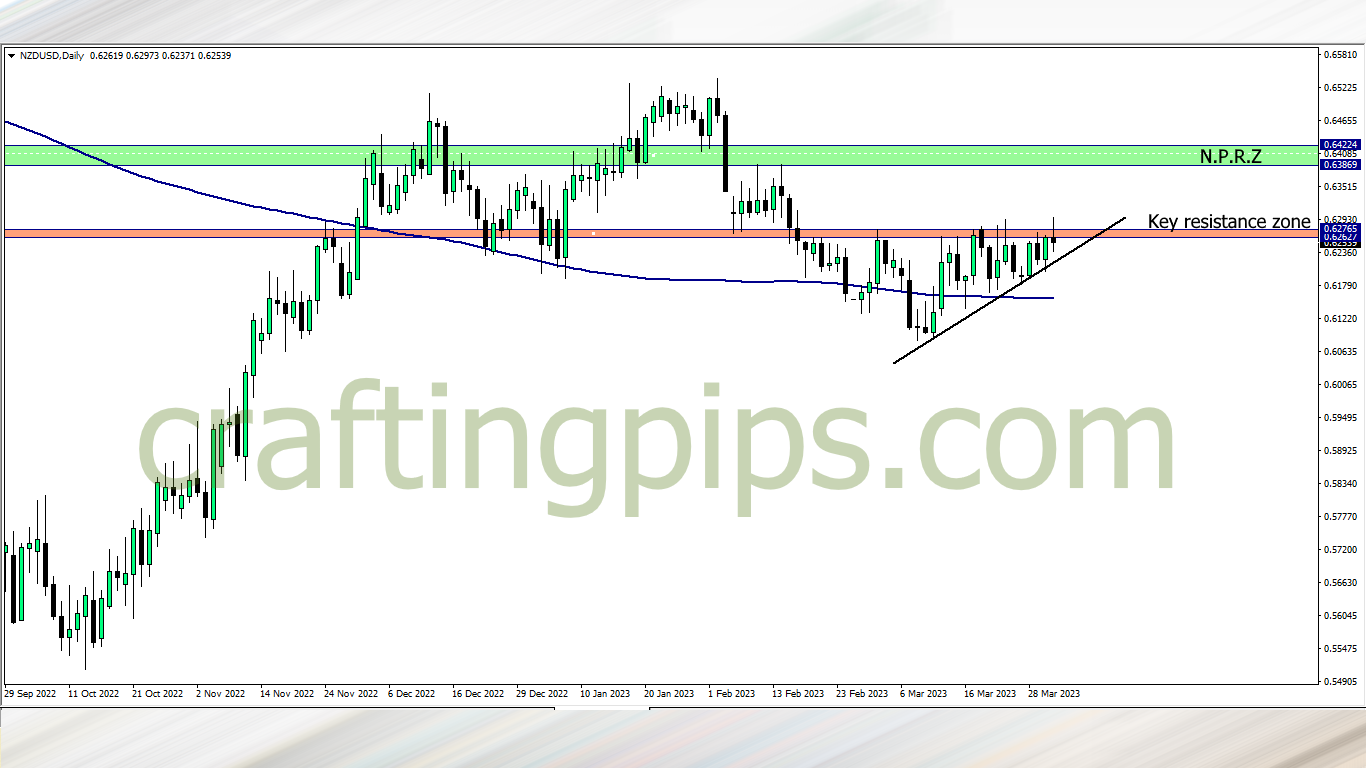

2. NZD/USD

In the entire March price desperately tried to break the key resistance zone but has constantly failed

While the bulls failed to come up with enough pressure to break the resistance zone. The higher lows constantly formed means that bullish pressure is gradually gaining ground.

This week we will see how well the resistance zone will fair against the buyers. On the weekly time frame we can see that the shoulder of a reversed head and shoulder pattern is been formed.

This week if the USD continues to plummet, and the resistance zone yields to the bulls, then price next bus stop will most likely be the green zone

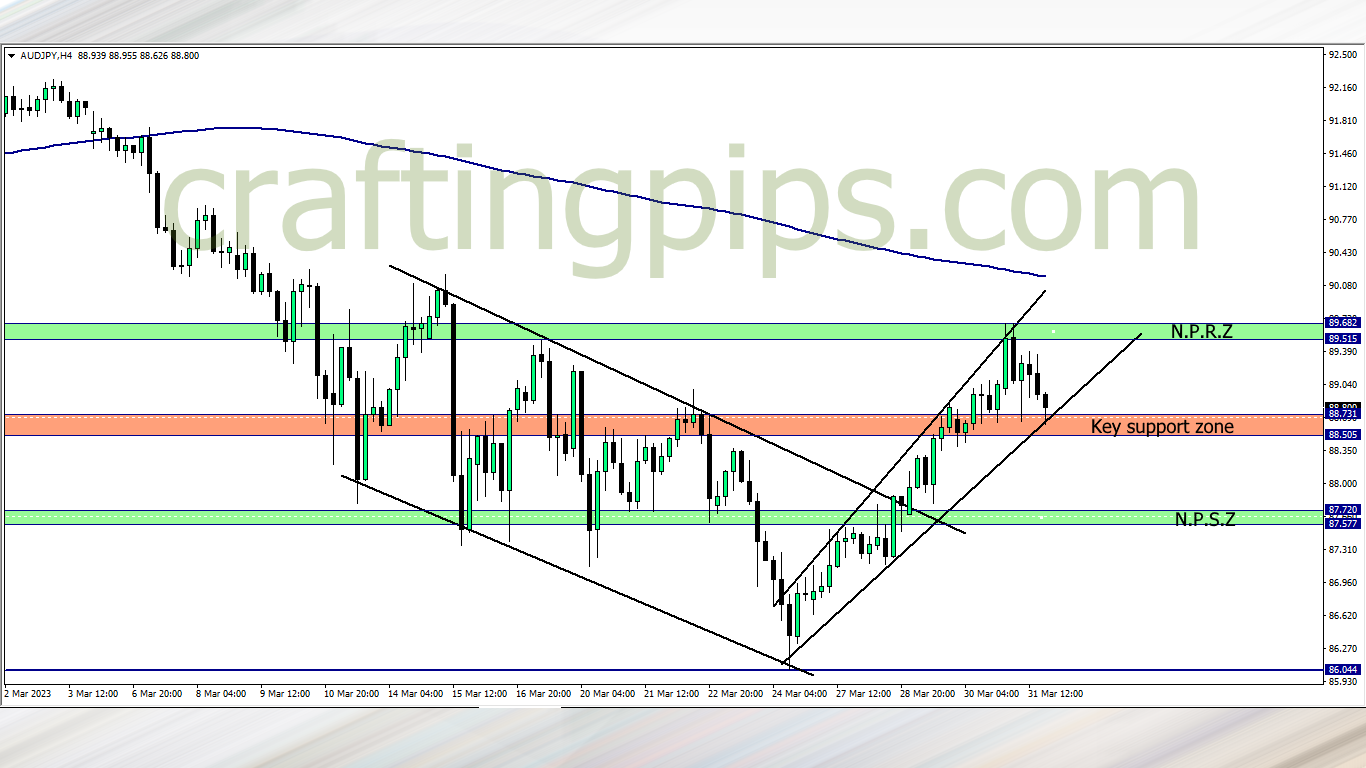

3. AUD/JPY

AUD/JPY has a 50/50 setup staring at us.

If the bears break the key support zone, then the green zone will be our next possible support zone, but if we do get a reversal confirmation candlestick on the key support zone, then NPRZ is price next bus stop

4. CAD/JPY

Head and shoulder formation about to get formed on CAD/JPY.

The close of the Sunday daily candlestick will reveal to us what we are to expect on Tuesday. If we do get a bearish confirmation, then NPSZ will most likely be our next bus stop before the close of the week

What say you?

-

FIDELCREST: https://fidelcrest.com/#CRAFTER

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.com/#a_aid=THE_CRAFTER