Hello traders,

let’s hit them charts:

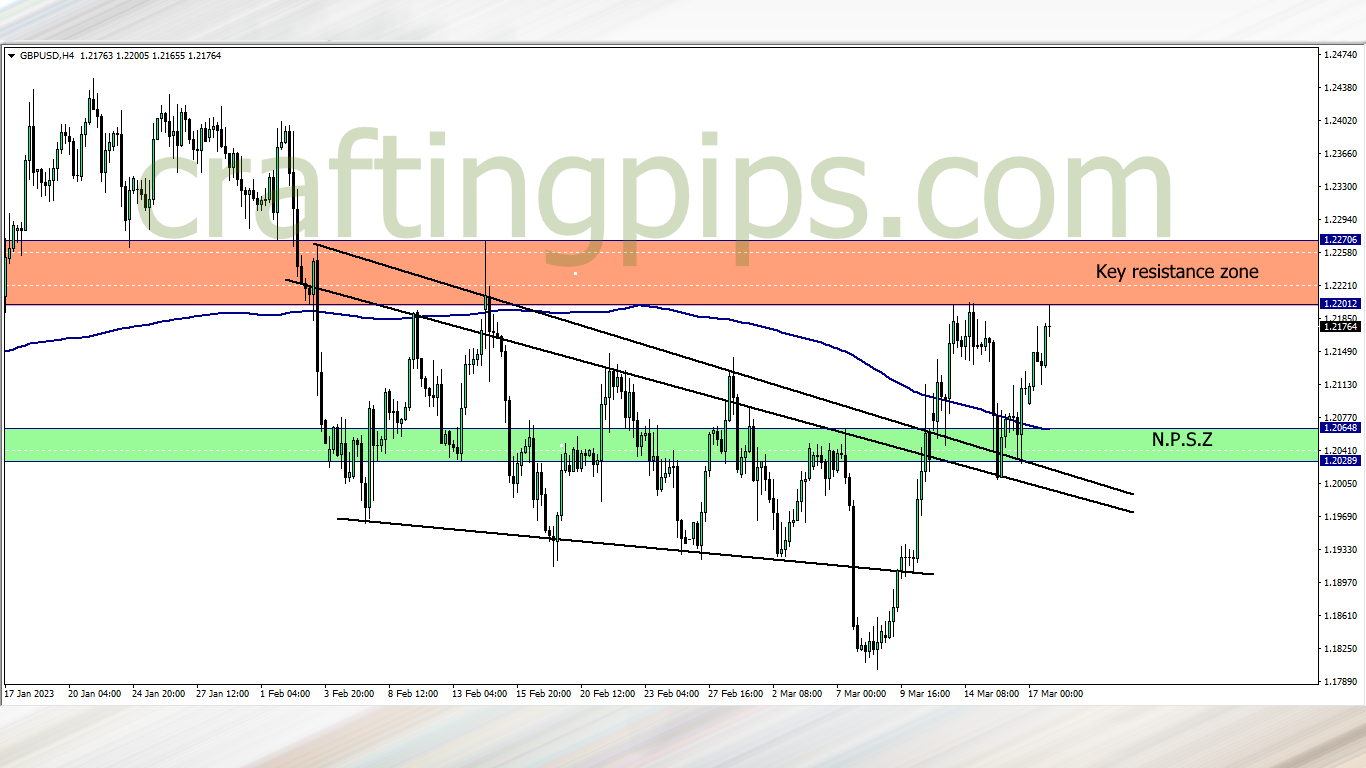

1. GBP/USD

Double tops can be spotted on the GBP/USD.

Price closing with a doji shows that there is a possibility that price may return to NPSZ the first few days of the week, but there is a high level of risk selling this pair because the resistance zone does not give us a good risk/reward ratio.

2. GBP/CHF

On the daily time frame price has reached a key resistance level, and the 200 ma also authenticates it.

This week we may most likely see price return to NPSZ.

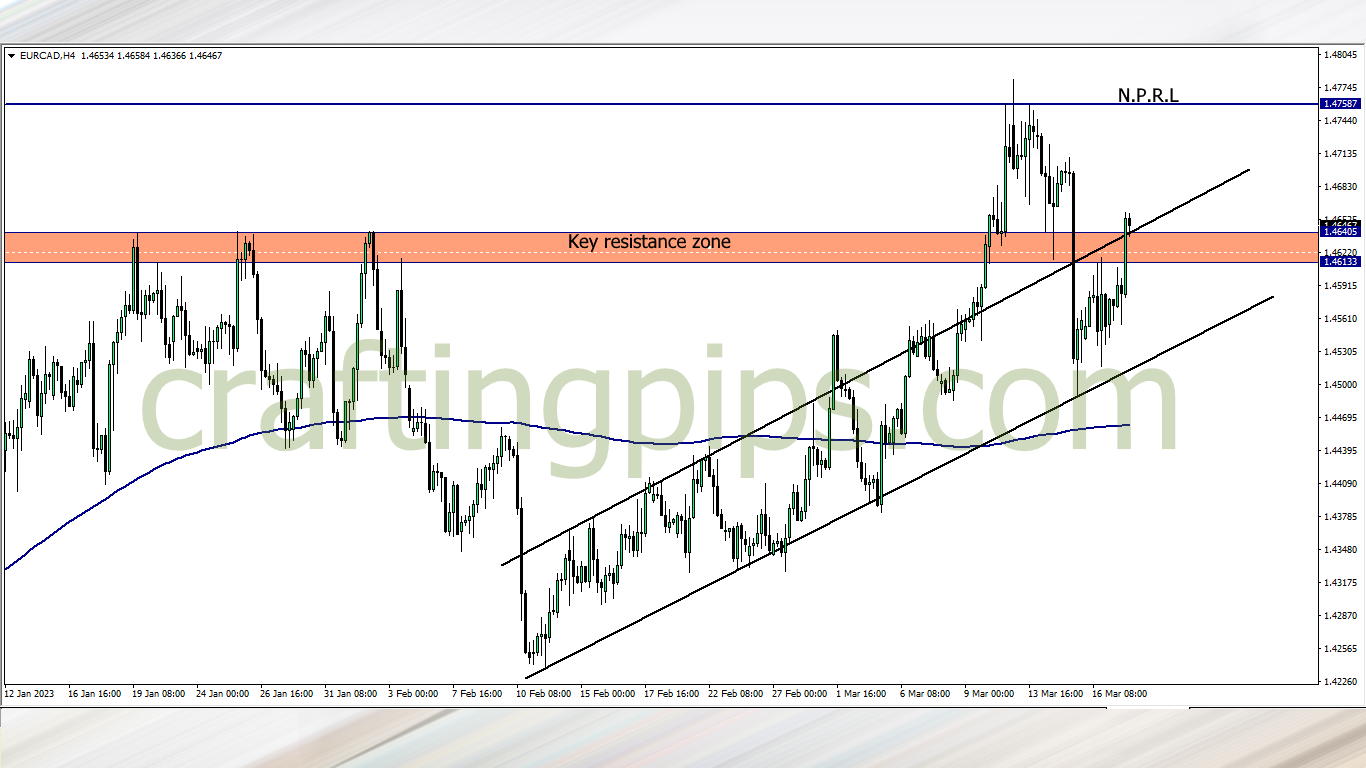

3. EUR/CAD

Since December 2021 the key resistance zone has managed to hold price.

Last week we saw a breakout of the key resistance zone. This week all we need is a bullish confirmation, and this may happen after a pullback. If that happens, then price next bus stop will most likely be NPRL

4. NZD/USD

A partial breakout can be spotted on the NZD/USD.

This week all we need is a confirmation, then we ride with the bulls to the 1st PSL

What say you?

Our telegram group: https://t.me/+UujC4KoBe1AN0fnK

-

FIDELCREST: https://fidelcrest.com/#CRAFTER

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.com/#a_aid=THE_CRAFTER