Hello traders,

welcome to a new week. let’s see what the charts have for us:

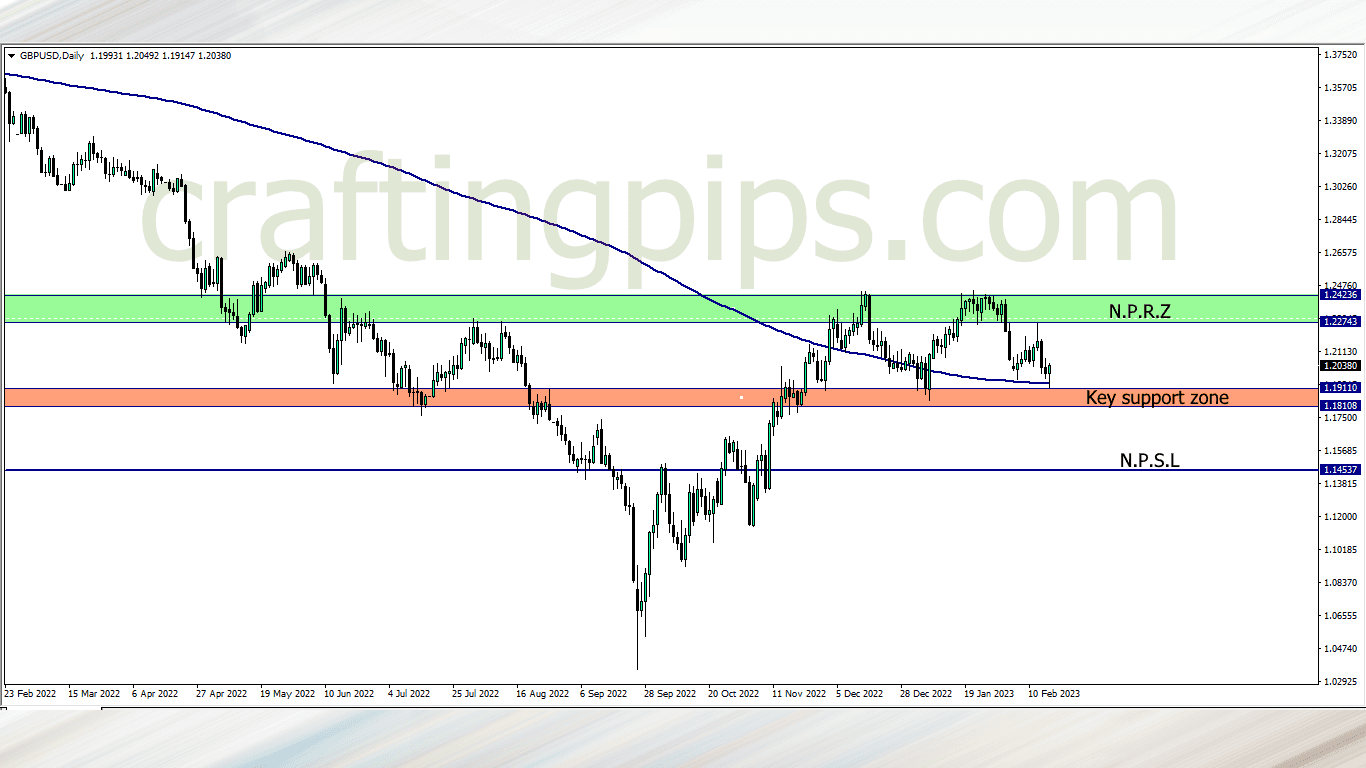

1. GBP/USD

GBP/USD closed last week with a bullish candlestick above the 200 ma, and on a key support zone. This means last week closed with the buyers showing signs of strength.

This week all we have to do is look for bullish confirmations before joining the journey to NPRZ

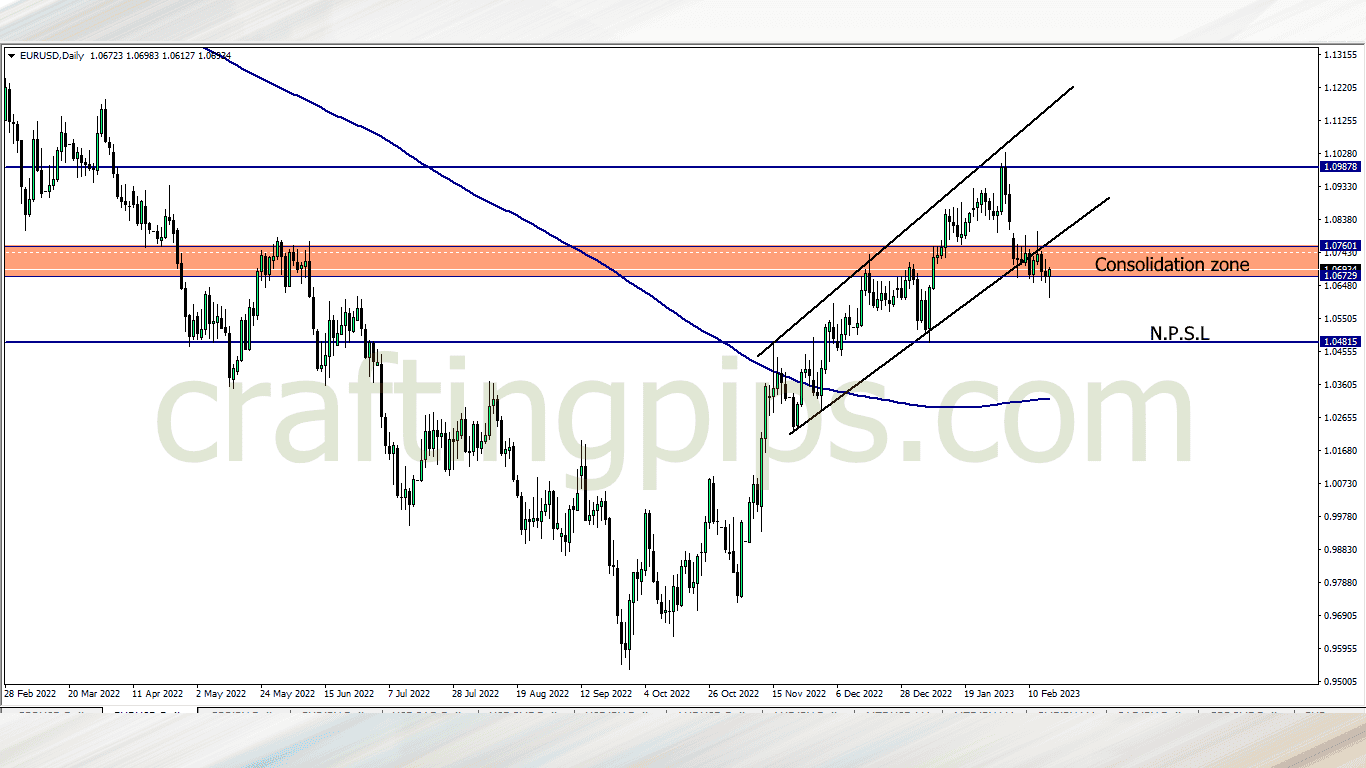

2. EUR/USD

Last week, EUR/USD closed with a bullish pinbar. Note that the wick is way below the consolidation zone, so even if the bulls come in this week, there is a probability that the buying pressure will be short lived.

What I will be watching out for this week will be seeing price fall below the consolidation zone, then I will join the sellers to ride price to the NPSL

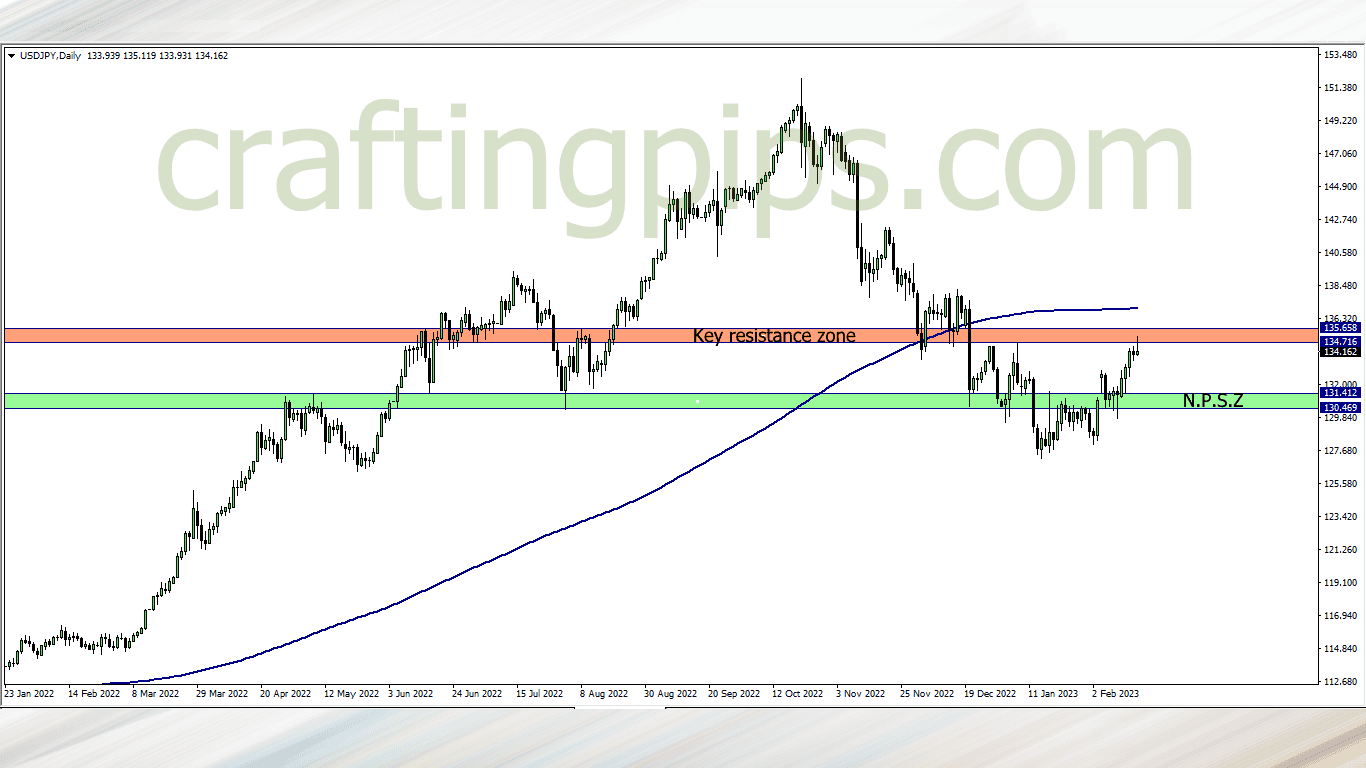

3. USD/JPY

USD/JPY closed last week with a bearish pinbar at a key resistance zone, and just below the 200 ma.

This week there is a huge possibility that price may revisit NPSZ

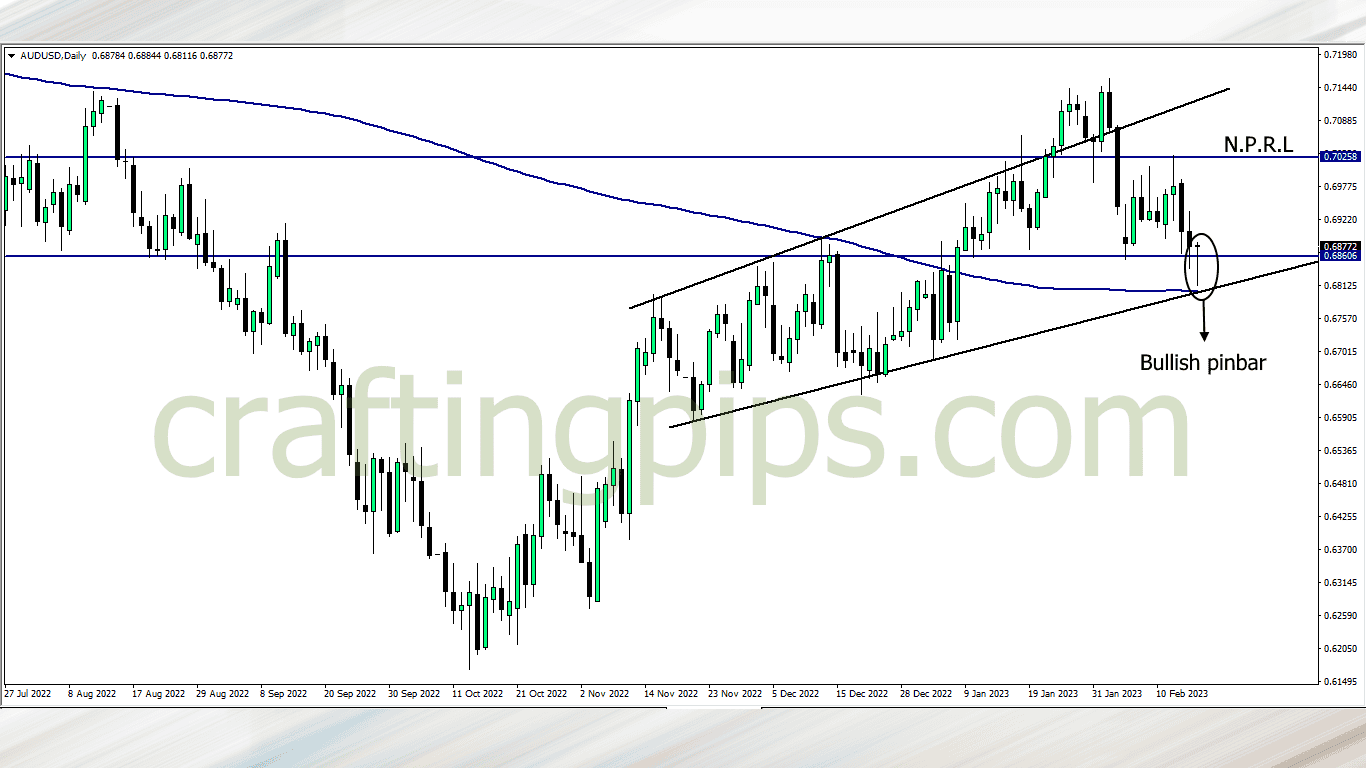

4. AUD/USD

At the close of the market, AUD/USD almost gave us a dragonfly doji at a key support level and also above the 200 ma.

So I am expecting fireworks from the buyer’s camp this week. I will be focusing on entering a buy trade once the market opens and some confirmations fall in place.

If things fall according to plan, then our next bus stop will most likely be NPRL.

What say you?

NOTE:

Hey traders,

If you are into trading for proprietary firms which I believe you should due to the many advantages involved, check out these carefully selected proprietary firms listed below.

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period.

If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code