This is where I share all my trades taken each and every week.

My reason for this is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- To have enough date to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY (13/02/2023)

CAD/JPY (11.05 am)

Analysis: I decided to buy CAD/JPY due to price breaking a key resistance zone that has held price for almost 2 months.

That said, this is an intra-day trade, so I do not intend to hold it past Monday… EXCEPT the bulls continue their rampage and my trailing SL is not triggered

CAD/JPY Update (3.50pm)

Closed at breakeven

NZD/USD (11 PM)

Analysis: My reason for buying was shared in our Tuesday market analysis. I don’t intend holding this trade for long as we have CPI news scheduled for 2.30 pm Tueday. So I will most likely exit or trail profits before the beginning of the London session

CAD/JPY (11.30PM)

Analysis: My reason for buying was shared in our Tuesday market analysis. I also don’t intend holding this trade for long as we have CPI news scheduled for 2.30 pm Tueday.

TUESDAY (14/02/2023)

GBP/CHF Update (1.30 pm)

Exited before CPI news with +32 pips (This was taken last week, so I will be recording it under 6th trading week

CAD/JPY Update (1.30 pm)

Exited before CPI news with -11 pips

NZD/USD Update (1.30pm)

Exited before CPI news with -15 pips

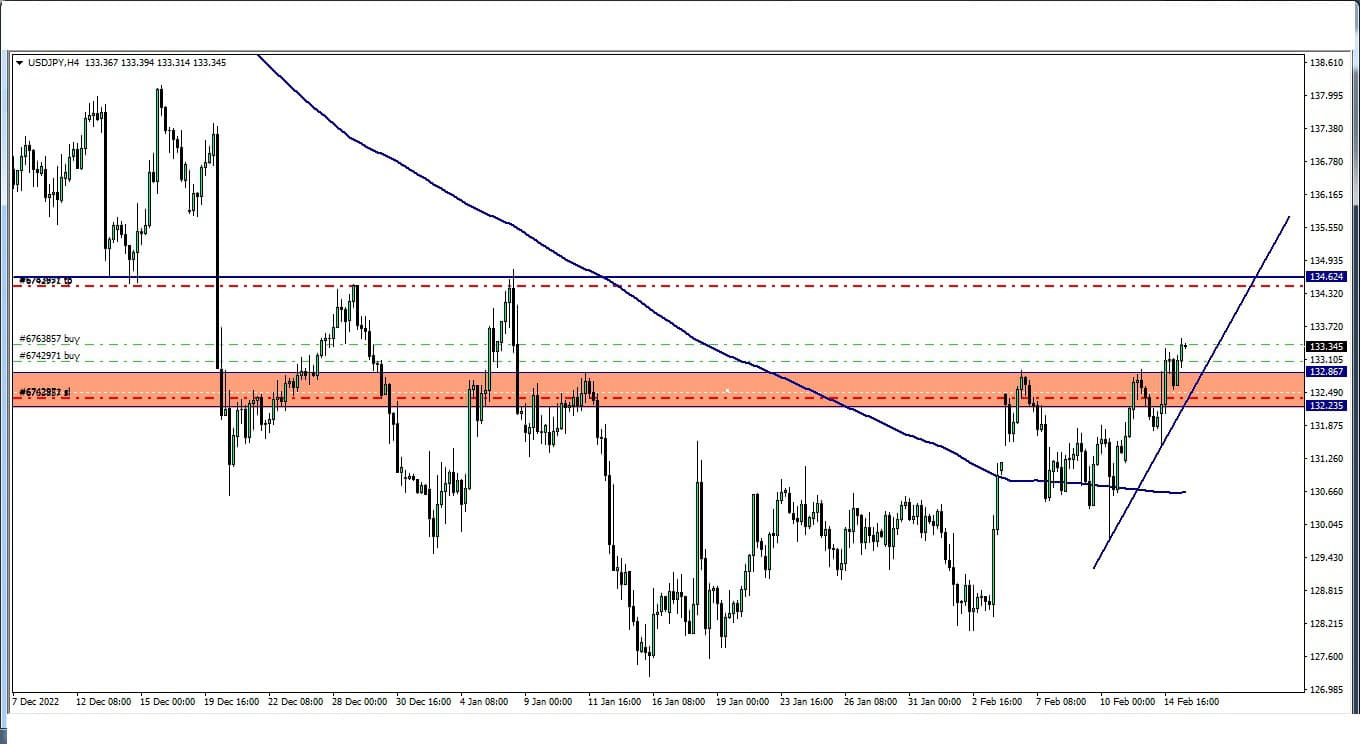

USD/JPY (10.30 pm)

Analysis: My reason for buying USD/JPY can be seen on our Wednesday analysis

CAD/JPY (11.45 pm)

Analysis: My reason for buying CAD/JPY can be seen on our Wednesday analysis

Analysis: My reason for buying CAD/JPY can be seen on our Wednesday analysis

WEDNESDAY (15/02/2023)

USD/JPY Update (11.05 am)

Analysis: Adding to the USD/JPY buy after the retest. Let’s see how it goes

USD/JPY follow up (1.30 pm)

Closed the trade with +57 pips

THURSDAY (16/02/2023)

The CAD/JPY I bought on Tuesday closed as breakeven

FRIDAY (17/02/2023)

Normally I rarely trade on Friday’s, but I spotted two hot setups (EUR/USD & USD/JPY) I just could not resist. let’s not also forget that at 2.30 pm we have a high impact news on USD, so I will be exiting this trade on or before 2 pm.

Let me share the setups:

USD/JPY 7.05 am

Analysis: Tuesday and Wednesday were spent in a fierce battle between the buyers and sellers, hence the reason why the resistance zone stood strong.

Friday presented us with a decent breakout which means that the bulls won the battle, hence my reason for joining the buyers

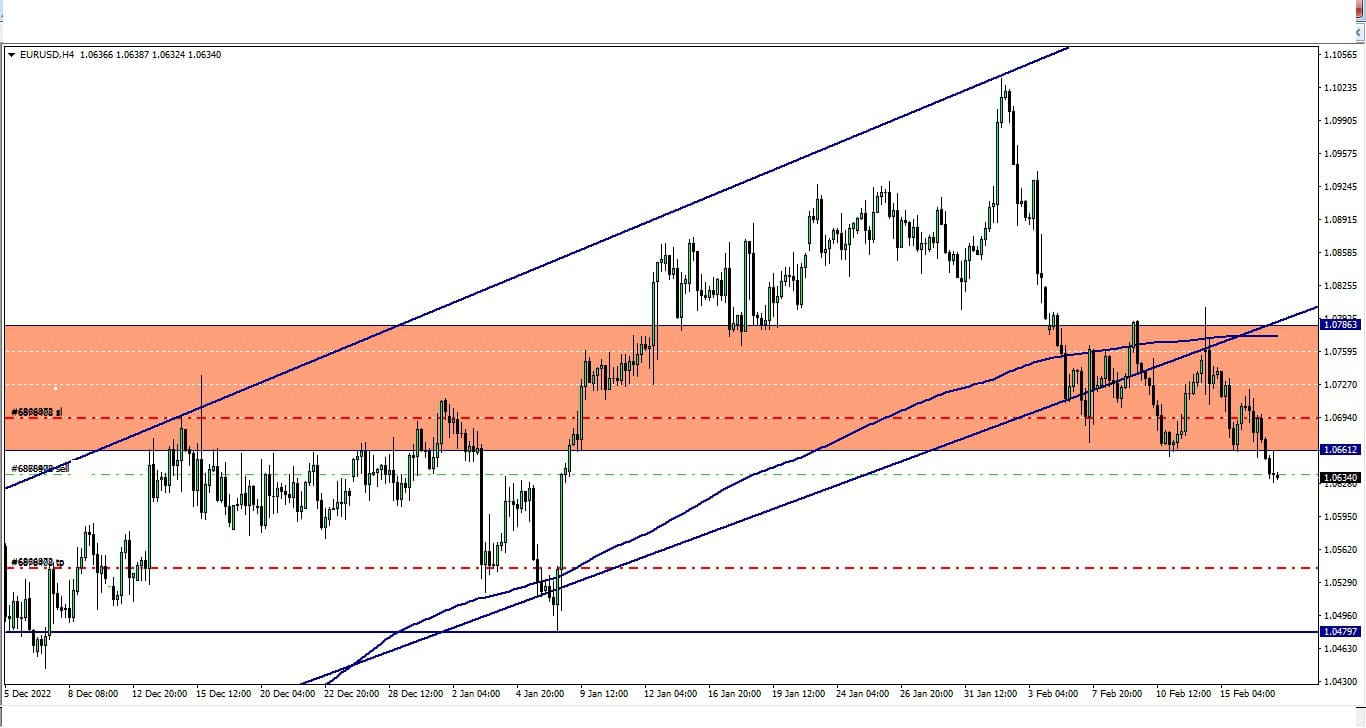

EUR/USD (7.05 am)

Analysis: I shared my analysis on Friday and I planned on selling ONLY when the daily candlestick breaks below the consolidation band… It did not, but I still sold because I spotted the buyers were already getting weak.

That said, I don’t plan on staying in this trade for long. I will be out before 2 pm

EUR/USD Update 11.05am

Analysis: Second position added after a bearish validation at the close of the 6 am candlestick

USD/JPY Update (1.25pm)

Trailing SL got hit, so we closed with + 6 pips

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (13/02/2023) | CAD/JPY | BUY | Breakeven |

| NZD/USD | BUY | – 15 pips | |

| CAD/JPY | BUY | – 11 pips | |

| THUS (16/02/2023) | USD/JPY | BUY | +57 pips |

| CAD/JPY | BUY | Breakeven | |

| FRI (17/02/2023) | USD/JPY | BUY | + 6 pips |

| EUR/USD | SELL | + 18 pips | |

| TOTAL | + 55 PIPS |

In conclusion:

This week was riddled with high impact news events so I lost a lot of potentially good trades by exiting early.

It was so bad that I exited my Friday trades early because I though there was a high impact news on USD by 2.30 pm (hahahha)

I am not complaining though because a win is a win, and all my trades were well executed.

How did your trading week go?

NOTE:

Hey traders,

If you are into trading for proprietary firms which I believe you should due to the many advantages involved, check out these carefully selected proprietary firms listed below.

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period.

If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code