Hello traders,

its the last week of the month of November. Let’s see what the charts have for us:

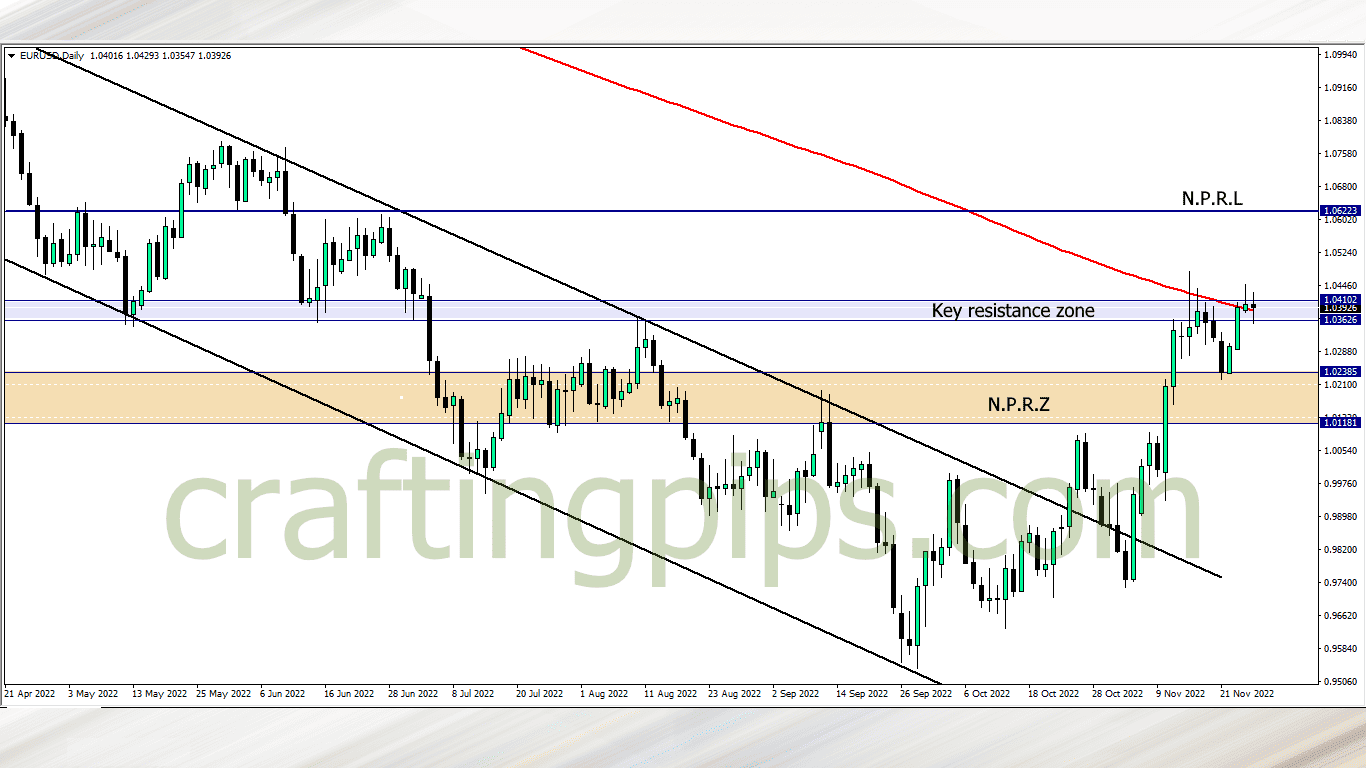

1. EUR/USD

Price is finding it difficult breaking the key resistance zone on the EUR/USD, and last week closed with an indecision in the market

The 200 moving average further authenticates the strength of the current resistance zone hence the difficulty encountered by the bulls breaking this zone last week.

This week will determine who would win between the buyers and sellers. If price breaks the current resistance zone and 200 moving average, then we may see buyers take price to the next possible resistance level (1.06223)

However if buyers from last week fail to break the current resistance zone, then we are most likely to see price fall back to support zone painted brown

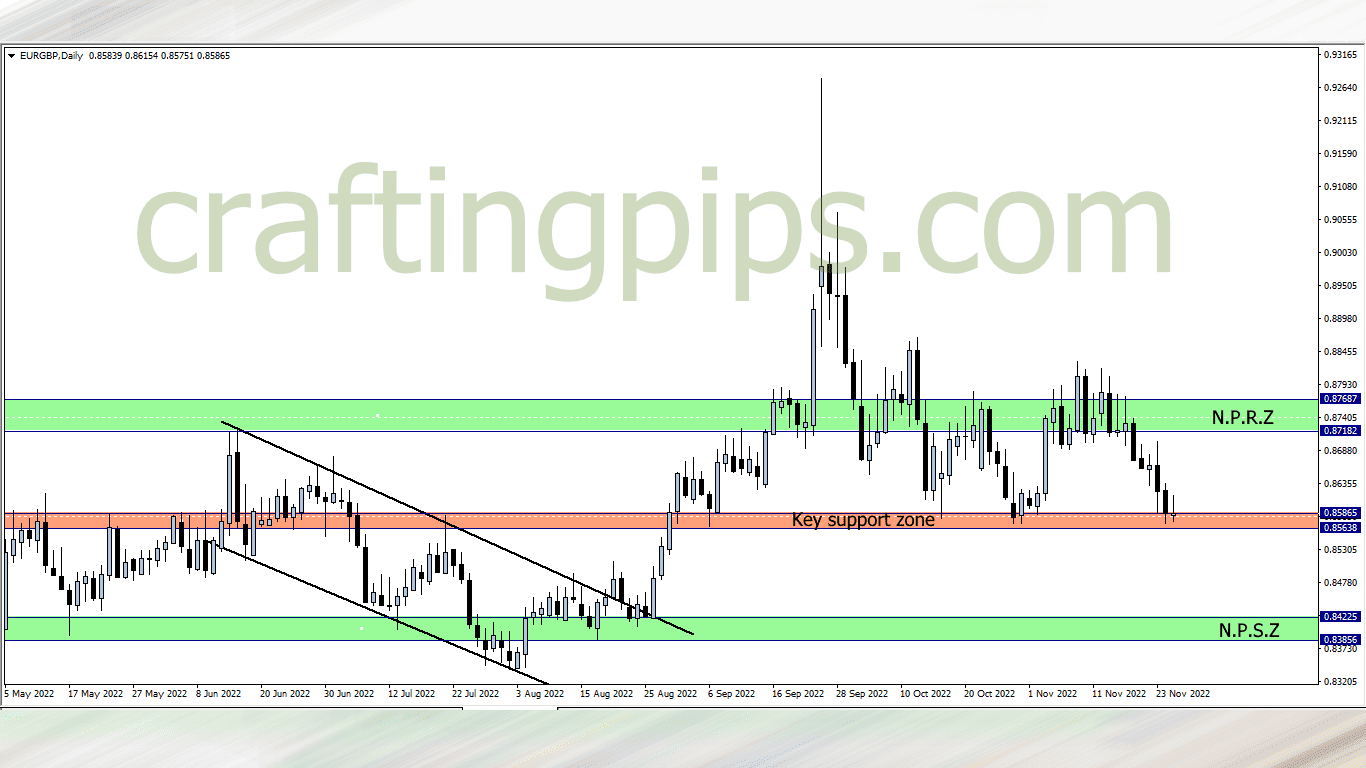

2. EUR/GBP

The current support zone on the EUR/GBP is being tested the fourth time (which makes the support zone a little more unreliable)

If the bears succeed in breaking the current support zone, then price next possible support zone will most likely be the green zone. We should also remember that the current support zone is viable, till it gets broken. So a reversal is possible, and if that happens price may revisit the previous resistance zone

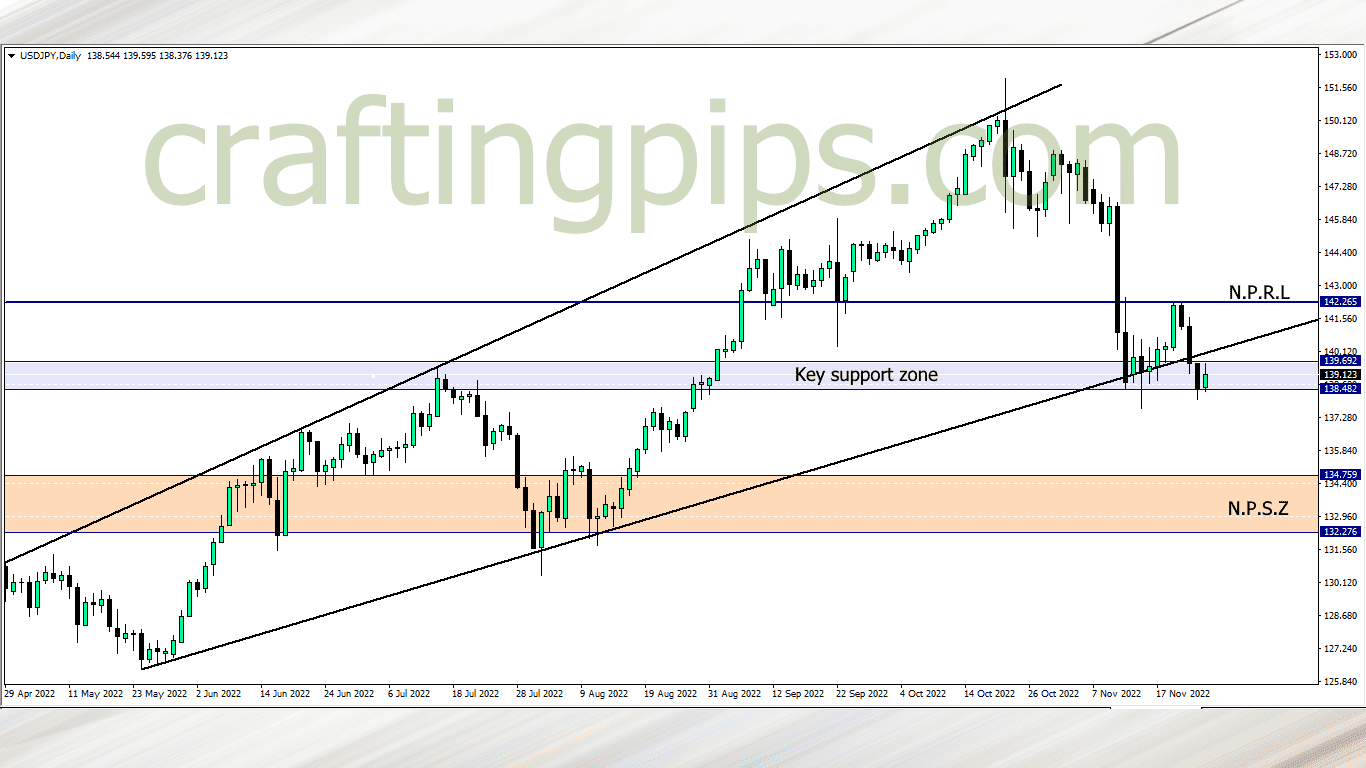

3. USD/JPY

USD/JPY buyers had a change of heart after visiting resistance level 142.265 last week

Price drastically dropped and only paused after it hit a key support zone. This week a breakout below the present support zone is all we should be waiting for. If that happens we may bag over 300 pips as price next move will be to the next possible support zone painted brown

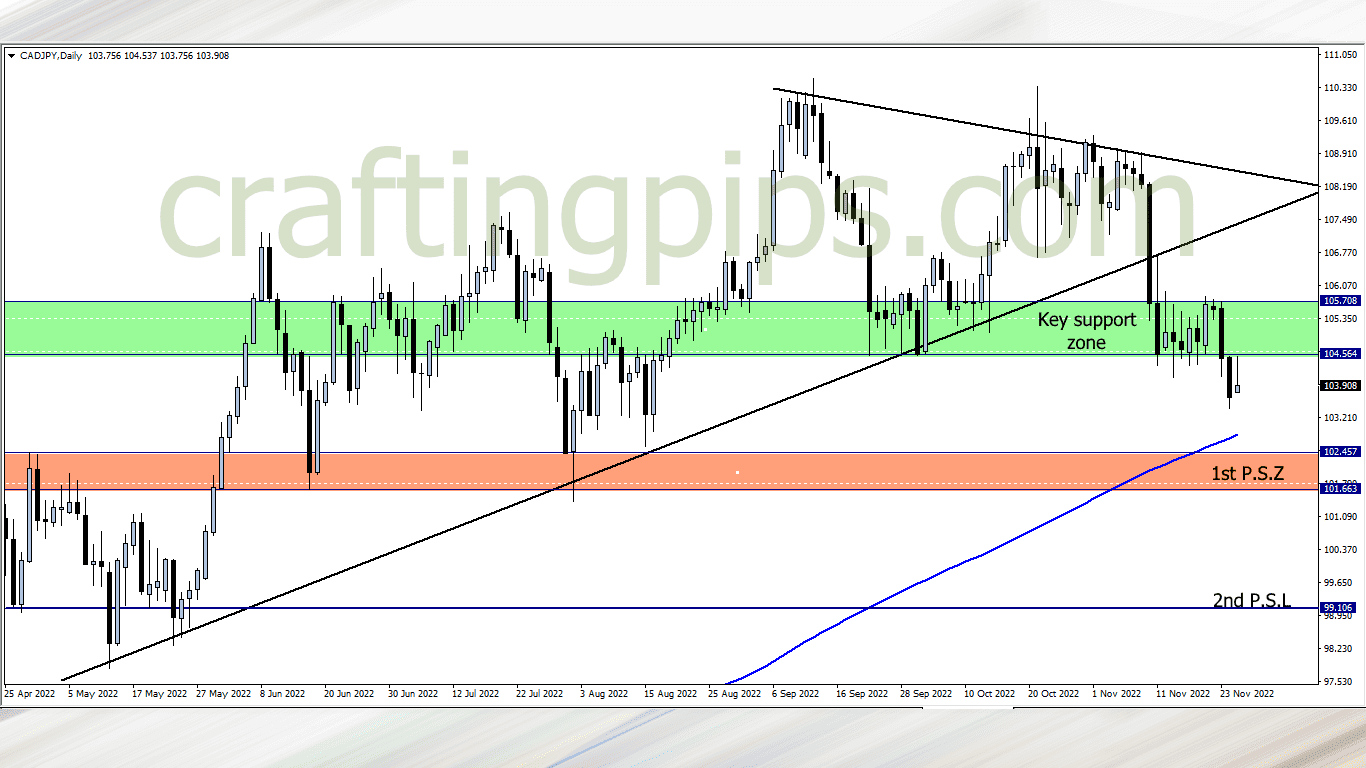

4. CAD/JPY

This week the bears are most likely going to continue pulling price the first possible support zone, although selling at this could be a little too risky due to the position of the 200 moving average.

My trade plan this week will be to wait and see if price will hit the first possible support zone, break it, and continue bearish to the second possible support level, or bulls taking over after price hits the first possible support zone, and take price back to previous key support zone (green zone) which will now act as a resistance zone

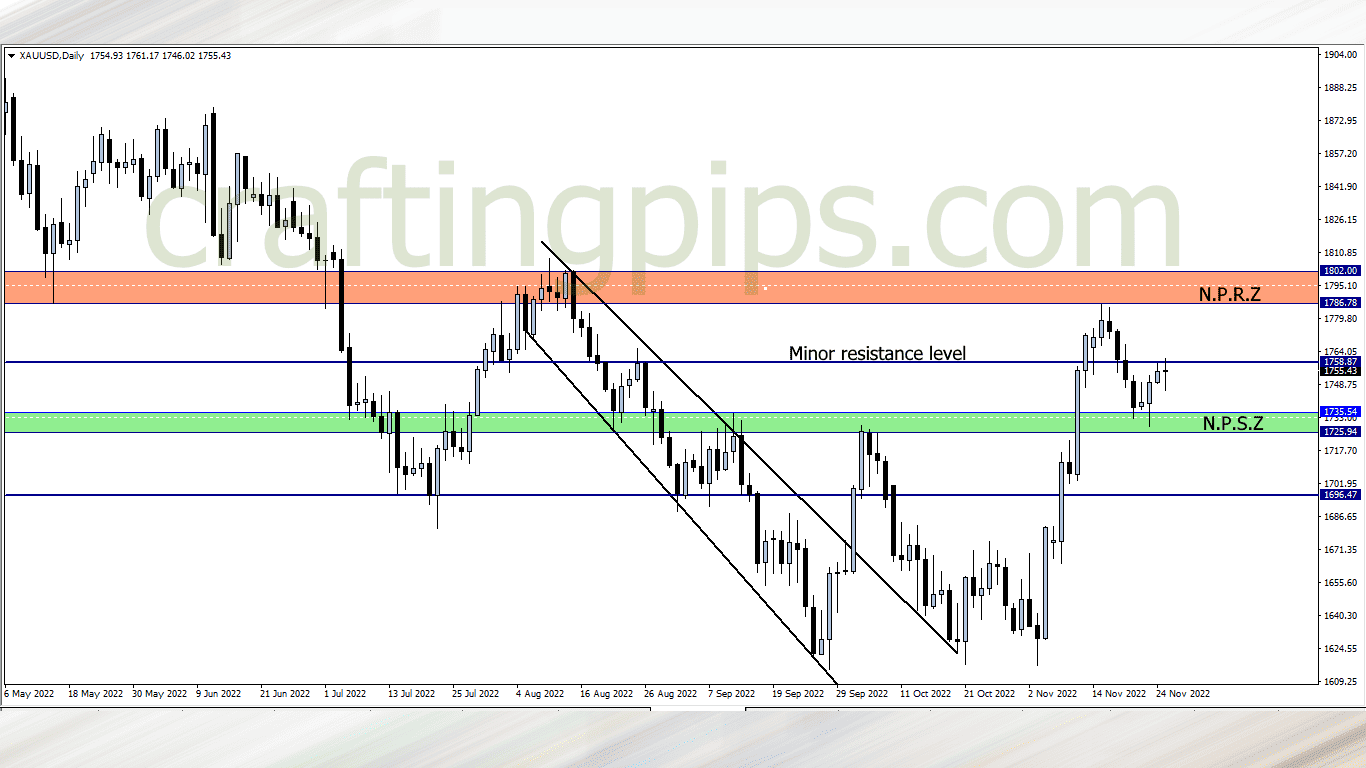

5. XAU/USD (Gold)

Last week Gold closed with an indecision between the bulls and bears. The market also closed at a minor resistance level.

For the conservative traders, it will be wise to wait for a bullish breakout before buying and using the red zone as the next possible resistance zone or wait for another indecision candlestick on the daily time frame before selling and using the green zone as our profits target

What say you?

Traders who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters

NOTE:

Hello traders, Are u tired of wasting your money on failed prop firm challenges?

Say no more…

Fundyourfx is willing to give u a DIRECT FUNDED account at an affordable price If u are interested, contact me & get my coupon code for a -5% discount.