Hello traders,

Some pretty good setups to watch out for this week.

Let’s hit the charts:

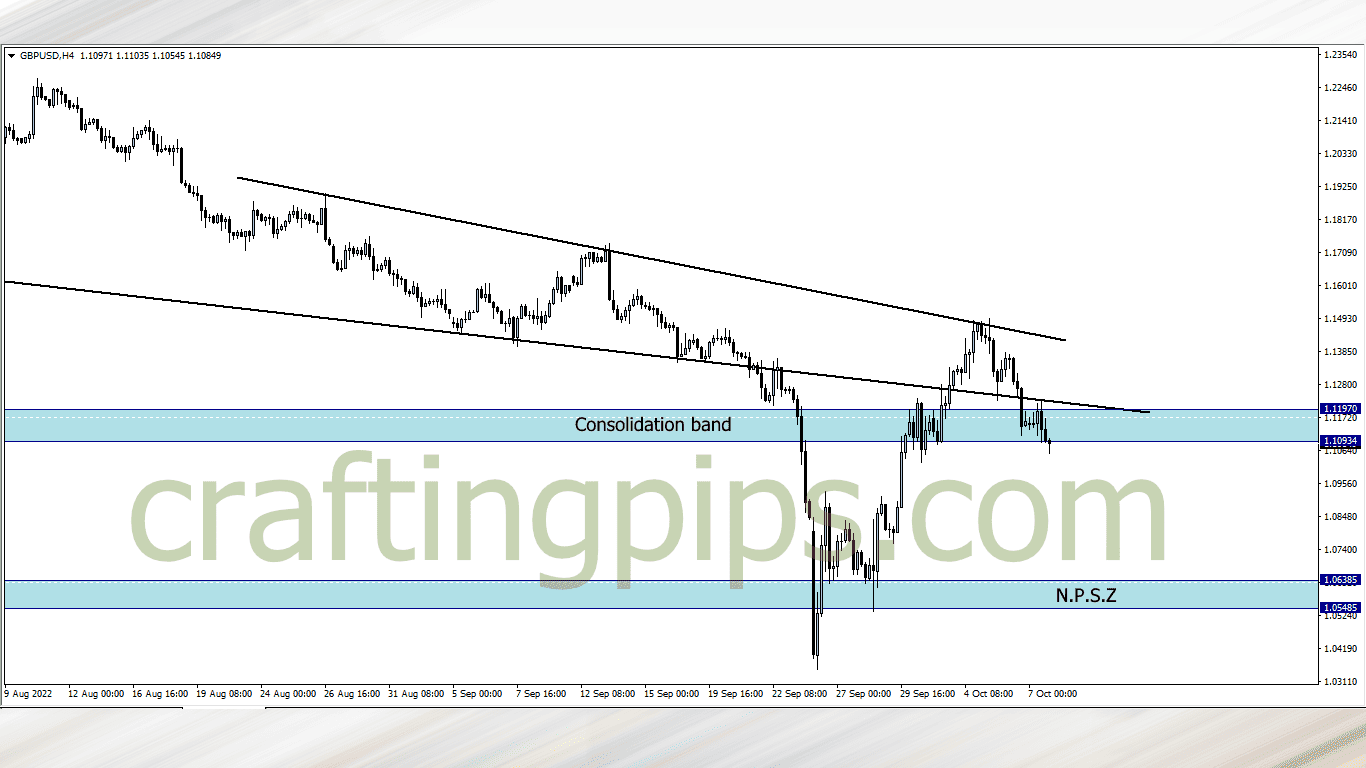

1. GBP/USD

The bears took charge last week Wednesday, and ever since we saw a steady fall of the GBP/USD

on the 4 hour time frame we can see a head and shoulder pattern formation. A breakout below the neckline means price may gift traders over 400 pips the first few days of the week

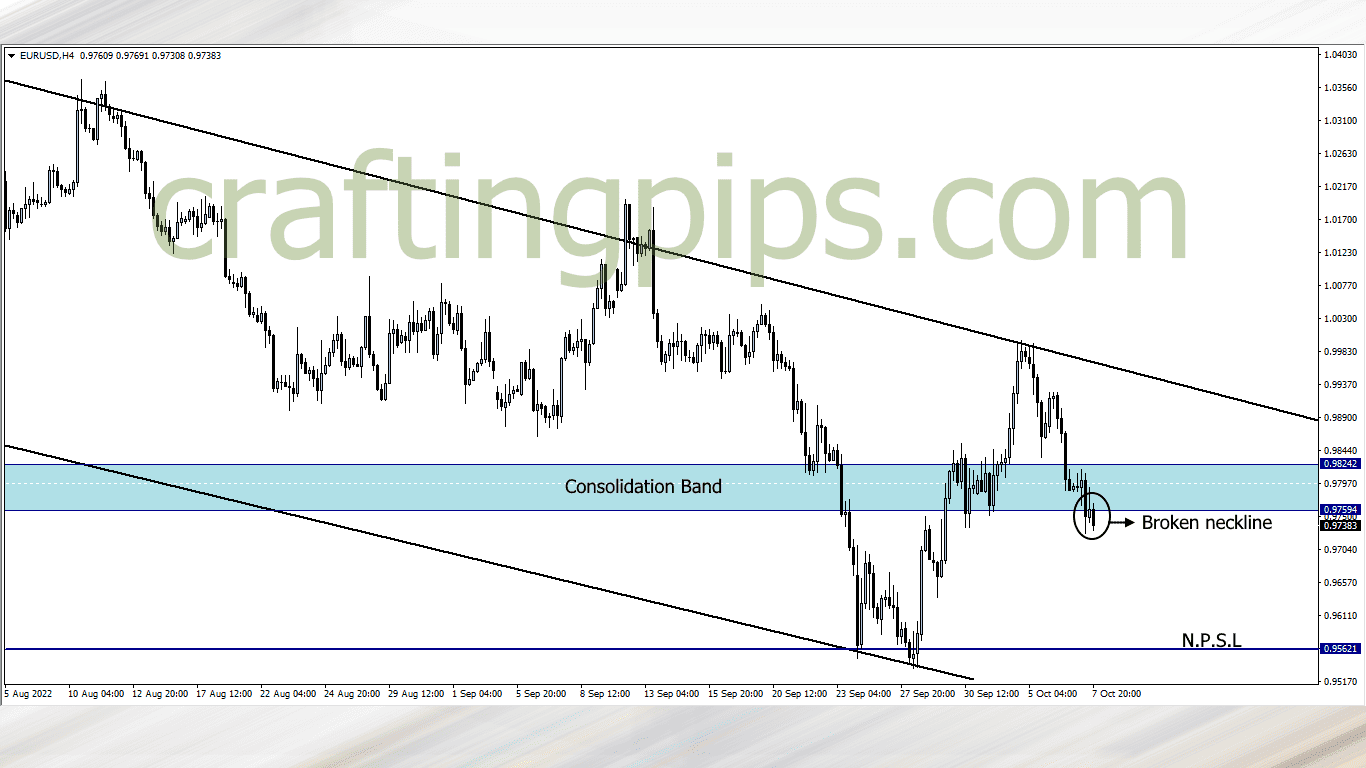

2. EUR/USD

A head and shoulders pattern formation can also be seen on the EUR/USD

Price has broken the neckline already. All we have to do is look for bearish entries and ride price to the next possible support level (0.95621)

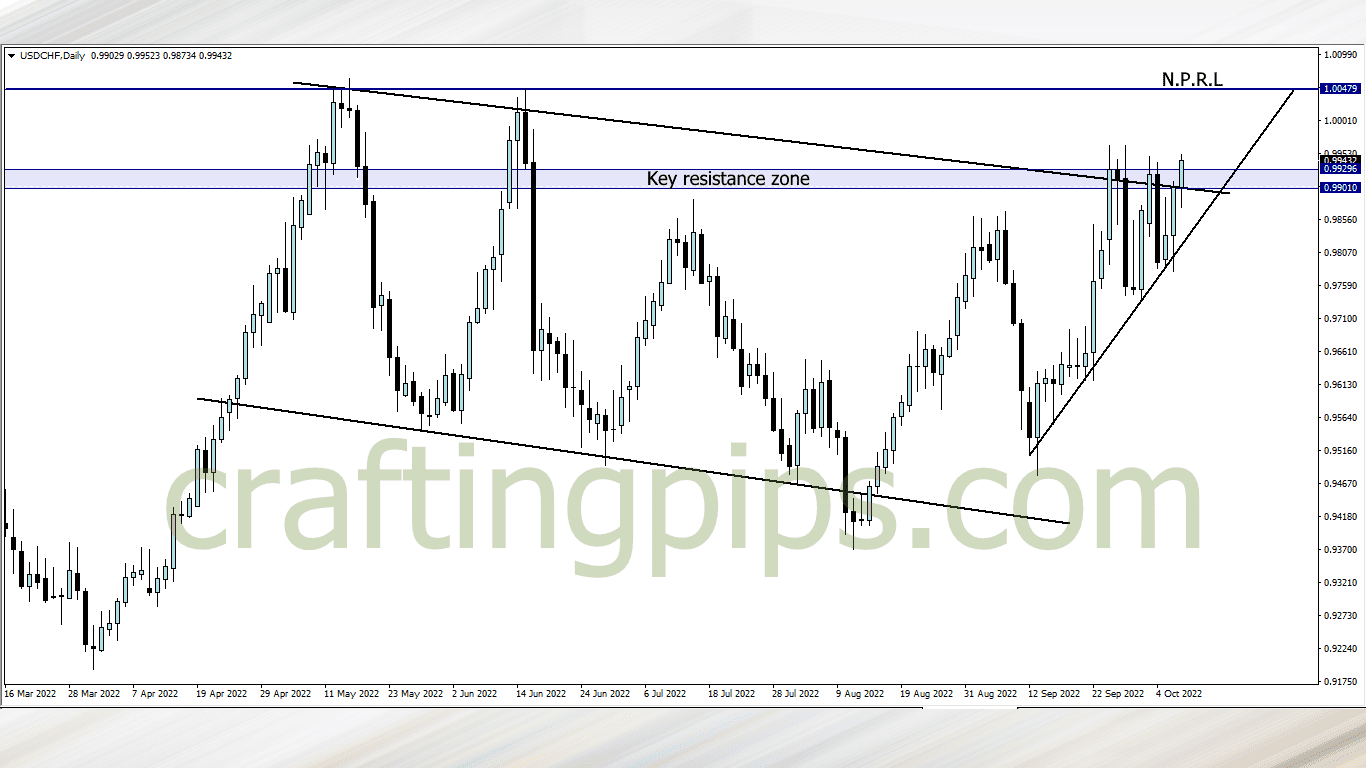

3. USD/CHF

For close to two weeks, price has been consolidating on the USD/CHF.

Friday closed with a bullish breakout on the daily time frame. Our aim this week will be to join the buyers and ride with them to the next possible resistance level (1.00479)

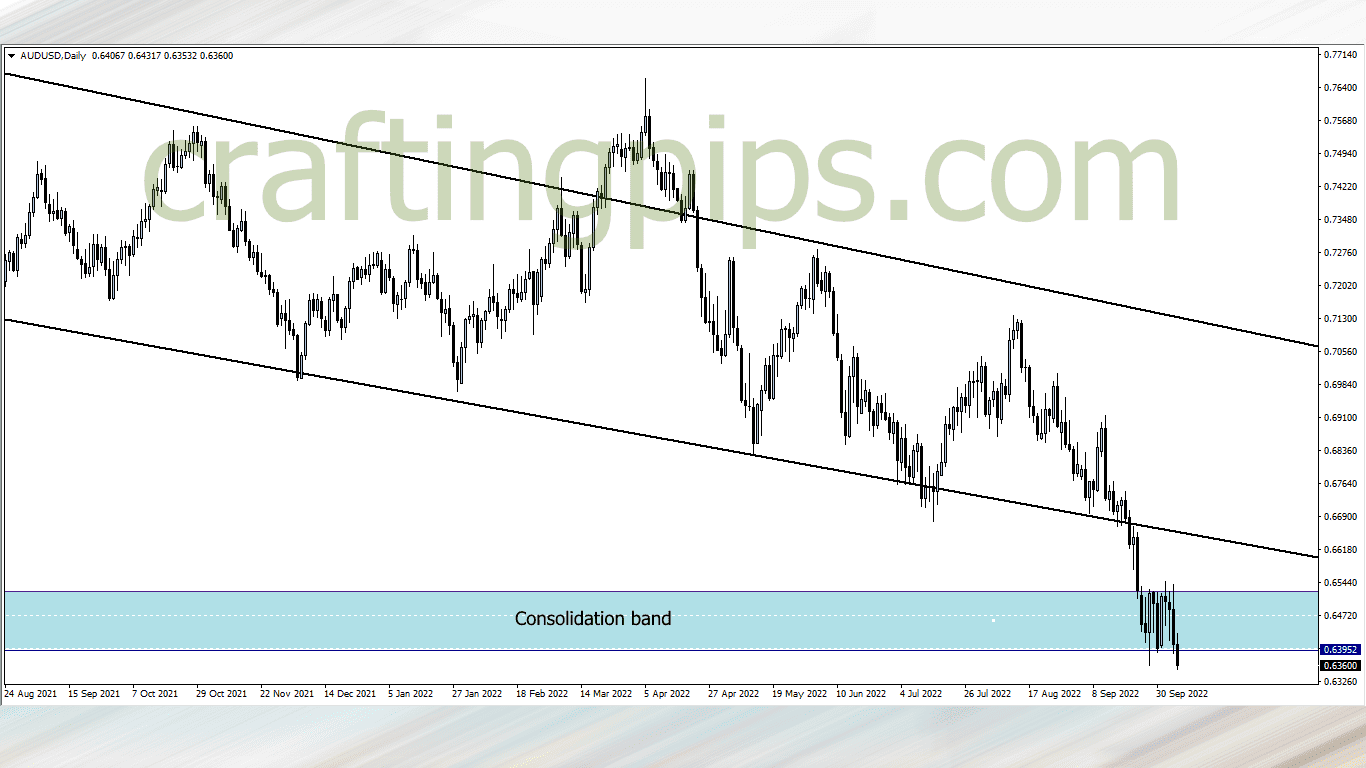

4. AUD/USD

For two weeks AUD/USD consolidated within the consolidation band. Last week Friday price broke the consolidation band at the close of the market.

This week there is a high possibility that price will continue its bearish run to the next possible support level (0.60006), which is over 350 pips away

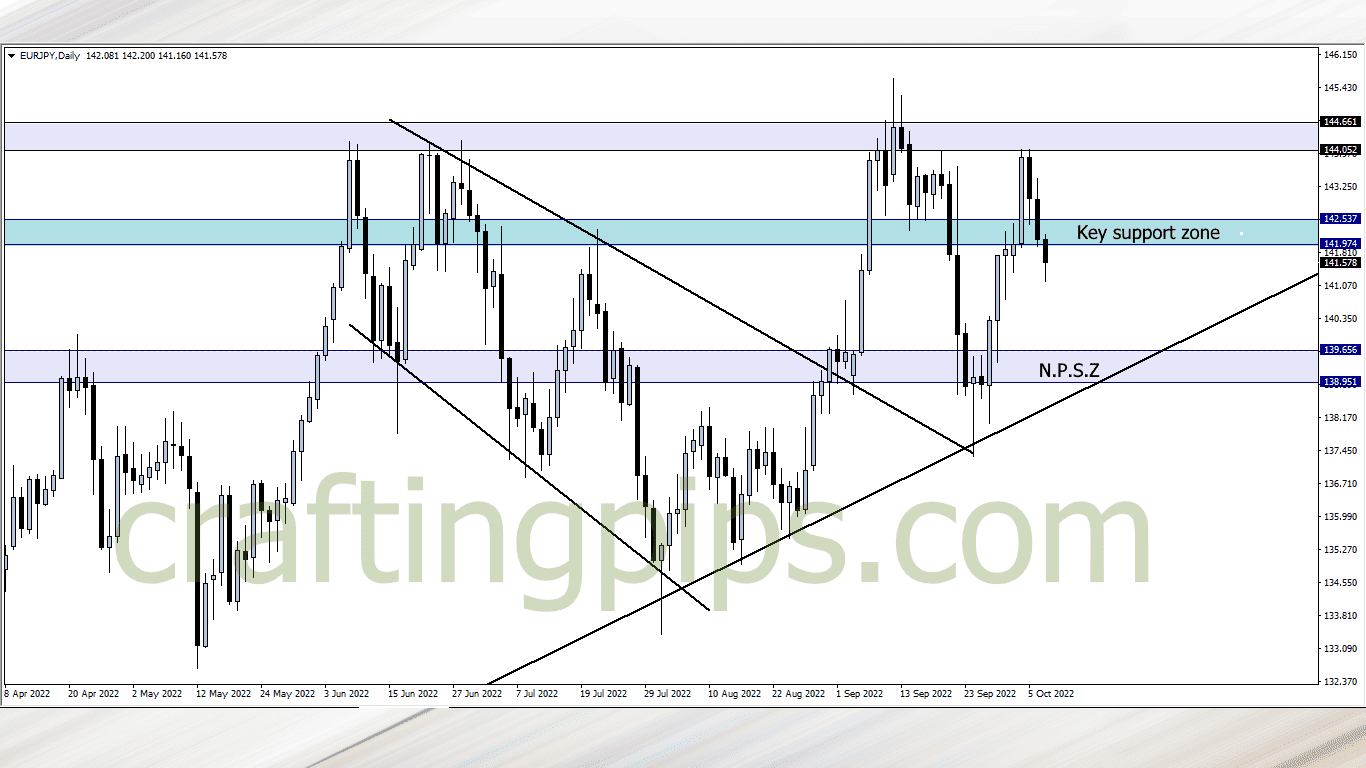

5. EUR/JPY

EUR/JPY broke a key support zone at the close of market on Friday.

This week we may see the bears pull price down the the next possible support zone

What say you?

Traders who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters

NOTE:

Hello traders, Are u tired of wasting your money on failed prop firm challenges?

Say no more…

Fundyourfx is willing to give u a DIRECT FUNDED account at an affordable price If u are interested, contact me & get my coupon code for a -5% discount.