Hello traders,

The week is filled with some great setups. Let’s hit the charts.

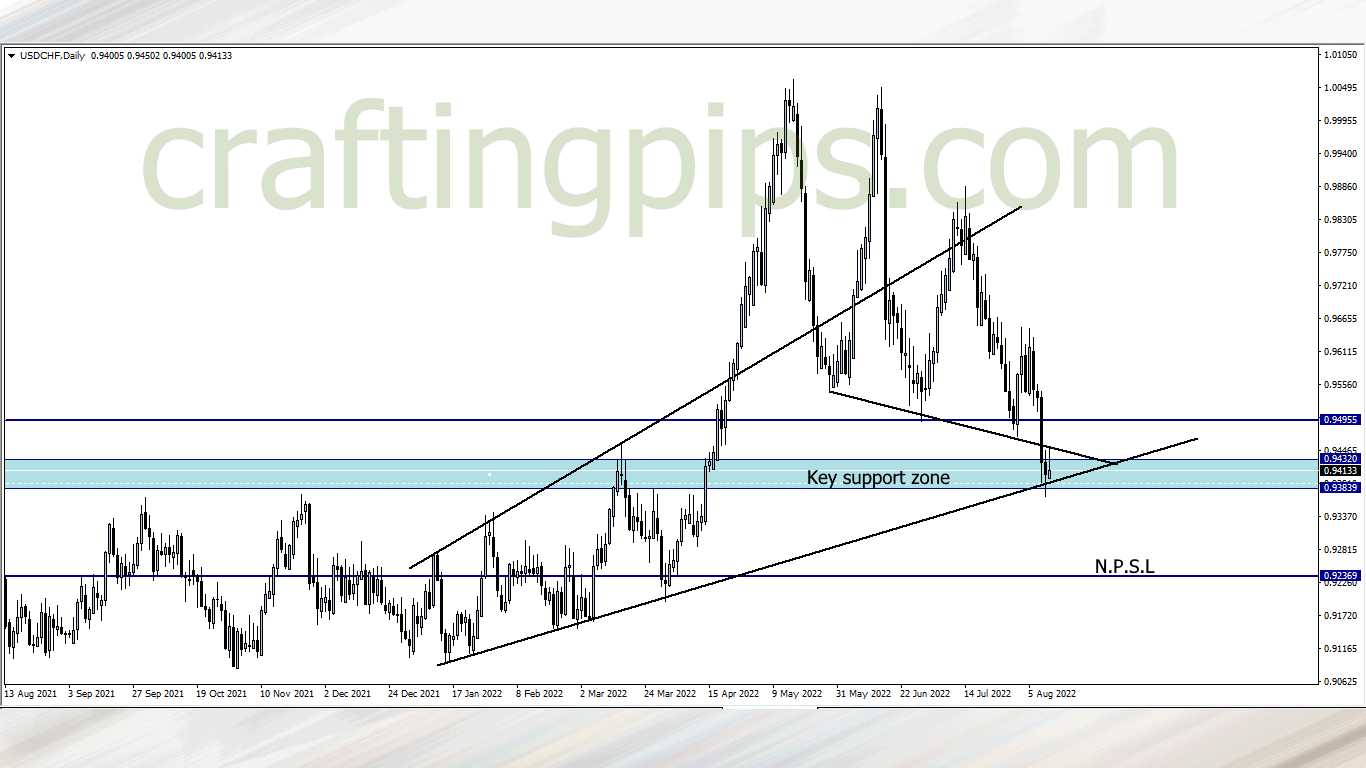

1. USD/CHF

On the daily time frame, USD/CHF is resting on an ascending trendline which has served as a key support level for the fourth time since January this year.

All I am interested in is price breaking out of the key support zone. If that happens, then price next bus stop will most likely be 0.92369

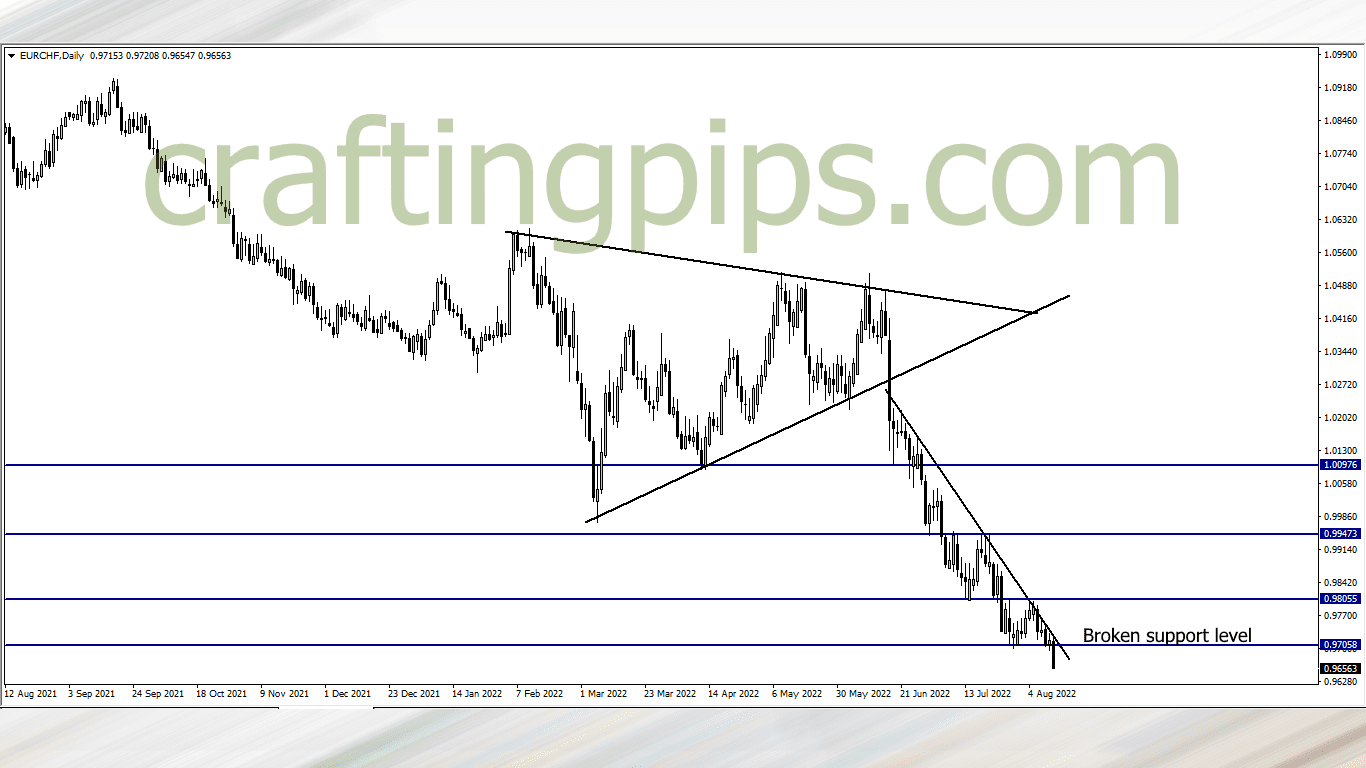

2. EUR/CHF

An important support level was broken on the EUR/CHF.

This is the lowest price has dived in over 20 years. So we could either the sellers as market resumes, or we wait for a pull-back before joining in.

Since there is no support level to place our target profit, we could target a 50-100 pips drop, after the pullback, then we start trailing profits.

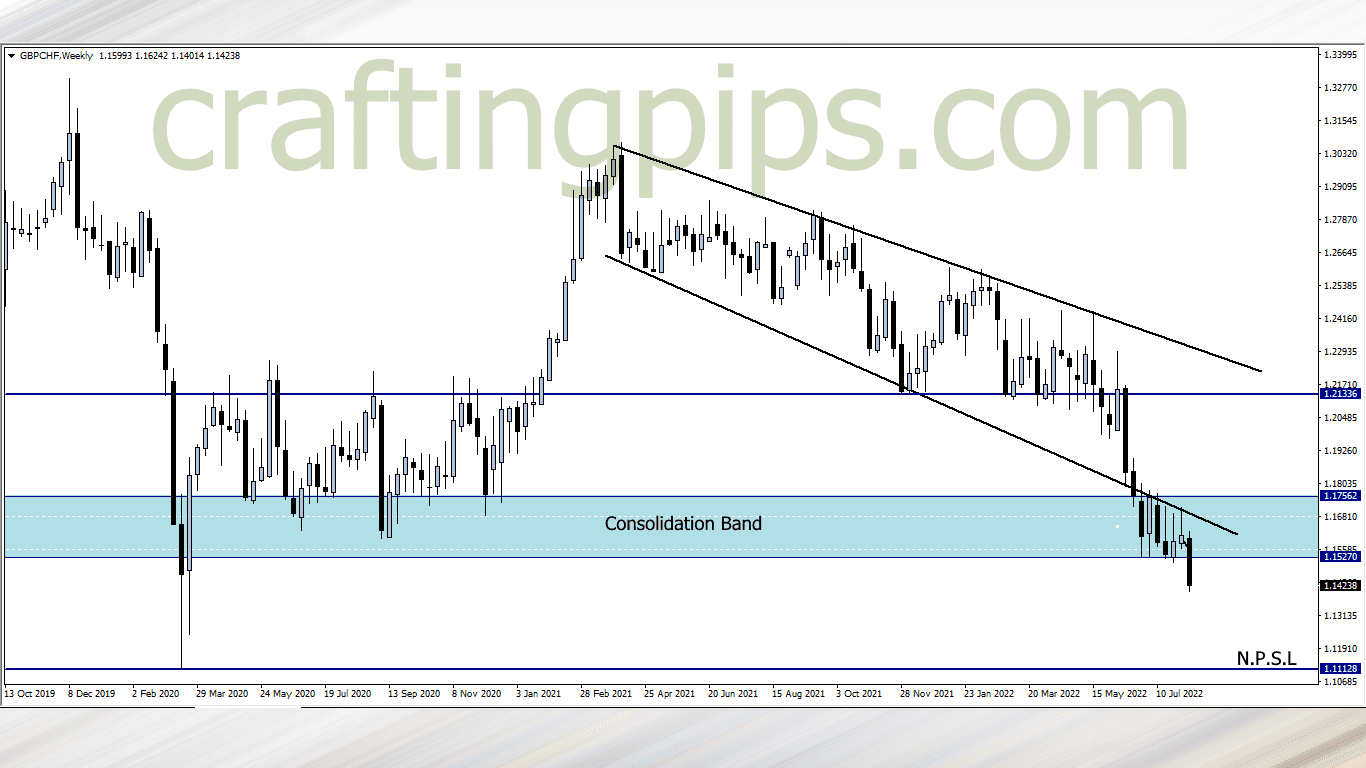

3. GBP/CHF

A clear breakout can be seen on the GBP/CHF weekly time frame, after spending over over a month consolidating within the consolidation band.

Our next possible support level is most likely to be 1.11128

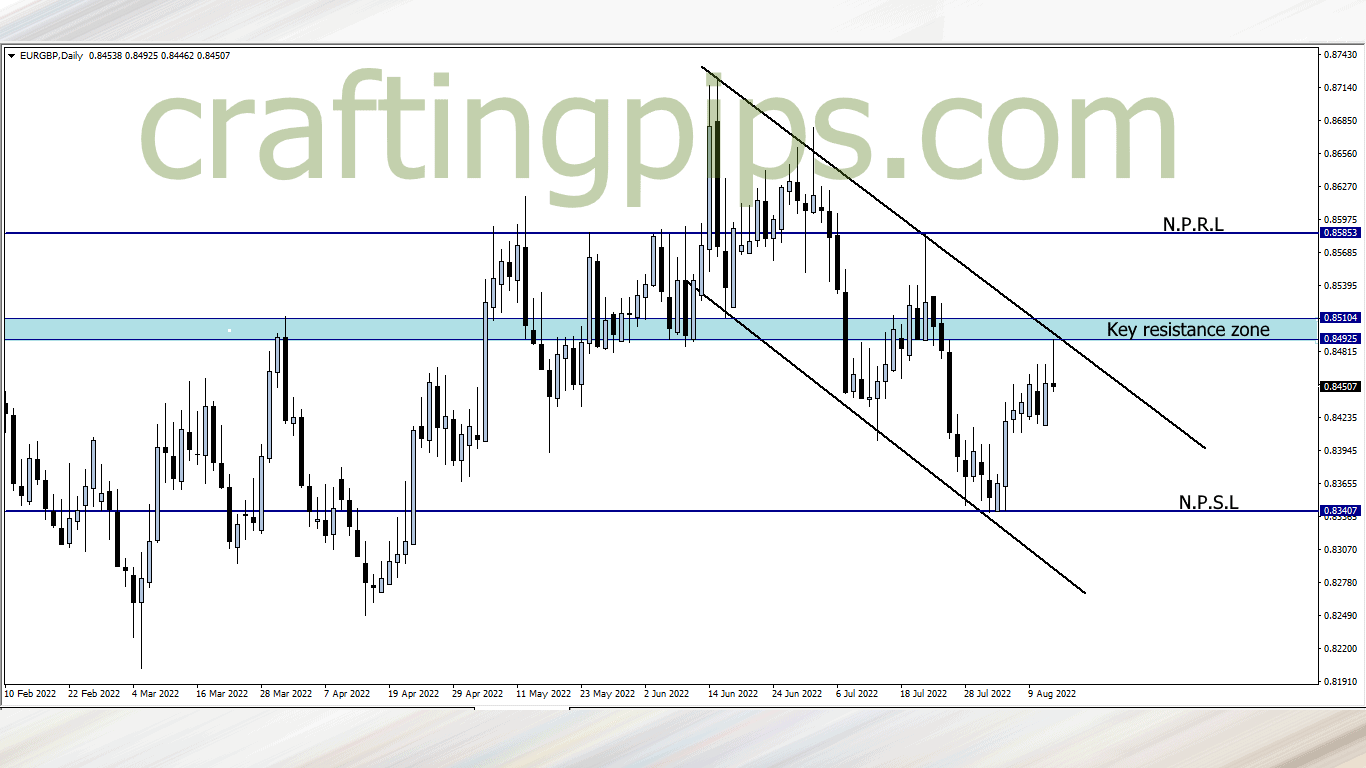

4. EUR/GBP

A bearish pin-bar touching the roof of a descending channel can be spotted on the EUR/GBP.

If the bears give us a confirmation to sell as we resume this week, then our next possible support level would be 0.83407.

However, if for any reason the key resistance zone is broken this week, then price first bus stop will most likely be 0.85853

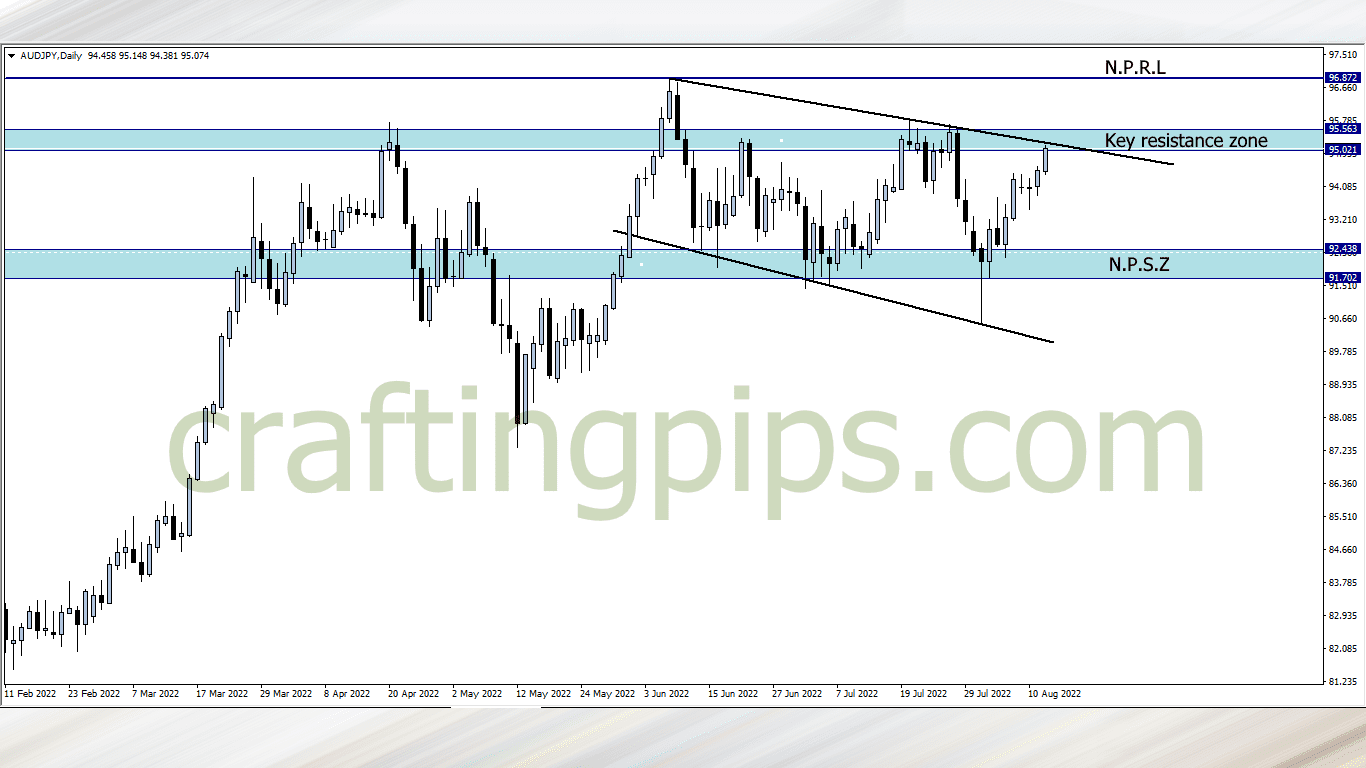

5. AUD/JPY

On the daily time frame of the AUD/JPY, price can be spotted touching the roof of a descending channel.

A reversal means we could see price re-visit the blue support zone this week, and a breakout means price will most likely first visit resistance level 96.872

What say you?

Traders who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters