Happy new month traders,

let’s hit them charts:

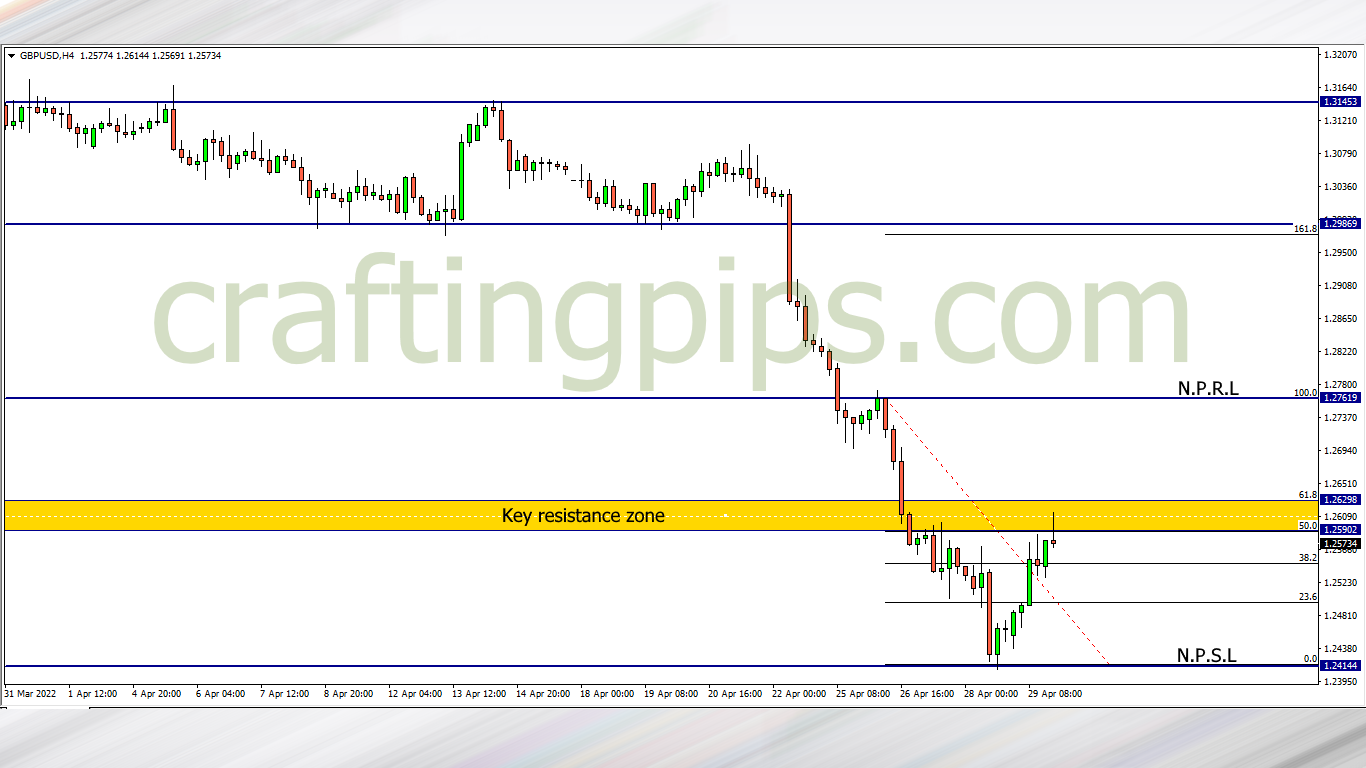

1. GBP/USD

GBP/USD was bearish all through last week.

On Friday we saw the bears pull off a pullback which took price back to a key resistance zone which coincides with Fibonacci’s golden ratio (50.00% and 61.8%)

The bearish pinbar is an indication that price may fall back to support level 1.24144, though we will be needing additional bearish confirmation before pulling the trigger.

This is not to say that the bulls can’t break the golden ratio and revisit resistance level 1.27619. If that happens, all we will be needing is a bullish confirmation.

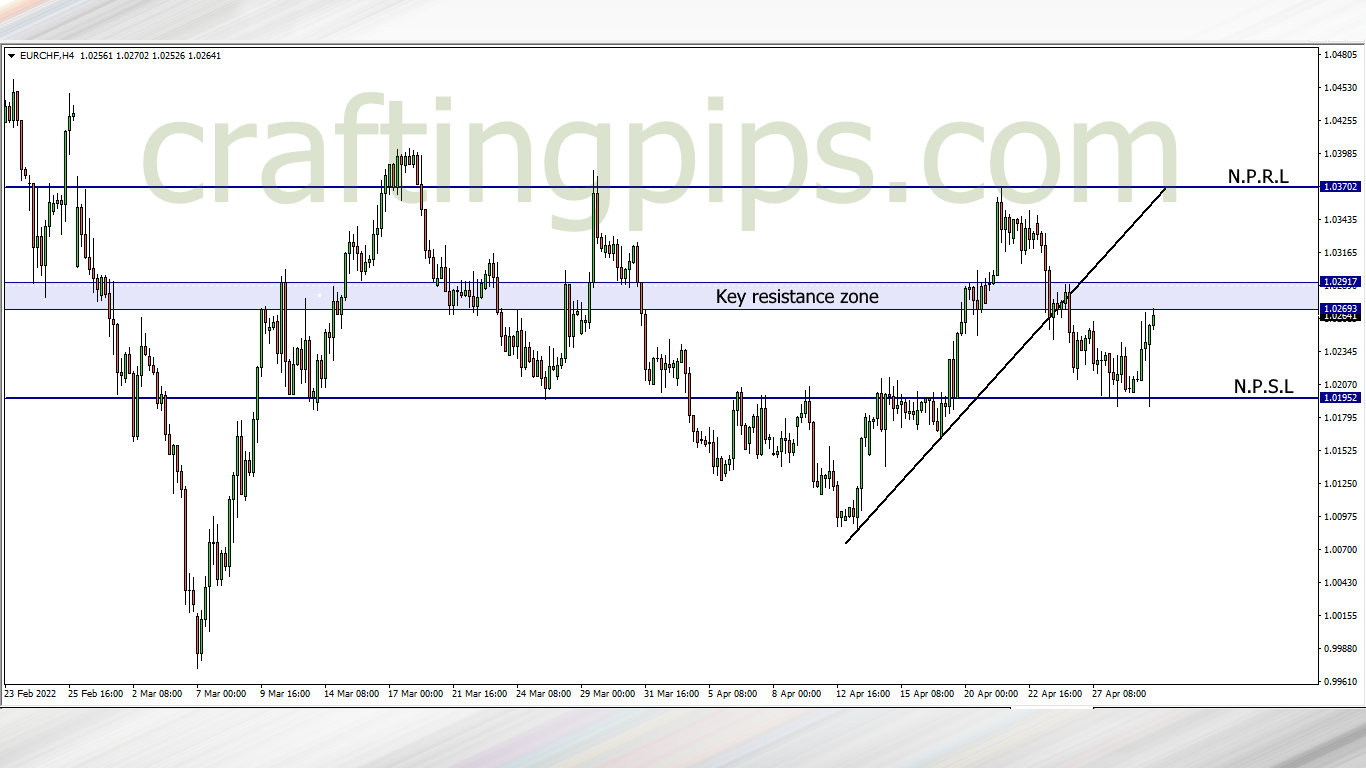

2. EUR/CHF

The key resistance zone is the only thing holding the buyers from hitting resistance level 1.03702.

However, if the bulls chicken out this week, and we do get to see the key resistance zone succeed in holding price, then we should be watching out for bearish confirmations which may take price back to support level 1.01852

3. CAD/JPY

On Friday price retested key resistance zone (102.343), before falling down to support level 100.924.

Judging from the strength of the bearish candlesticks, we may see price break the present support level and go further down to the next possible support level (98.998)

If the breakout fails, then we wait for reversal confirmations (if they happen) before joining the bulls back to resistance level 102.343

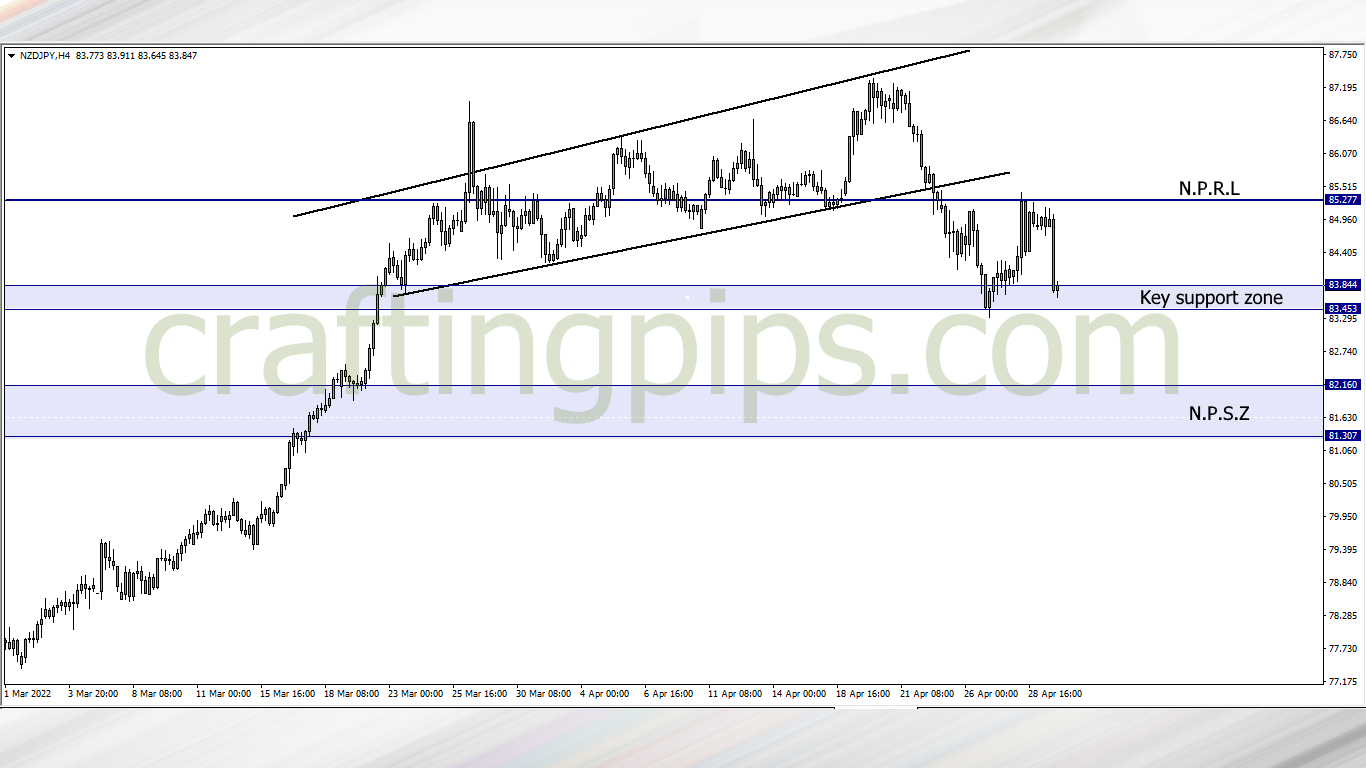

4. NZD/JPY

On the NZD/JPY we can see that there was a correction to the pullback on Firday. This gave the bears an upper hand as the market closed for the week.

If the present key support zone is broken, then price will most likely drop to the next possible support zone (81.307 – 82.160)

What say you?

Traders who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters