Happy New Year traders,

Hope you had a fun-filled holiday?

I took a break off the market, and I am excited to get back into action this week.

Without wasting any more time, let’s hit the charts and see what the market has for us this week

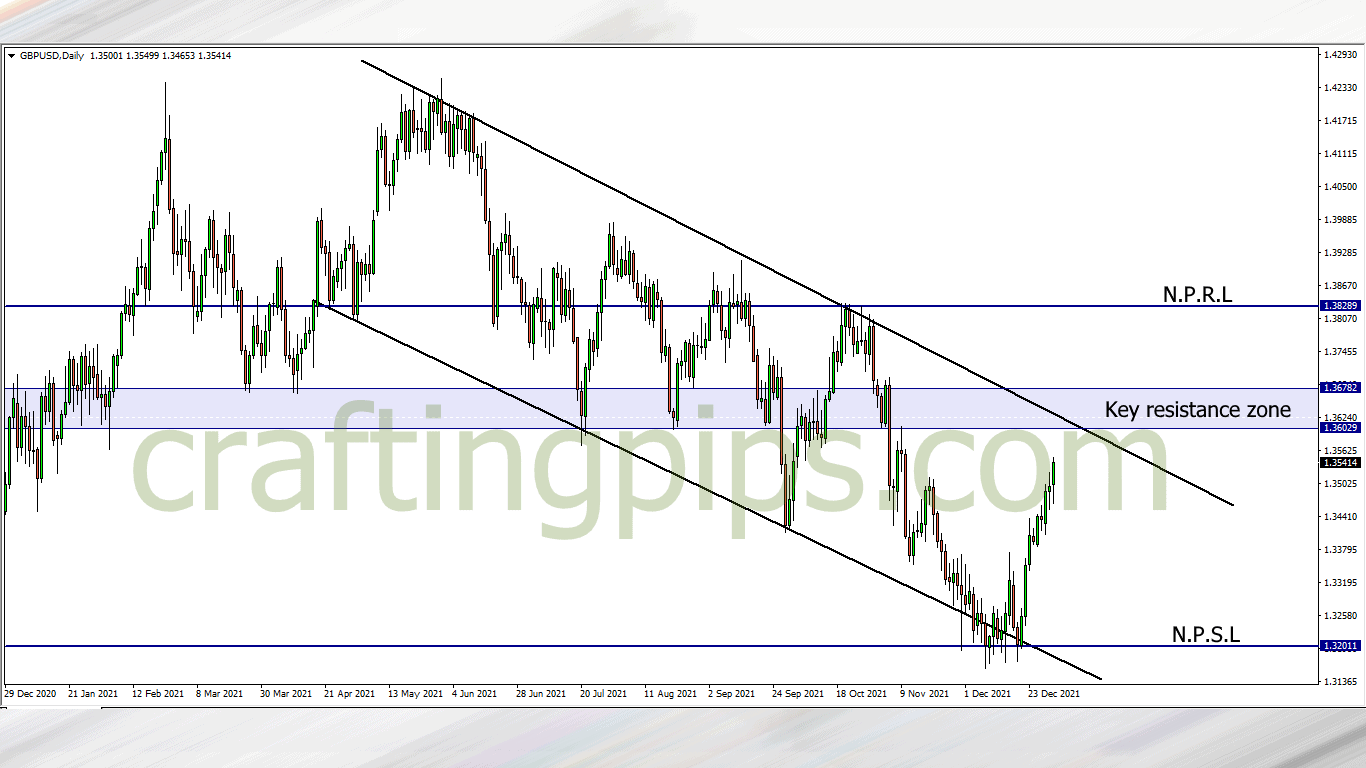

1. GBP/USD

On the GBP/USD, price is on its way to a key resistance zone.

This trade may take a while to materialize as its on the daily time frame. If the key resistance zone is strong enough, then price may get rejected and we may see price revisit support level 1.32011.

If the bulls are ambitious enough and break the key resistance zone, then following the buyers to resistance level 1.38289 won’t be a bad idea

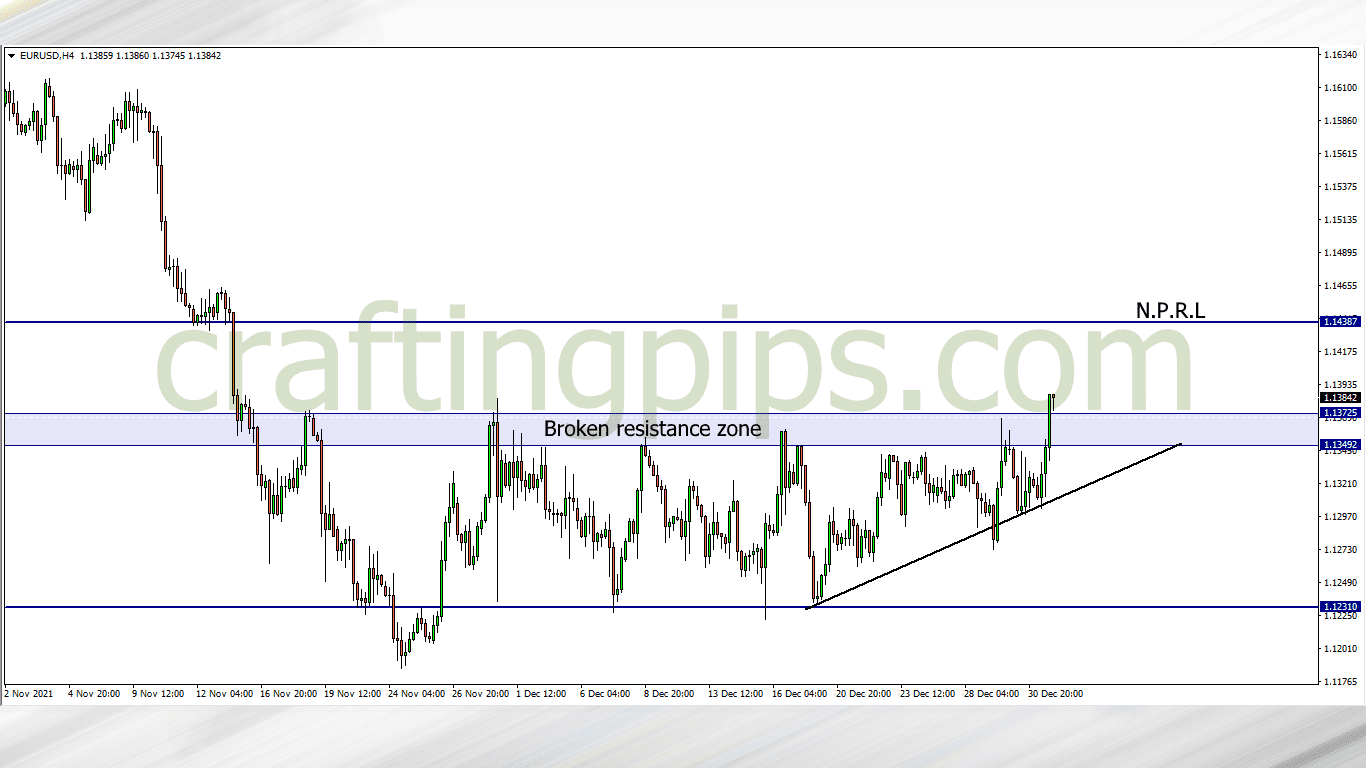

2. EUR/USD

Since last year, the EUR/USD has steadily formed higher lows in an attempt to break a key resistance zone that has held since November last year.

Judging from the strong bullish breakout of price that happened last week, this week we may most likely see price continue its bullish run to the next possible resistance level 1.14387

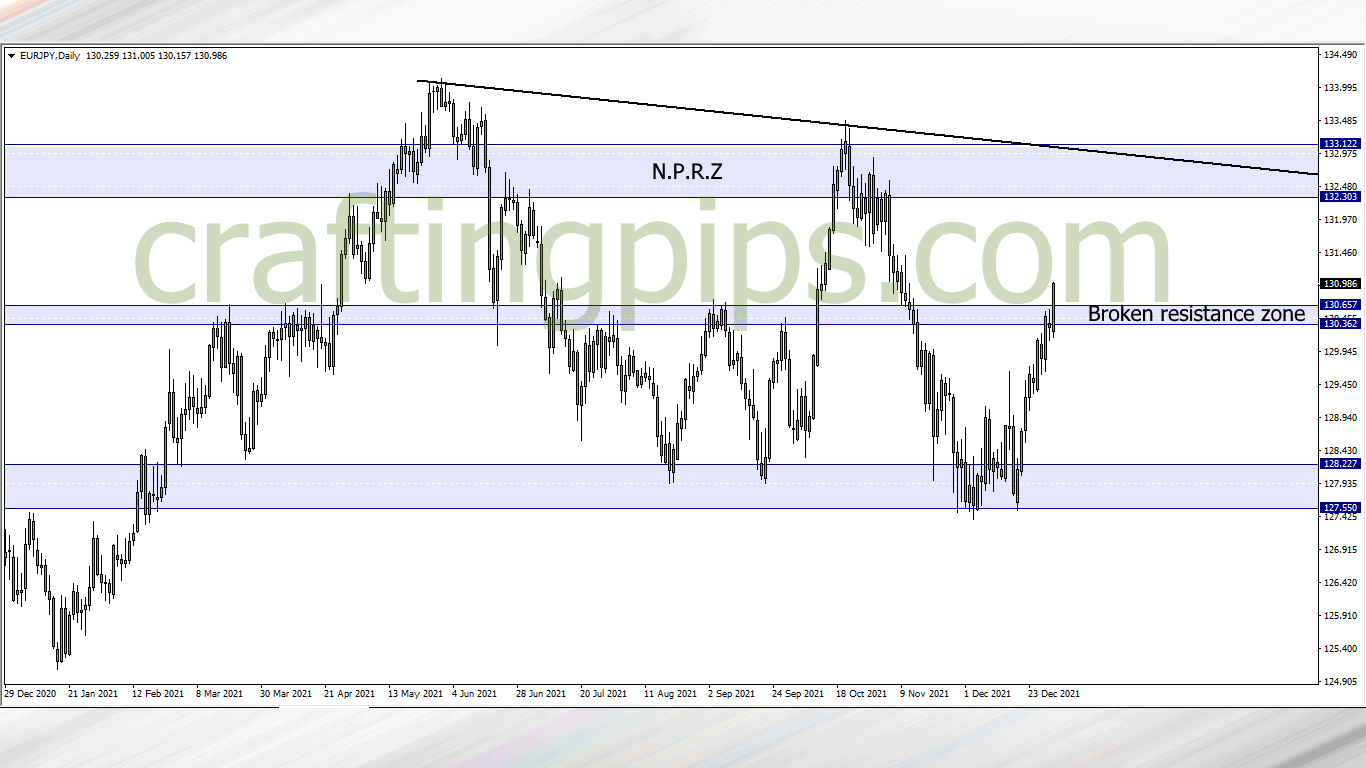

3. EUR/JPY

We can see another decent breakout on the EUR/JPY.

In my opinion, all we should be hunting for this week should be big fat strong bulls which will most likely drag price to the next possible resistance zone

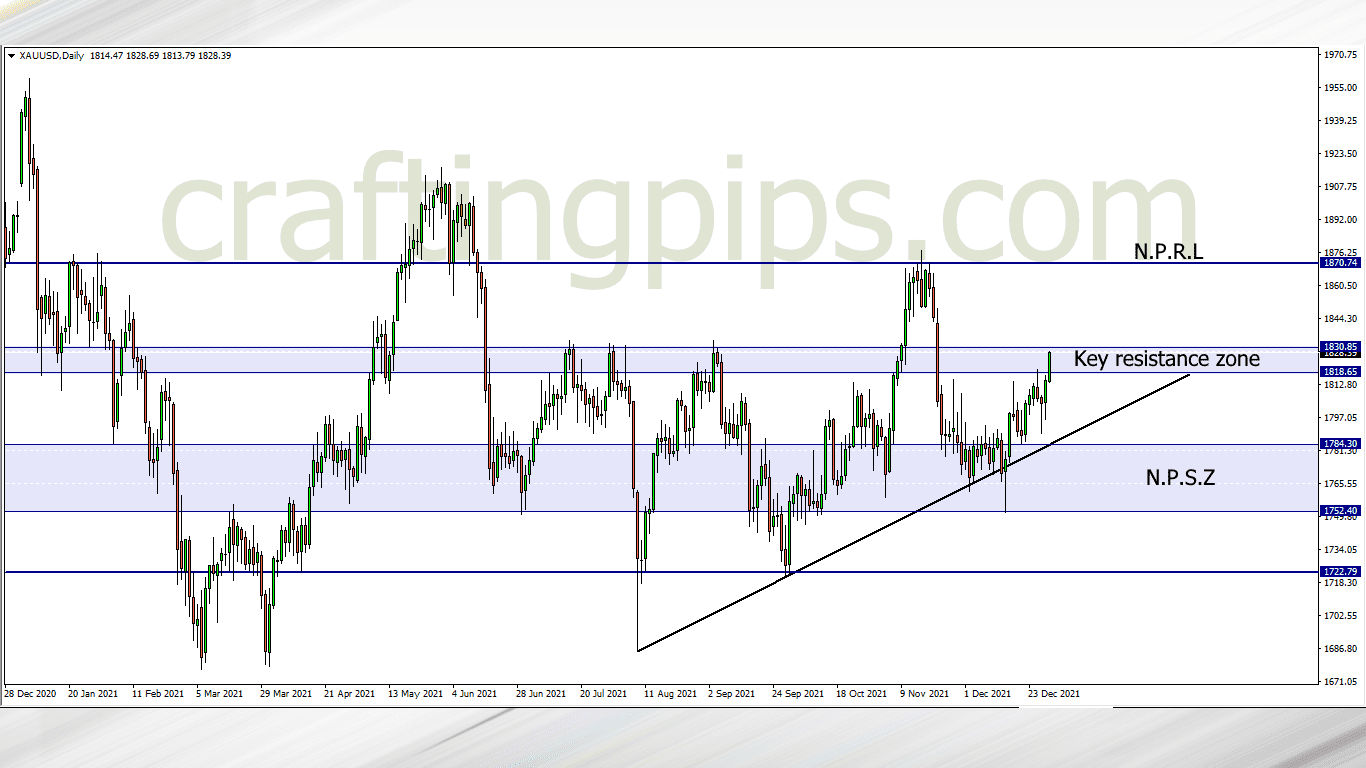

4. XAU/USD (GOLD)

Gold has an interesting setup we should be watching out for.

Higher lows have been quite consistent on the daily time frame, and a key resistance zone is about getting tested this week.

This week, if we do get a breakout confirming that the bulls rule, then we will ride to the next possible resistance level (1870.74)

What say you?

For those who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters