Hello traders,

It’s 4 days before Xmas. Most traders have wrapped up for the year and liquidity may be very low in the market.

That said, I will share my view on some pairs. If a miracle happens and we do get some liquidity, we may smile to the bank before Xmas.

More importantly, this week will be my last of week of trading (if at all). I will be enjoying this magical holiday season with family and friends, so my analysis of the market will be scanty.

That said, let’s see what the market has for us.

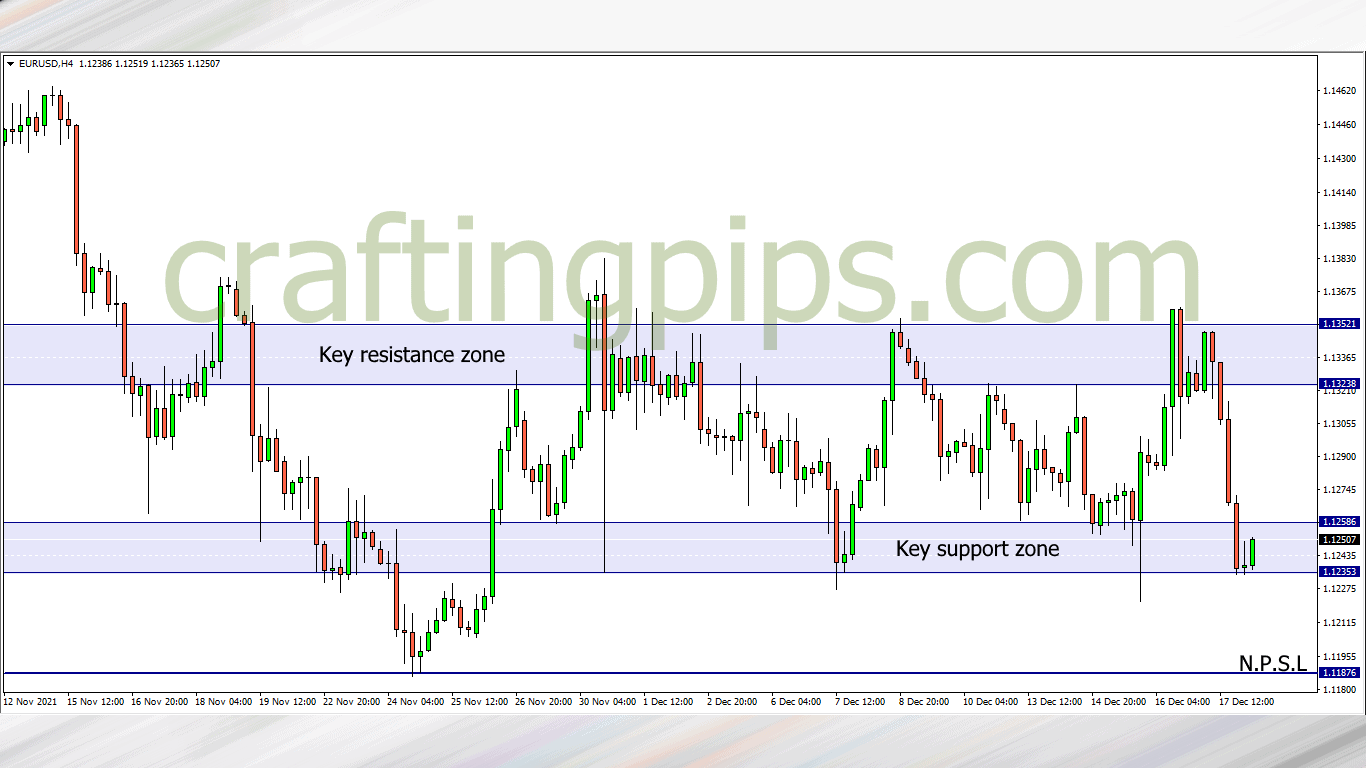

1. EUR/USD

The bears ruled the market last week on the EUR/USD. Price is currently resting within a key support zone.

My bias is that price may most likely continue its downward movement to support level 1.11876 this week. However, if price gives us a convincing reversal setup, then we may see price return to resistance level 1.13238.

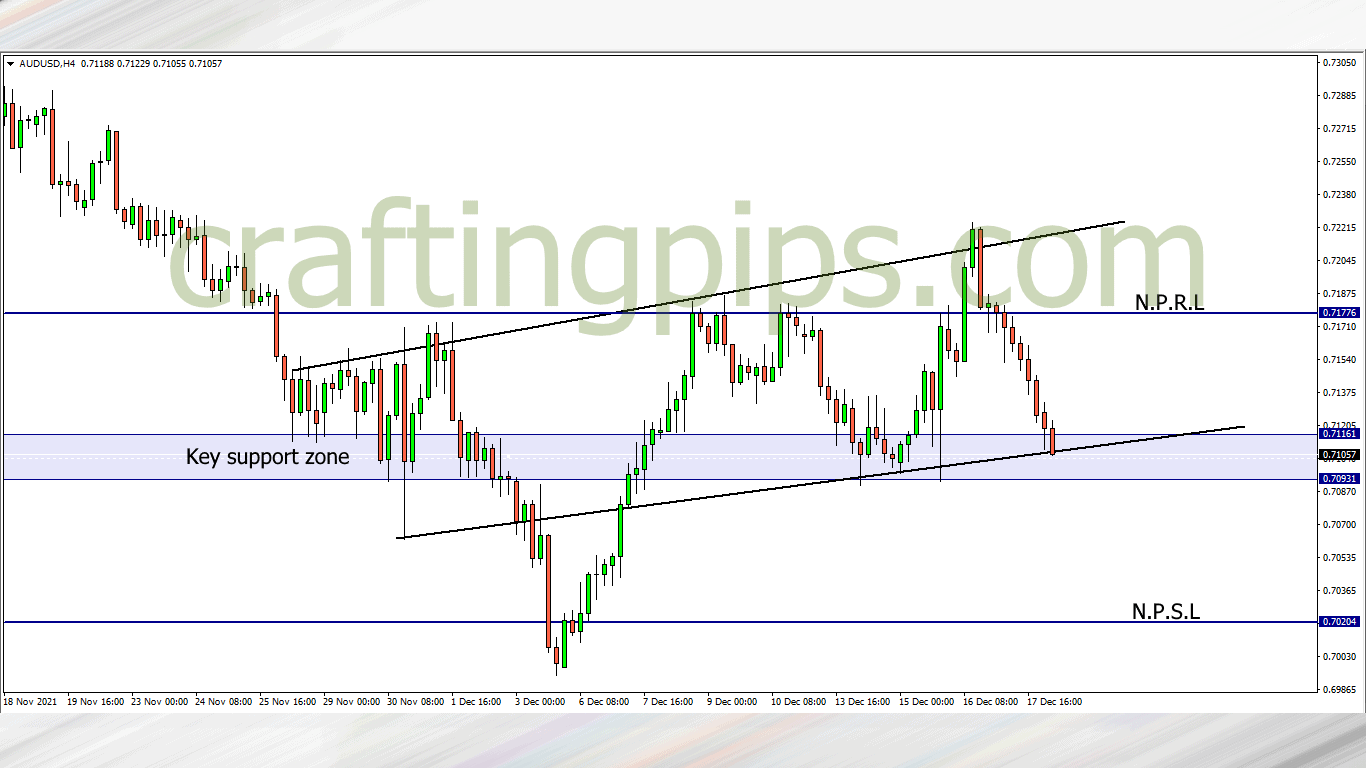

2. AUD/USD

We can see an ascending channel on the AUD/USD.

A breakout of the key support zone, and price may most likely hit the next possible support level (0.70204).

If we do get a reversal of price and a strong buy confirmation, then resistance level 0.71776 may be our next target.

My bias is that price will break the key support zone and most likely hit 0.70204

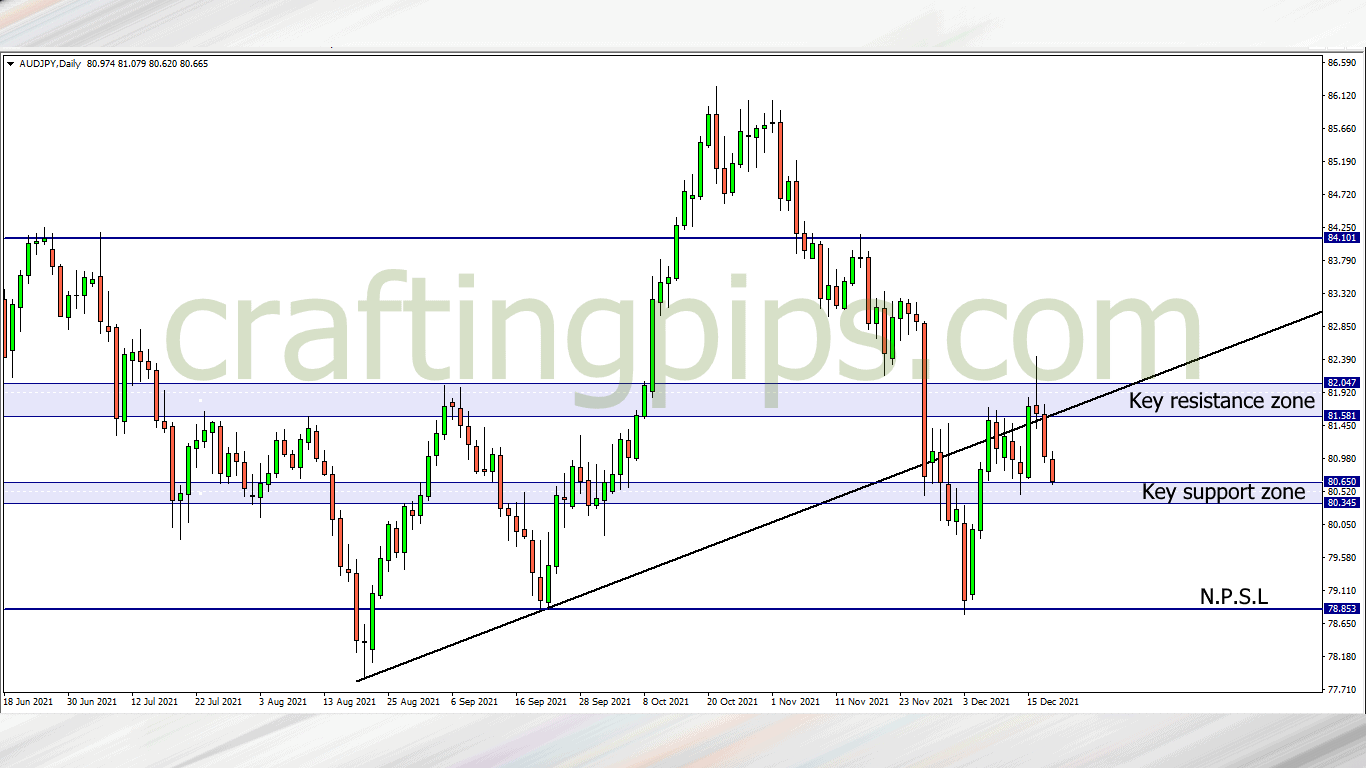

3. AUD/JPY

Price on the daily time frame of the AUD/JPY has been ranging between a key resistance zone and key support zone.

Price on the daily time frame of the AUD/JPY has been ranging between a key resistance zone and key support zone.

I will be waiting for price to break the key support level before joining the sellers, and probably ride the breakout to the next possible support level (78.853)

However, if price continues to range, and gives us a good reversal setup, then 81.581 will be our next target

What say you?

For those who are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters