Do you think there is?

After all, most of the things we learn while growing up, tends to hover around a universal or culturally accepted norm or procedure.

Let’s take the sit belt of a car for instance. There is a universally accepted way of wearing it, what I am trying to say is, no one wears a sit belt round their neck.

So also is wearing our pants. I mean, no one wears his pants on their head.

Or do you?

A cultural norm also dictates how you cook your porridge or how you decide to dress up. Each of these actions is characterized by cultural values.

Talking about trading, there should be a universal, or culturally accepted rule when placing a stop loss order.

What say you?

For clarity sake, let us start by defining what a stop loss order is.

First definition:

A stop loss order is an order placed with a broker to sell a security when it reaches a certain price.

Stop loss order are designed to limit an investors loss on a position in a security.

For those who are confused by the technicality of the first definition

Here is the

Second definition:

A stop loss order is the amount of money you are willing to lose, if a trade you place in the market, goes bad.

A stop loss order is sometimes called: “Cost of running a business” among traders.

Let us use a business as an analogy to further buttress what a stop loss order means.

You would agree with me that in running any business, there is a certain amount of money you set aside for monthly reoccurring expenses

Such as:

- Salaries

- Rent

- lighting etc

Aha…, I can see your eyes sparkle with that understanding only the gods posses.

That is what a stop loss order is to forex traders

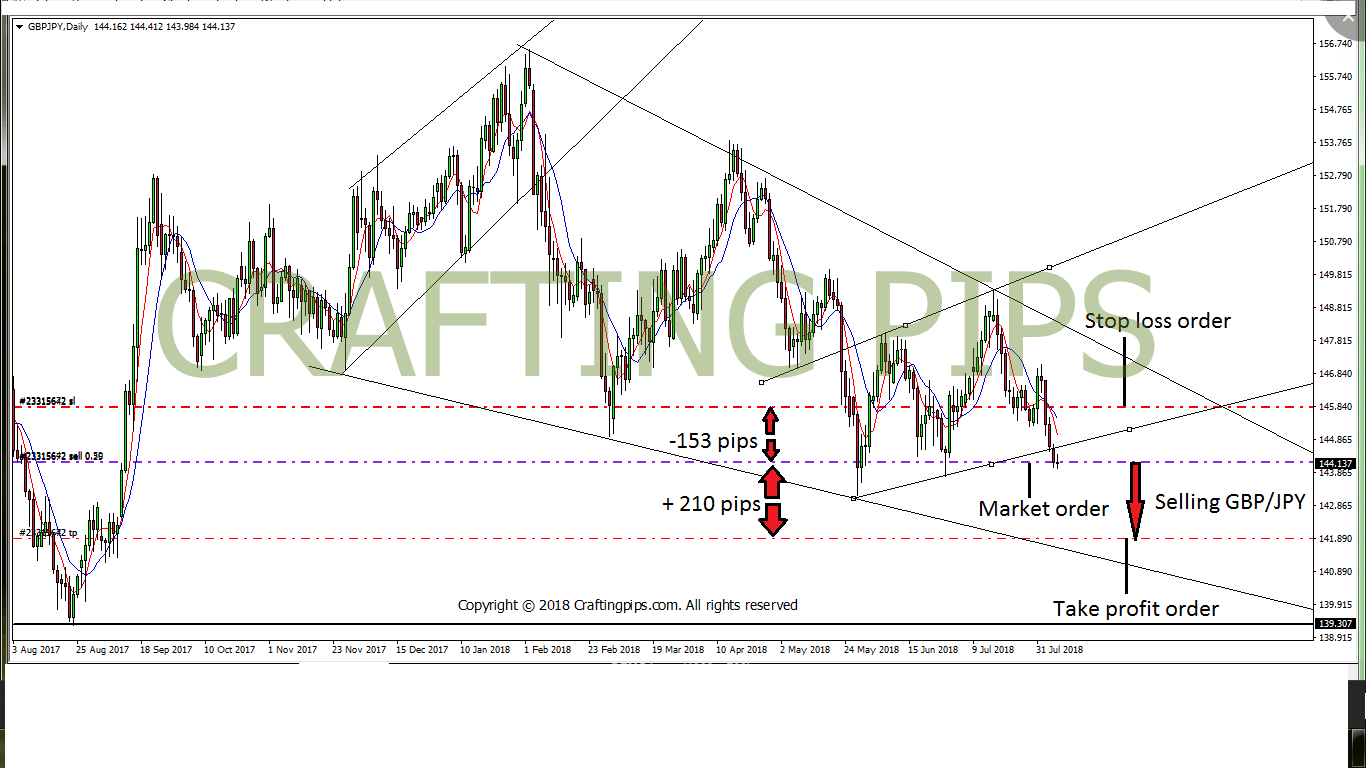

In forex trading, a stop loss order is represented as seen in the diagram below.

Market Order: This is the price you click on buy or sell (In the chart above I sold GBP/JPY)

Take Profit Order: This is an agreed price you decide to take profits after placing a trade (In the chart above, take profit order is approximately +210 pips away from the market order)

Stop Loss Order: This is an agreed price you decide to exit a trade if the market goes against you, also known as “cost of running a business“. (In the chart above, my stop loss order is approximately -153 pips)

NOTE: One of the key ingredient to becoming a bad ass trader, is knowing how to apply your stop loss on trades.

Well,

That settled, I will show you a technique I use in applying stop loss orders to my trades.

So, let’s begin

I use two types of stop loss orders:

- The psychological stop loss order

- The real stop loss order

1. The psychological stop loss

My psychological stop loss order is defined as that negative price a bad trade assumes before I manually close the trade.

Mind you, such a trade is not terminated by the STOP LOSS ORDER I initially placed when taking the trade.

Let me explain further

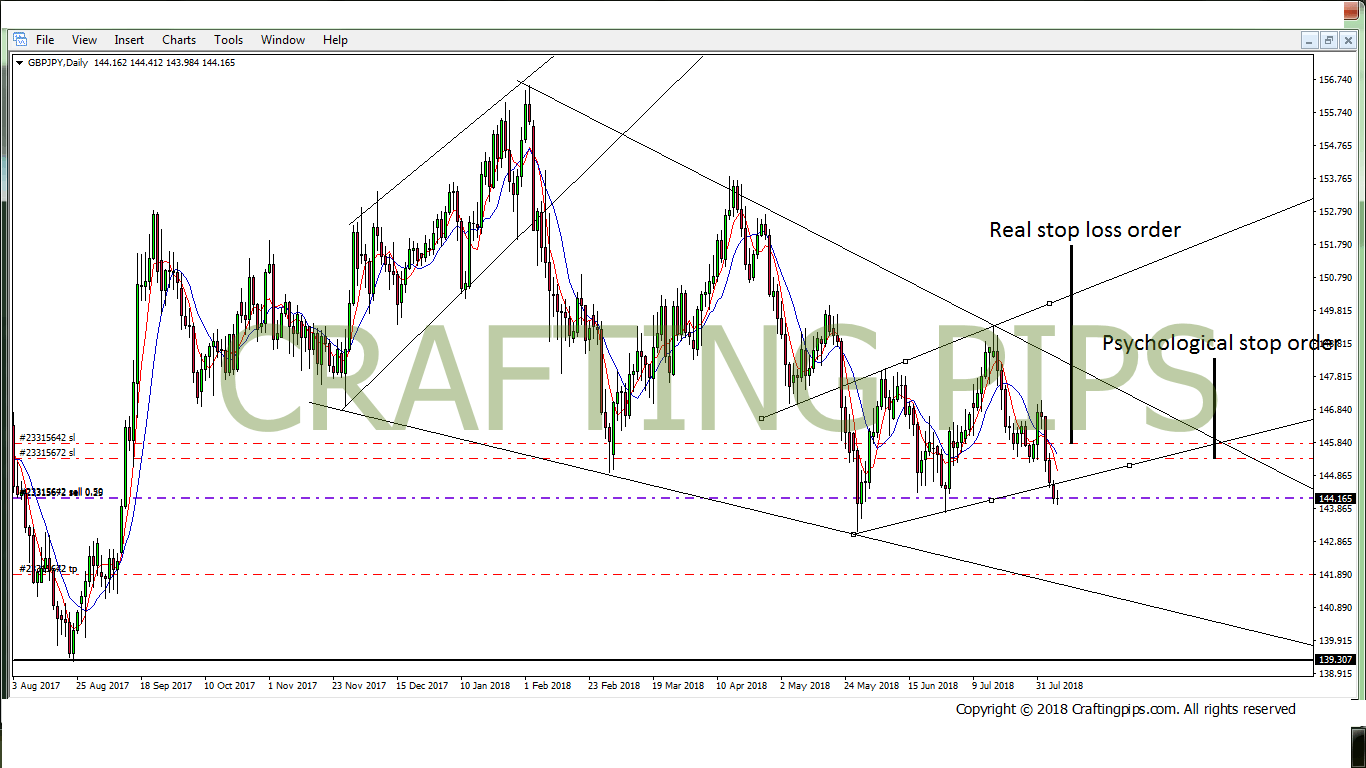

NOTE: The psychological stop order on the chart above was drawn in order to illustrate where I would exit a trade when it goes against me (in real sense,the psychological line is imaginary, it was only drawn in the chart for illustration purposes).

Now I know the next question in your mind is:

How and what determines a psychological stop loss order in a trade?

Beautiful question.

The answer to that question is:

When in a trade, and you notice that the last candlestick formed after you click on buy or sell, has it’s REAL BODY close above or below a support or resistance level.

The candlestick imprinted in such a scenario, most likely signifies a bullish or bearish reversal. Other times, it may signify a major pullback which may hit your stop loss

Hmmm… I know you are still looking lost, let me explain using a charts.

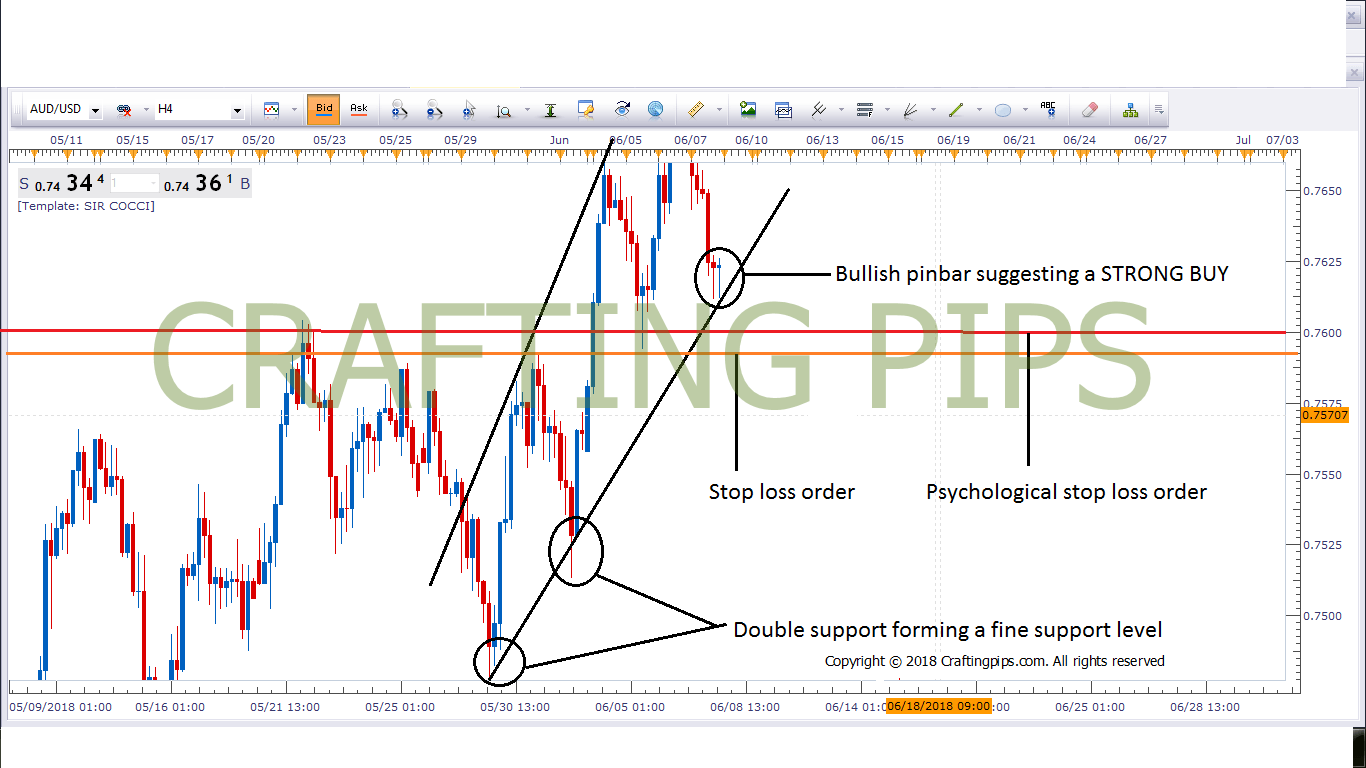

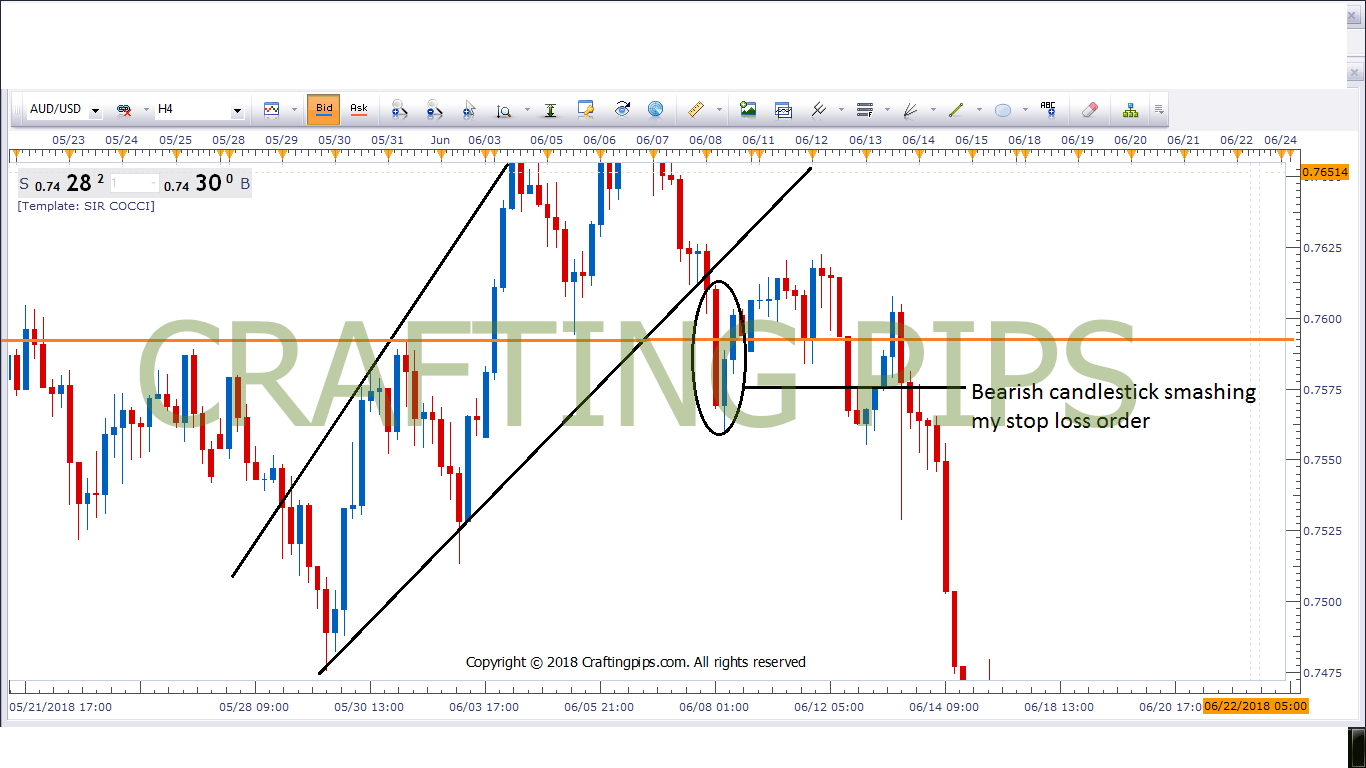

CHART 1

Let us assume that I bought AUD/USD, and my reason (which almost always is) for doing so is because of the double bullish pin bar candlesticks which was formed at a key support level along a trend.

Mind you, my stop loss order (orange line) is already fixed a few pips below my psychological stop loss order (red line across 0.7600)

At this point I am smiling to myself, counting another good trade on my trading journal.

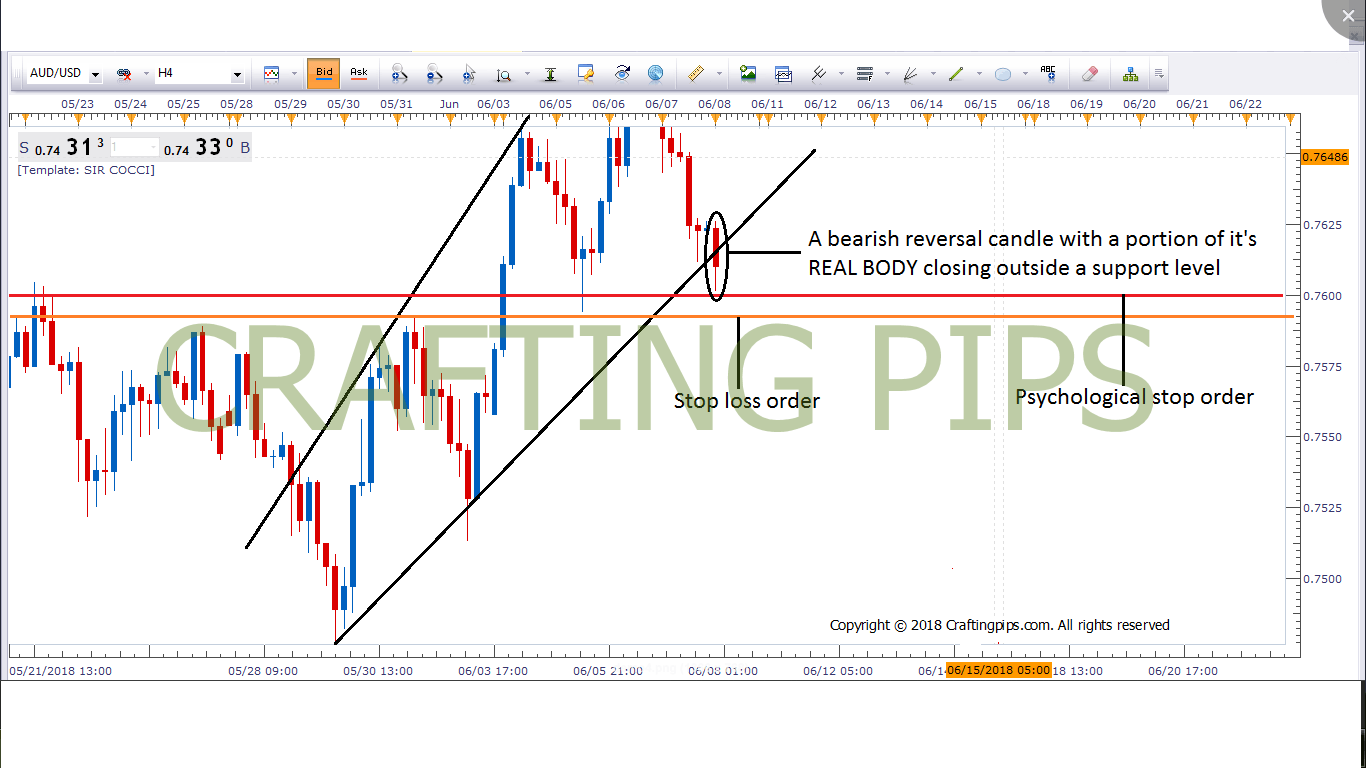

CHART 2

Woooow…

The next candlestick falls below the key support level I drew, and the bad part is, a portion of the candle’s real body has been imprinted across the support.

Am I sad?…

hell yeah, but I don’t take it too hard on myself, remember, its called the running cost of a business.

So my next line of action is to get off the trade since my psychological stop loss order has been triggered.

CHART 3

Wallaaaaaa….

If I were still on that trade, my stop loss order would have been hit by a bearish candlestick.

That said, let us closely look at the pros and cons of this technique

Merits of a psychological stop loss

- It prevents your psychological trading tank from draining out

If you are a trader, and are going through a losing streak (which happens every ones in a while), trust me, this techniques prevents your psychological trading tank from draining out very fast.

In trading, it is much more dangerous losing your psychological advantage over the market compared to losing a huge sum of your trading capital to the market.

Your trading capital can easily be built back with the right psychology, however your trading psychology takes a while to replenish, after a series of bad trades.

- It saves you time, as you don’t have to necessarily wait till a trade hits your stop loss before moving on to another trade.

Some bad trades have a habit of dragging endlessly. They may stalk a particular level or form a consolidation, before finally hitting your stop loss.

The psychological stop loss order filters this problem, hence giving you more time to absorb the shock of a loss before going into another trade.

- It gives you the flexibility of managing more trades over a period of time.

Assuming I had a trading rule of not risking more than 3% of my trading account on a particular trade, and I take a 2% risk on a trade which turned bad.

Instead of waiting for a period of 24/48 hours for a trade to hit my stop loss, I could stop the trade manually once it hits my psychological level. This would give me more hours to recover before going for my next trade.

- It helps to greatly minimize the effect of compounding losses in your trading account.

For instance,

If you placed a stop loss order at -100 pips on a particular trade, and you risked -2% of your total account, it won’t be a bad idea if your psychological stop loss was -85 pips and total risk on trading account was -1.5%.

I don’t know about you, but losing -1.5% of my total account is by far better than losing the original -2% I set my stop loss on

There is no doubt that a trader who can manage a psychological stop loss properly, will have lesser stop loss hits in his trading account overall.

Let us give an illustration, by using my personal two good friends: Mr. Kola and Mr. John

Assuming both traders risk 2% per trade, but Mr. Kola operates with the psychological stop loss order technique, while Mr. John doesn’t.

| KOLA | JOHN |

| -1.8 | -2.0 |

| -1.6 | -2.0 |

| -1.8 | -2.0 |

| TOTAL LOSS | TOTAL LOSS |

| -5.2% | -6% |

Mr. John had an accumulative loss of -0.8% more than Mr. Kola on just 3 trades. When judging the same scenario using an entire month, Kola would definitely have lesser losses compared to John.

Alright guys, before we start smiling to ourselves, about this new discovery, let us all agree on something

Every skill acquired, has it’s own lapses.

This brings us to the merits and demerits of the psychological stop order.

Demerits of a psychological stop loss

- You could ruin your chances of turning a loss into a win.

This happens to me close to 45% of the time. You could psychologically exit your trade, and just then, the gods of forex trading decides to mock you by reversing the trade a few pips away from your your stop loss.

You now get to witness price, dancing to Davido’s skelewu, as it slowly moves towards your target profit.

Its FREAKING PAINFUL buddy.

- Baby siting your trades in order to psychologically exit bad trades could take a huge toll on you as a trader.

It is not an easy task checking you trades more often than usual, it may ruin your social activities for the entire day.

Imagine ruining your lunch date with bae, after flicking through your trading app, only to discover that your trading position is forming a consolidation, and you have been on -60 pips for close to 4 hours.

Anything bae says at that point may sound offensive.

Ponder over that.

2. The Real stop loss order

The only difference between the way I apply my stop loss order and how some others do, is:

I tend to give a decent distance between the market order and my stop loss order, so that the market has enough room to dance as it moves through its path.

Like I always say,

The continuous battle between the bulls and the bears rarely allows the market to move in a straight line, hence the market’s back and forth pendulum-like movement. For this reason, it is never advisable for a spectator of this game to stay too close to the ring, lest they are ready to flee or face the repercussions of an accidental blow.

Fillipo Saga.

A quote that clearly warns us to keep a decent distance from the heat of the action when placing stop loss orders.

Someone is asking,

how far, is too far and how close is too close in placing a stop loss on a trade?.

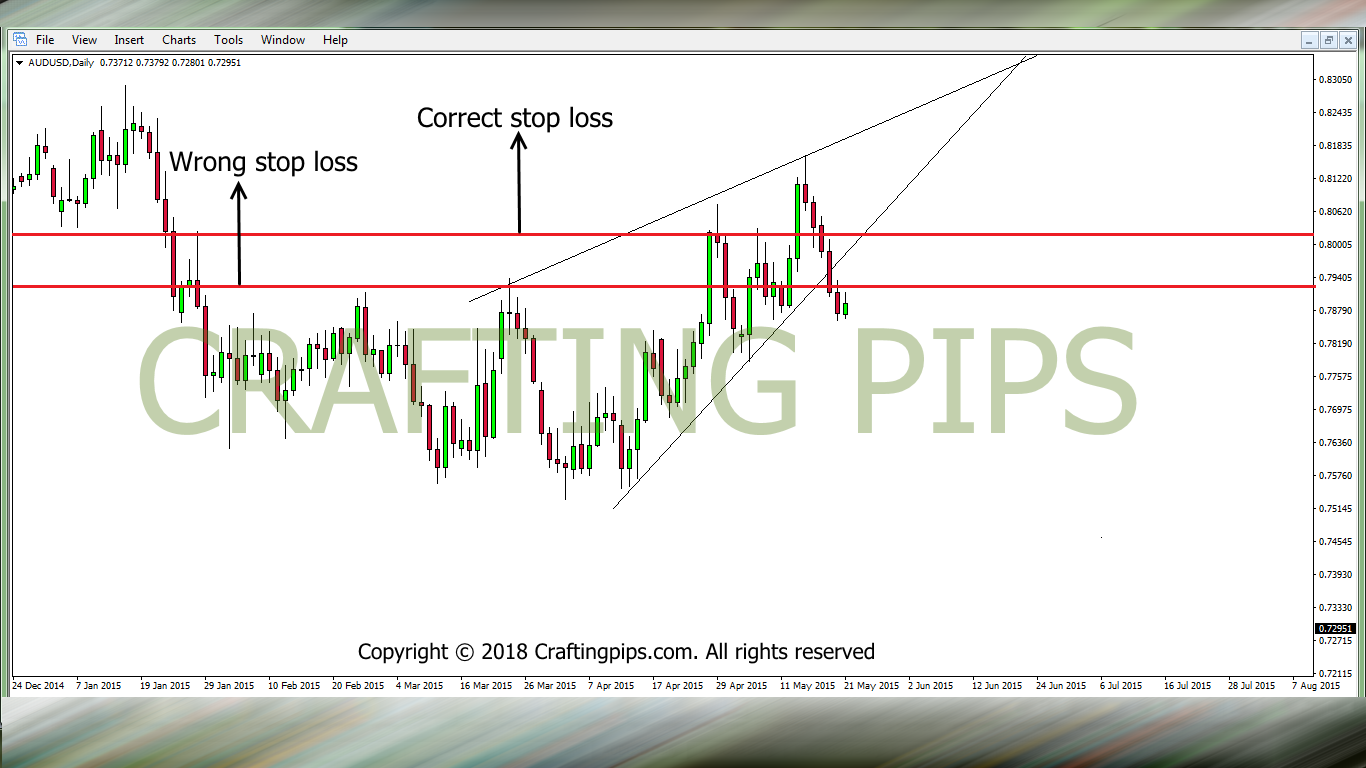

Let’s get back to the charts my friends.

CHART 1

The wrongly placed stop loss was clearly placed by a greedy trader, wanting to observe the bout between the bulls and the bears from a VIP sit, right in front of the ring.

While the correctly placed stop loss order is from a trader who has learnt his lessons over the years.

Let’s see what happens on the second chart.

CHART 2

On this chart, the greedy trader may either have sustained a bad gash or ran away with a few scrapes to his knees. Either way, he is out of the trade

Meanwhile the experienced trader is still riding the trade, he is rarely bothered about the market’s pullback.

From the charts above, it is obvious that placing tight stop loss’s is not just risky, but it also does not allow enough room for the placement of a psychological stop loss we earlier discussed about.

On a final note:

Applying such a technique to your trades require a great level of discipline and skill in reading candlesticks formation and psychology. If you are going to apply this craft to your trading, I would advice you practice and perfect it on a demo account first.

That said, let me know if this information helped you in anyway, your contributions will also be appreciated