Hello traders,

I have got some interesting setups lined up, let’s hit the charts.

1. USD/CHF

This is the first time price has broken the resistance level 0.92331 in almost 3 months. The last time price broke this same level, was September 2020.

If we do get an additional bullish confirmation, price may hit the next possible resistance level before the close of the market this week.

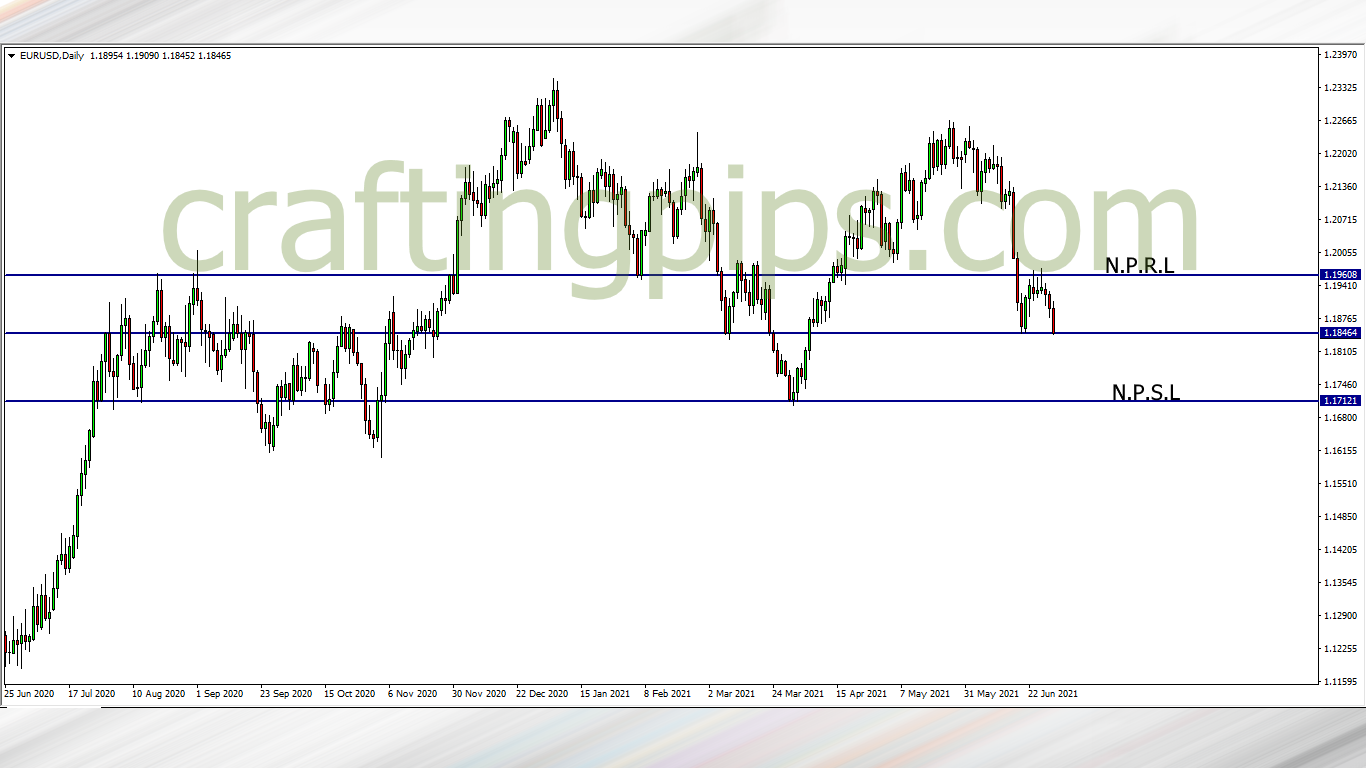

2. EUR/USD

The EUR/USD has given us a double bottom.

In my opinion, the selling pressure high, but price may respect the current support level (1.18464) by bouncing back to resistance level 1.18818, or probably just forming a consolidation on the current support level before the bears possibly take over.

If we do get a bearish confirmation, price next bus stop will most likely be 1.17930

3. GBP/USD

Another double bottom sighted on GBP/USD.

We may most likely see price react to support level 1.37983 by bouncing back to resistance level 1.38729

If price then breaks the 1.38729 resistance level, then we could see the bulls take over and price may continue its way up to the next possible resistance level 1.39344

Another point to note is:

If price breaks the current support level, the next possible support level will most likely be 1.37076

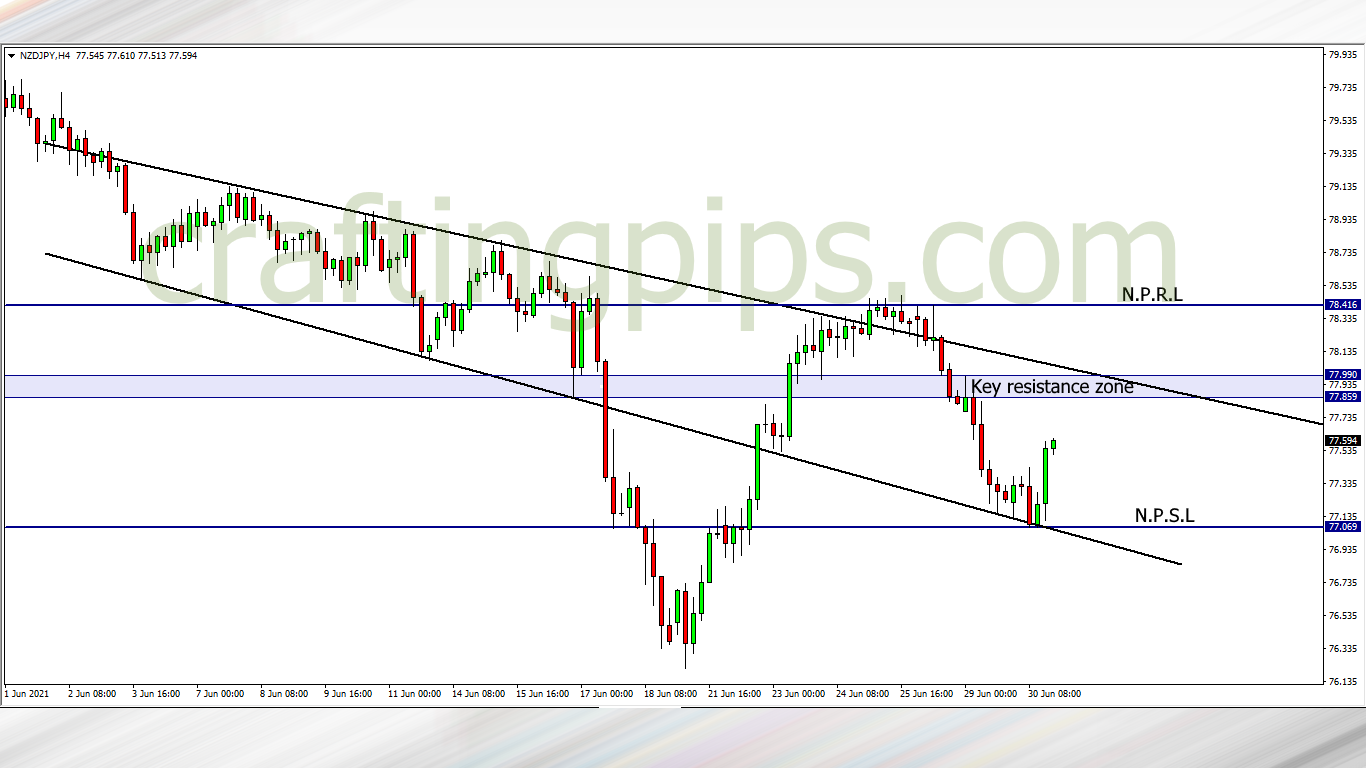

4. NZD/JPY

NZD/JPY spent the better part of the day bouncing off support level 77.069

A place to watch out for is the key resistance zone. If the bulls show any signs of weakness, we should be looking out for a reversal, and price possibly returning to support level 77.069

If price breaks the resistance zone, then the bulls may be further encouraged to take price to 78.416

What say you?

ATTENTION:

For those who are interested in joining our FREE trading group on Telegram, where trade ideas are discussed, which may assist your trading career while being infected by positive vibes

Smash the link: https://t.me/joinchat/FN30PxlwXbk2BcuTDdH5yg

[newsletter_form type=”minimal”