Hello Traders,

Let’s see what the market has for us.

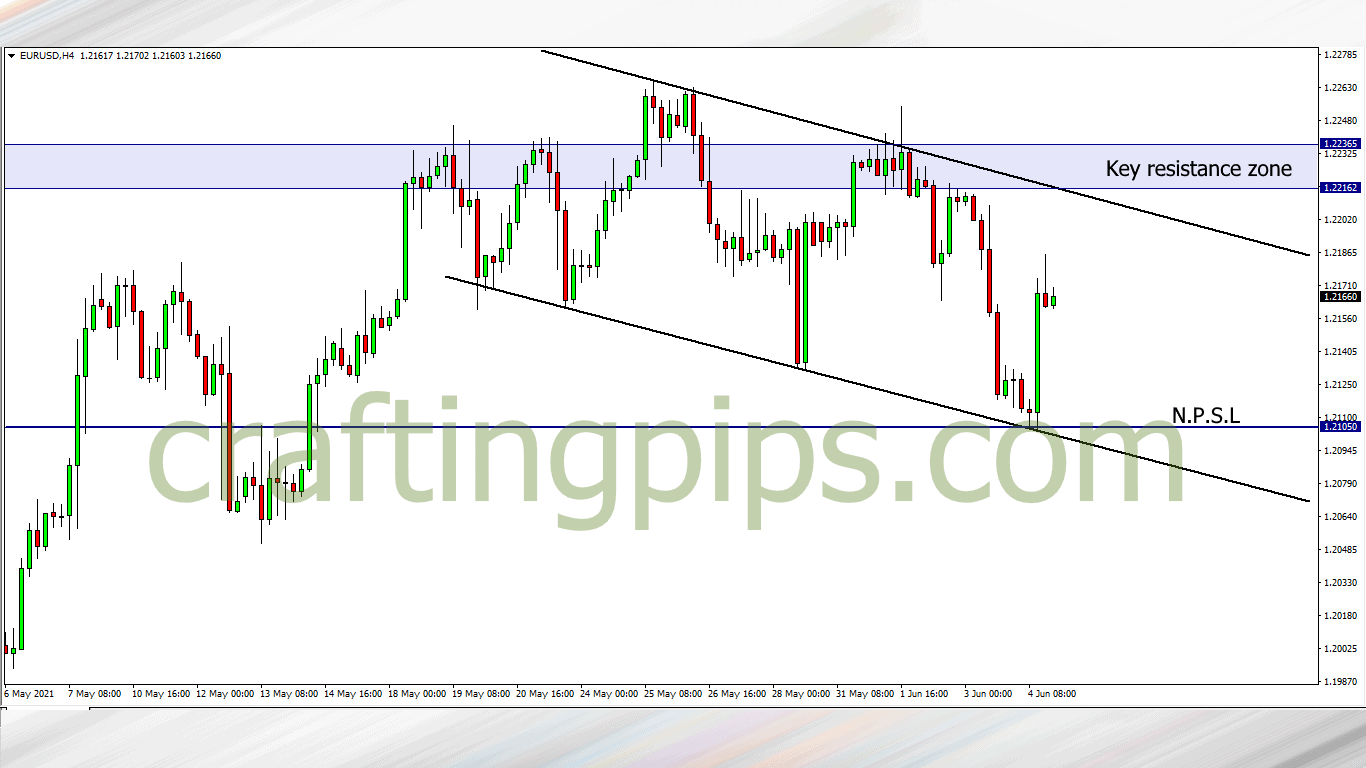

1. EUR/USD

On the 4 hour time frame we can see EUR/USD has formed a descending channel. One thing we should note is the strong resistance zone.

The best place to trade this setup is waiting for price to reach the key resistance zone and wait to see if price would show any confirmations for a reversal or breakout

A breakout through the key resistance zone would mean price re-visiting resistance level 1.22628, and a reversal means price possibly reaching support level 1.21050

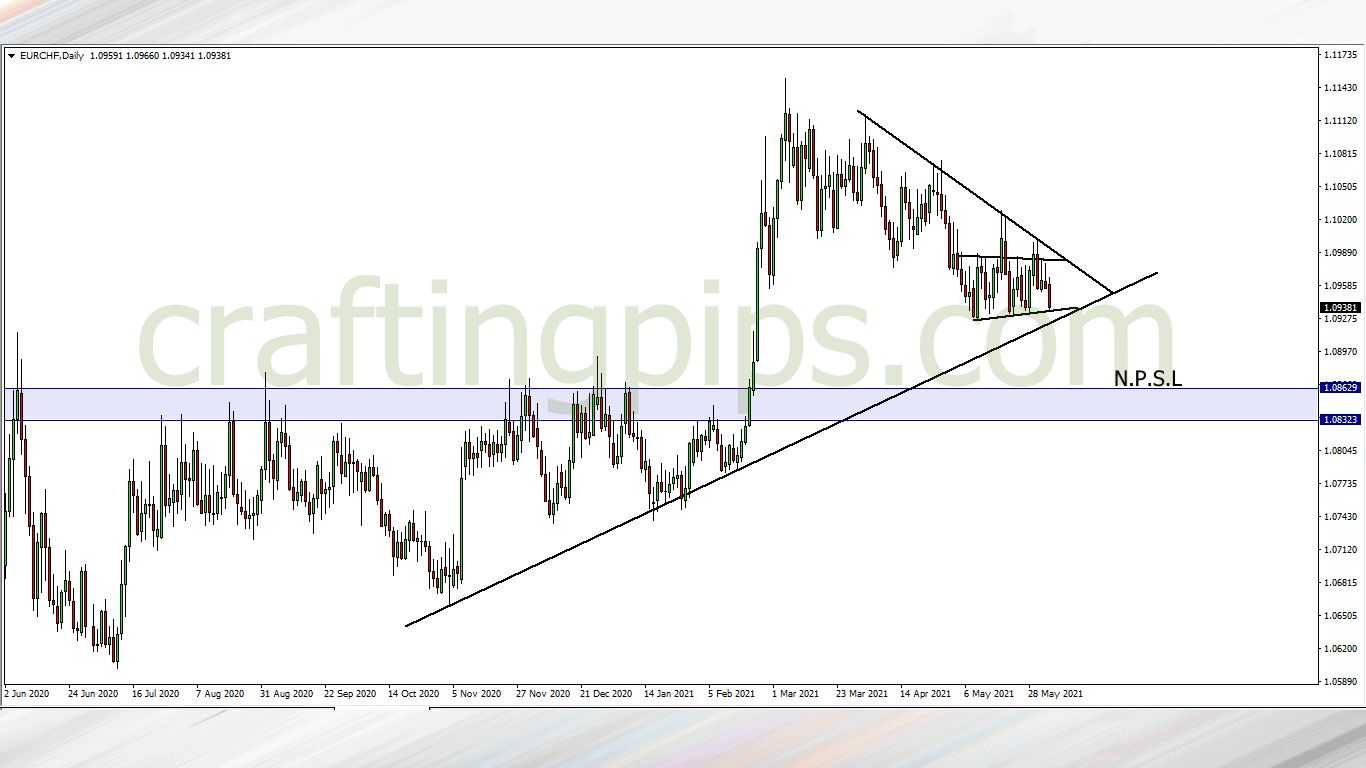

2. EUR/CHF

On the daily time frame the EUR/CHF is looking pretty.

We can see strong consolidation of price around the key support level 1.09306. The up and down movement within the smaller ascending channel may linger for a while.

However, if we do get a bearish breakout of the current support level, we may see price visit 1.08629.

So, it’s a waiting game for us, except we want to risk trading the smaller ascending channel, which currently is on a good level to buy, all that may be needed is an additional bullish confirmation.

3. XAU/USD (GOLD)

On the daily time frame we can see gold closing last week with a strong bullish candlestick.

Meaning we are likely to see price hit the previous high (1909.41). But the real question here is what happens next after price hits 1909.41?

Well, in my opinion, we may see price break the 1909.41 resistance level “IF” the bulls are rugged enough. This means price next bus stop would be 1957.74.

Let’s not also be in a hurry to make any bullish assumptions here. We need adequate bullish confirmation before we stake our hard-earned cash.

What say you?

ATTENTION:

For those who are interested in joining our FREE trading group on Telegram, where trade ideas are discussed, which may assist your trading career while being infected by positive vibes

Smash the link: https://t.me/joinchat/FN30PxlwXbk2BcuTDdH5yg

[newsletter_form type=”minimal”