Hello Traders,

It’s almost mid-week ladies and gentlemen, let’s see what the market has for us

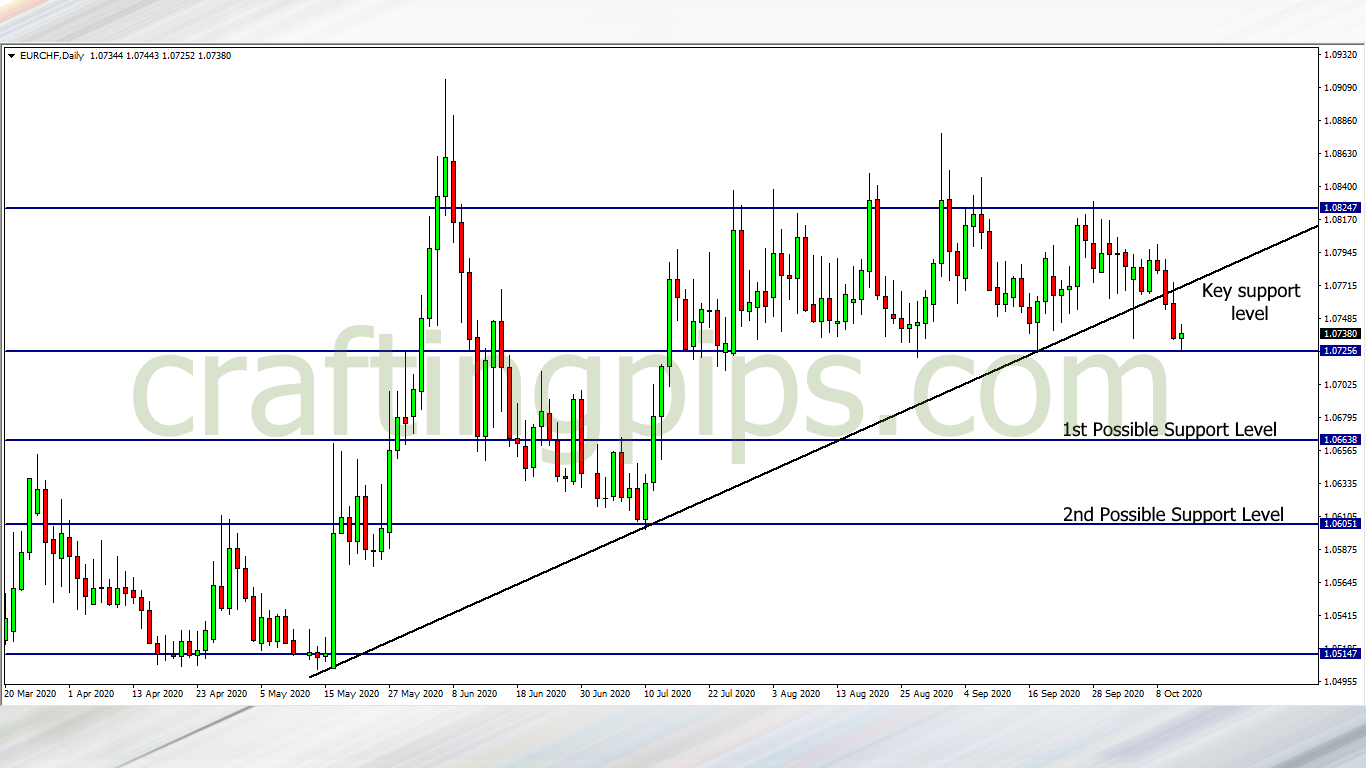

1. EUR/CHF

On the EUR/CHF, support level 1.07256 has held for over 4 months now

Presently we can see price breaking out of the ascending trendline, but still respecting the 1.07256 support level.

Personally, I believe price may restest resistance level 1.07639, before a possible breakout of support level 1.07256

Which may further encourage the bears to take price to the next possible support level (1.06638).

If the bears are strong enough, after hitting support level 1.06638, price may continue to drop, hence hitting the second possible support level.

2. AUD/JPY

The AUD/JPY is already showing signs of a weakening support level (75.547)

If the close of the 10 pm candlestick supports our view, we could see price fall to the first support level (74.941)

If 74.941 isn’t a strong support level when price hits it, we may see price continue its bearish journey to the next possible support level (73.996)

3. XAU/USD (GOLD)

Overall, Gold has a bearish outlook, but do not let this metal deceive you with its antics.

There is a possibility that gold could break support level 1887.74 and hit the next support level (1874.42).

But again we should also watch out for how price reacts around resistance level 1897.79. If we do get a breakout, there could be a possibility for a short buy to the next possible resistance level (1911.81)

However, if resistance level 1897.79 stands strong and price reverses, there would be a higher possibility of price breaking out of support level 1887.74, and hitting 1874.42 as the next possible support level

What do you think?

ATTENTION: For those who are interested in joining our FREE trading group on Telegram, where trade ideas are discussed, which may assist your trading career while being infected by positive vibes

Smash the link: https://t.me/joinchat/FN30PxlwXbk2BcuTDdH5yg