Hello Traders,

How has your weekend been?

It’s been great over here.

Gearing up for another trading week always gives me so much excitement.

Not necessarily because there is money to be made… No, far from that.

The excitement is mostly about playing my own role in the financial market.

Being able to analyze the market alongside millions of other skilled traders and the trill of my analysis hitting their target is always exciting. I don’t think I can ever get used to it.

It’s like every Sunday, a trading island opens, where traders walk into.

Each trader heavily equipped and their sole aim is to mess up other traders because that’s the only way they get paid.

So if you are a sniper, you better ensure your sniping game is tight so you don’t get counter snipped.

If your game is stalking on your prey and pouncing on them at the right time…

Oh well, you better make sure your target is not a dummy/trap, set by another trader to lure you out of your hiding.

It’s like going out on a hunting mission every single week, and being smart to trade the market with an edge best know to you

Alrighty, before my imagination takes me farther than I planned on going, let’s hit the charts ladies and gentlemen.

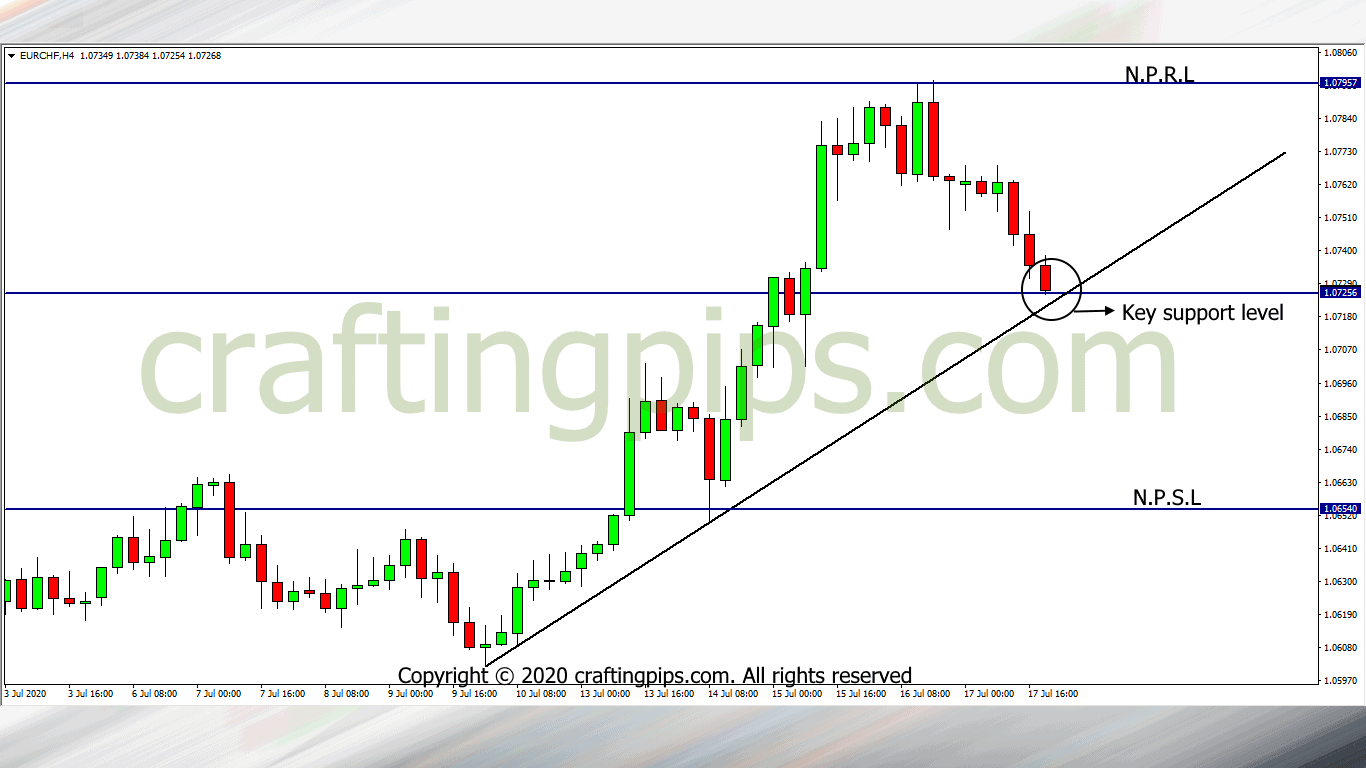

1. EUR/CHF

On the EUR/CHF, resistance level 1.07957 was a hard nut to crack.

This immediately sent a bearish bias message to traders in the market, hence pulling price down to support level 1.07256

Presently price is suspended by an ascending trendline and if the market resumes with a strong bearish sentiment, we could see a bearish breakout, which will most likely encourage price to hit the next possible support level (1.06540)

We should also be mindful, a possible reversal could be lurking at this level. It’s a brand new week and market resetting itself may mean buyers flooding the market and taking price back to resistance level 1.07957

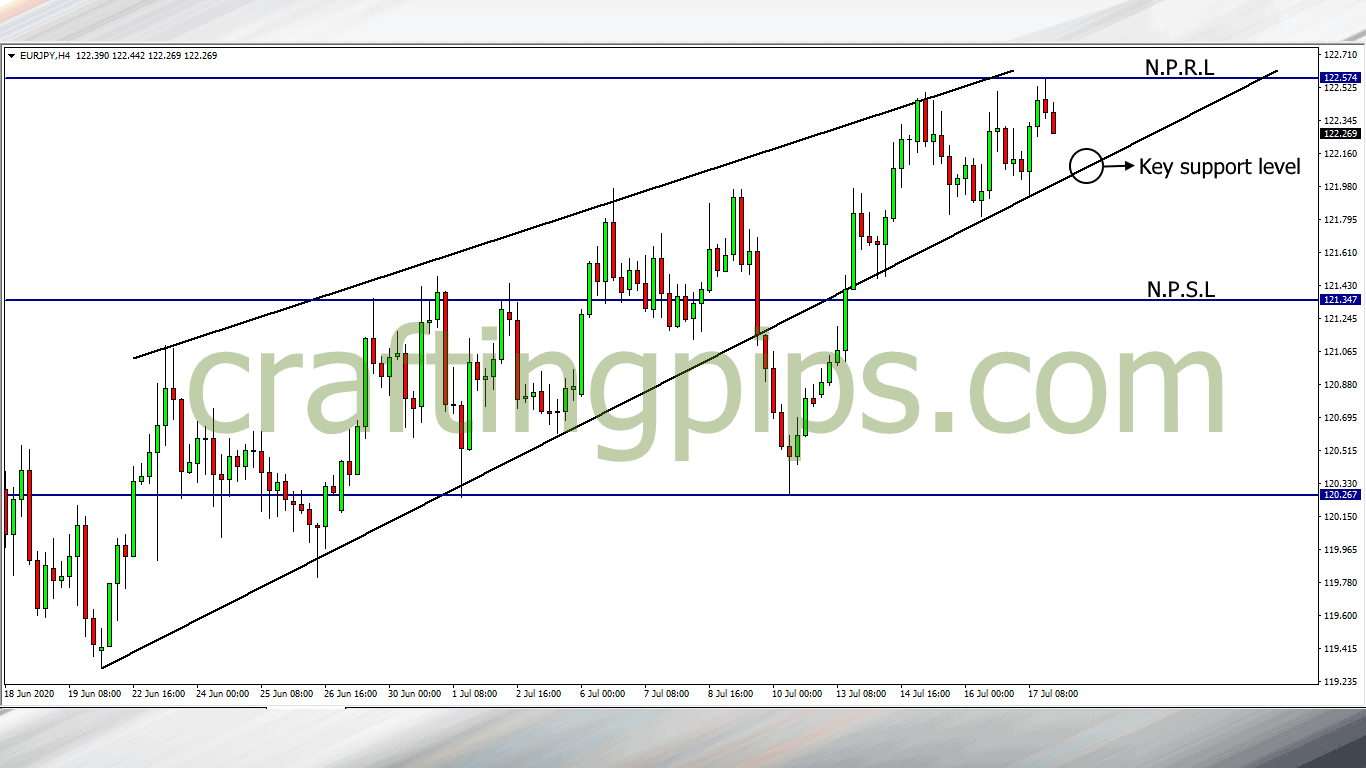

2. EUR/JPY

For some funny reason, the EUR/JPY has always found resistance level 122.574 a difficult level to break.

If you go back in recent history, this level was only broken on the 4th of June, before then, we had a few fakeys.

In my opinion, the narrowing ascending channel we are seeing could be a likely build-up of price to break resistance level 122.574, which will most likely force price to a previous resistance level (123.931)

Also bear in mind that the ascending channel has held price for quite a while now and may be growing weak. A bearish breakout may encourage sellers to further push price to hit support level 121.347

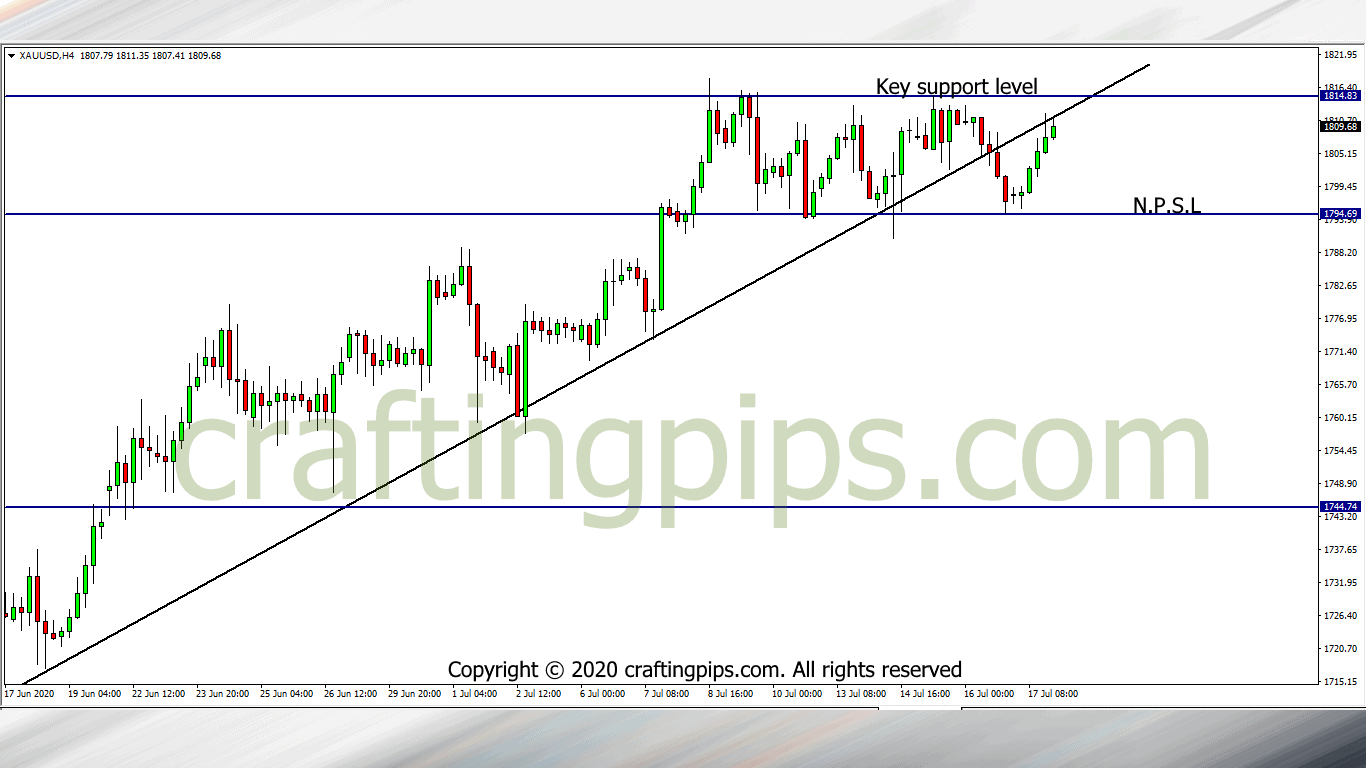

3. XAU/USD (GOLD)

Gold Gold Gold…

In my opinion, this precious metal still has what it takes to break resistance level 1814.83 and hit the next possible resistance level which is over +800 pips away (1898.63)

Last week we saw a brief breakout of support level 1805.29 before price corrected itself. This move is keeping Gold within a range of 1814.83 and 1794.69.

So we have two possible ways we could trade Gold this week:

- Wait for a possible breakout of 1814.83 and go long or

- Wait for a possible reversal at 1814.83, which will most likely take price back to support level 1794.69

What are your thoughts?

ATTENTION: For those who are interested in joining our trading group on Telegram, hit: https://t.me/joinchat/FN30PxlwXbk2BcuTDdH5yg