Hello Traders,

I know it’s tomorrow, but allow me to formally welcome you into the month of June.

How did trading go for you this month of May?

I took a minor loss, but I believe June will be a better month for me/us.

Apart from looking forward to a better month, another thing that gets me excited is that the most anticipated game of the year will be out in less than 3 weeks from today.

The Last of Us part 2 will be out officially June 19th, this is after 5 years part 1 was released, and so many canceled released dates.

I just can’t wait to get a copy.

That said, let’s hit the market and see if any of our setups this week can help us pay for a copy of the game.

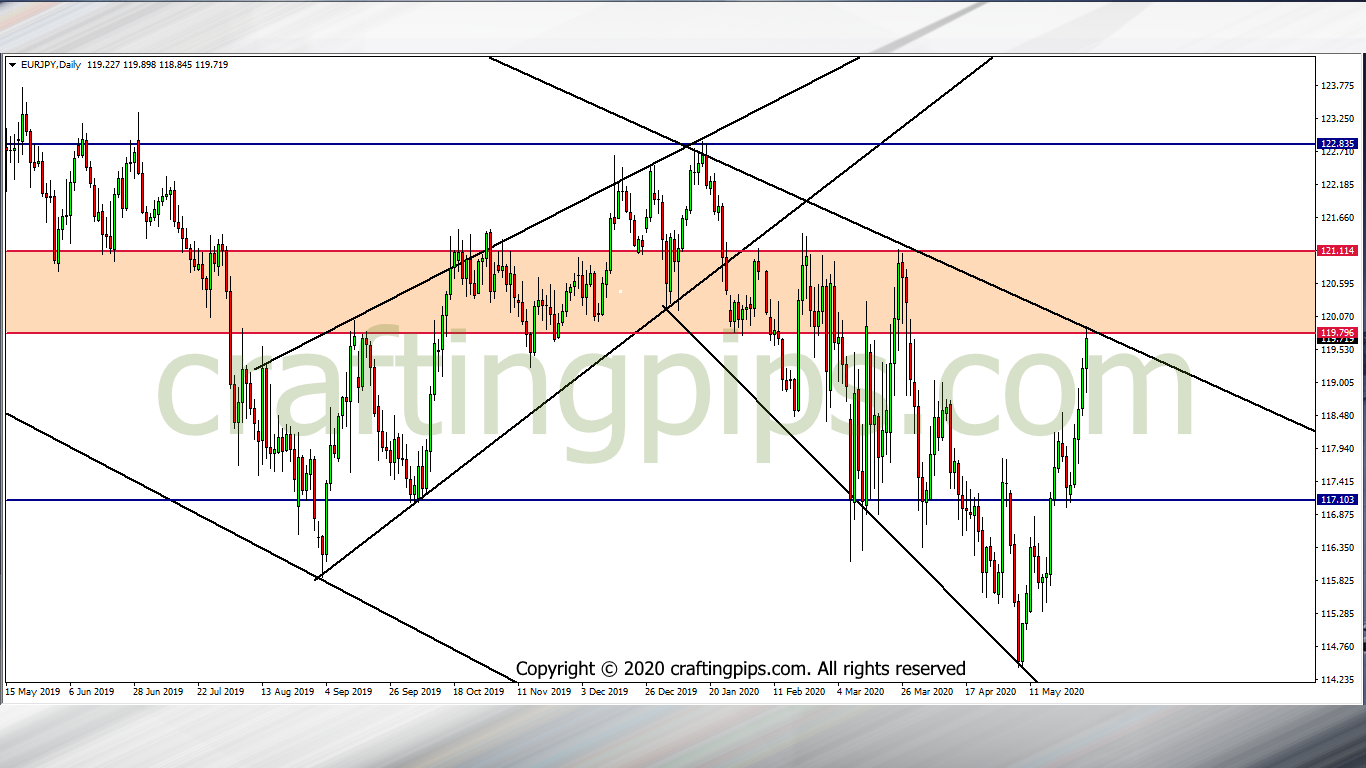

1. EUR/JPY

EUR/JPY spent the entire last week of the month spewing over +250 pips. Price closed on Friday by hitting a strong resistance level at 119.796.

If we resume the week with the Euro still strong, our next possible resistance level would be 121.144 and if the Bears are strong enough to cause a reversal on the EUR/JPY, then our possible support level would be 117.103.

2. EUR/CHF

The EUR/CHF has pretty much the same setup as the EUR/JPY.

EUR/CHF even closed with a bearish pin-bar after hitting resistance level 1.07083. If we get a bearish confirmation when the market opens, then our first support level would be 1.05773.

On the other hand, the Bulls take charge, then a breakout should encourage us to look out for a buy position, having in mind that 1.08379 will most likely be our next possible resistance level.

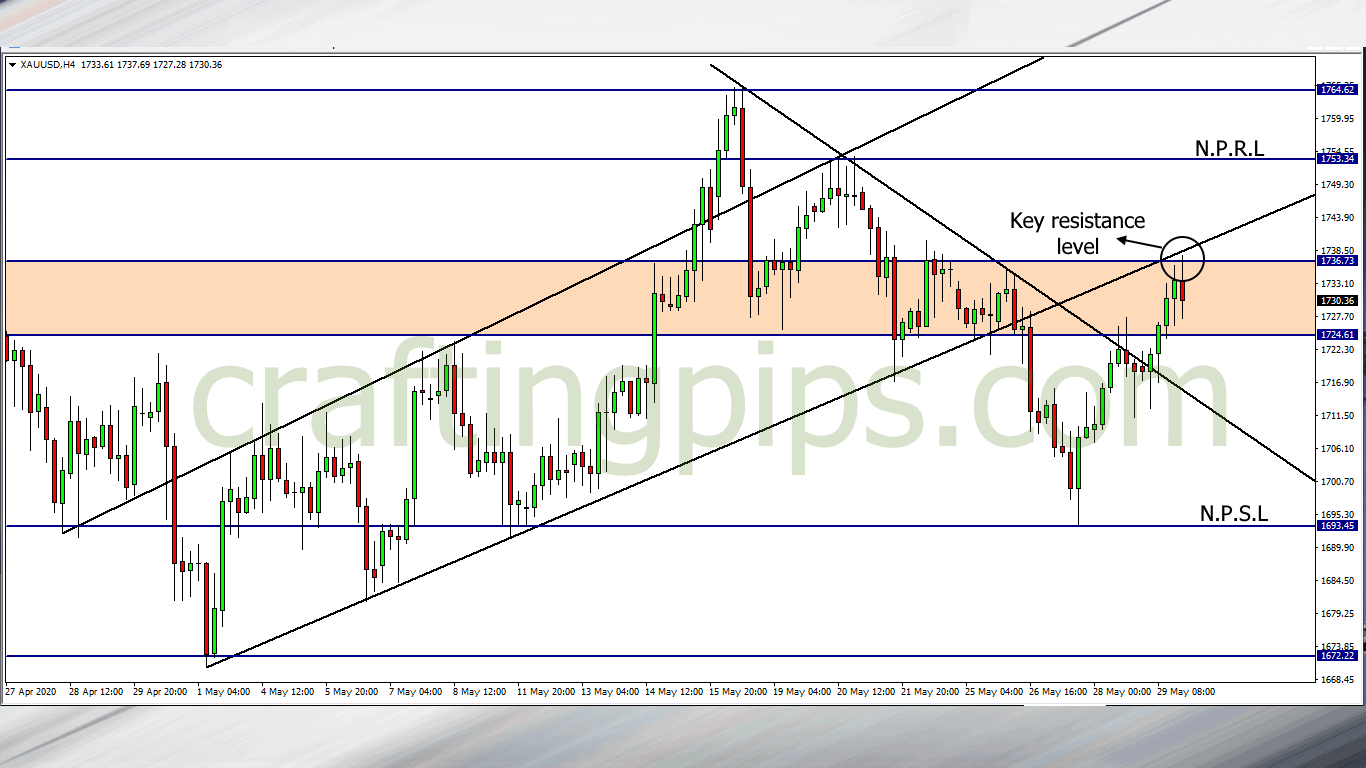

3. XAU/USD (GOLD)

On Friday, we saw Gold close after hitting resistance level 1736.73 within the consolidation band.

I am bullish bias, and a breakout will most likely take price to the next possible resistance level (1753.34)

Also note that a reversal of price could also mean the likelihood of price re-visiting support level 1693.45.

What are your thoughts?