Hello Traders,

How was your weekend?

Mine was super awesome.

You know why?

I had a winning streak on my betting gig. I was beginning to feel like a sorcerer as game after game was hitting the mark (lol). Nothing feels better when your analysis pays the bills.

I also had the opportunity to travel and enjoy the scenery of a neighboring state outside Lagos.

Alright, this week has already begun, however, the market is still asleep. Let’s head to our charts and see what setups we should be bookmarking for the week ahead.

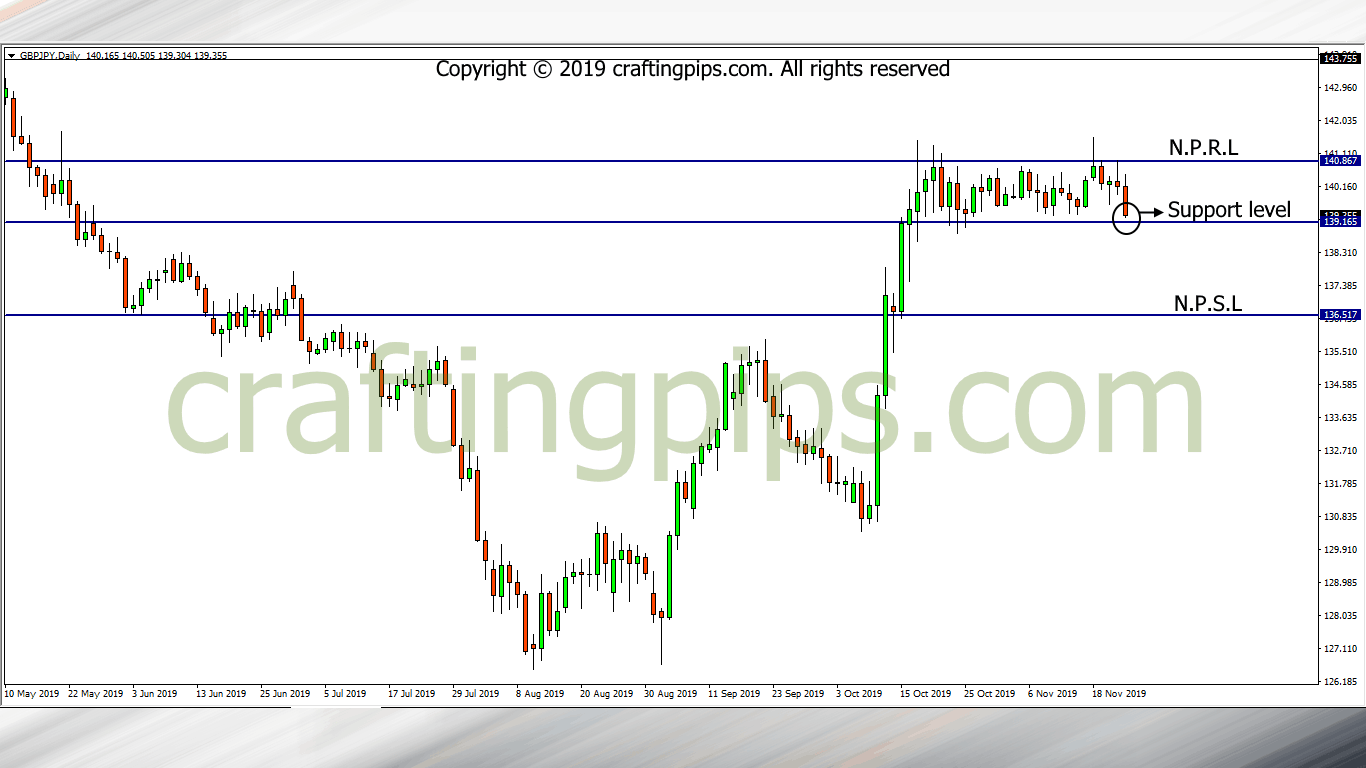

1. GBP/JPY

Price on the GBP/JPY is locked within a channel on the daily chart for over 4 weeks. On Friday the market closed by price having a strong bearish candlestick.

Price reaction to support level 139.251 will be what we should be focusing on.

A breakout will most likely encourage the bearish move of price to the next possible support level (136.517) and a reversal of price will also encourage the Bulls to take price to a previous resistance level (140.867).

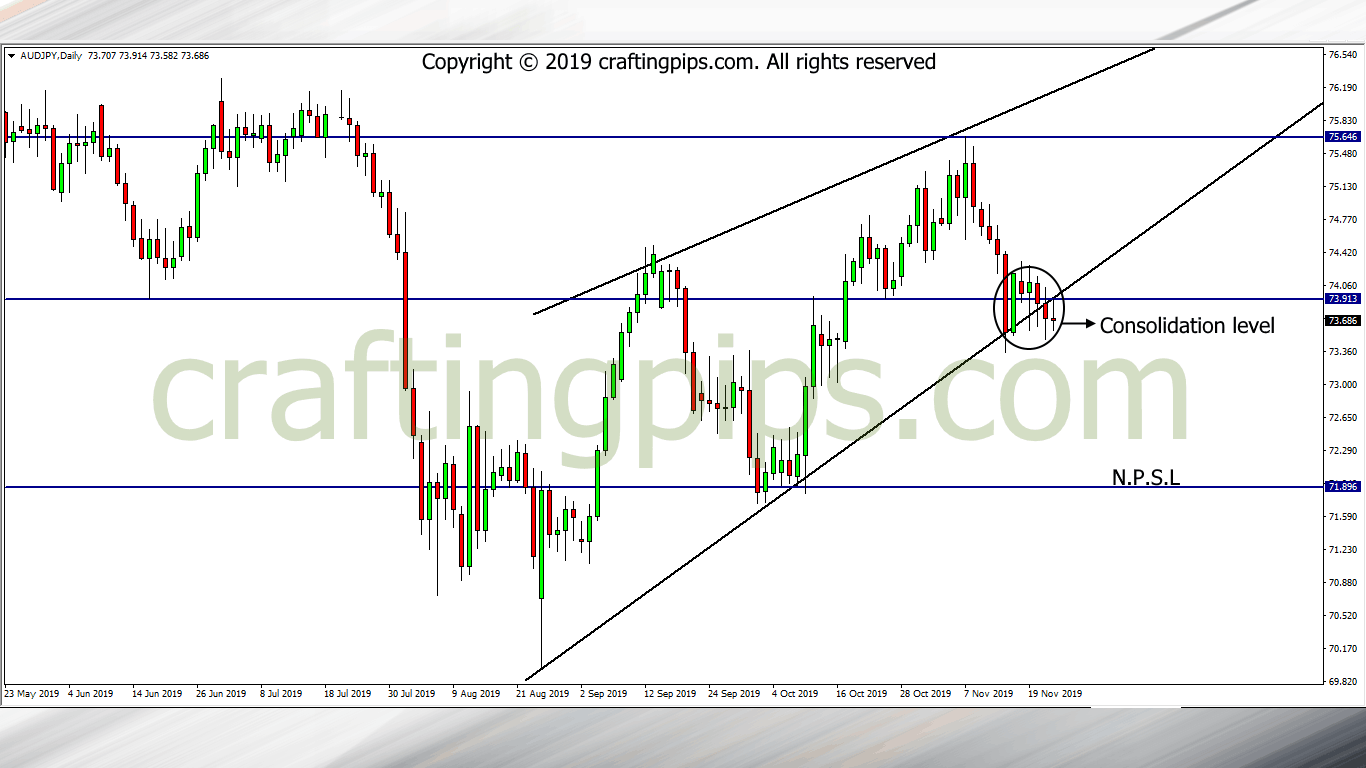

2. AUD/JPY

AUD/JPY looks promising.

Presently we can see price form a consolidation around the breakout level (73.577). This is not enough to say the Bears would do their thing this new week.

However, it’s a sign that if a bearish confirmation occurs during the first few hours/day, we could ride a downward trend till price hits the next possible support level 71.896.

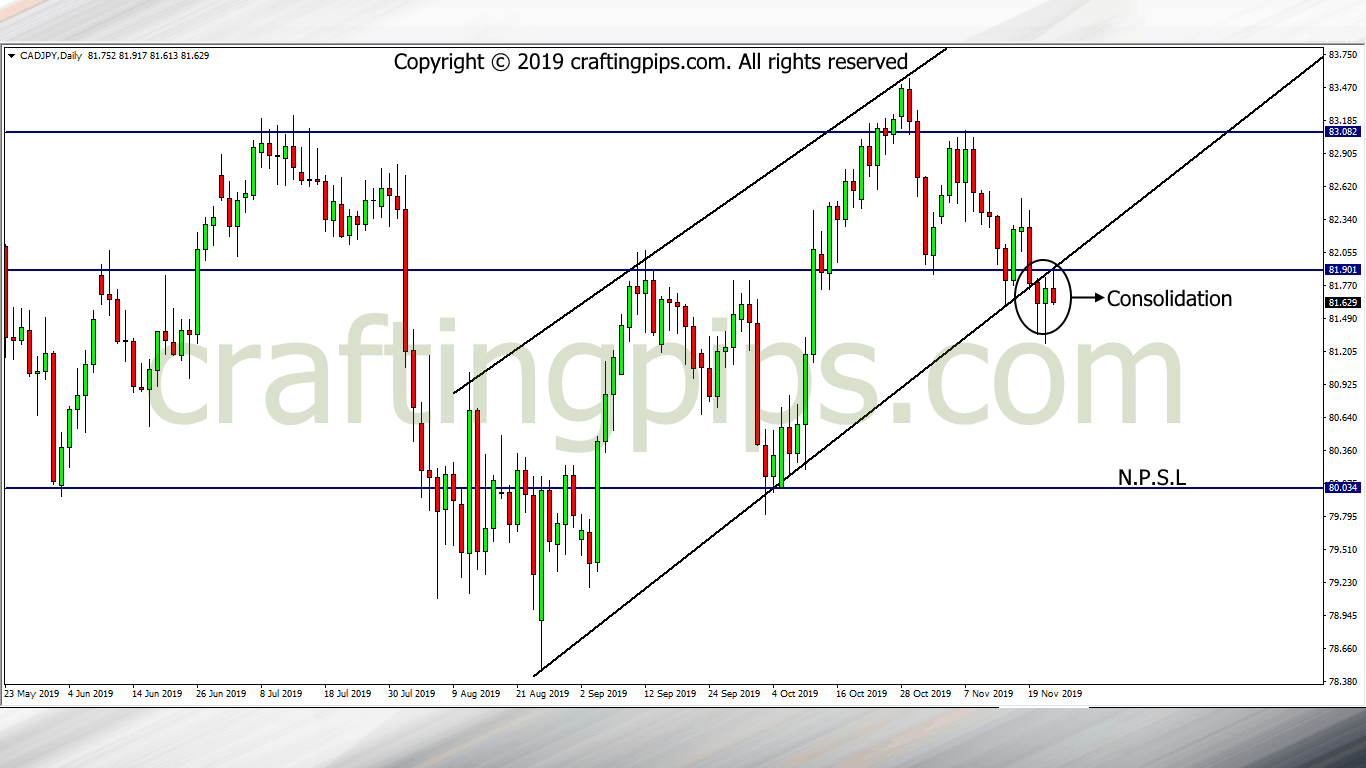

3. CAD/JPY

CAD/JPY closed with a bullish pin bar just below a former support level (81.901) on the daily chart.

A further bearish confirmation will most likely send price to the next possible support level (80.034).

That’s all we have for today ladies and gentlemen. Kindly subscribe and share our content if they have been helpful to you as a trader.

For those who are interested in sports trading, you can also join our telegram channel, hopefully, in the nearest future, I will separate sports trading channel from that of the forex trading channel

Till tomorrow’s analysis, do have a great day ahead, and as always…

Remain pip-full.