Hello Traders,

How did your first weekend in the month of November go?

Well well, mine went fine, I have been working on my soccer trading skills in the last few months, I have made some groundbreaking discoveries which I am still very much testing.

I will definitely reveal my sports trading results on my social media platform as soon as I round up my little research.

That said, let’s get back to our charts and see what the market has for us this week.

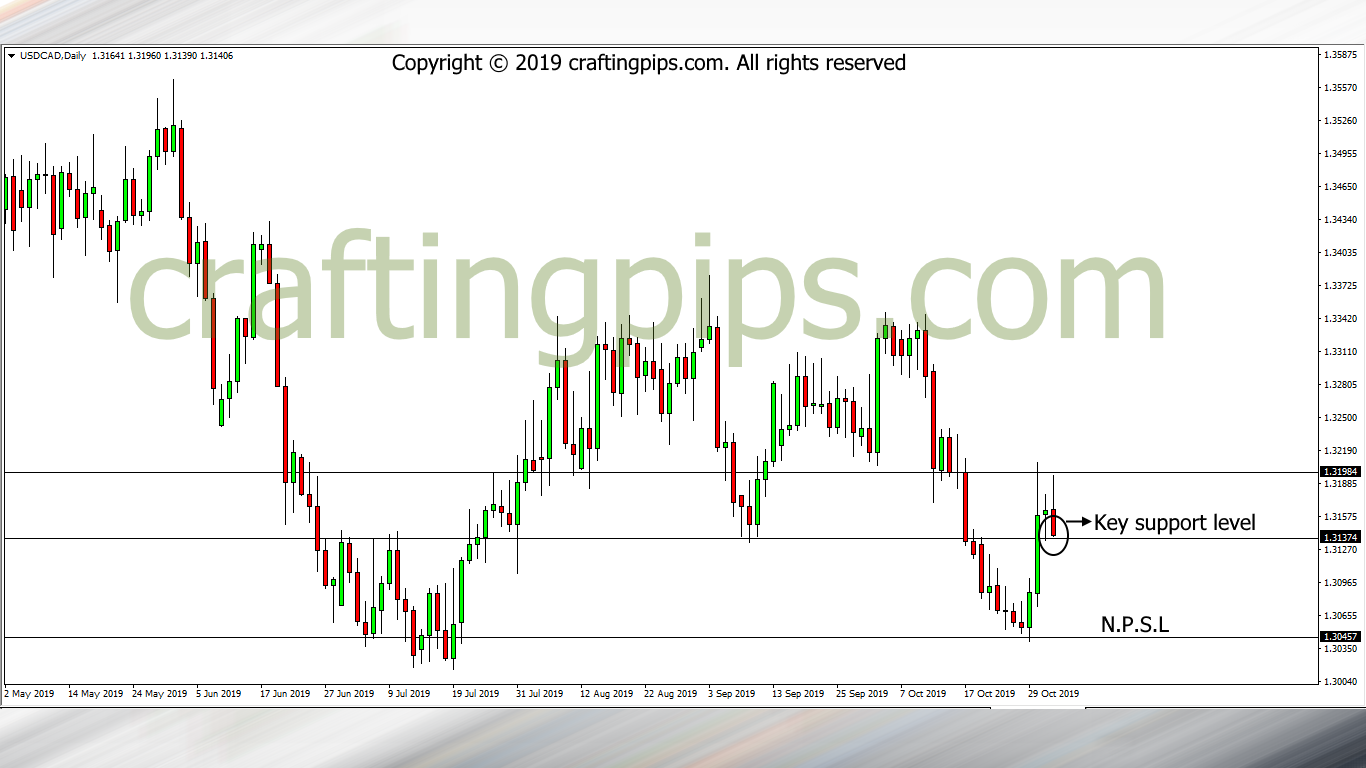

1. USD/CAD

On Tuesday, the USD/CAD on the daily chart experienced a strong bullish move but got hooked around the 1.31962 resistance level.

The market finally closed on Friday with a bearish pin-bar candlestick, which stopped exactly on the support level 1.31360

Personally I have a bearish bias outlook regarding this pair, because of the descending channel price formation on the weekly chart.

After the Sunday/Monday market noise settles down, we should have a clearer picture of this pair.

2. CAD/JPY

CAD/JPY has a beautiful ascending channel price pattern on the daily chart.

All we need do here is a wait to see price reaction after hitting support level 81.318.

If price bounces back, we could be seeing price revisiting resistance level 83.479 and if a bearish breakout occurs, there is every tendency for price to visit support level 80.063

A keyword in managing this pair would be PATIENCE.

3. XAU/USD (GOLD)

After Gold embarked on a bullish rampage on Wednesday, it got stopped dead in its tracks by a strong resistance level (1514.40)

At this point, price has two options:

- A breakout which could further encourage price to continue it’s bullish move to the next possible resistance level (1534.09) or

- Price could reverse and head back to seek refuge on the support level 1495.40

Personally, my bias lies in the former, but again, we have to ensure we get a breakout confirmation before we follow the trend.

That’s all we have for the week…, but there would be more setups shared here as the week progresses, so do ensure your subscribe and share our content with that pip loving friend of yours, so that you don’t miss out on market opportunities

Do have a great week ahead and as always…

Remain pip-full.