Hello Legendary Traders,

I am so excited as we hit the last trading week of September and also closing the third quarter of the year.

How did your weekend go?

Yesterday, I got wowed while watching some matches in the football leagues.

First, it was Manchester city disciplining Watford with 8 un-replied goals and on the other hand Grenada setting Barcelona ablaze with 2 un-replied goals. It was a bittersweet experience for me.

After such an experience, I quietly walked over to my trading desk to see how we could attack the market this coming week.

The market is teeming with some nice setups this week. Without wasting much of our time, let’s quickly go through each of the setups.

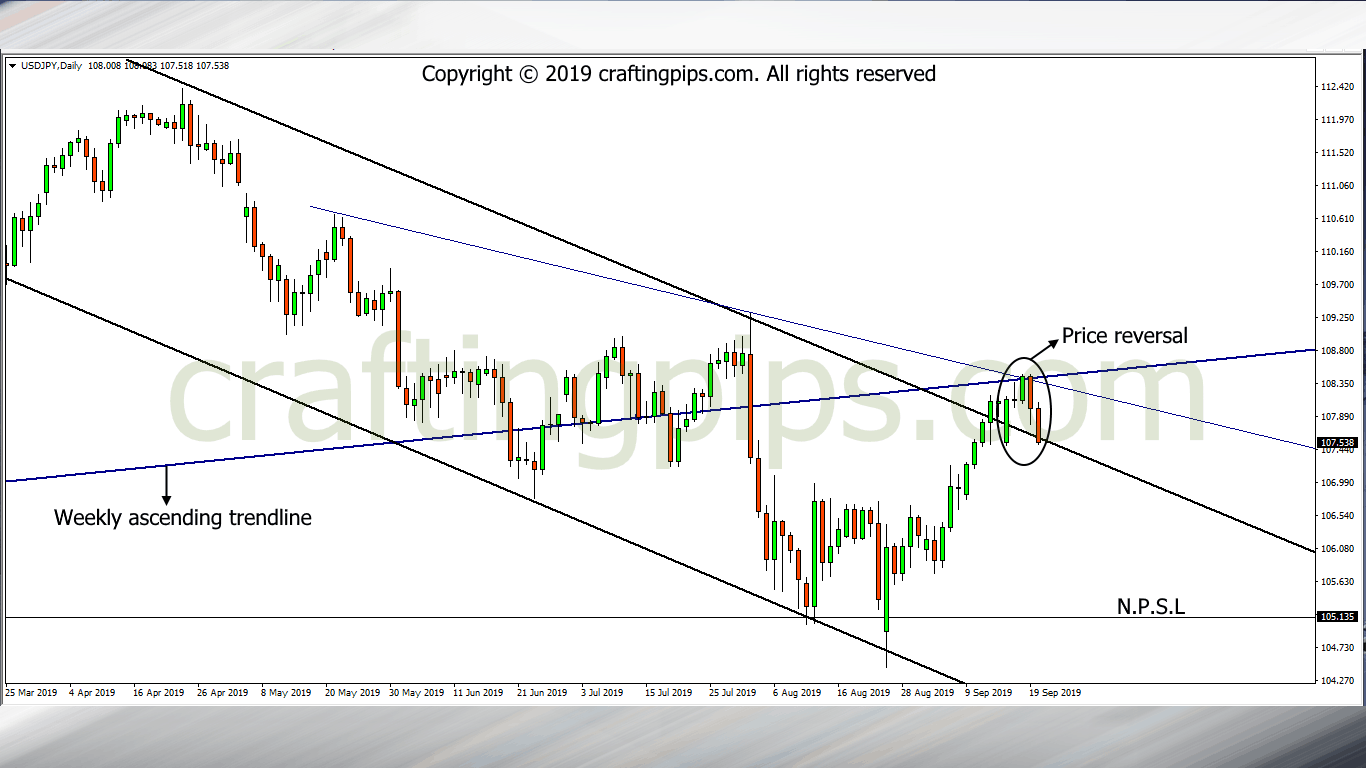

1. USD/JPY

USD/JPY on the weekly chart closed with a beautiful gravestone doji, showing that we could see a huge bearish reversal this coming week on the USD/JPY.

On the daily chart, we can see that price on the USD/JPY was rejected at level 108.422 which is also a resistance and support level of an ascending trendline and a descending expanding channel.

If the Japanese Yen continues with its strength this week, there is a possibility that we see price fall to support level 105.135.

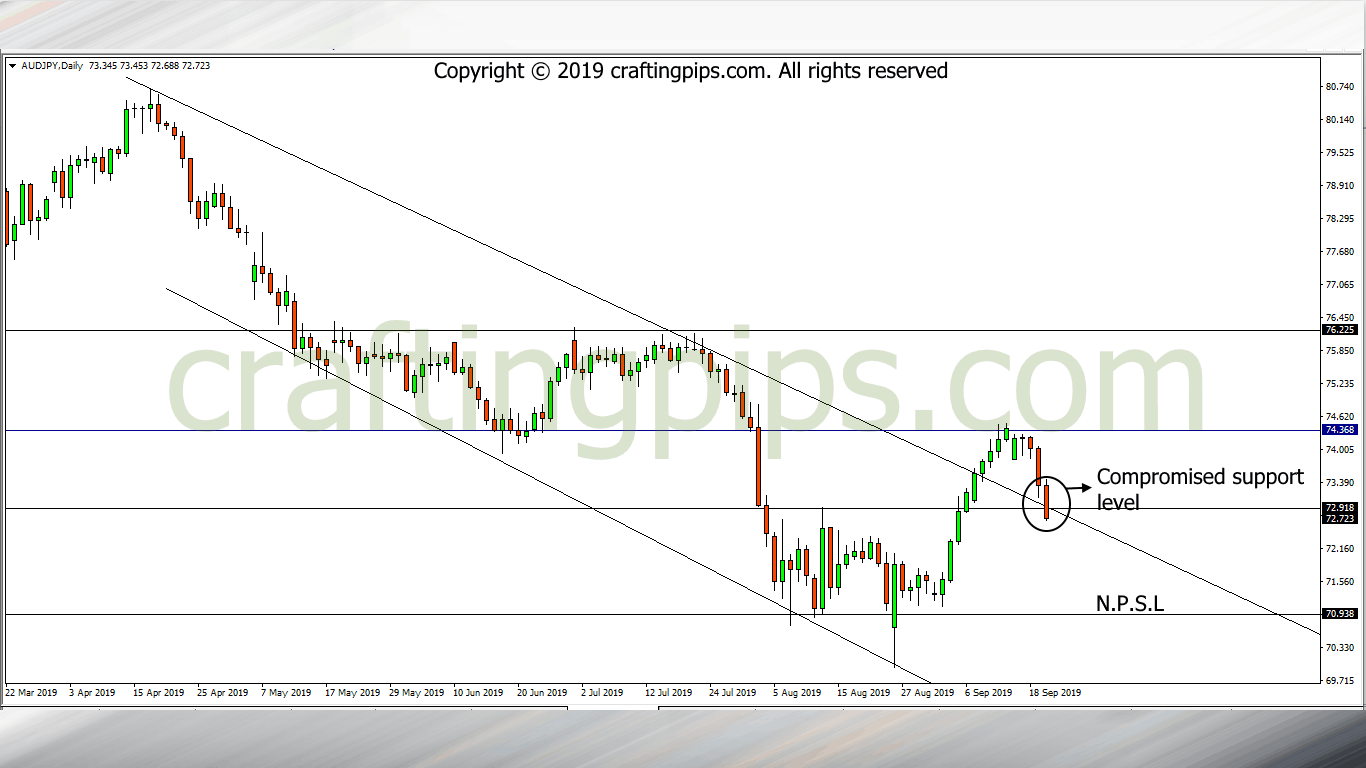

2. AUD/JPY

I had mixed feelings towards the AUD/JPY last week as it approached support level 72.918.

I didn’t look at my charts last week Friday, but I can see today that price may have no plans in respecting support level 72.918.

If the Australian dollar resumes the week with the same weakness it closed with last week, there is a huge possibility that price next possible support level would be 70.938.

3. NZD/USD

NZD/USD closed last week by breaking a very important support level (0.62800).

The last time price came close to breaking this support level was the year 2015. The weekly candlestick ended up closing with a huge wick below the support level, which later heralded a bullish outcome in the market.

So, if we were to follow when a proper breakout last occurred, we would be looking at the year 2008. When the breakout happened, we saw price immediately hit support level 0.57922, which is roughly over +400 pips journey from the present price level.

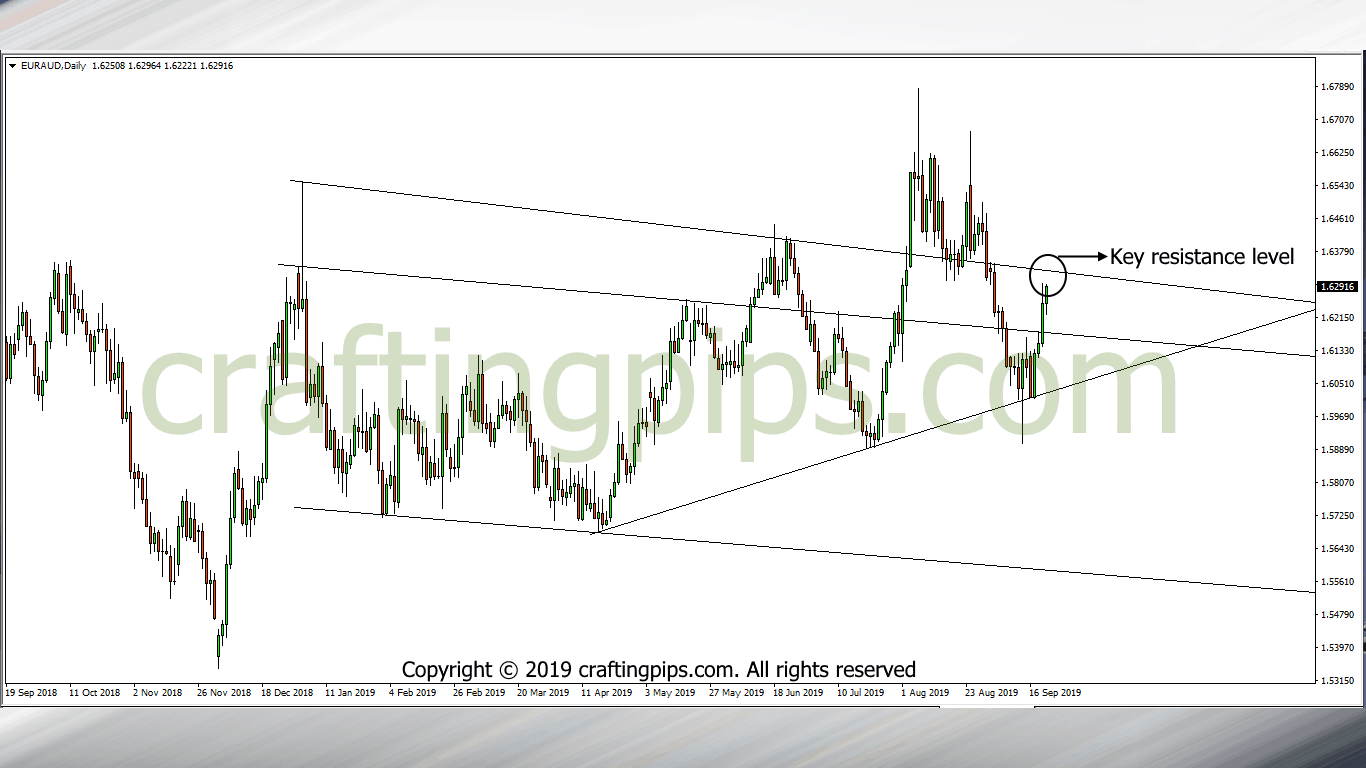

4. EUR/AUD

Price on the EUR/AUD is approaching a critical resistance level (1.63315) within a descending channel.

We could be looking at either a breakout or reversal of price on this pair.

A reversal should bounce price back to support level 1.61682 and a breakout will most likely encourage price to hit the next possible resistance level (1.65772).

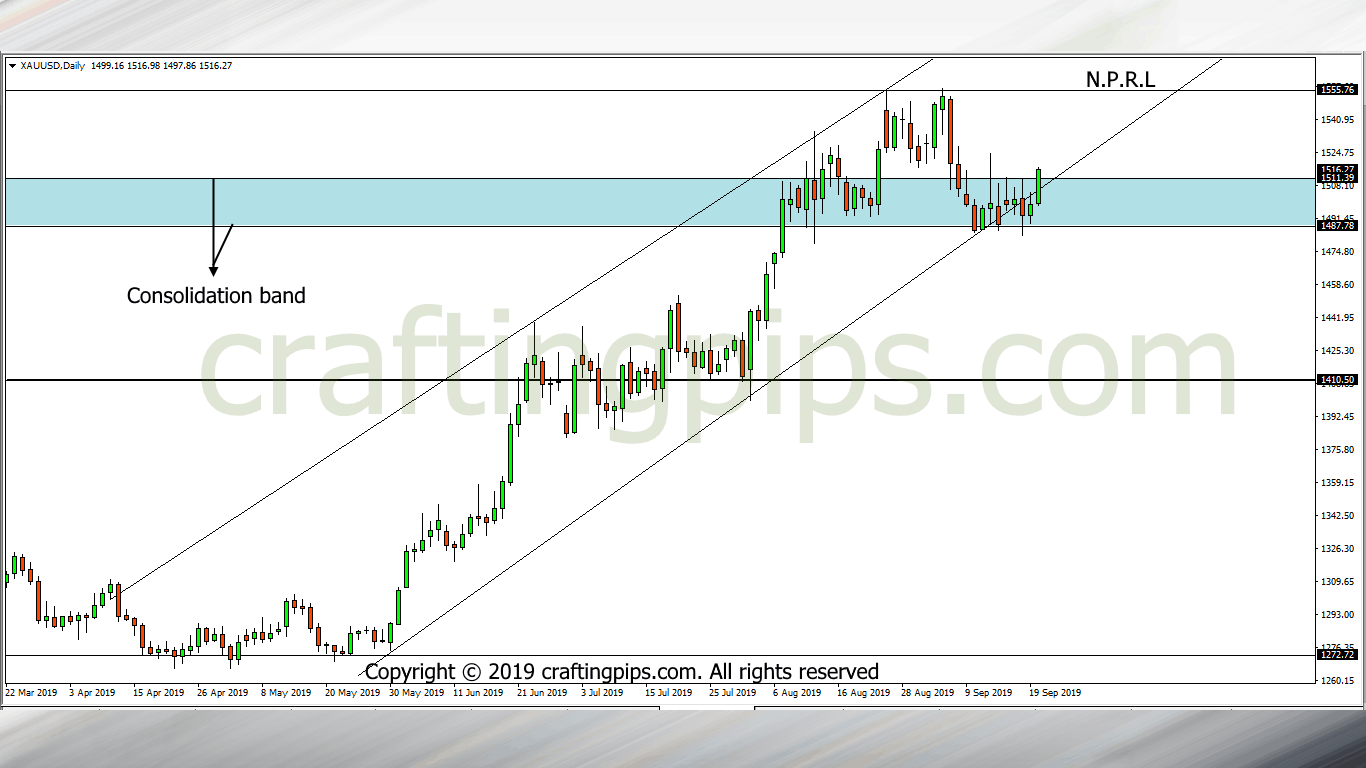

5. XAU/USD (GOLD)

After Gold spent almost 2 weeks within the consolidation band, the market closed with price breaking out of the resistance level (1511.39) of the consolidation band.

There is a huge possibility that gold is gathering momentum to hit a previous resistance level (1555.76) this week.

NOTE: In all of these setups, it’s important that we ensure our system confirms our bias before committing financially to them. Also, ensure your risk management game is tight, remember:

A single trade should never define a trader

For those joining us for the first time, you could subscribe to our content which we publish every single day of the week apart from Saturdays.

We also offer mentoring services if you still struggle to make money off the market.

That said, I which you a pip-full and productive week ahead.