Welcome to the month of June fam,

A cold cloudy weekend over here, with a little bit of rain. I was supposed to publish an article on Friday, but I messed up badly.

Things came up, time went by and I somehow in between lost my muse. If there is anything I hate to do is procrastinating. Give it enough breathing space and it will paralyze your purpose.

Alright, alright, before I judge myself to stupor, let’s move on to what we may most likely be seeing in the market this first week of the last month of the second quarter of 2019.

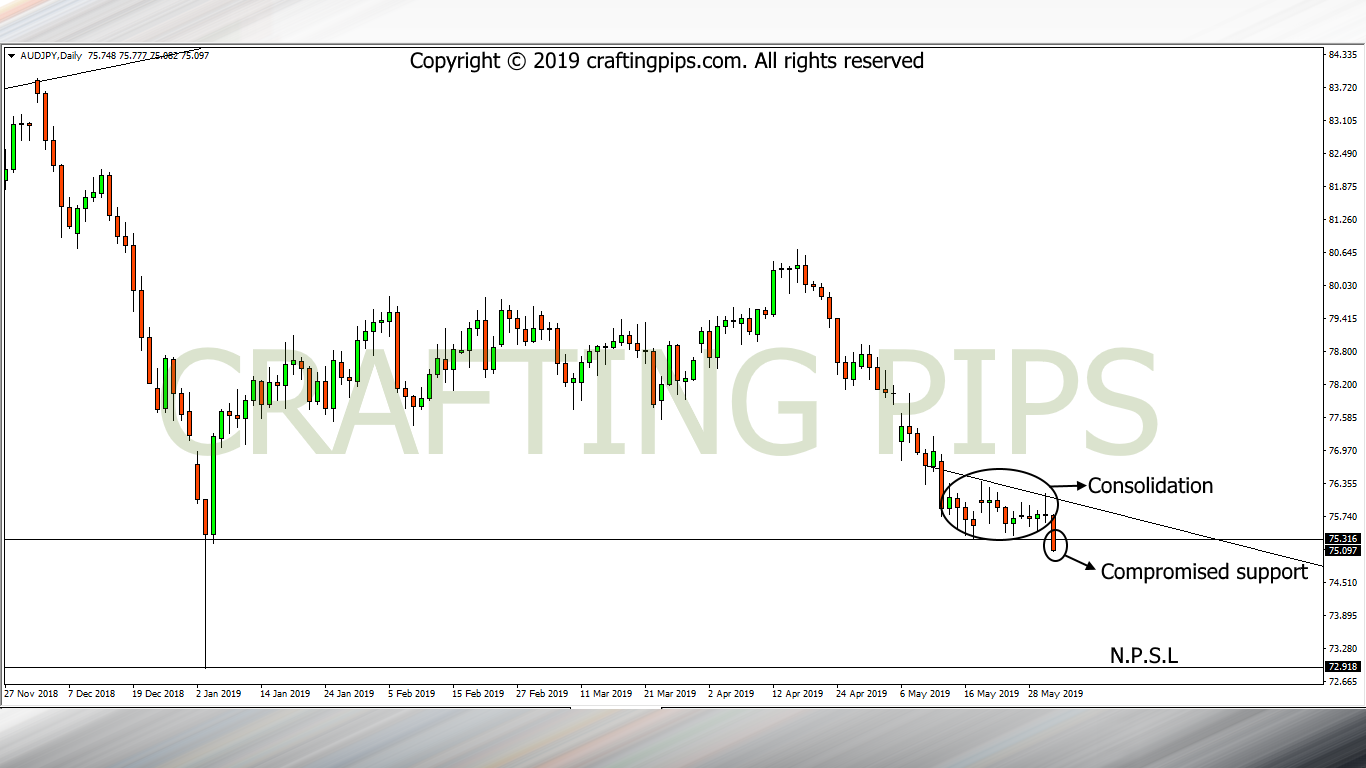

1. AUD/JPY

We saw on Friday the Australian dollar hammered by the Japanese Yen, hence a key support level (75.316) was broken.

The last time we saw this support level broken, was January this year and it was a pull-back. Price has been within a consolidation level for about three weeks.

If the present support breakout is confirmed, we may see price hit the next possible support level (72.918).

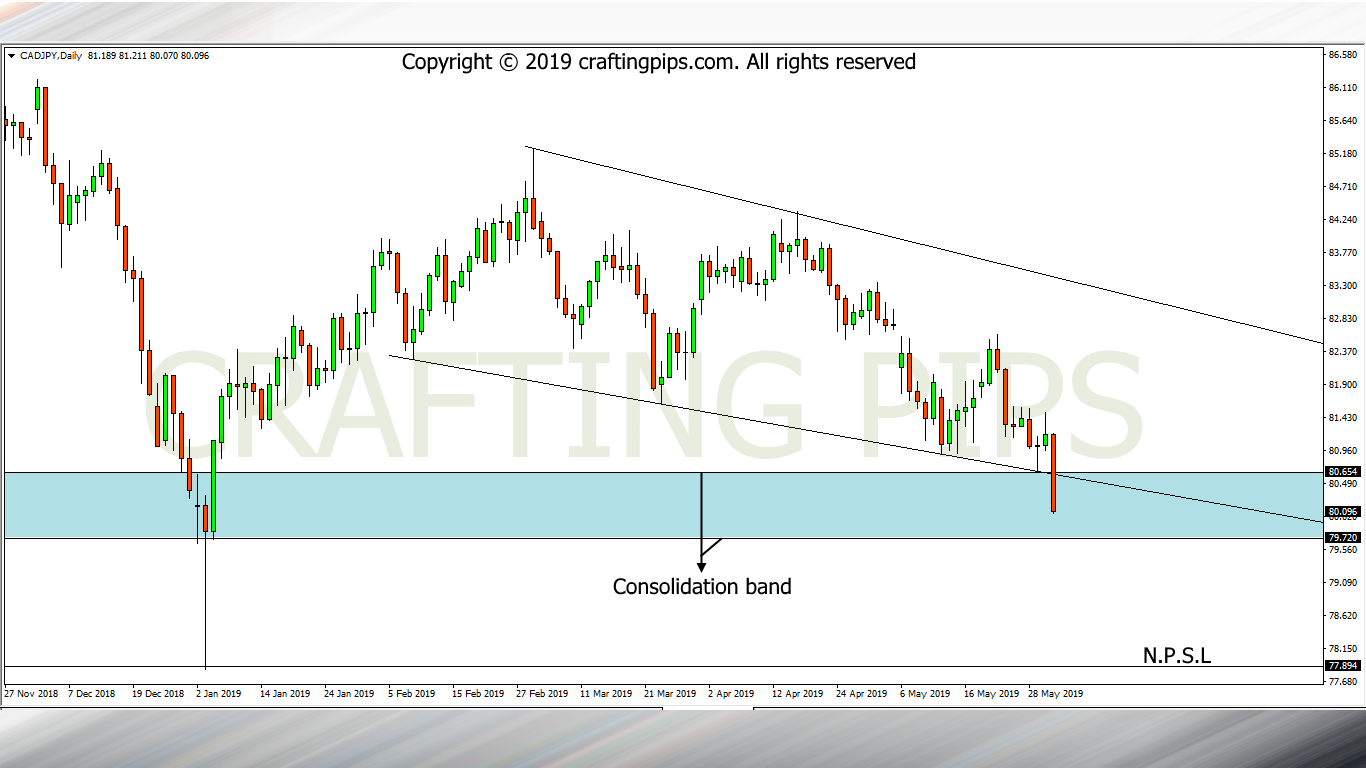

2. CAD/JPY

Canadian dollars has broken the key support level (80.611) of a descending channel.

Price is presently locked within a Consolidation Band on the daily chart, however, on the weekly chart, the bears are taking no hostages. Price is bearish

If you are interested in selling this pair, I would suggest you wait for price to break through the consolidation band on the daily chart before selling it.

We may most likely see a slight consolidation on the CAD/JPY before the bears start another downward spiral within the week.

3. CHF/JPY

A consolidation of price after the support breakout on CHF/JPY could be a sign of another bearish move.

Let’s not forget that the last candlestick formed before the close of the market on Friday was a bearish pin-bar.

If the market wakes up later today supporting the bears, we may most likely see price hit the next possible support level (107.604)

So, we have come to a close of the week’s analysis, and if you notice, the Japanese Yen closed last week being the King of the charts.

Tomorrow is another day for another market analysis.

Do have a pip-full week ahead