Good day traders,

Today was an explosive day in the market. Sharp moves across most currency pairs. I hope we were able to use that to our advantage, by either trading profitably or staying by the sidelines.

Alright…

That said, let’s see what the market has for us today.

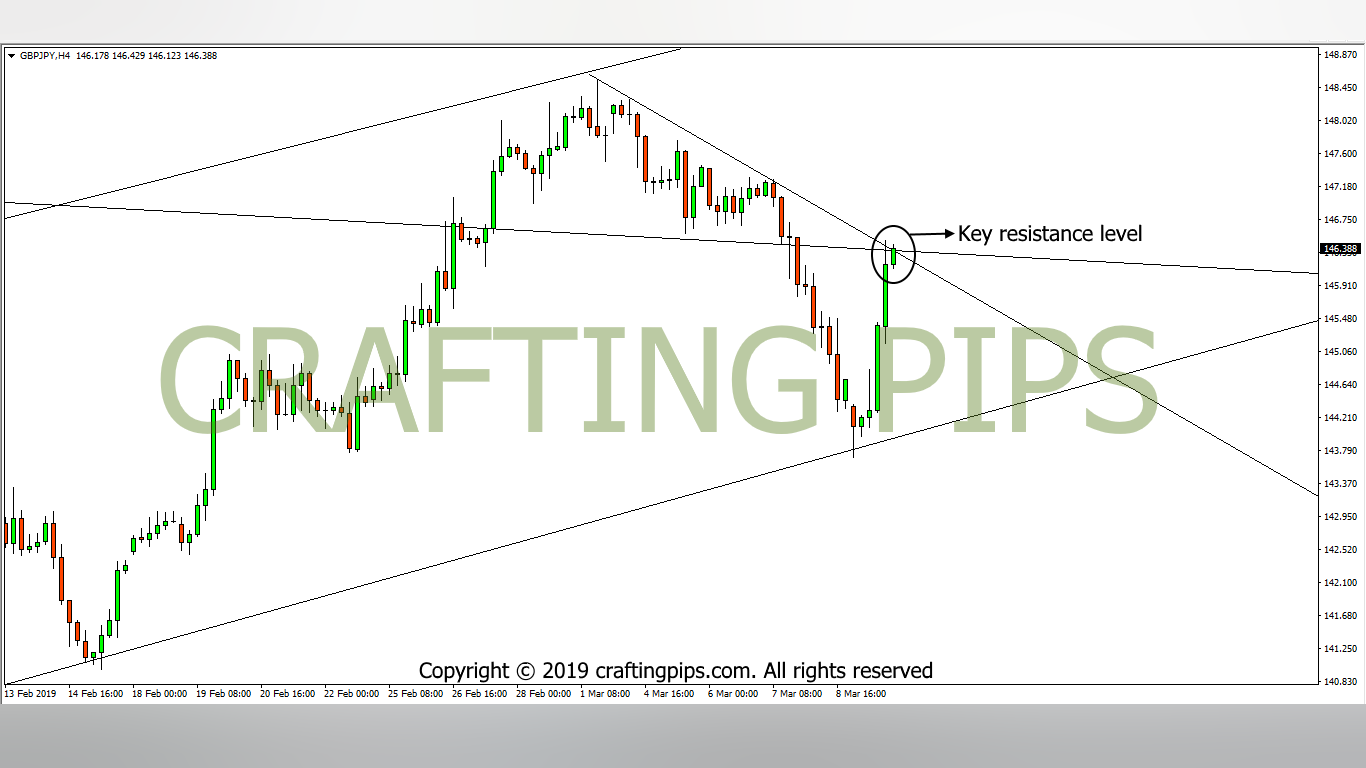

1. GBP/JPY

GBP/JPY is currently battling with a key resistance level (146.361) posed by a descending trendline on the daily chart.

Today we saw the bulls drive the market on GBP/JPY. There is a great tendency that the present resistance level will be broken, if the bulls continue their run. If that happens, price’s next resistance level will be around level 148.266.

On the other hand, if the present resistance level holds strong, price may temporarily reverse to support level 144.418, before deciding any major movement.

The only advantage we have as traders, is to wait for confirmation before committing our coins.

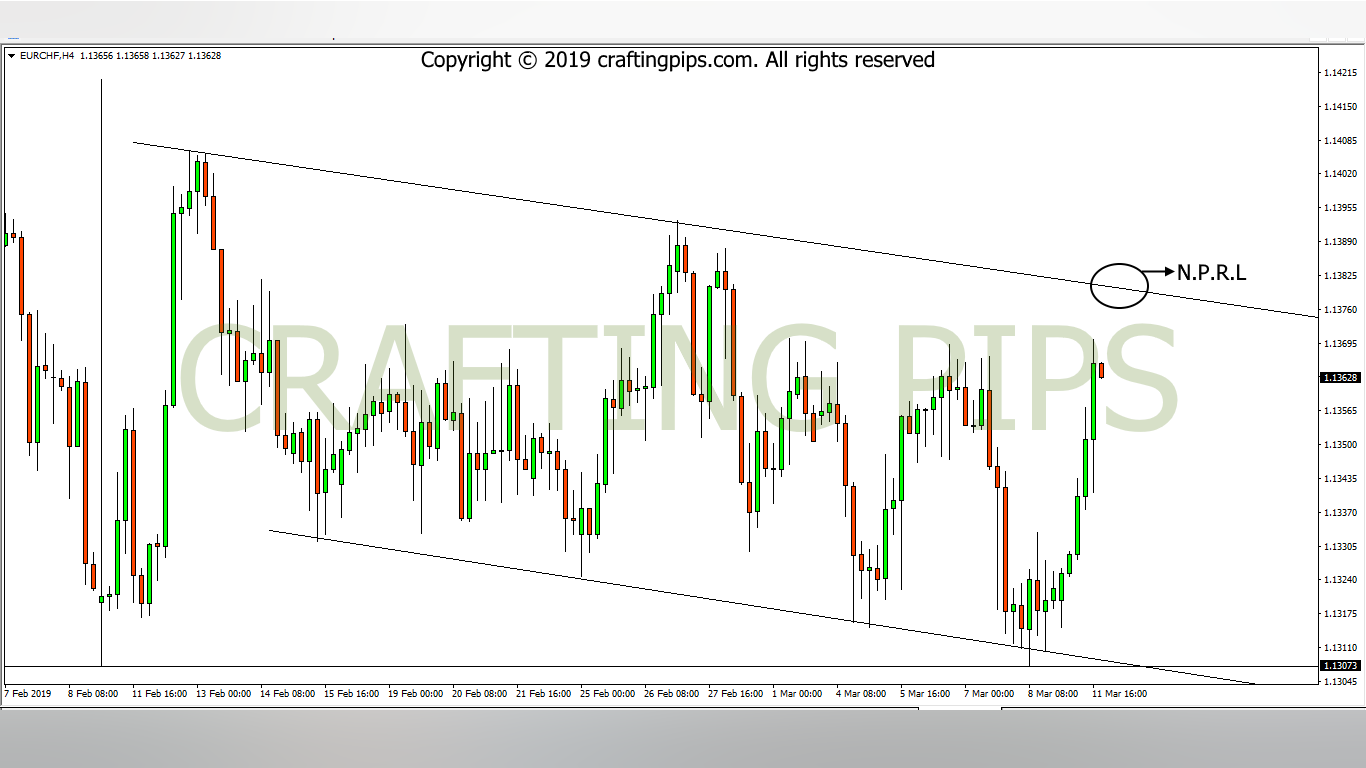

2. EUR/CHF

EUR/CHF has a beautiful descending channel on the 4 hours chart.

Presently I am waiting to see price’s reaction to resistance level (1.13804). A reversal at that level, should send price back to level 1.13166.

If for any reason, price breaks the N.P.R.L, there is every likelihood that price may rise above level 1.13925.

NOTE: Both trades are pretty straight forward, all we need is the patience of that PROVERBIAL DOG who ate that THICK MEAT (not the fat bone ….lol)

That said… We are done with today’s analysis, kindly comment, share and subscribe if you dig our analysis.

Do have a pip-full day ahead.

Gbpjpy. How do I calculate my sl and tp?

Bought at147.259

In calculating a stop loss and target profit, so many things are involved.

Some of which are:

1. The size of your account

2. How much you are willing to risk

etc.

kindly reach us at fxpipping@yahoo.com for a better explanation

Thank you Ogini