Good day traders,

Here we are again, it’s the close of the trading week. Tricky Friday’s presents us with trades that may look great, yet elude us if not well handled.

Let’s go into our charts and see if we could apply some trading skills to steal some pips for the weekend.

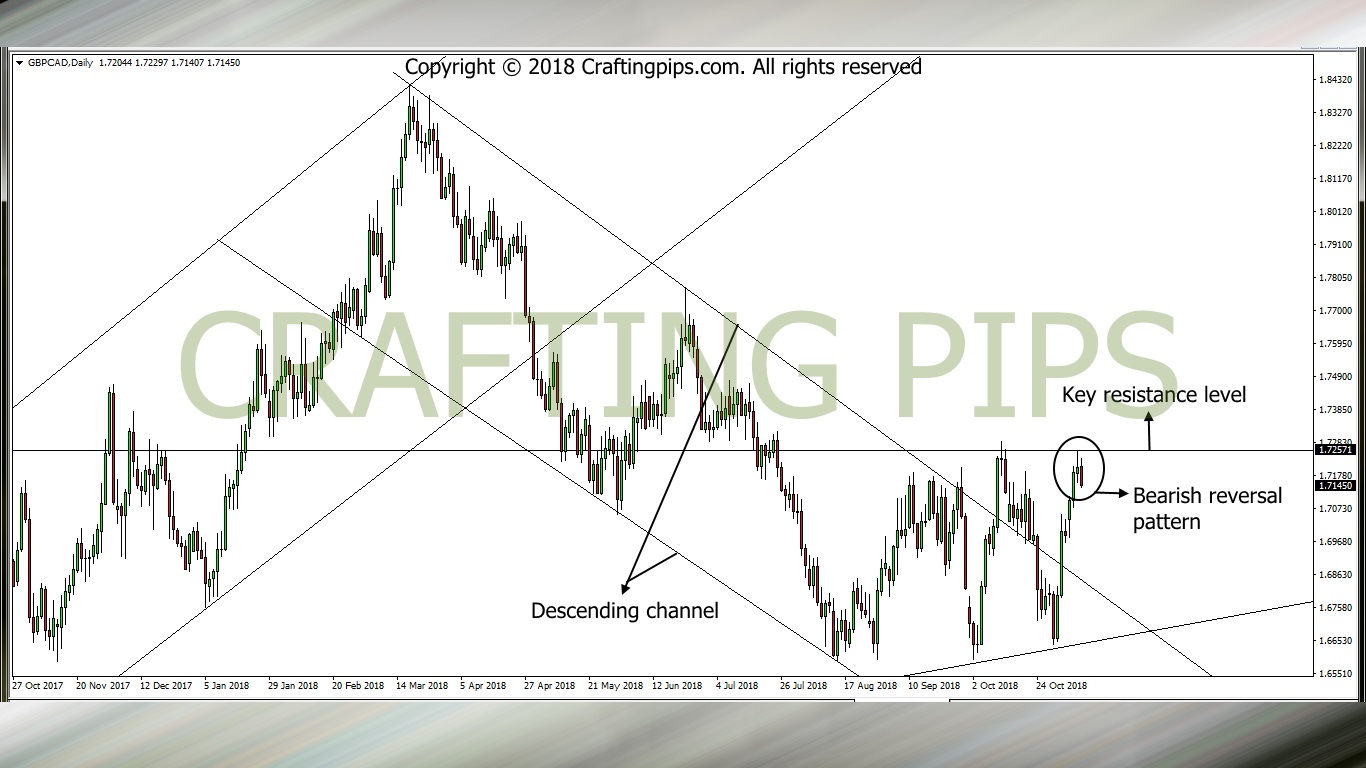

1. GBP/CAD

After GBP/CAD had a bullish breakout from a major descending channel(1.70461), however it lost steam around level 1.72571, and this level became a big psychological resistance level for price to break.

There is a second attempt to break the current resistance level (1.72571), but price seem to respect this level so much so, that price is currently attempting a bearish reversal. If the current candlestick closes bearish, we should get ready for price to hit its next support level (1.69569).

Failure for the present candlestick to close bearish, price may just stalk the current resistance level before the close of the market.

2. EUR/CAD

EUR/CAD setup is pretty straight forward. On the 4 hours time frame, price is currently making an attempt on a bearish breakout from an ascending channel through a key support area (1.49278).

After the 11pm candlestick formation, if we still have this outlook, then we should go bearish and hope that price hits its next support level (1.48467) before the market dies out.

However if the candlestick closes with a bullish pin-bar or doji, extreme caution should be applied if at all you plan to trade it.

With this, we are through with our analysis for the week, catch us again on Sunday, where we hit you with our weekly setups.

Do have a beautiful weekend folks

Kindly comment and share

Great analysis. Watching out closely.

Hello Dunny

I am glad you enjoyed the analysis, watch our for our weekly analysis popping out any moment from now and do subscribe to our newsletters. This will enable you get our daily market analysis in your email as soon as we publish.

Thanks once more