My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 26/02/2024

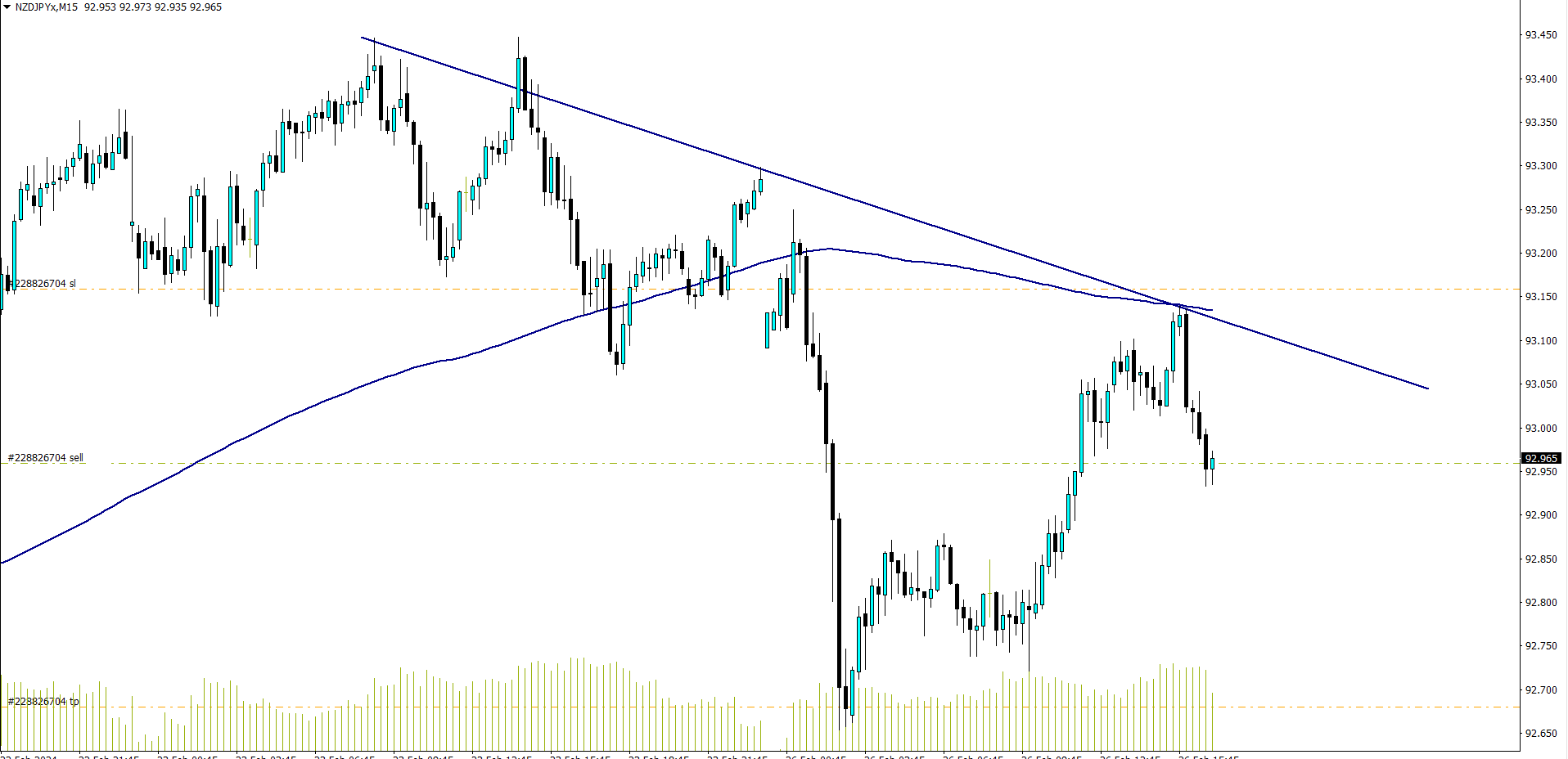

NZD/JPY (4.15 PM)

Analysis: My sell on the 15 minutes time frame was because of my 4 hour bearish outlook

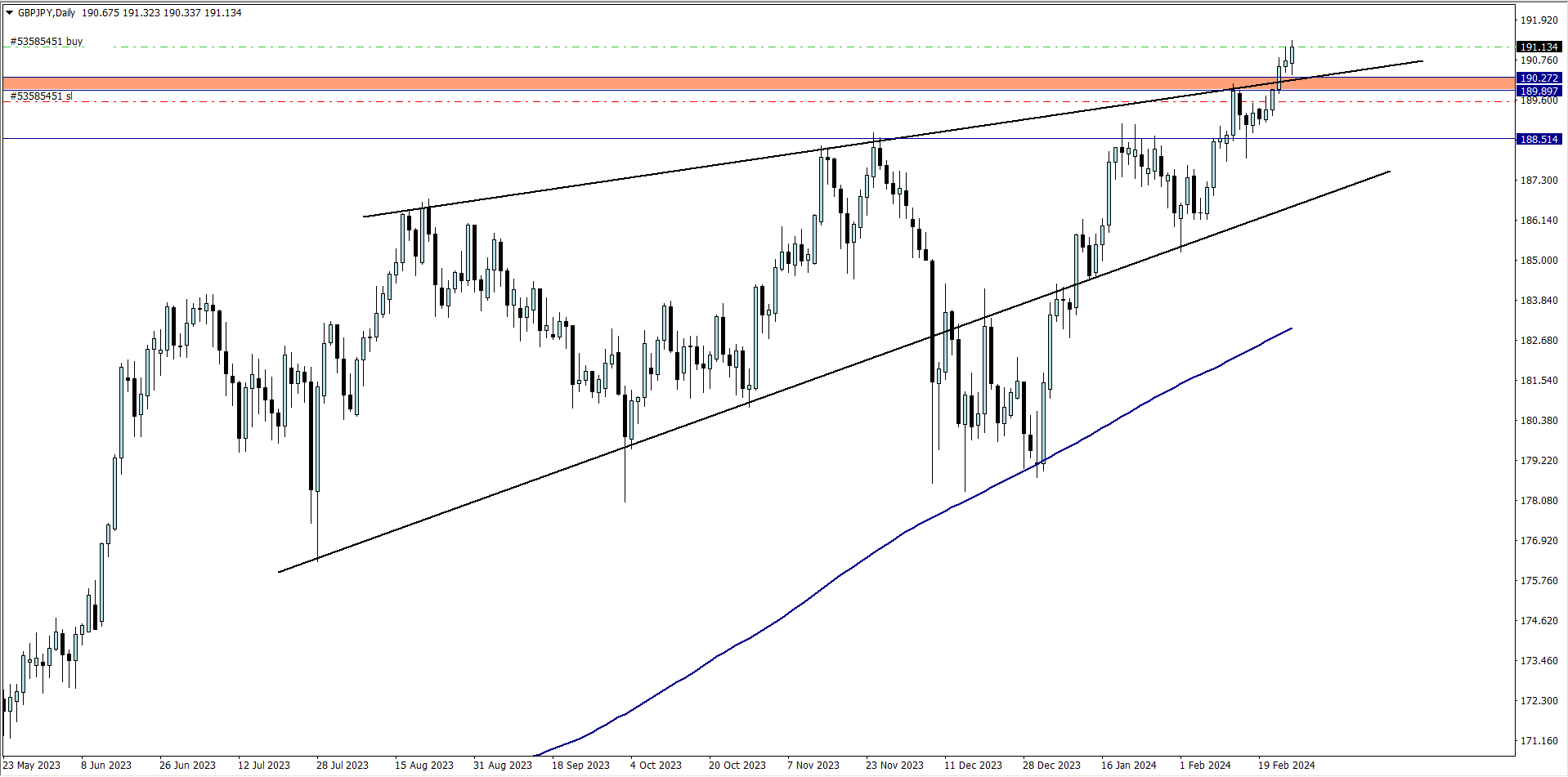

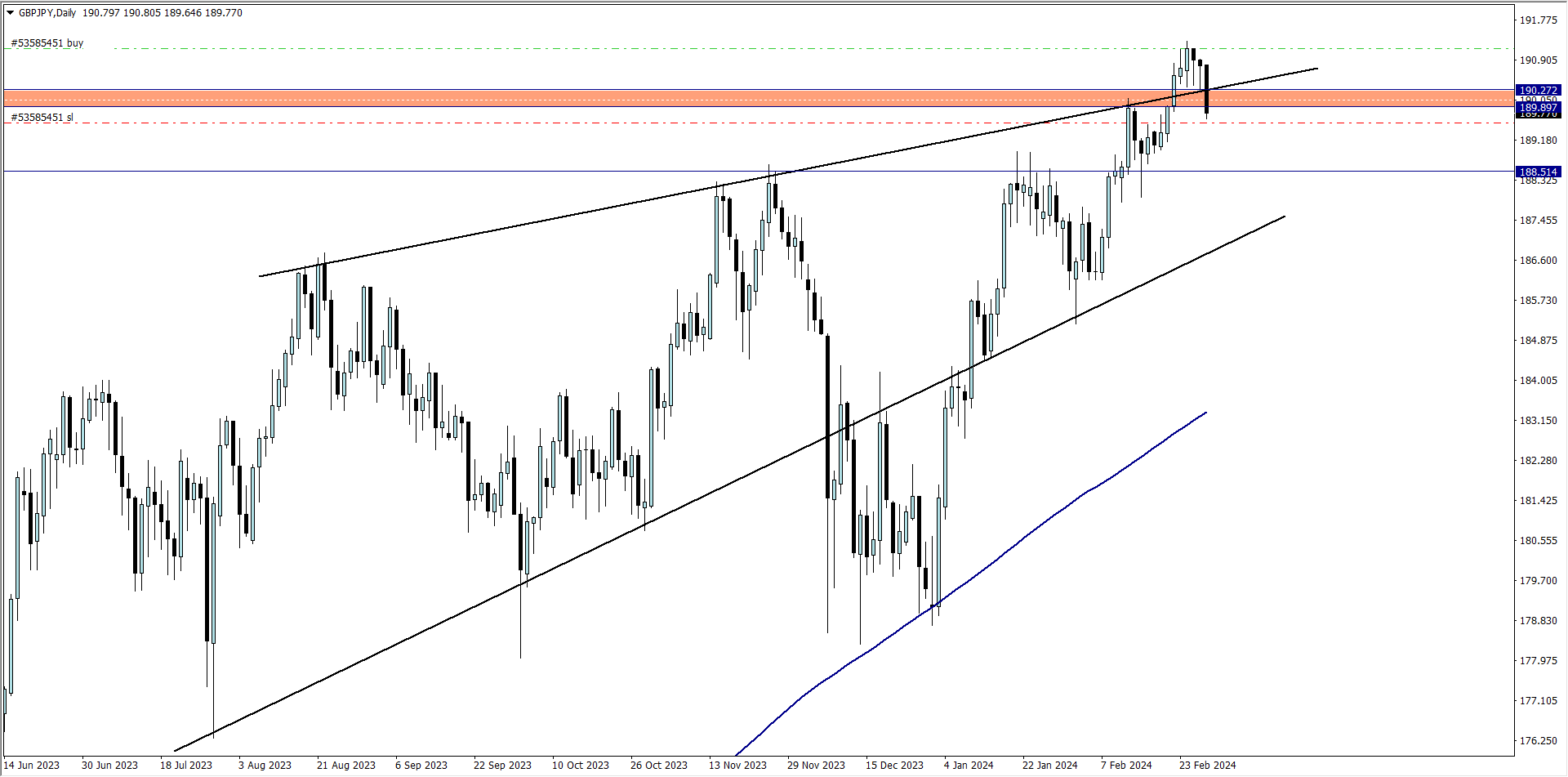

GBP/JPY (8.50 PM)

Analysis: My reason for buying GBP/JPY was shared on our Weekly Market Analysis

TUESDAY 27/02/2024

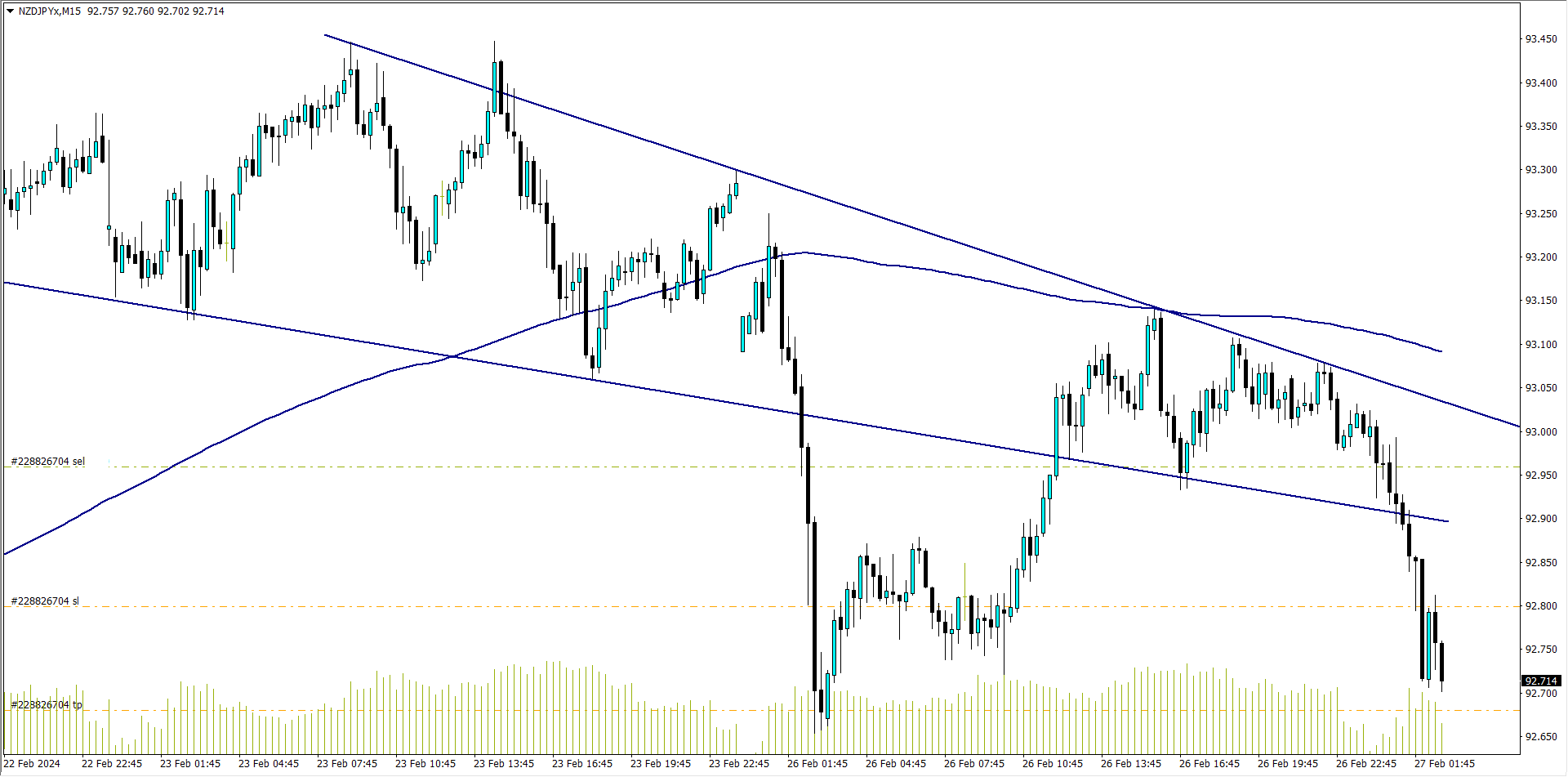

NZD/JPY update (2.30 am)

Analysis: Tp hit (+26 pips)

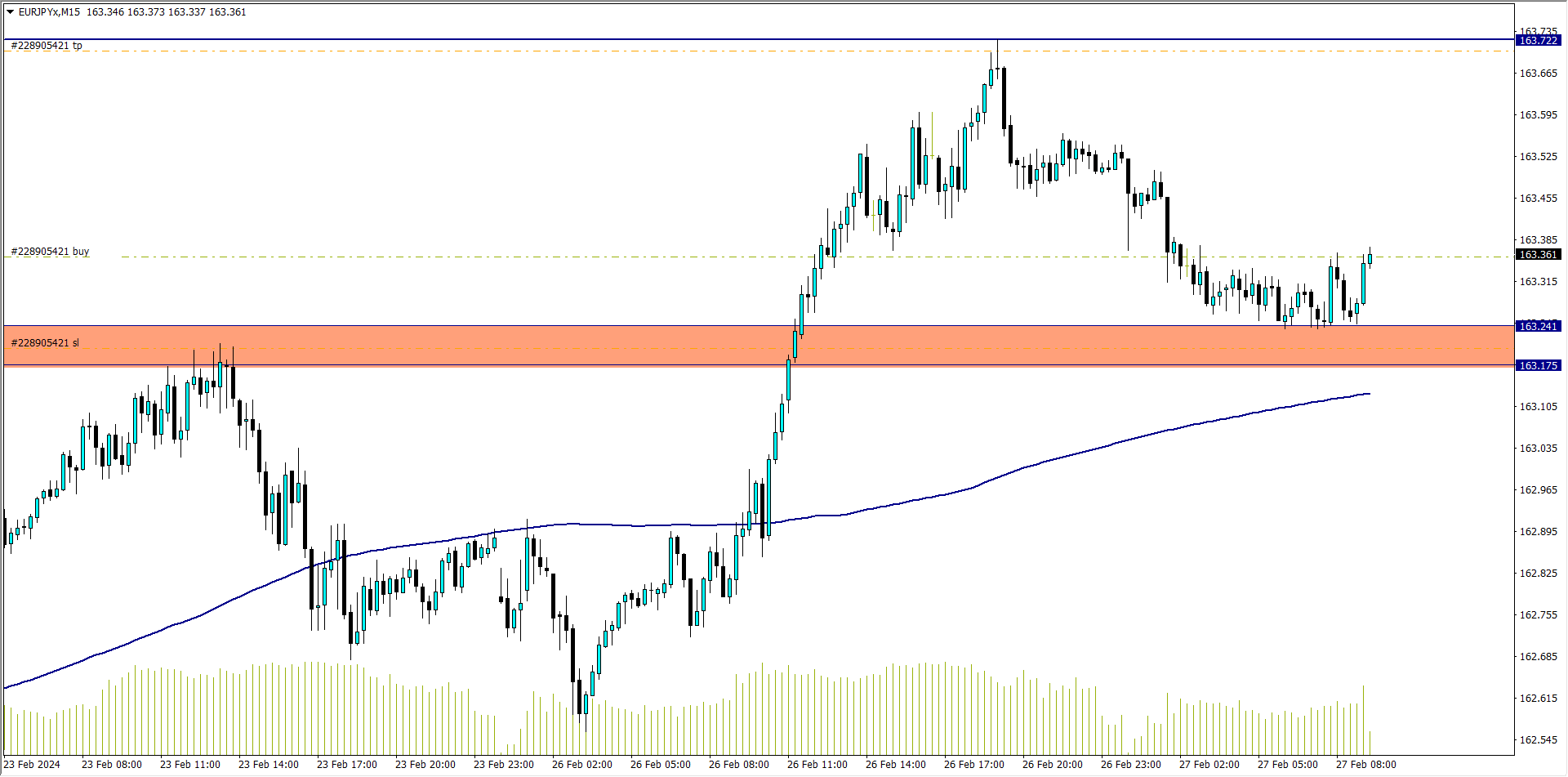

EUR/JPY (8.16 am)

Analysis: My reason for buying was because of the bullish outlook on the daily and 4hr time frame. That said, this trade closed with -15 pips loss

WEDNESDAY 28/02/2024

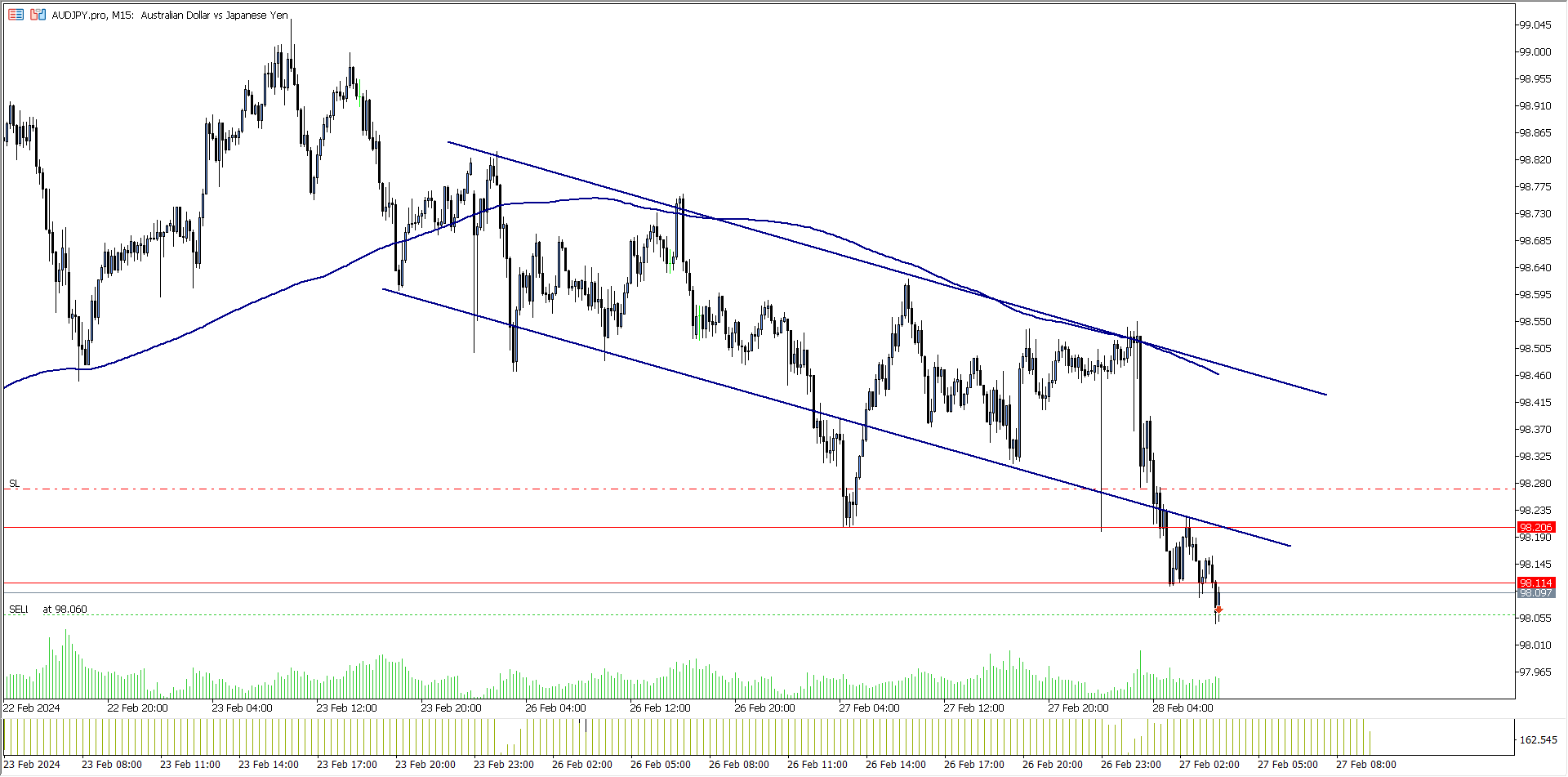

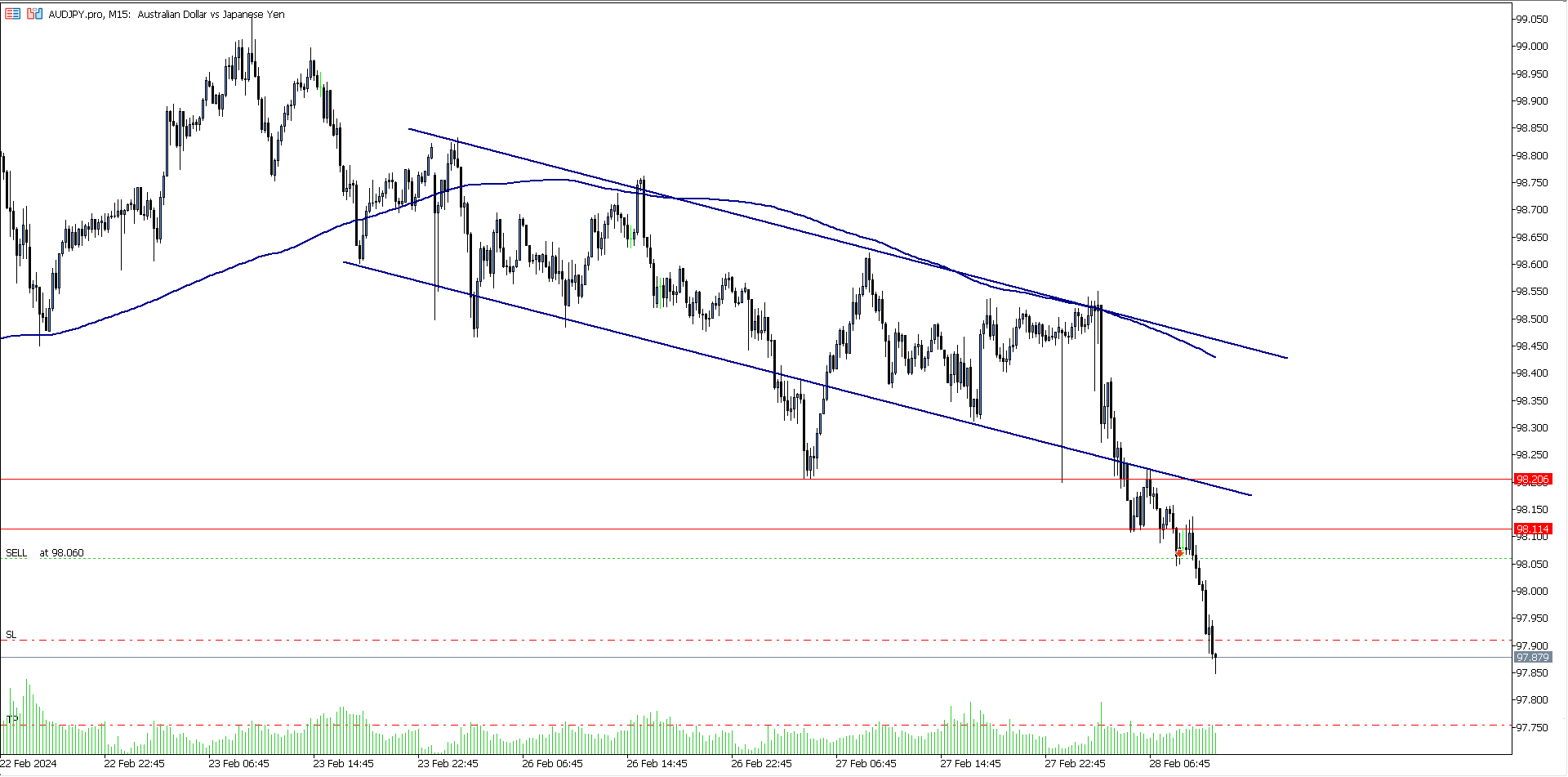

AUD/JPY (8.06 am)

Analysis: I sold AJ based on the daily and 4hr time frame bearish outlook

AUD/JPY update (11.20 am)

Analysis: Trailing Sl kicked me out at +15 pips

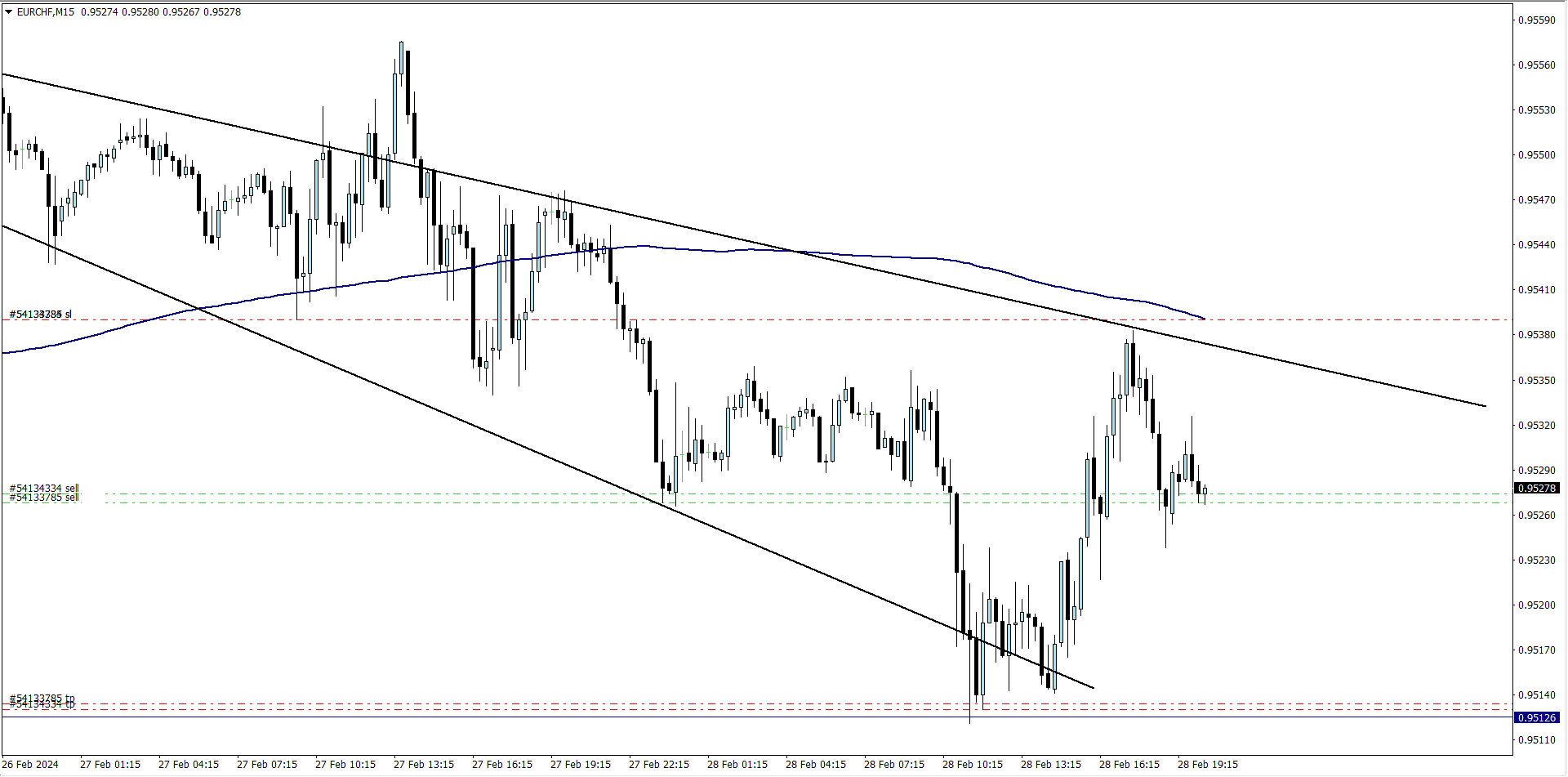

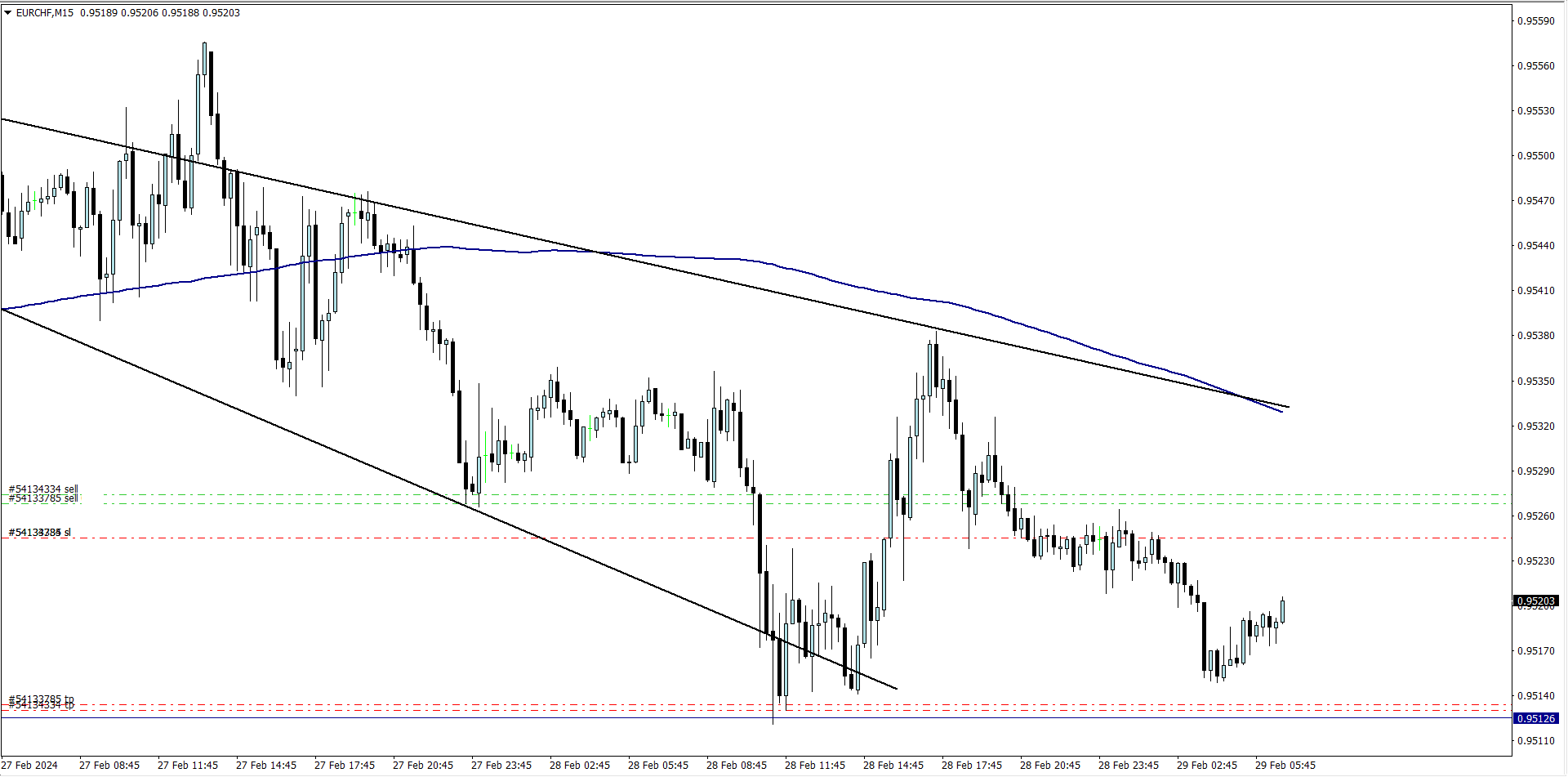

EUR/CHF (7.30 PM)

Analysis: I sold EUR/CHF based on the daily and 4hr time frame bearish outlook

THURSDAY 29/02/2024

GBP/JPY update (6am)

Analysis: I finally closed the trade I took on Monday with -157 pips, but I lost about -1% of my trading capital

EUR/CHF update (8.10 am)

Analysis: I closed my EUR/CHF trade with +7 pips (trailing SL)

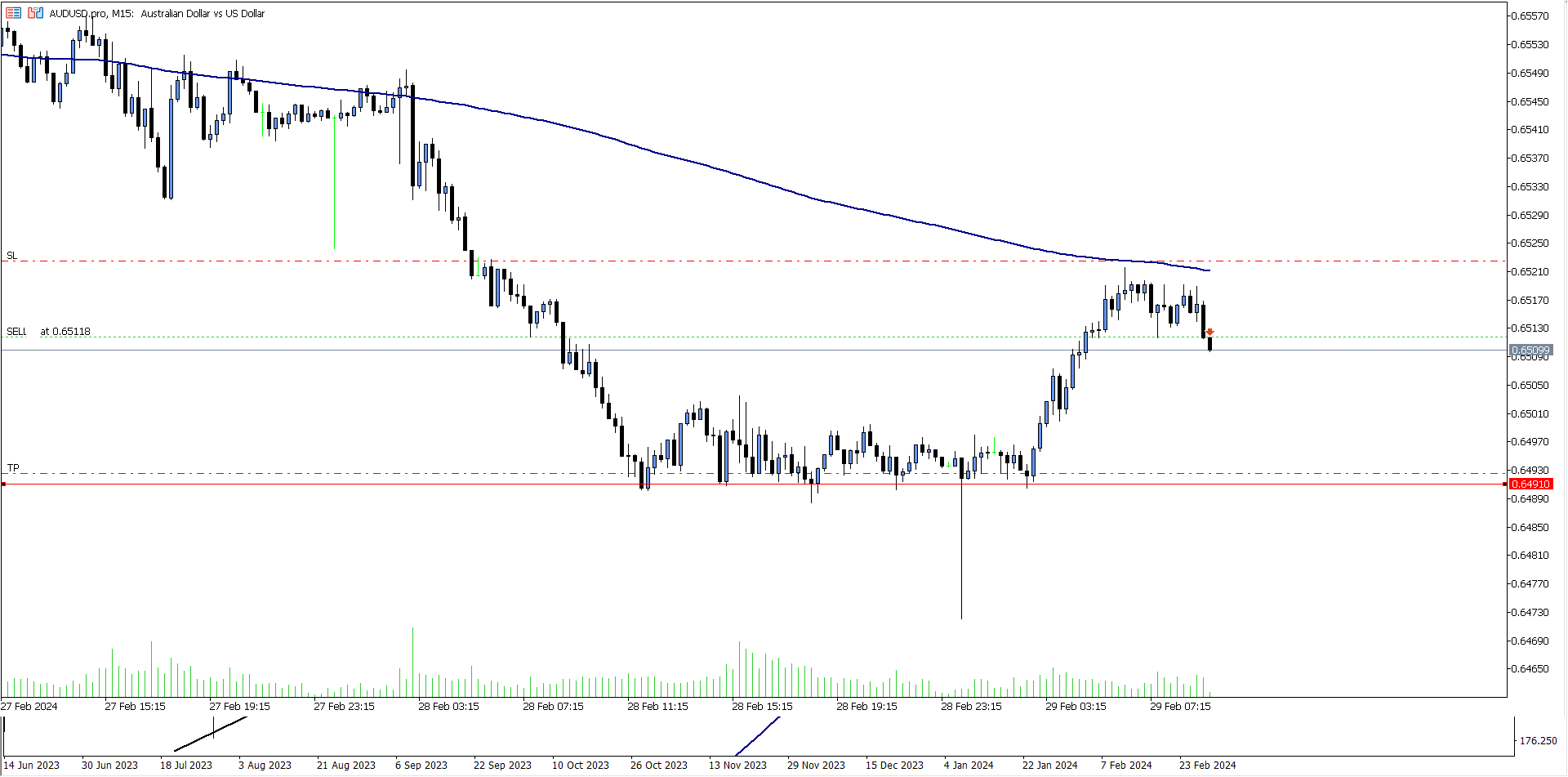

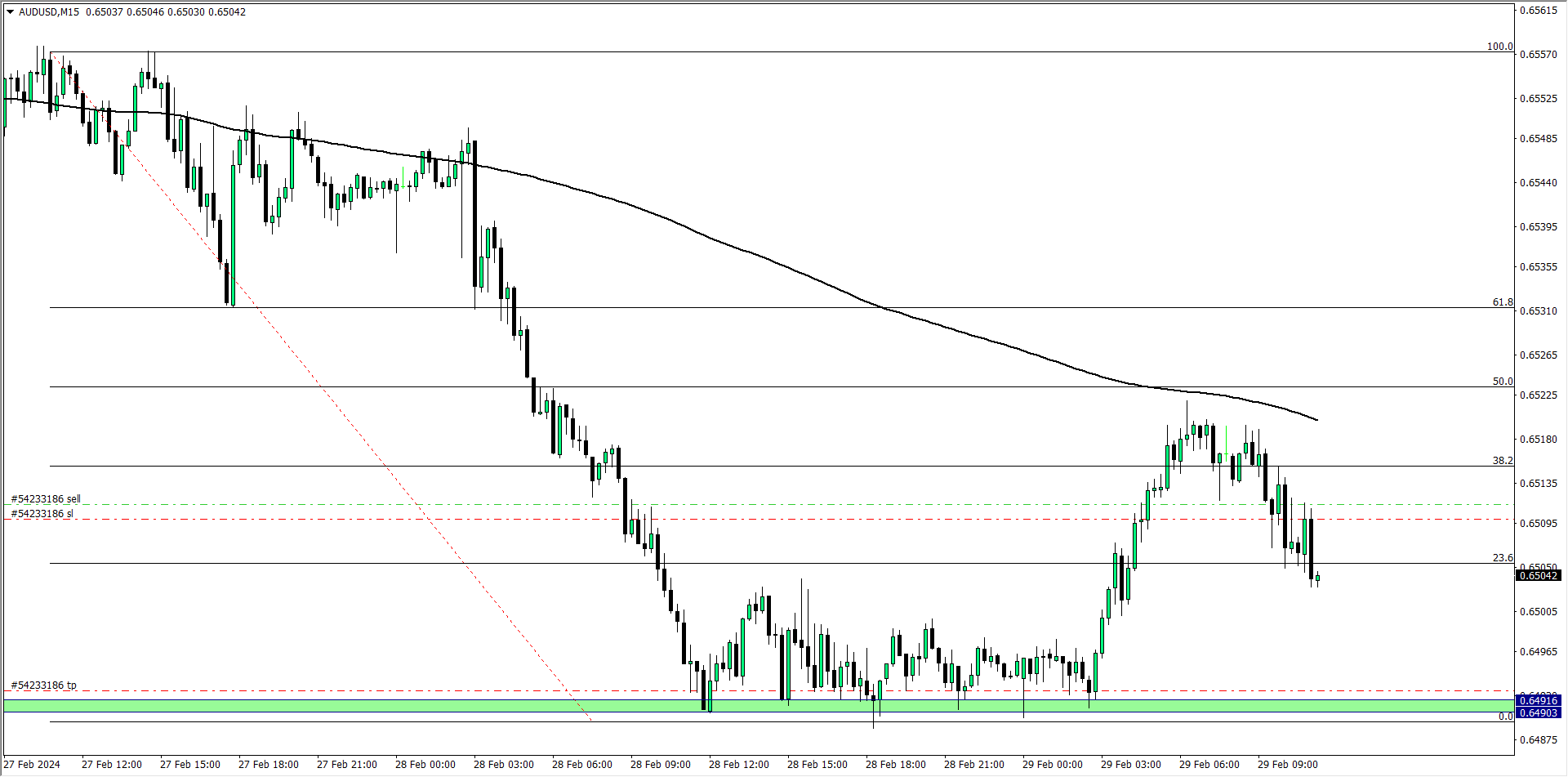

AUD/USD (8.40 am)

Analysis: I sold AUD/USD based on the daily and 4hr time frame bearish outlook

AUD/USD update (11.05 am)

Analysis: I got out with +7 pips (trailing SL)

FRIDAY 01/03/2024

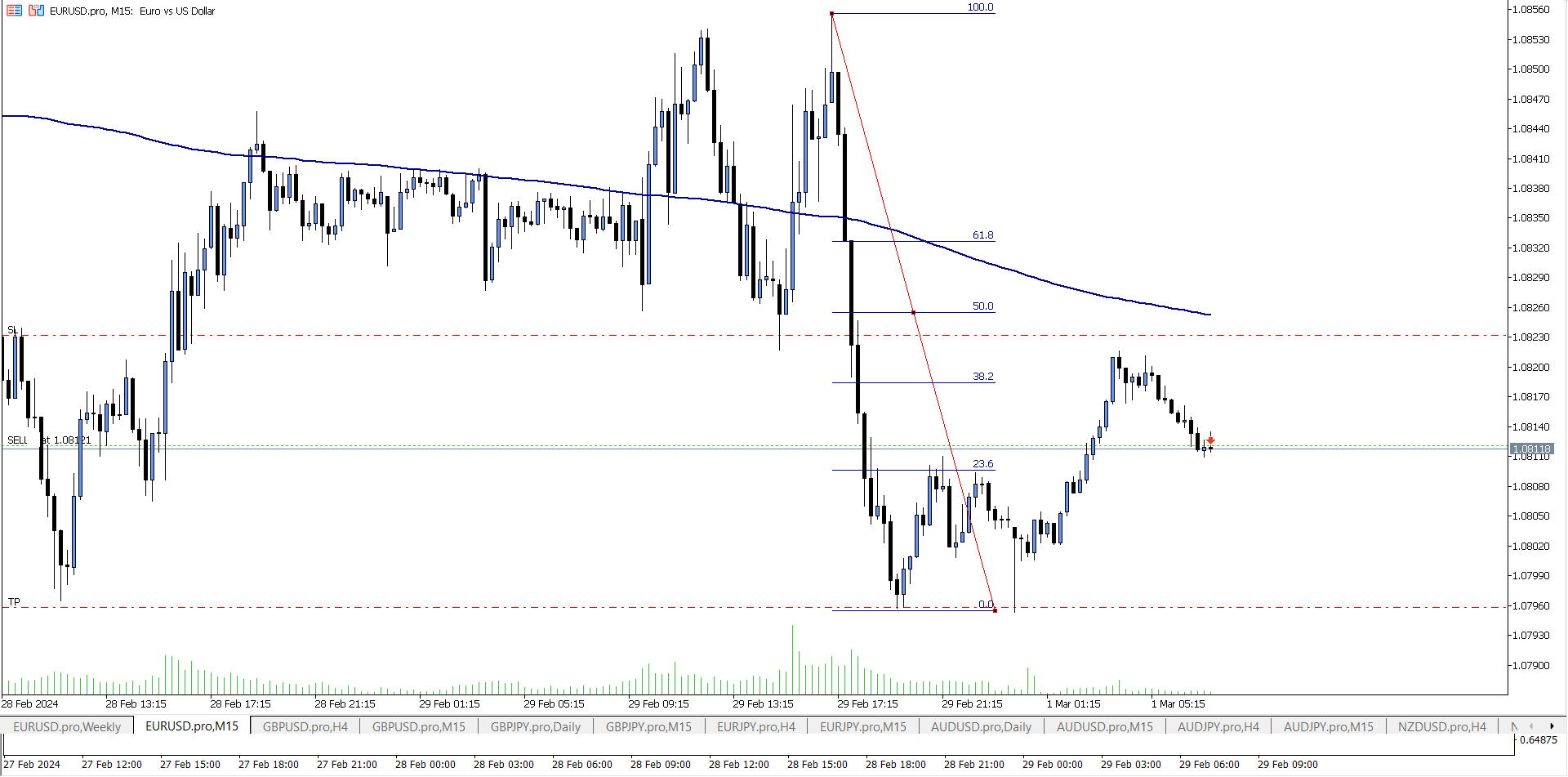

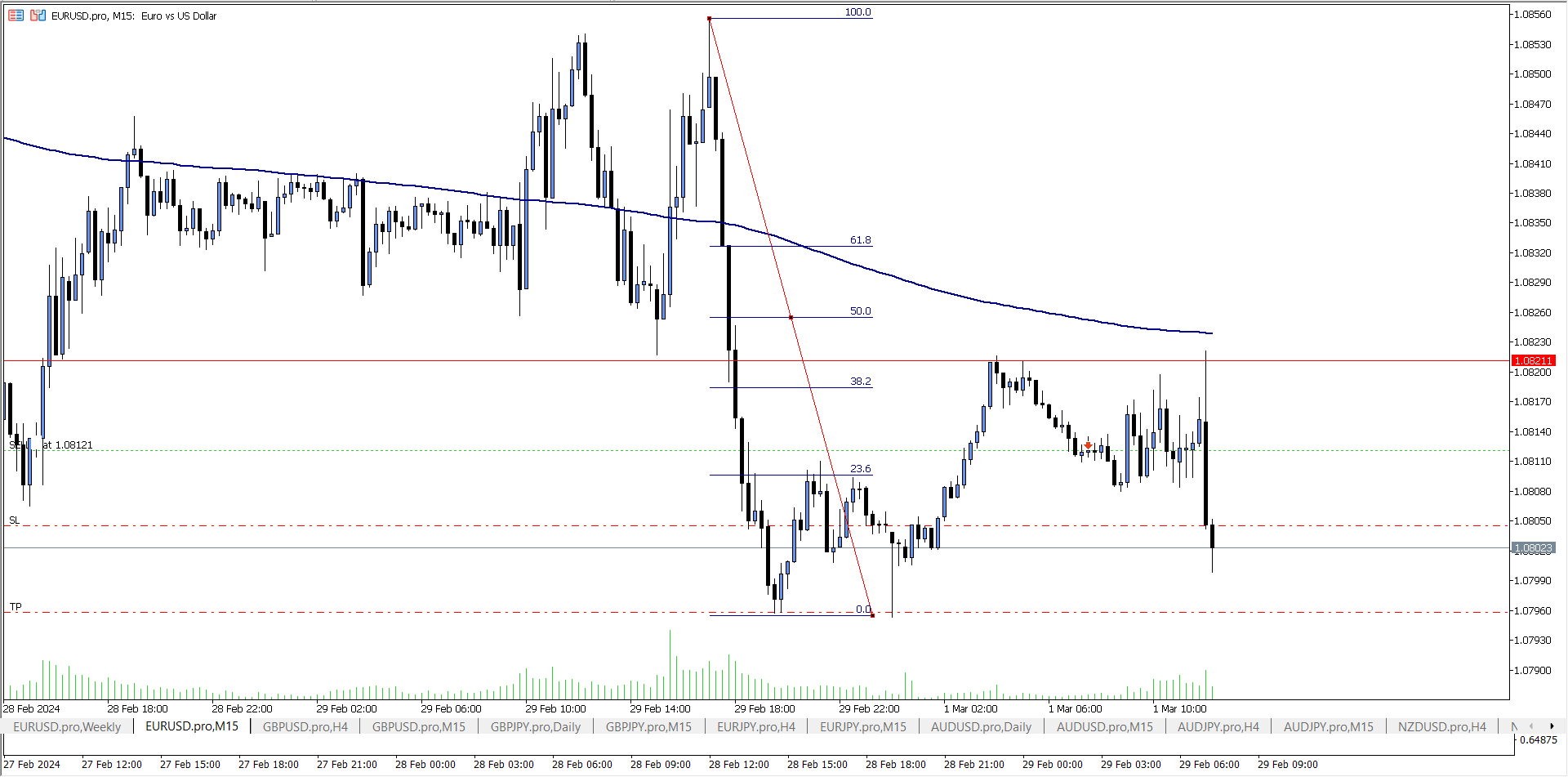

EUR/USD (6.45 am)

Analysis: I sold EUR/USD based on the daily and 4hr time frame bearish outlook

EUR/USD Update (11.22 am)

Analysis: I got out with +7 pips (trailing SL)

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (26/02/2024) | NZD/JPY | SELL | +26 pips |

| GBP/JPY | BUY | -157 pips | |

| TUE (27/02/2024) | EUR/JPY | BUY | -15 pips |

| WED (28/02/2024) | AUD/JPY | SELL | +15 pips |

| THUS (29/02/2024) | AUD/USD | SELL | +7 pips |

| FRI (01/03/2024) | EUR/USD | SELL | +7 pips |

| TOTAL | – 117 pips | ||

Trade activity summary for the month of February

| 1st TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| THUS (01/02/2024) | GBP/JPY | SELL | +7 pips | |

| FRI (02/02/2024) | CAD/JPY | SELL | +15 pips | |

| TOTAL | + 22 pips | |||

| 2nd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (05/01/2024) | CAD/JPY | SELL | Breakeven | |

| TUE (06/01/2024) | USD/CAD | BUY | -36 pips | |

| WED (07/01/2024) | CHF/JPY | BUY | – 53 pips | |

| THUS (07/01/2024) | CHF/JPY | SELL | – 33 PIPS | |

| TOTAL | – 122 PIPS | |||

| 3rd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| WED (07/01/2024) | CHF/JPY | BUY | – 38 pips | |

| TOTAL | – 38 pips | |||

| 4th TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (19/02/2024) | NZD/JPY | BUY | + 71 pips | |

| WED (21/02/2024) | NZD/JPY | BUY | – 13 pips | |

| THUS (22/02/2024) | AUD/JPY | BUY | + 13 pips | |

| TOTAL | + 71 pips | |||

| 5th TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (26/02/2024) | NZD/JPY | SELL | +26 pips | |

| GBP/JPY | BUY | -157 pips | ||

| TUE (27/02/2024) | EUR/JPY | BUY | -15 pips | |

| WED (28/02/2024) | AUD/JPY | SELL | +15 pips | |

| THUS (29/02/2024) | AUD/USD | SELL | +7 pips | |

| FRI (01/03/2024) | EUR/USD | SELL | +7 pips | |

| TOTAL | – 117 pips | |||

| GRAND | TOTAL | -184 pips |

In conclusion:

This week was an insanely busy week for me in the market because I had to become an intraday trader due to the lack of good swing trades. So I capitalized on the market’s 10-20 pips move rather than the usual 40 to 200 pips move

This shift in my strategy from last week paid off big time, as I almost hit +10% ROI on one of my accounts and about 2.5 to 3% on my other accounts. This shift saved me this week, as the only swing trade I took closed with -1% (-165 pips) of my trading capital.

Afterwards, my other trades were purely focused on intraday moves. I closed the week with about +1.8% ROI despite the negative in pips.

I had two bad weeks in the month of February, but my last two weeks were profitable enough to put me on an average of +3 to +7% on all of my accounts

Never under estimate the power of flexibility in trading

How did the month of February go for you?

NOTE:

-

THE FUNDED TRADER: (Use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS