This is where I share all my trades taken each and every week.

My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- To have enough date to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

TUESDAY (28/02/2023)

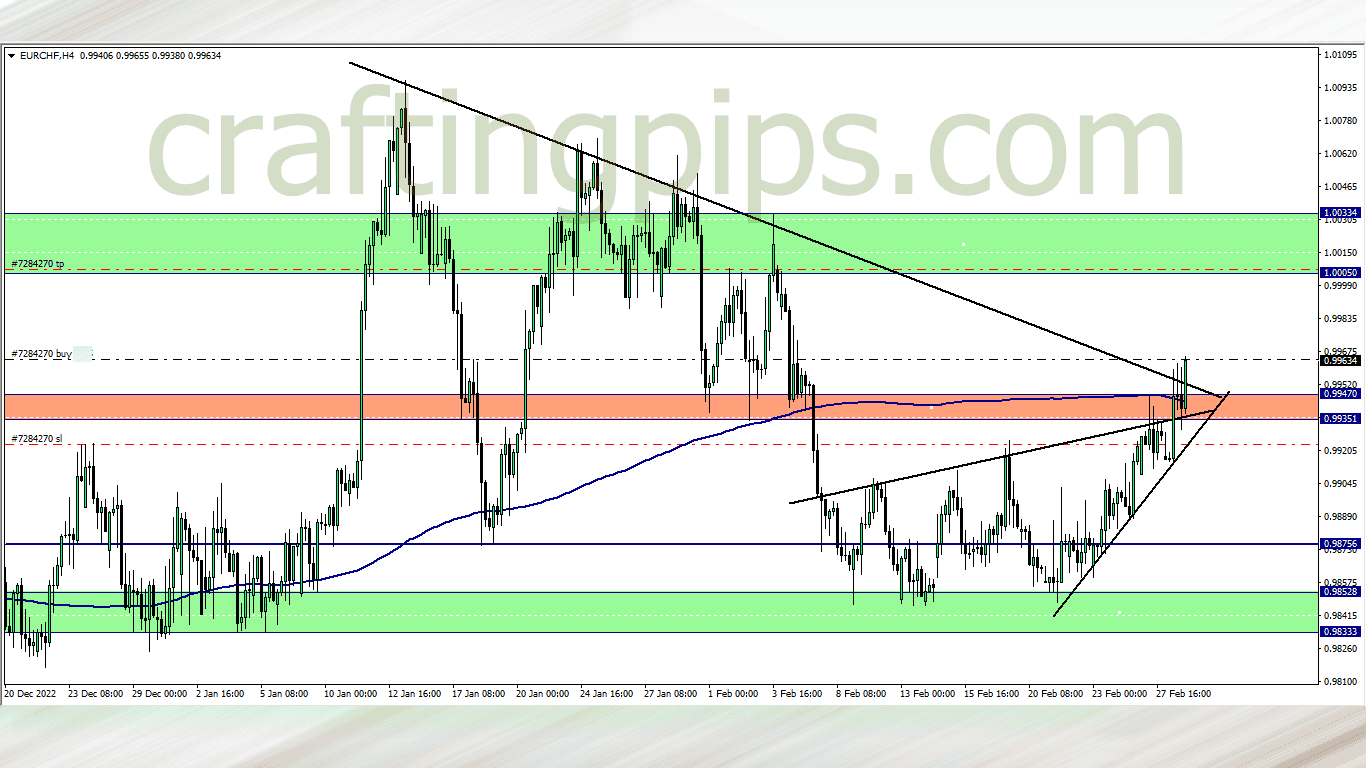

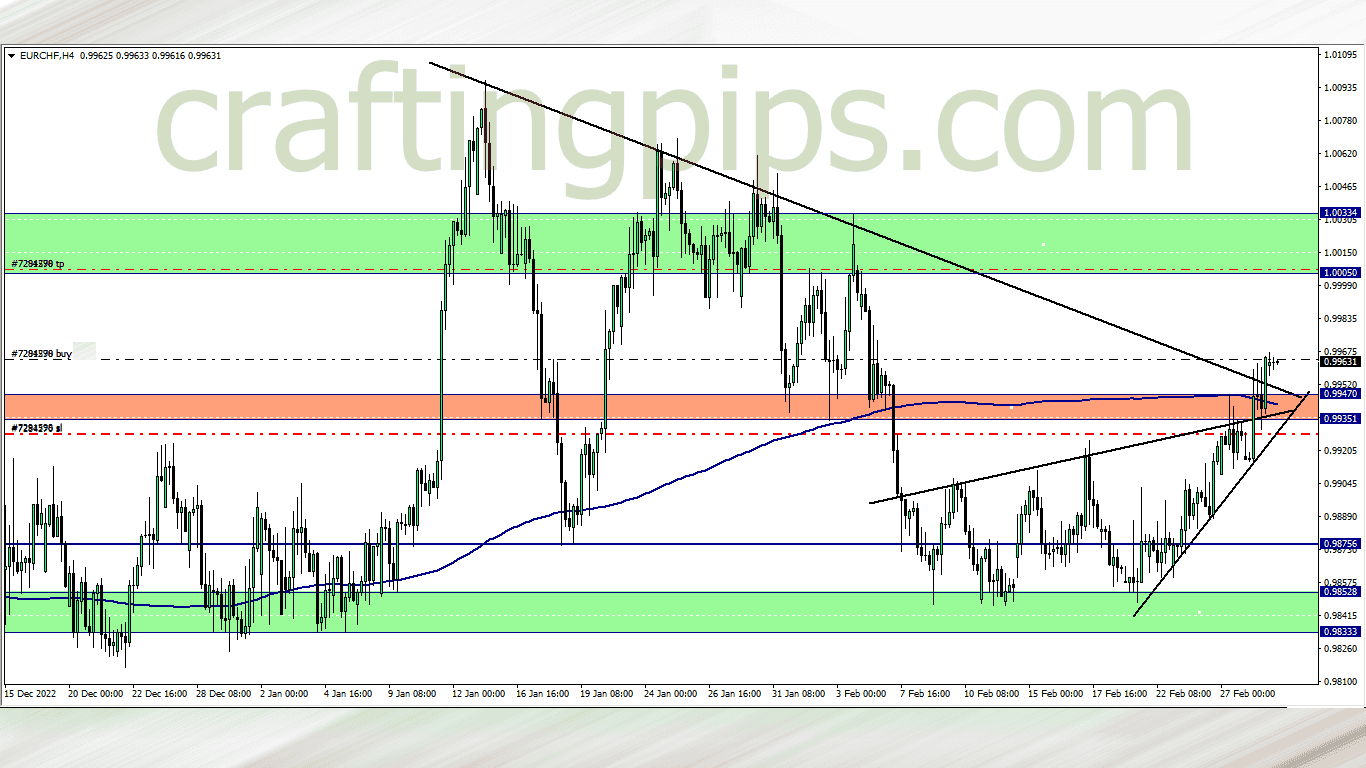

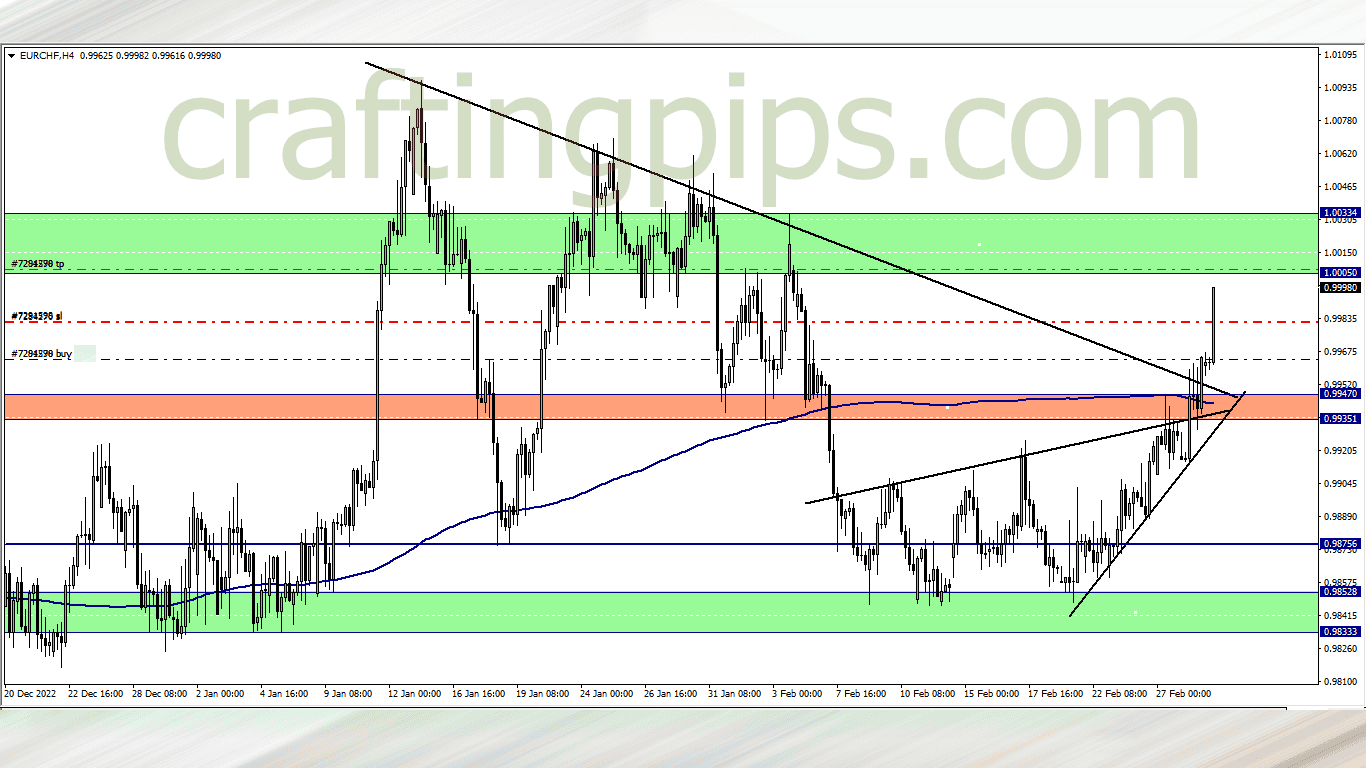

EUR/CHF (10.30 pm)

Analysis: Just in case you are wondering why I have EUR/CHF recorded in the month of March, when I actually took it a few hours to midnight in the month of February, it easy. I closed my February journal after the my last trade (GBP/CHF), so EUR/CHF analysis is for the month of March, as seen here

My reason for taking a buy on EUR/CHF can be seen on our Wednesday market analysis

WEDNESDAY (01/03/2023)

EUR/CHF Update 01/03/2023 (9 am)

Analysis: Judging from the doji’s formed all through the Asian session, the buyers are still in control of the market, so I added to my buy position.

EUR/CHF Update (9.11 am)

Analysis: I placed a tight trail on this baga. reason for this is the high impact news on GBP scheduled for 10am. The trade closed with +46 pips. A good way to start the new month

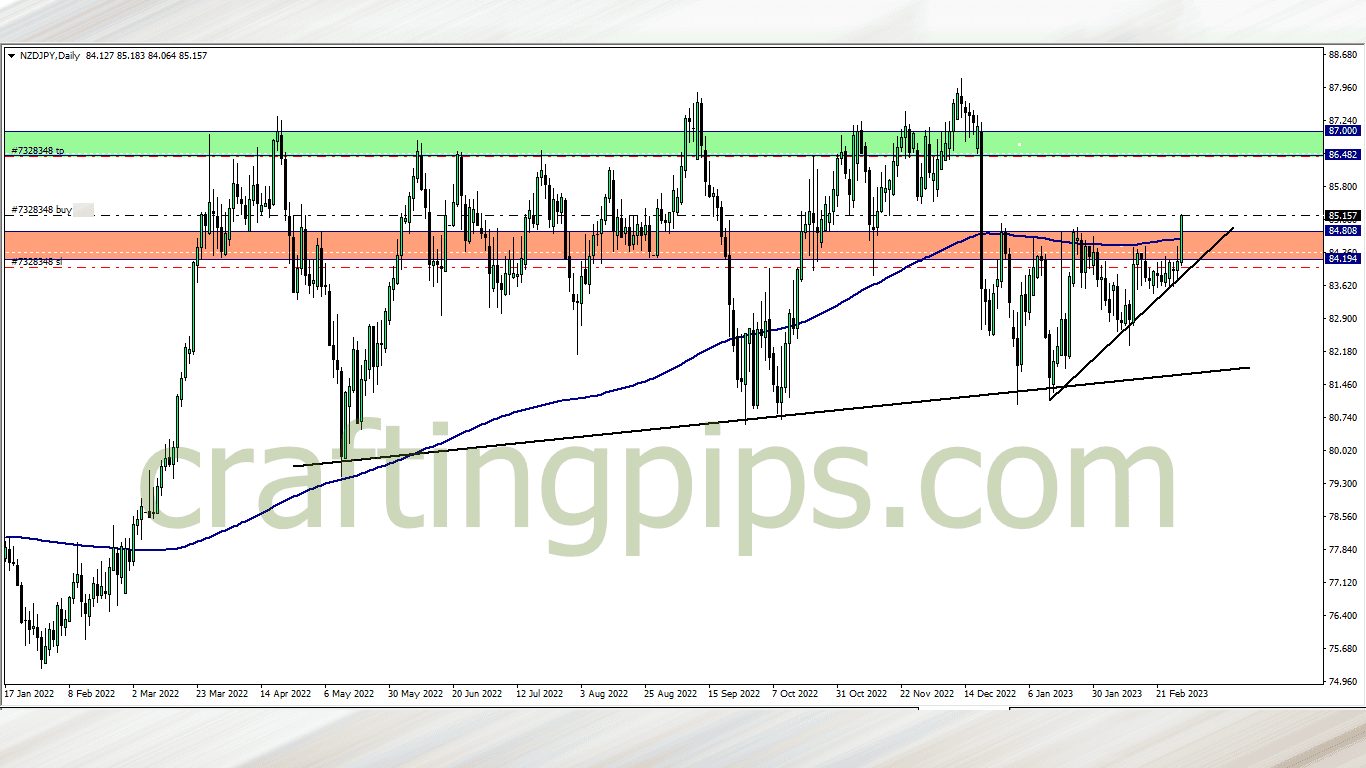

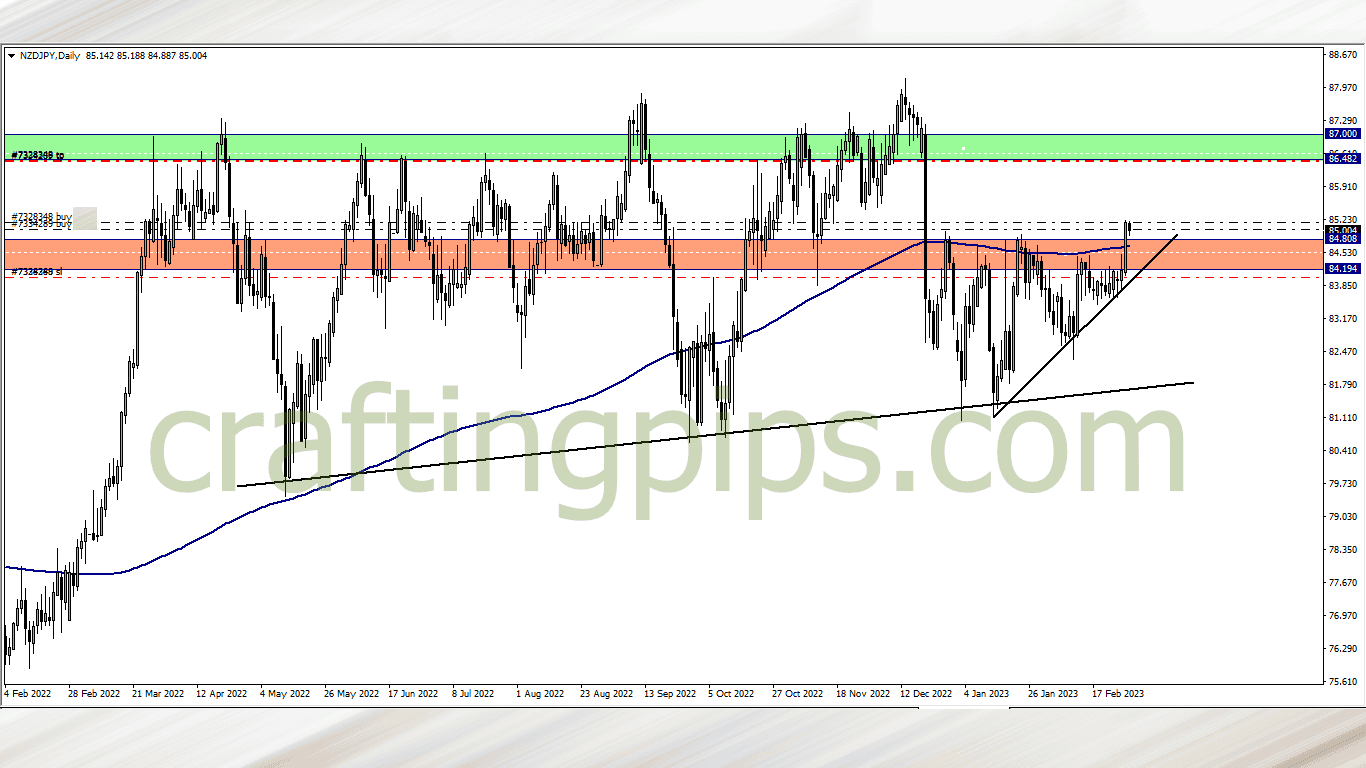

NZD/JPY (10.30 pm)

Analysis: My reason for buying NZD/JPY was shared on our Thursday analysis

THURSDAY (02/03/2023)

NZD/JPY Update (6.30am)

Analysis: Some confirmations in my system prompted me to scale in this morning. Mind you, I am not expecting this trade to hit my TP (If it does though, praise God). My plan for this trade if to hold it to till the Asian session, however if it allows me great opportunities to scale and trail, then we go with the flow.

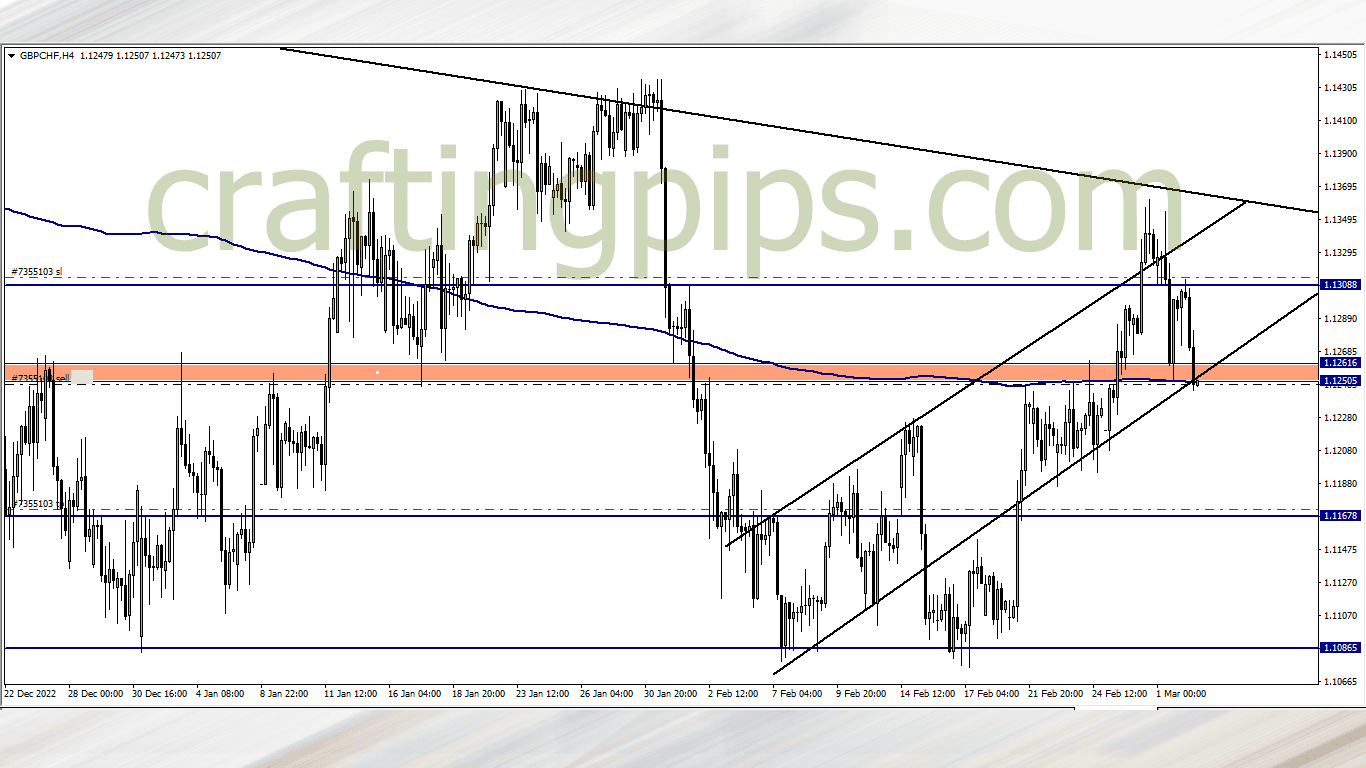

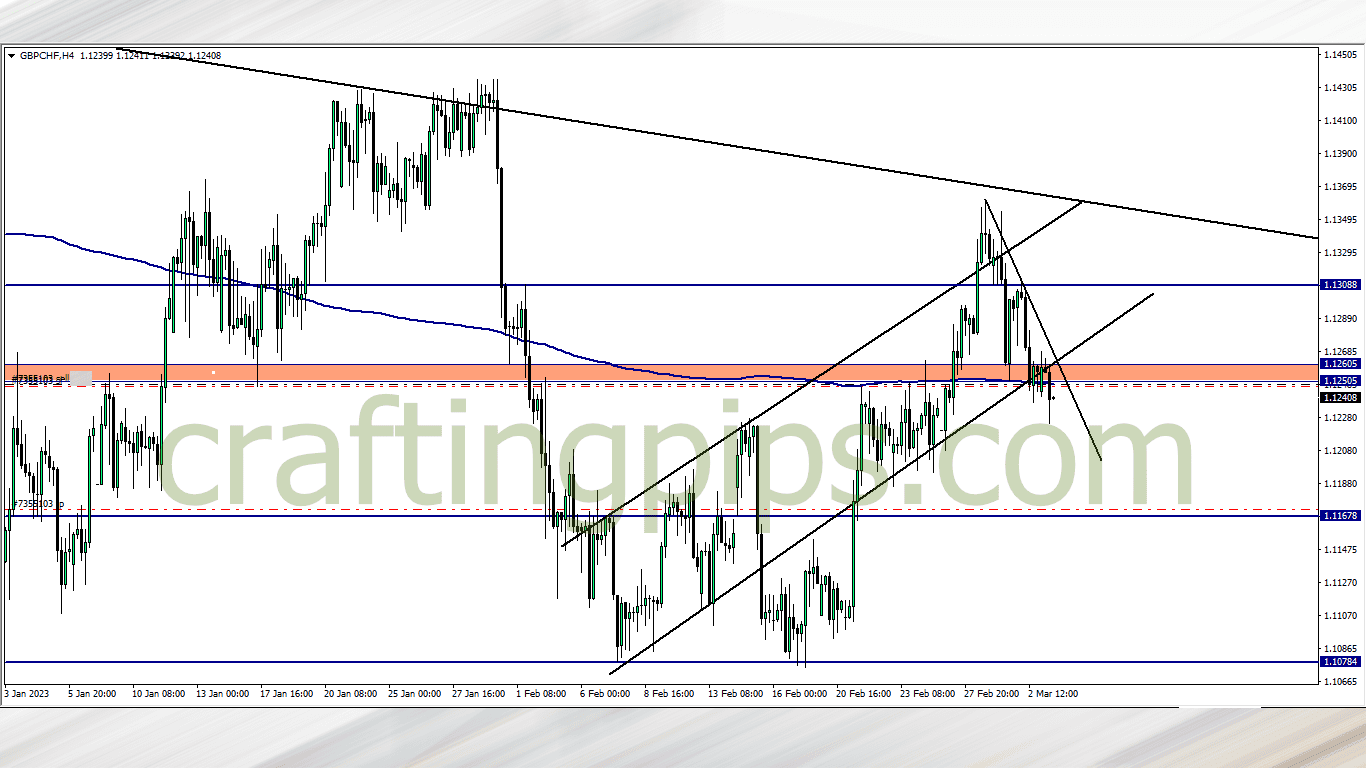

GBP/CHF (3 pm)

Analysis: This is one pair I have been trailing and was a bit skeptic selling on the daily time frame at the close of the daily candlestick on Wednesday, because of the way the candlestick closed on the daily time frame.

I call this entry the “Kamikaze entry” because price has not properly broken the support zone or the 200 ma, so there should be a bounce before a fall downwards. But guess what?

From experience such downward moves are sometime swift and by the time they materialize, it may be too late to get into them due to bad risk reward ratio, so I would rather get in early, then put my SL above the daily close in order to give price enough room to play before the fall.

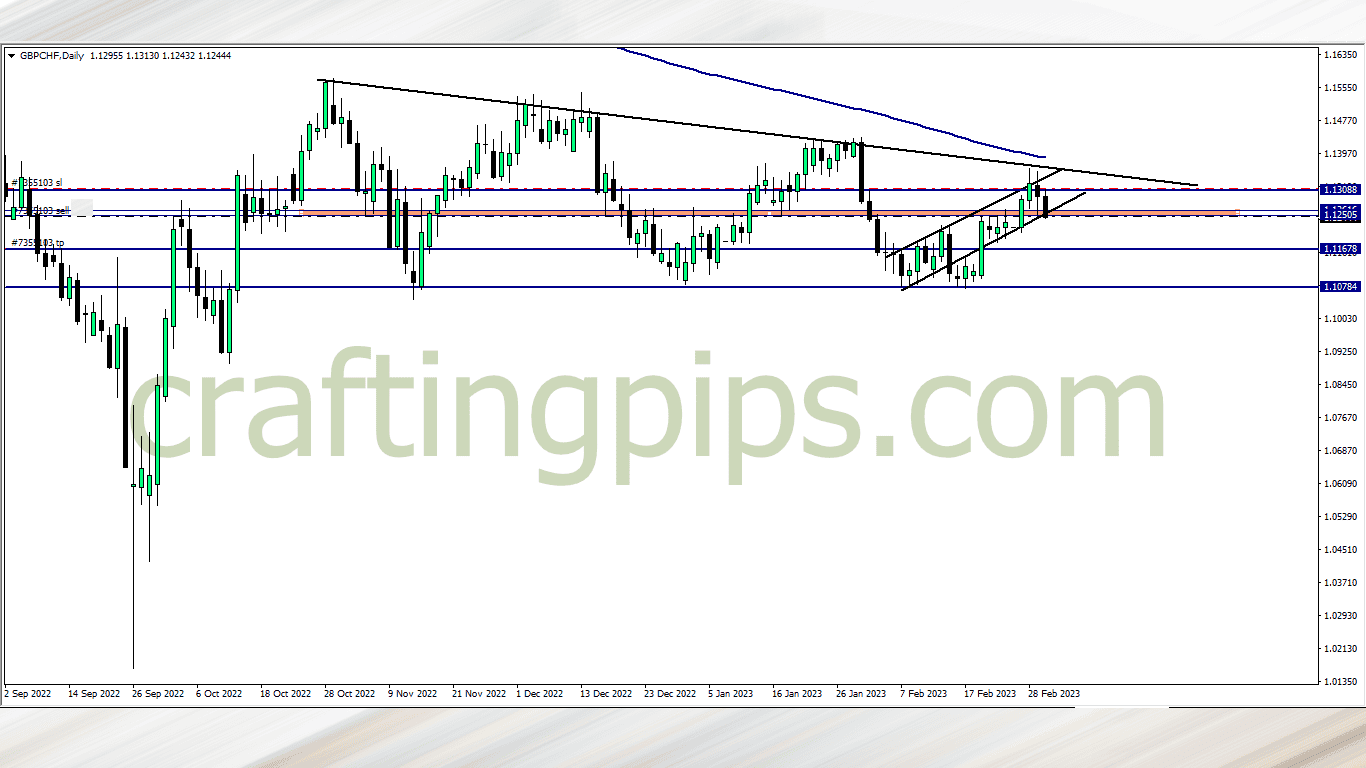

Check out the daily time-frame setup below:

GBP/CHF Daily time frame

You can see the resistance level aligning with the 200 ma, which suggests huge bearish move in the future

FRIDAY (03/03/2023)

GBP/CHF (11 am)

Analysis: After almost 24 hours and a questionable breakout, I decided to lock the GBPCHF sell at breakeven. The “Kam1kaze entry” closed at breakeven. I am glad making that decision because I would have held a negative position over the weekend

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| WED (01/03/2023) | EUR/CHF | BUY | + 46 pips |

| NZD/JPY | BUY | Pending | |

| FRI (03/02/2023) | GBP/CHF | SELL | Breakeven |

| TOTAL | +46 PIPS |

In conclusion:

The week started off with a bang.

5 trades in total: 2 good trades, 1 loss, 1 breakeven, and 1 pending trade (NZD/JPY). If you are wondering why you are just seeing just 3 out of the 5 trades, then check here. I recorded the two other trades this week under the month of February.

My execution this week was decent. I took a risk taking the Kamikaze setup, but I am glad exiting the trade (especially after seeing the outcome) based on discretion. It shows my killer instincts in the market was top notch.

My hope is that the NZD/JPY trade pulls through next week, then I will be in decent profits for the month. So far, this week was profitable. I hope it stays that way for the rest of the month.

How did yours go?

NOTE:

Hey traders,

If you are into trading for proprietary firms which I believe you should due to the many advantages involved, check out these carefully selected proprietary firms listed below.

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period.

If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code