This is where I share all my trades taken each and every week.

My reason for this is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- To have enough date to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 20/02/2023

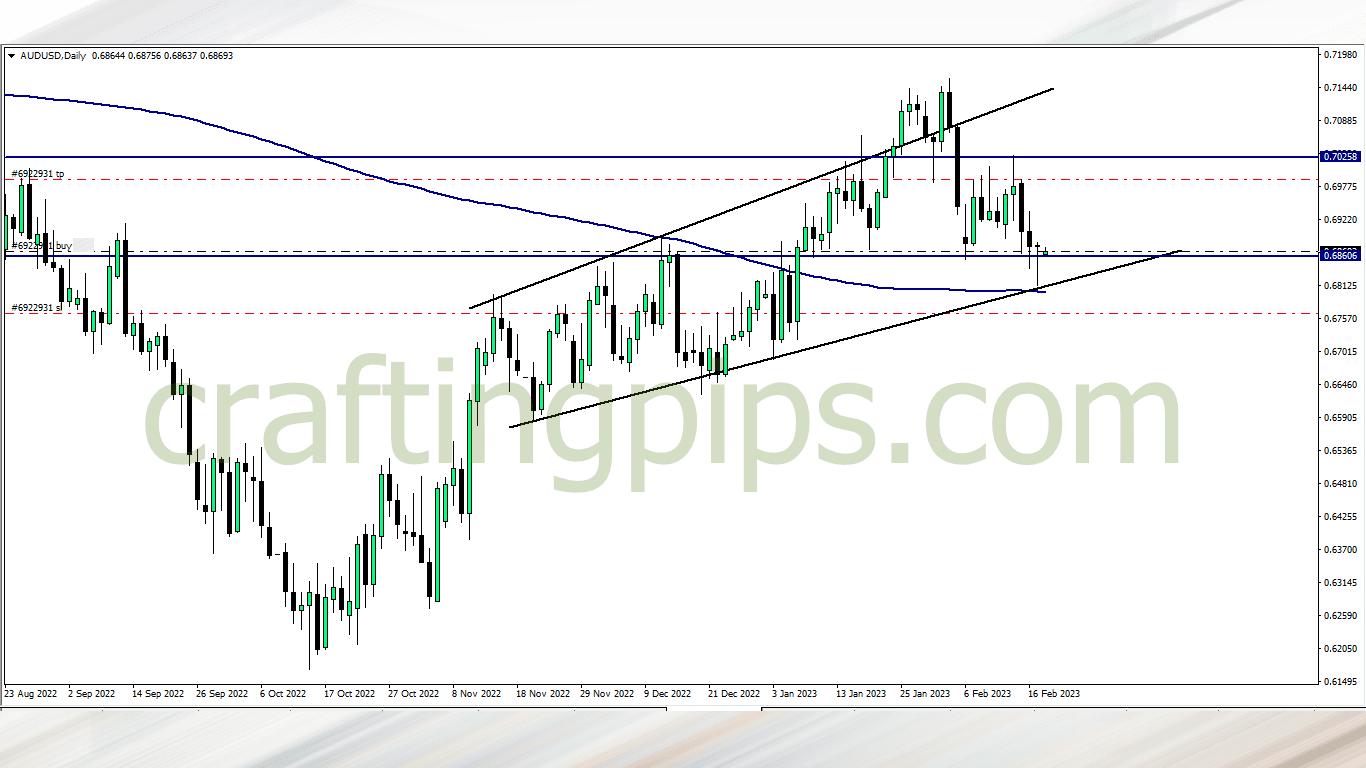

AUD/USD (12.30 am)

Analysis: My reason for buying AUD/USD was shared in our weekly analysis

AUD/USD Update (10.30am)

My trailing SL got triggered and the trade was closed with +32 pips

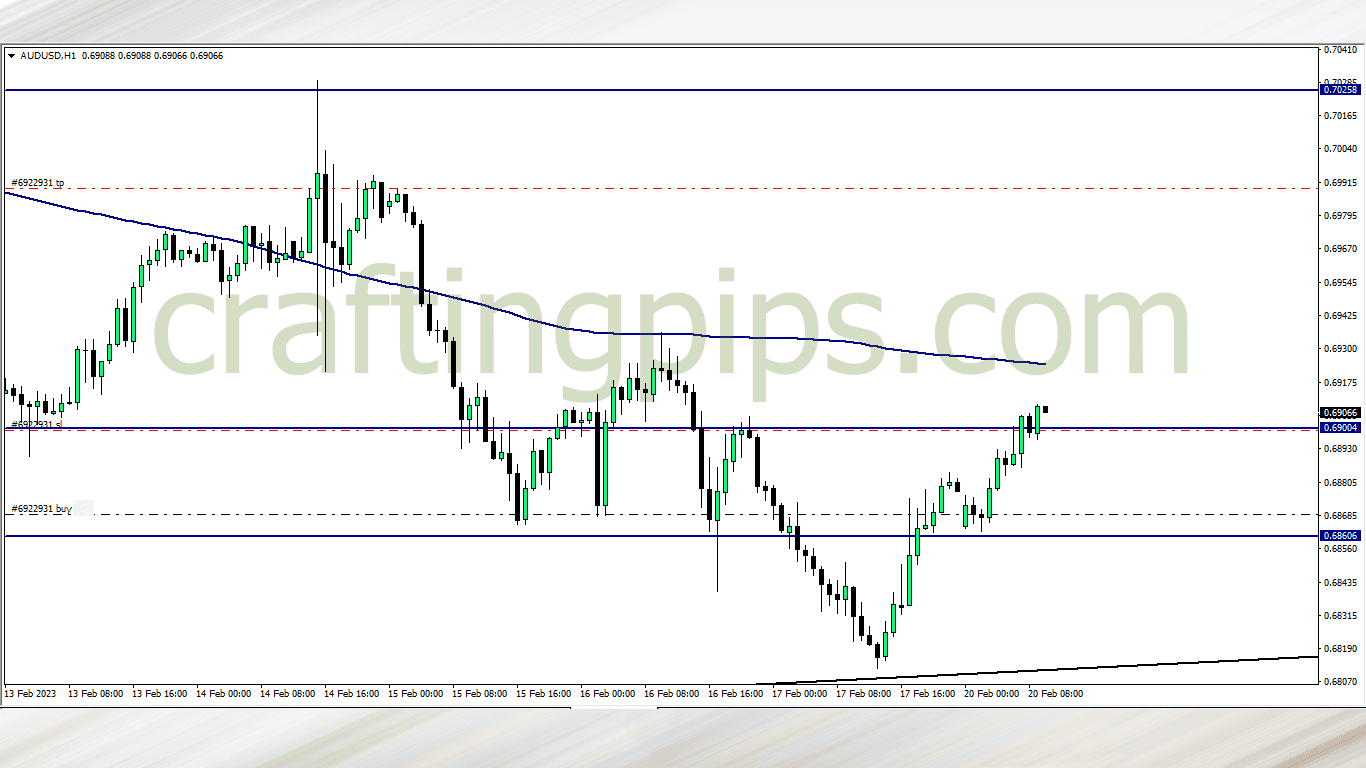

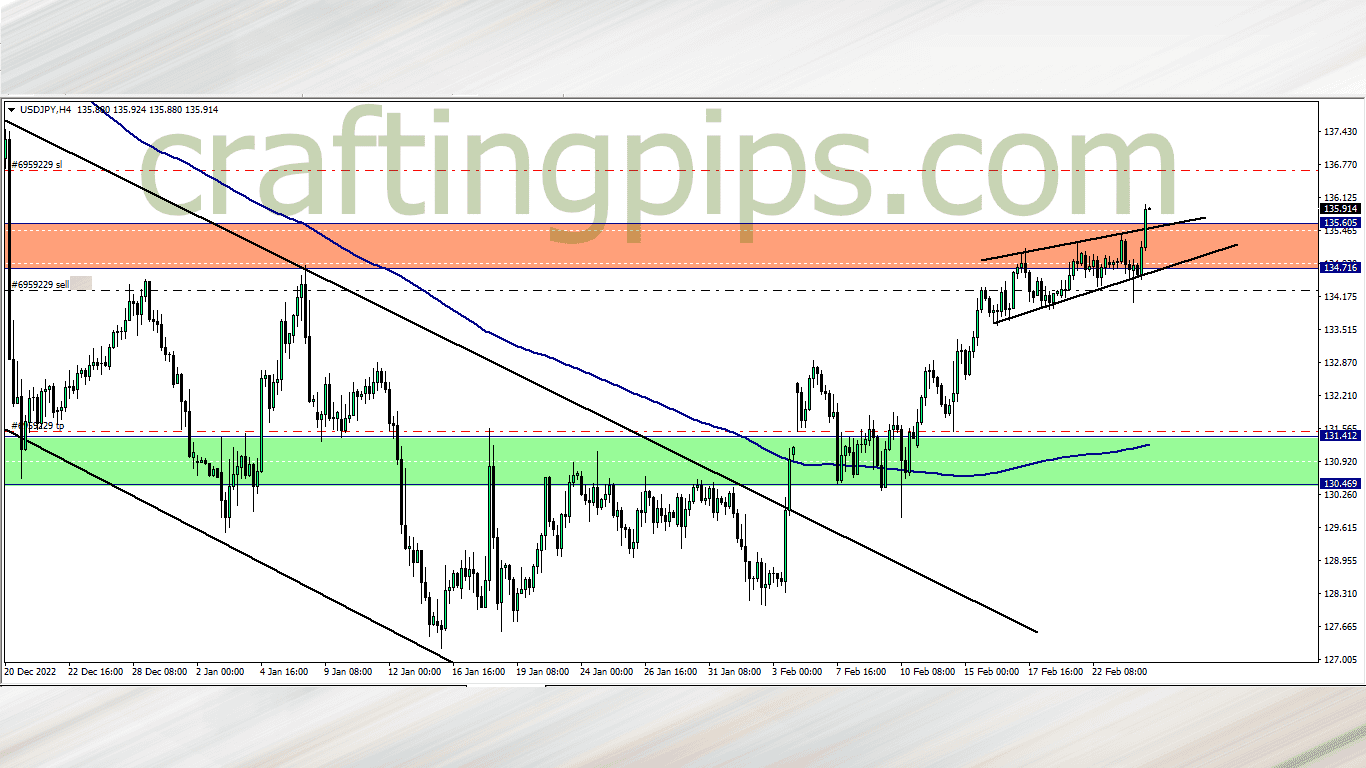

USD/JPY (10.30 pm)

Analysis: Since last week the bulls have found it difficult breaking the light Salmon colored resistance zone.

We are a few hours away from the close of the daily candlestick, yet the zone stands. Also price is below the 200 ma, which gives the resistance zone more credibility

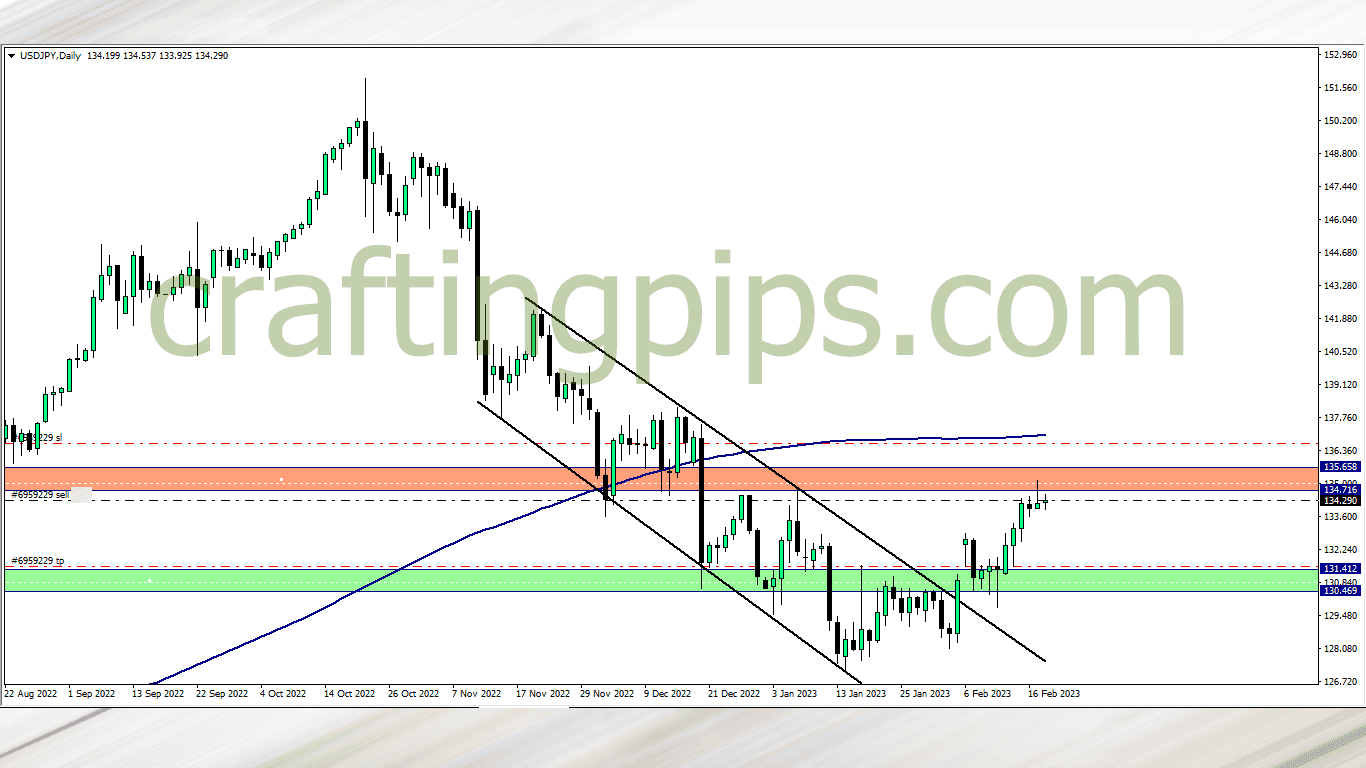

WEDNESDAY 22/02/2023

Analysis: Since last year December price was trapped within a consolidation. Tuesday’s daily candlestick closed with a dramatic bullish breakout of the key resistance zone and 200 ma. I will be expecting price to hit the green zone before the week run’s out

THURSDAY (23/02/2023)

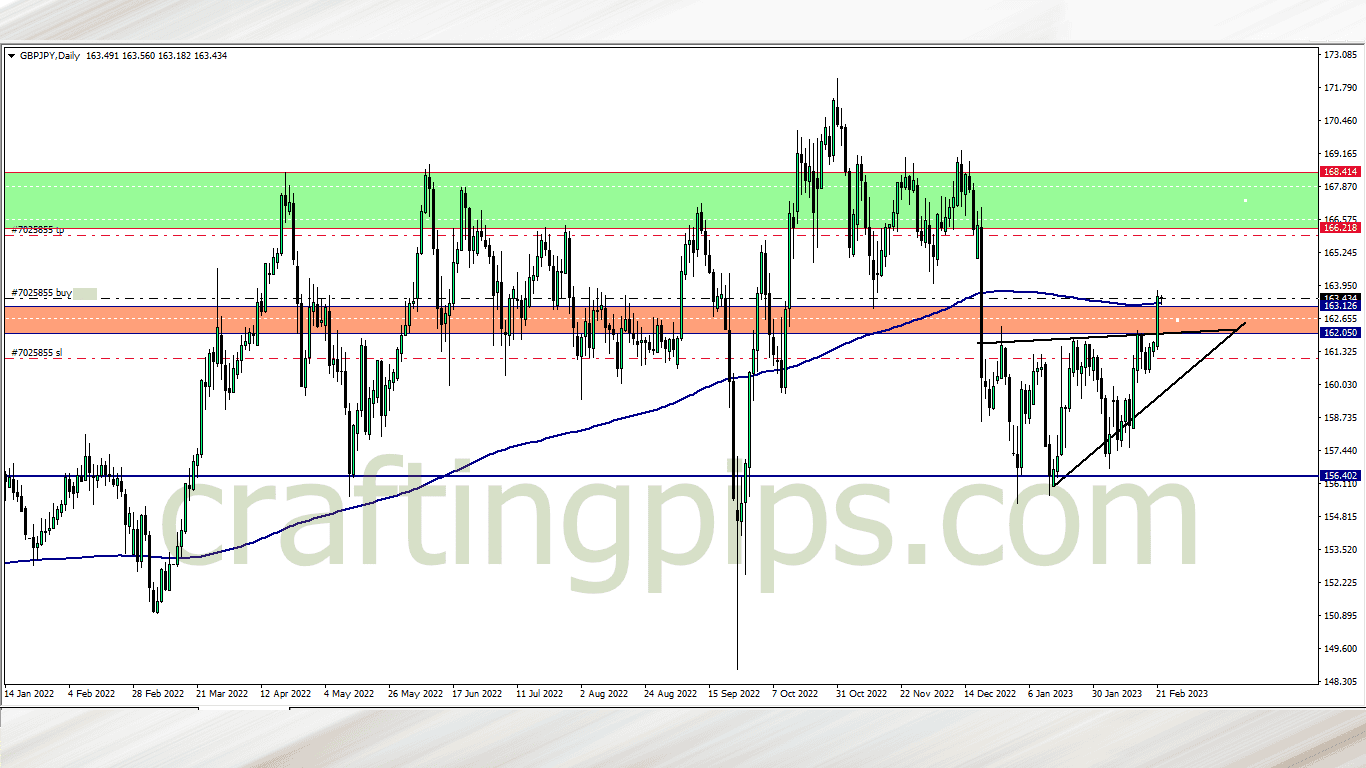

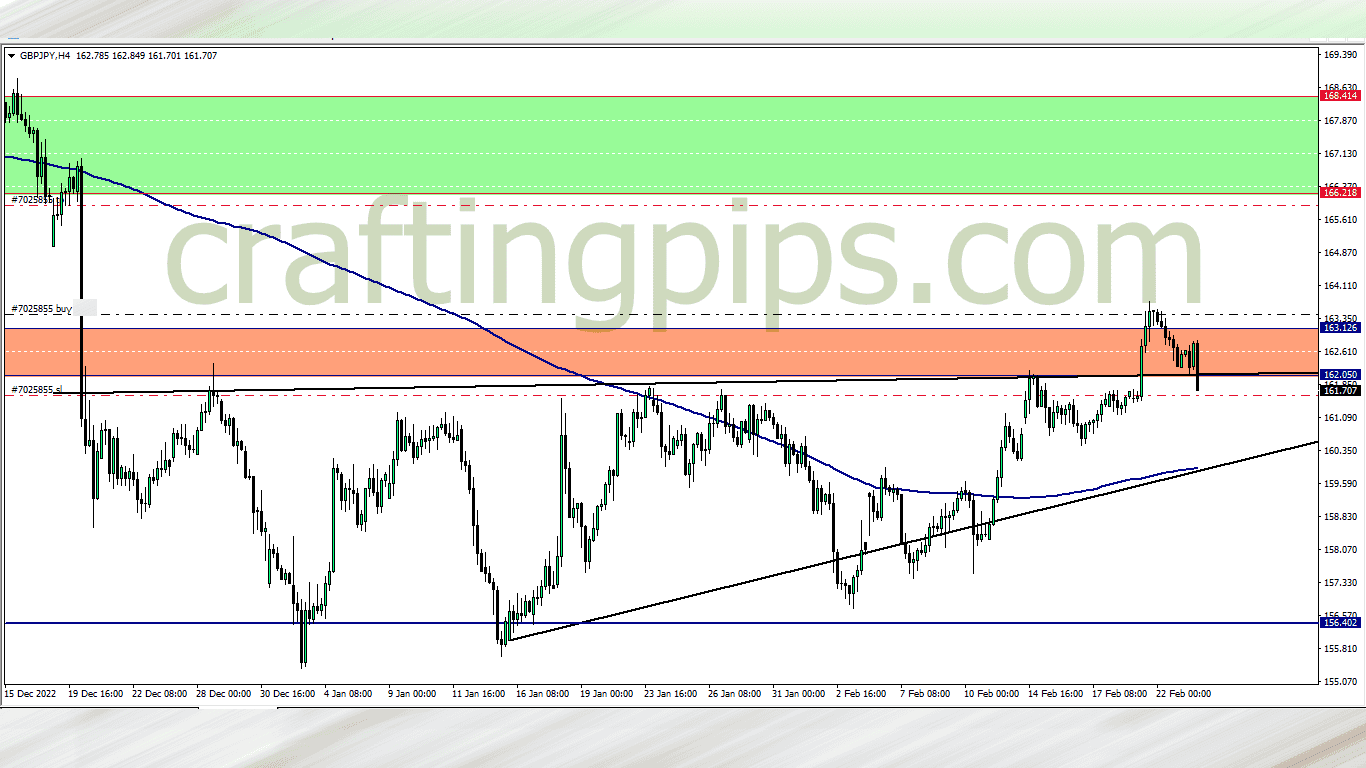

GBP/JPY 7pm

Analysis: Locked -185 pips because price broke below the light Salmon colored support zone. This is a key indication that our SL will get hit, and it did get hit, so it was a good call

FRIDAY (24/02/2023)

USD/JPY (3.10 pm)

Analysis: I closed the trade at -150 pips. At this point there is already an invalidation of my analysis. We can spot a clean breakout of the 11 am candlestick and there is a huge probability that price will hit my SL.

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (20/02/2023) | AUD/USD | BUY | + 32 pips |

| THUS (23/02/2023) | GBP/JPY | BUY | – 185 pips |

| FRI (24/02/2023) | USD/JPY | SELL | – 150 pips |

| TOTAL | – 303 pips |

In conclusion:

This week was extremely slow in the market. I started the week with a good call on AUD/USD, and I was happy the way I managed the trade.

I was dissatisfied with my GBP/JPY trade because I got in too early. Yes, price broke the 200 ma, but it was not neat. I depended on just price structure breaking an old resistance zone, neglecting the rookie break on the 200 ma (I will work on that in my next trades)

The USD/JPY was well executed but still went bad. I guess the market had the last laugh.

I had a very good opportunity to buy USD/JPY after I closed the bad trade, and I would have recovered from this week’s loss but I did not due to my rules which are:

- I mostly don’t trade on Friday’s and again

- The timing of the breakout on UJ is questionable

So I am closing with a loss for the week, but I am hopeful, we still got two more trading days in the month of February. Do have a great weekend and for my Nigerian brothers and sisters, do vote wisely

NOTE:

Hey traders,

If you are into trading for proprietary firms which I believe you should due to the many advantages involved, check out these carefully selected proprietary firms listed below.

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period.

If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code