My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 19/02/2024

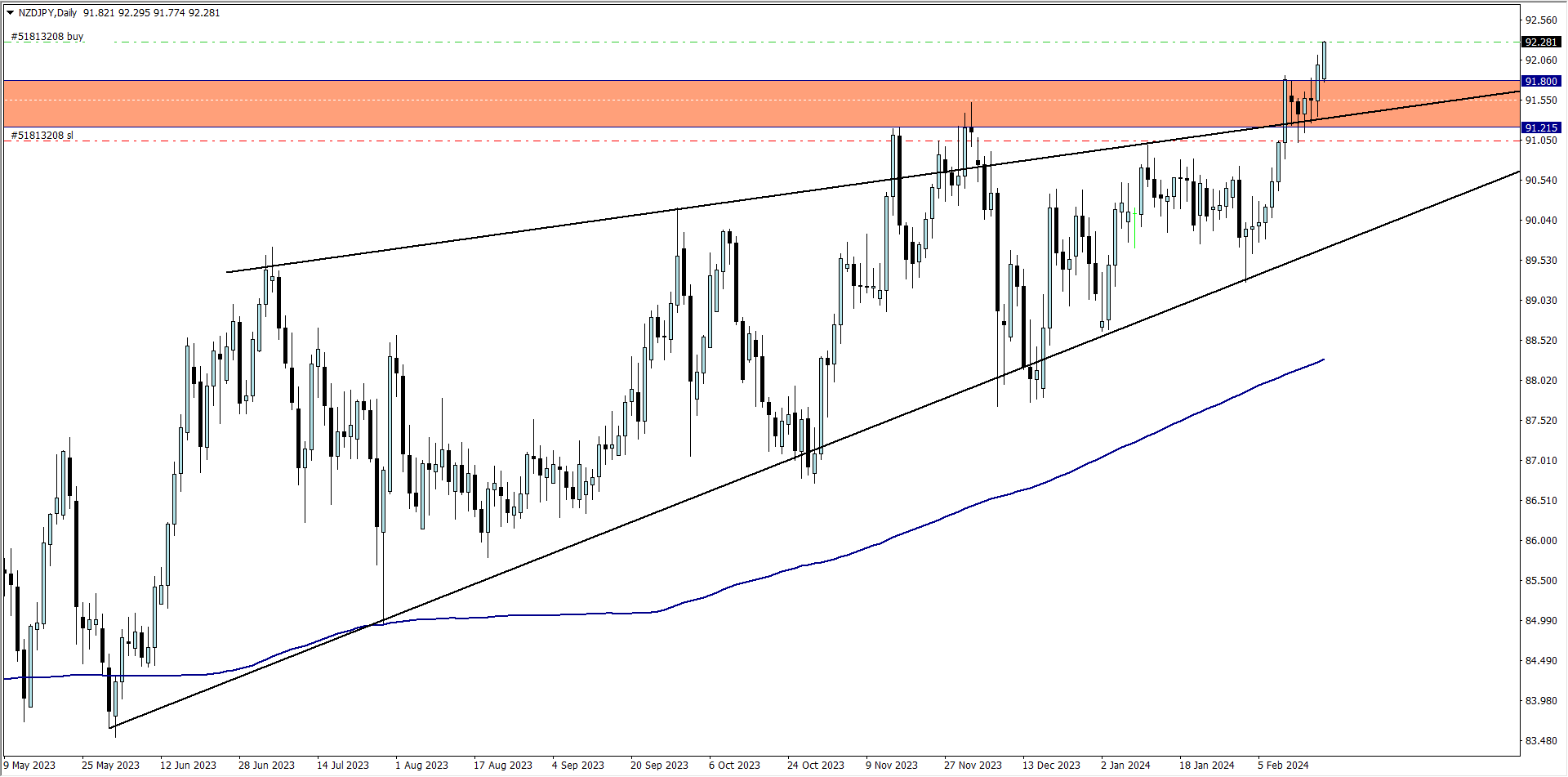

NZD/JPY (8.30 PM)

Analysis: My reason for buying was inspired by our Weekly Market Analysis

TUESDAY 20/02/2024

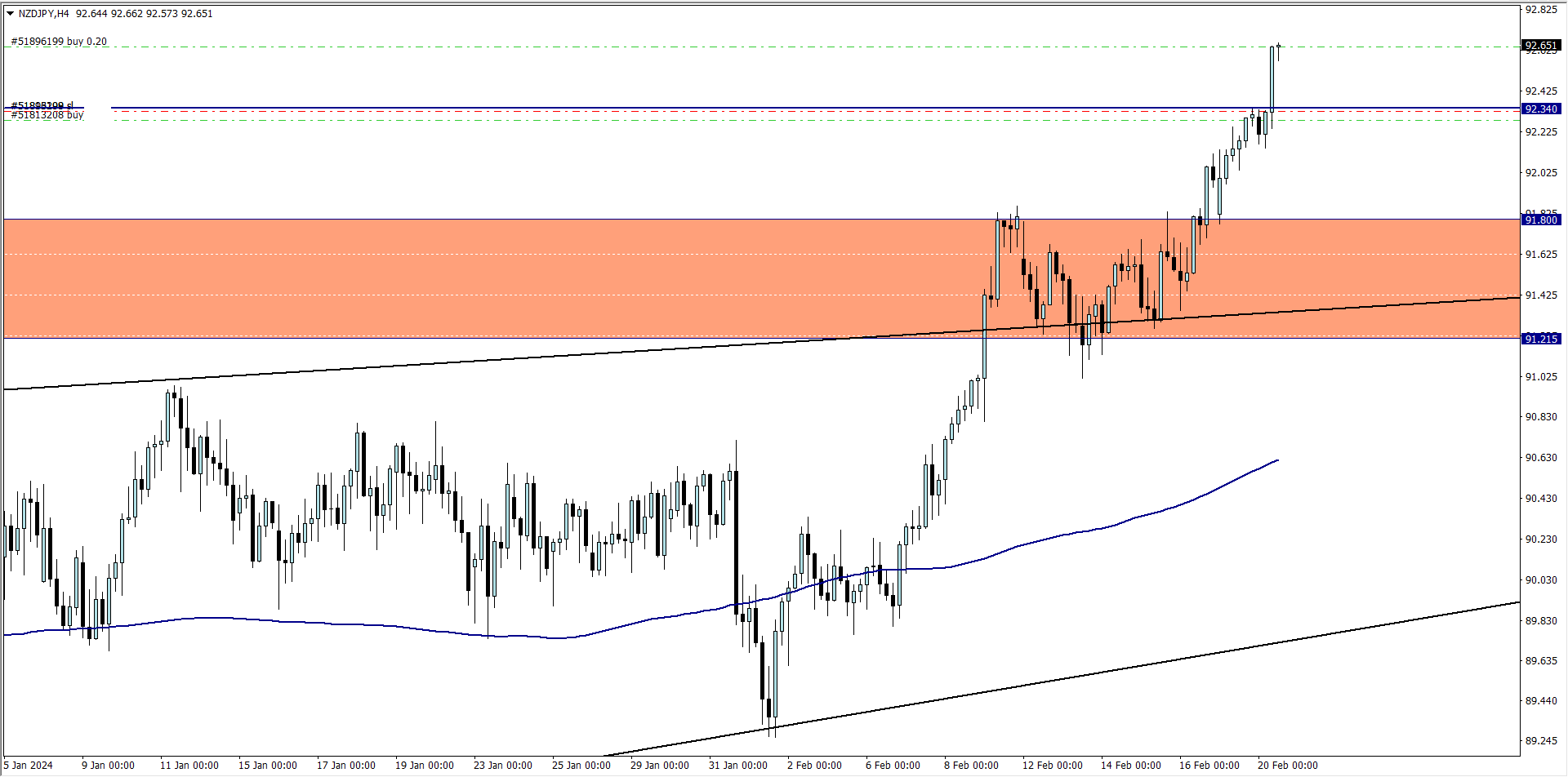

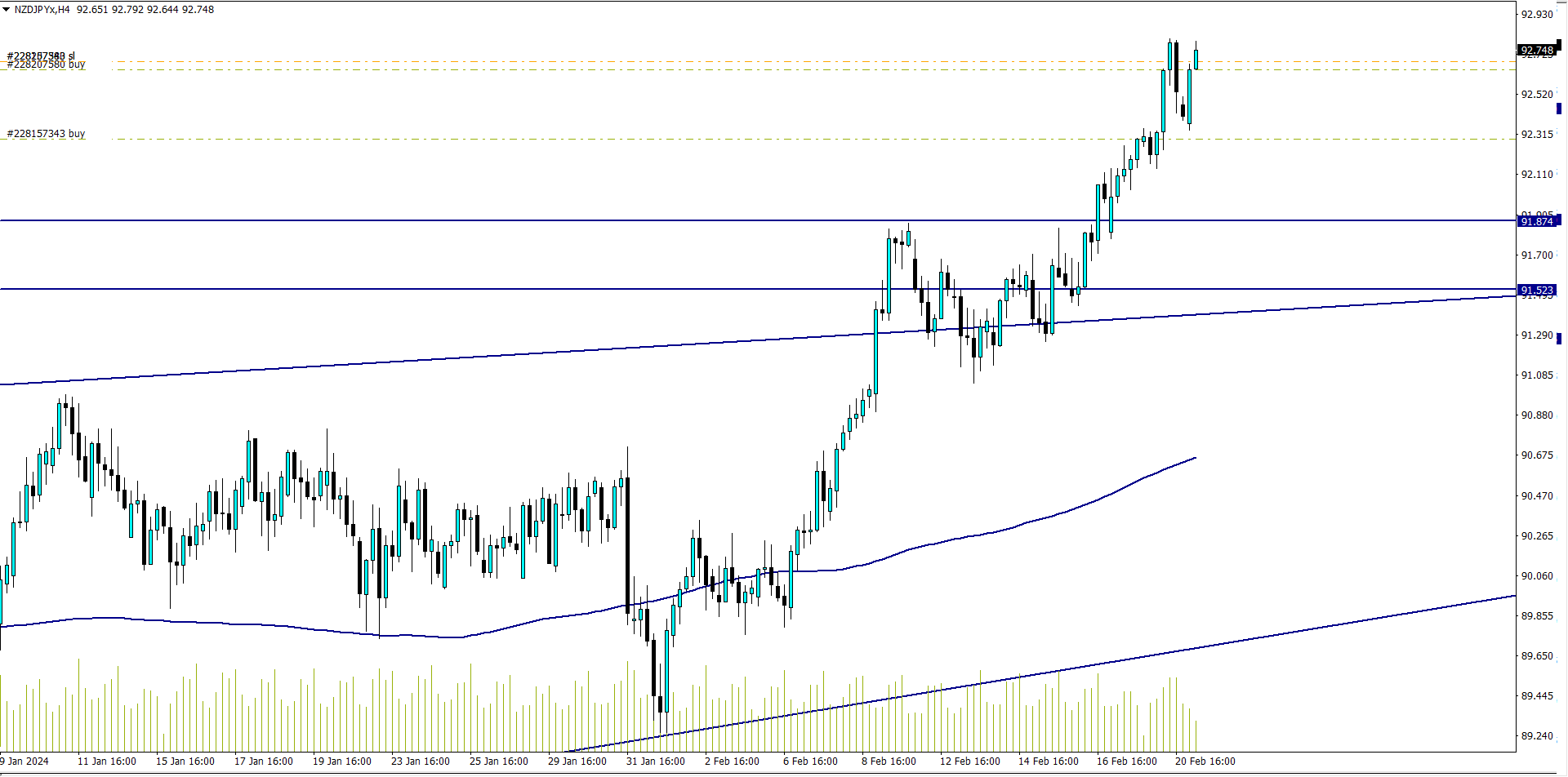

NZD/JPY Update (12.50 PM)

Analysis: Added position to my already existing NJ trade

WEDNESDAY 21/02/2024

NZD/JPY Update (6.50 am)

Analysis: I finally closed this trade with +71 pips (2 positions)

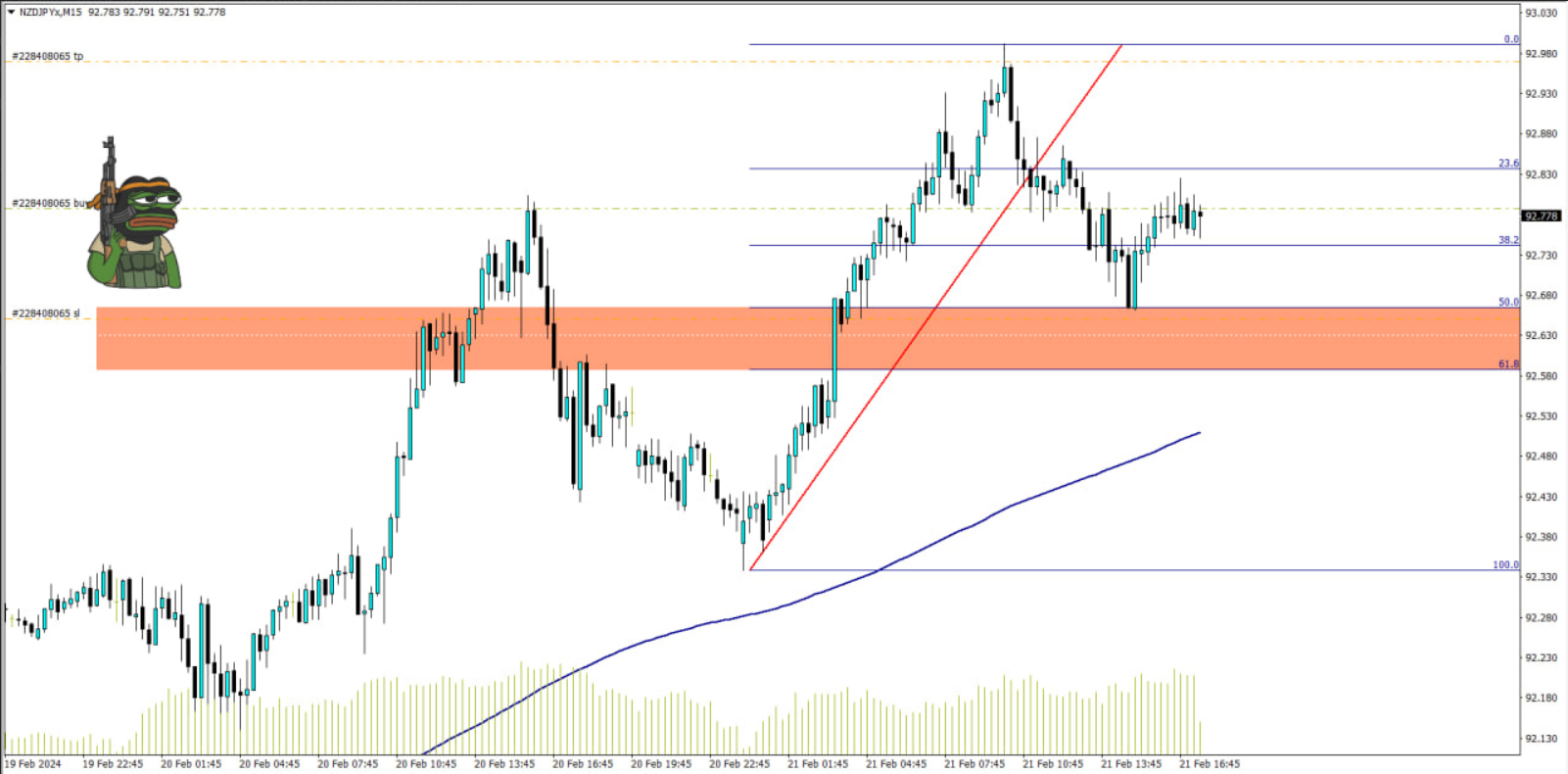

NZD/JPY (4.40 pm)

Analysis: I used my Fib levels to hunt for buy opportunities on the NZD/JPY. This trade was painful because after hitting my SL, price went straight to my TP. So I lost -13 pips

THURSDAY 22/02/2024

AUD/JPY (7.34 pm)

Analysis: The buy was inspired by our Friday Market Analysis. I ended up closing this trade with +13 pips (trailing SL)

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (19/02/2024) | NZD/JPY | BUY | + 71 pips |

| WED (21/02/2024) | NZD/JPY | BUY | – 13 pips |

| THUS (22/02/2024) | AUD/JPY | BUY | + 13 pips |

| TOTAL | + 71 pips |

In conclusion:

This week was one of my best week’s in recent times.

I was extremely busy creating content, and at the same time trading, so I could not document all the trades I took.

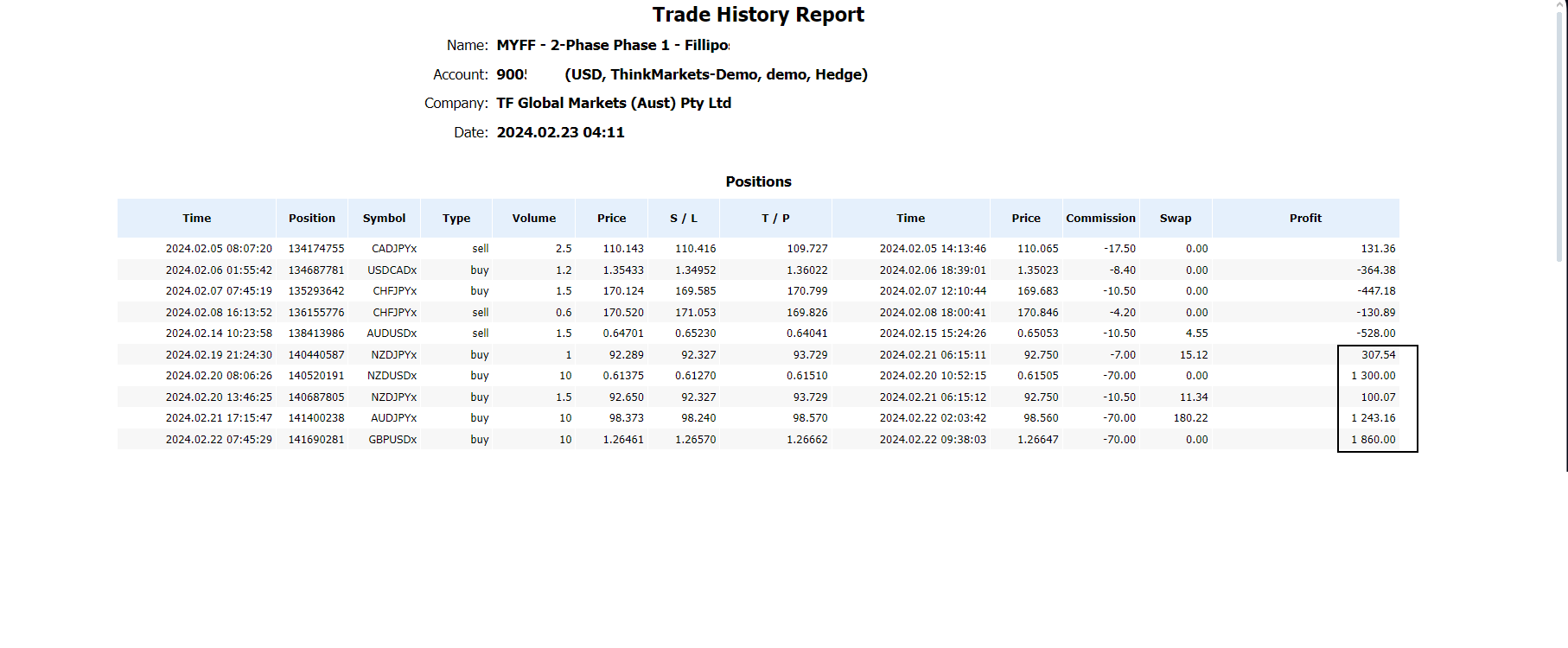

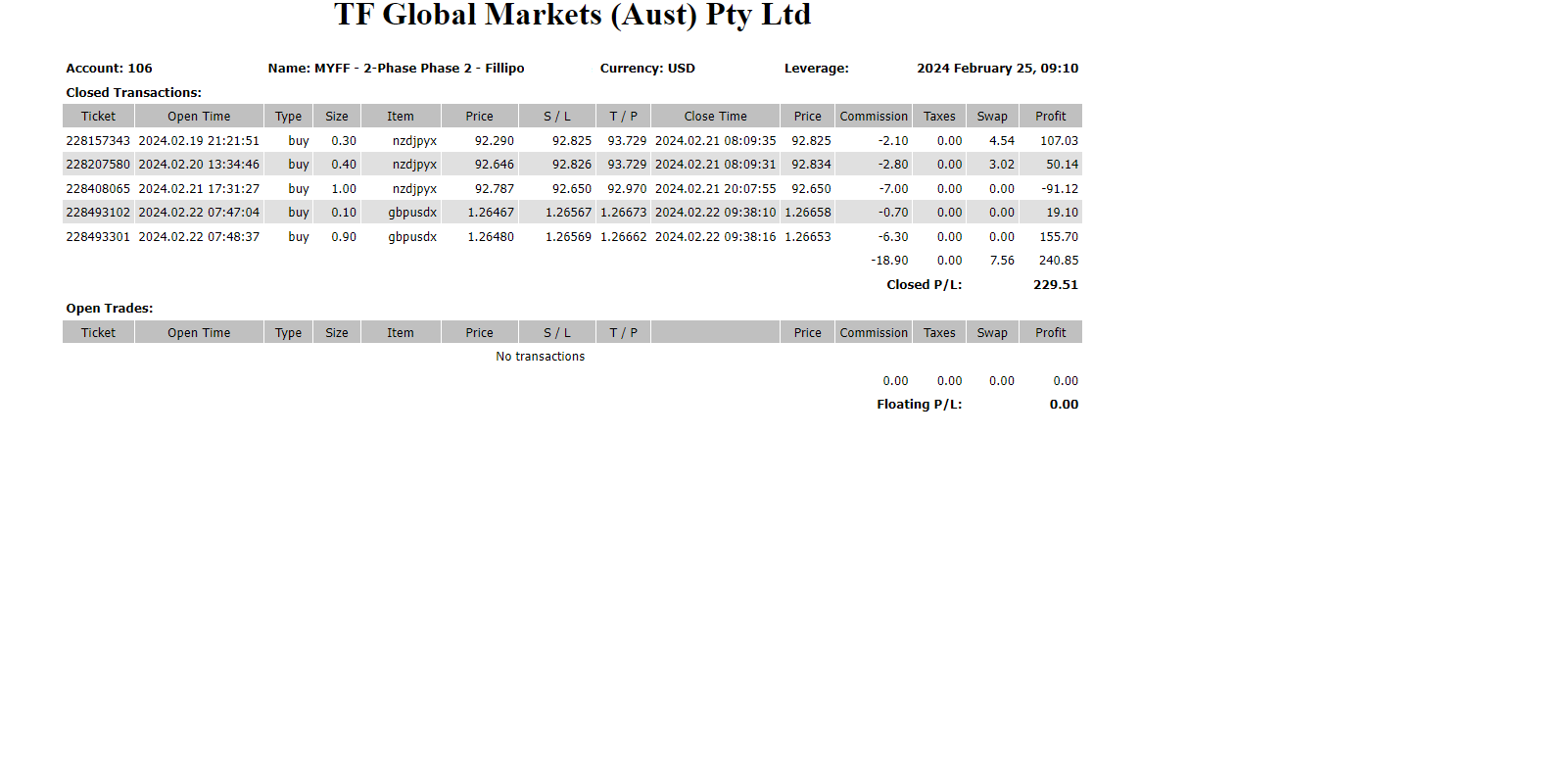

That said, my execution on all my trades was flawless. I closed with almost +10% ROI on one of my accounts. So I passed phase 1 even though I suffered 2 bad weeks in a row

On my other accounts, I made +2% to +4% ROI.

Looking forward to the next trading week.

How did yours go?

NOTE:

-

THE FUNDED TRADER: (Use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS